Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

racer26

Active Member

I mean... I always figured most of those ridiculous concept cars didn't actually function, and were basically rolling sculptures.

RobStark

Well-Known Member

404, page not found

This happens about 5% of the time I try to log-on click electrek stories.

dandurston

Member

FredTMC

Model S VIN #4925

racer26

Active Member

T3slaTulips

Member

Worked fine for me. That poor reviewer. I think he thought the thing was going to split in two a couple times.

This time it seems to be their problem. The 404 page has a link further down to the same story, but it takes you back to the same 404 page.

erthquake

Active Member

Yeah me too. Another 404 from Electrek

So annoying. I know others are able to read it because I can see the comment count going up. The link on the 404 page is a Wordpress preview link. I'm guessing something's fouling up with a cache plugin.

erthquake

Active Member

Google cache of VW article on Electrek

Snapdragon III

Member

Forget all this heads up display talk. The steering wheel in that VW concept is what I imagine when Elon says "The controls look like a spaceship" I hope they have something like that to surprise us in the Model 3.

dirtyofries

Member

404, page not found

This happens about 5% of the time I try to log-on click electrek stories.

This happens to me A LOT. No idea why

I don't think Fred will mind- we give him lots of reference links and good press- He and crew do a great job over there.

Fred- I never have the above described issues (on Safari)- but in iOS often get stutter scrolling and other misbehaviors. There may be some recursive references or other issues with your HTML generators or other active ad Java-Script etc. Might want to have it checked out

Here's the article in full:

VW lets media drive demo version of its all-electric I.D. Concept presented as a ‘Tesla Model 3 killer’

VW has presented the I.D. Concept as its first major entry in electric vehicles with an affordable long-range option to compete with the Tesla Model 3.

In a somewhat surprising move, the German automaker has allowed some media outlets to drive the wobbly show car they used to unveil the concept last year.

When automakers unveil new concepts, they generally don’t let anyone test drive them unless they have produced alpha/beta prototypes or sometimes even not until they get to pre-production.

In the case of VW’s I.D. Concept, which is not expected to hit the market until 2020, it can tell you something about the company’s attempt to drum up hype around the car if they are willing to set the expectations with this show car.

In this short test drive by Alex Goy from Carfection, you hear the vehicle cracking when driving at low speeds. Nonetheless, it’s still the best look we got so far at what VW is setting up to be its next flagship EV:

It will also be the first VW EV built from the ground up to electric and not just a converted gas-powered car like the e-Golf.

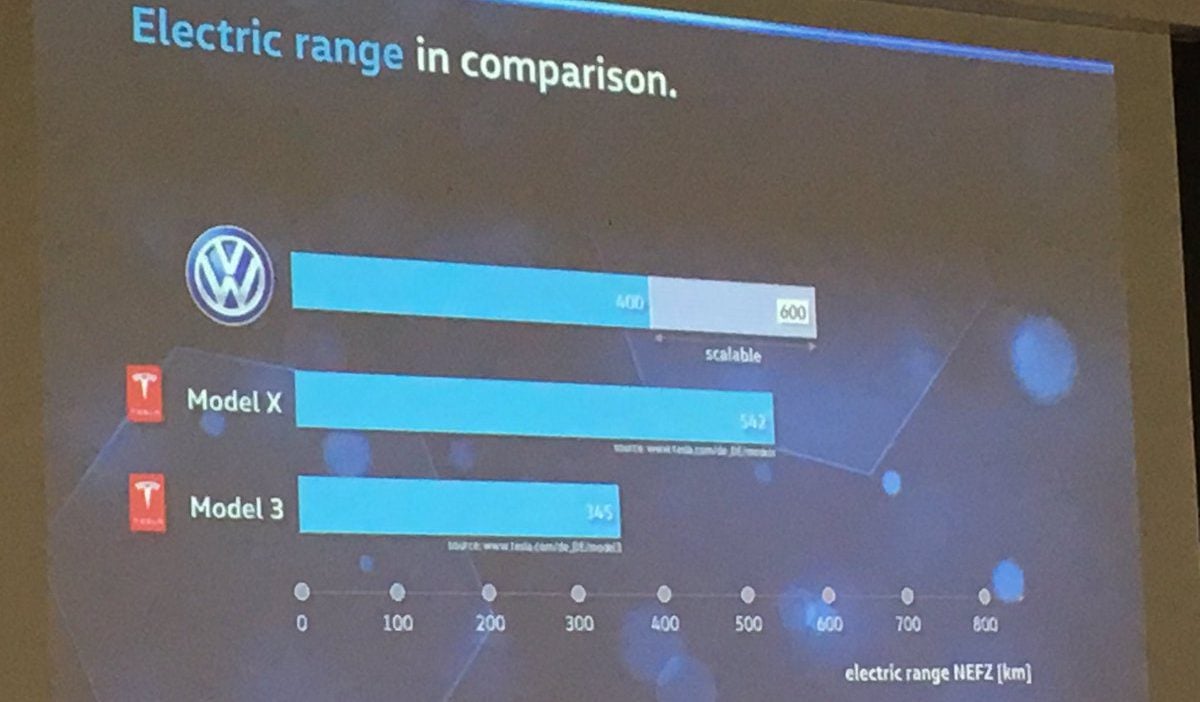

VW claims that it will have a NEDC-rated range of “400 to 600 km” (~250 to 375 miles) depending on the battery pack configuration.

Before even unveiling the concept last year, VW announced that it would beat the Model 3 and X in electric range by misrepresenting the NEDC-rated range of the Model 3. In a presentation, it pinned the two vehicles against each other even though they are both unreleased yet and they are planned to be released 3 years apart.

When it will be brought to market in 2020, it will be built on Volkswagen’s new modular electric platform and the body will be about ‘Golf-size’. Furthermore, the German automaker is teasing a price competitive with the Tesla Model 3 around $30,000.

I wouldn’t be surprised if VW is successful in creating hype around the car, but I wouldn’t expect the production version to look anything like what we are seeing today.

--------

p.s.

Hi, I'm Fred Lambert for electrek and I produced the above article-

and I also like my friends over at TMC-

especially the one that wrote this p.s. on my behalf

Fred- I never have the above described issues (on Safari)- but in iOS often get stutter scrolling and other misbehaviors. There may be some recursive references or other issues with your HTML generators or other active ad Java-Script etc. Might want to have it checked out

Here's the article in full:

VW lets media drive demo version of its all-electric I.D. Concept presented as a ‘Tesla Model 3 killer’

VW has presented the I.D. Concept as its first major entry in electric vehicles with an affordable long-range option to compete with the Tesla Model 3.

In a somewhat surprising move, the German automaker has allowed some media outlets to drive the wobbly show car they used to unveil the concept last year.

When automakers unveil new concepts, they generally don’t let anyone test drive them unless they have produced alpha/beta prototypes or sometimes even not until they get to pre-production.

In the case of VW’s I.D. Concept, which is not expected to hit the market until 2020, it can tell you something about the company’s attempt to drum up hype around the car if they are willing to set the expectations with this show car.

In this short test drive by Alex Goy from Carfection, you hear the vehicle cracking when driving at low speeds. Nonetheless, it’s still the best look we got so far at what VW is setting up to be its next flagship EV:

It will also be the first VW EV built from the ground up to electric and not just a converted gas-powered car like the e-Golf.

VW claims that it will have a NEDC-rated range of “400 to 600 km” (~250 to 375 miles) depending on the battery pack configuration.

Before even unveiling the concept last year, VW announced that it would beat the Model 3 and X in electric range by misrepresenting the NEDC-rated range of the Model 3. In a presentation, it pinned the two vehicles against each other even though they are both unreleased yet and they are planned to be released 3 years apart.

When it will be brought to market in 2020, it will be built on Volkswagen’s new modular electric platform and the body will be about ‘Golf-size’. Furthermore, the German automaker is teasing a price competitive with the Tesla Model 3 around $30,000.

I wouldn’t be surprised if VW is successful in creating hype around the car, but I wouldn’t expect the production version to look anything like what we are seeing today.

--------

p.s.

Hi, I'm Fred Lambert for electrek and I produced the above article-

and I also like my friends over at TMC-

especially the one that wrote this p.s. on my behalf

Some interesting Powerwall developments also reported by electrek.

DC version of the Powerwall (w/o integrated Tesla inverter) is being discontinued in Europe and the Asia/Pacific region. Tesla discontinues DC version of Powerwall 2 in Europe/APAC, only available in America and AC everywhere else

Also interesting that Tesla now has installation dates listed on the website for different countries -- April for the U.S., May for Canada, Germany and Australia (the only ones I checked).

Could be a sign that PW2 shipments will be ramping up in Q2. Not sure what the implications of discontinuing the DC version in Europe/APAC might be but maybe someone can chime in.

DC version of the Powerwall (w/o integrated Tesla inverter) is being discontinued in Europe and the Asia/Pacific region. Tesla discontinues DC version of Powerwall 2 in Europe/APAC, only available in America and AC everywhere else

Also interesting that Tesla now has installation dates listed on the website for different countries -- April for the U.S., May for Canada, Germany and Australia (the only ones I checked).

Could be a sign that PW2 shipments will be ramping up in Q2. Not sure what the implications of discontinuing the DC version in Europe/APAC might be but maybe someone can chime in.

FredLambert

Member

Yeah guys the 404 problem is really annoying. It's a problem with Wordpress and they hAve been working on it for weeks. It affects a few articles every week seemingly randomly and only for certain people, but we can't seem to find any correlation with region, browser, or anything like that.

A really weird problem. We have Wordpress VIP and they assure us that they are working on it.

Some have reported that googling the headline and clicking through there works. O don't know since I've never been affected by the issue myself.

A really weird problem. We have Wordpress VIP and they assure us that they are working on it.

Some have reported that googling the headline and clicking through there works. O don't know since I've never been affected by the issue myself.

A closer number, based on your own sources but with better assumptions would be

Total installed TE up to end of 2016: 300-398 MWh

Total COGS for TE during same period of time: $111.3M (2016) + $ 12.3M (2015) + $4.0M (2014) = $127.6M

So cost for TE on average over the three years was between $321/kWh and $425/kWh

Needless to say, TE is not having great margins even without discounts to large scale products. But let's find out at exactly what price was TE being sold at

Total revenue from TE up to end of 2016: $181.4M (total revenue for SCTY and TE in 2016) - $84.1M (revenue of SCTY in 2016) + $14.5M (TE in 2015) + $4.2M (TE in 2014) = $116M

So ASP for TE over the three years was between $291/kWh and $387/kWh.

This translates into a gross margin of around -9%.

You are making fundamental mistake in your calculation. The resulting number (-9%) is NOT gross margin.

The Revenue used in the calculation above is not the total revenue, as unknown part of the revenue was deferred because some installations were part of PPA(s), not the outright purchase. In the case of using deferred revenue in gross margin calculation you need to back out the COGS that correspond to this deferred revenue. Since Tesla did not provide breakdown of TE deferred revenue and COGS that correspond to this deferred revenue (unlike for the TA), the -9% is meaningless number, it is NOT gross margin. If you still have doubts, take a look at how gross margin is calculated for TA. Calculation for TE is not any different.

Additionally, since the revenue is partially deferred, the ASP calculation is invalid.

Also, am not sure where are you getting TE COGS for 2015 and 2014. As far as I recall they did not disclose this information until relatively recently.

From the passages quoted by JBRR above we know that cost of TE revenue in 2016 was $99M.

Also wrong. The correct number is $178.3M (total COGS for SCTY and TE) - $67M (COGS of SCTY) = $111.3M

I suggest you read what I posted one more time. As stated the TE revenue was calculated for 2016, namely: (total 2016 increase in COGS) - (SCTY increase in COGS) = $166M - $67M = $99M.

On October 27 Tesla indicated that to that date they installed 300MWh of TE. In the Q4 shareholder letter they shared that total TE installations were 98MWh. So we can assume that total installed capacity of TE in 2016 was between 300 and 398MWh.

This is just wrong. "To date" means from at least 2015 when they revealed TE and very much likely to include installed capacity before as they showcased several industrial cases of TE as pilot projects.

No, it is not wrong. It is wrong to include 2014 and 2015 in the calculation because it was very low volume production of initial iteration of TE products which has no bearing on gross margins going forward. This is the reason I concentrated on using 2016 numbers only.

Now, in order to complete my calculation I needed to get numbers that envelope TE sales in 2016. I do not know what is your background, but this approach is routinely used in engineering (my background) in order to arrive at definitive conclusion in spite of uncertainties involved in data. The upper boundary for TE sales in 2016 is obviously 300MWh + 98MWh = 398MWh.

In calculating the lower boundary, note that 80MWh installed at the SCE Mira Loma Substation clearly was not included in the 300MWh of deployed BES as of October 27, since it was not deployed until late December. Assuming about 18MWh installed in 2014/2015 yields lower boundary for 2016 installation of 300MWh.

They are right there sitting on page 44 and 45 in the recent 10-K.Also, am not sure where are you getting TE COGS for 2015 and 2014. As far as I recall they did not disclose this information until relatively recently.

I suggest you read what I posted one more time. As stated the TE revenue was calculated for 2016, namely: (total 2016 increase in COGS) - (SCTY increase in COGS) = $166M - $67M = $99M.

Didn't you notice the word "increase"? To get COGS of TE in 2016, you need to add back COGS for TE in 2015, which was $12.3M. Then you arrive with $111.3M. To do it in a simpler way, just do what I did - subtracting the $67M from the $178M. Unless you can prove SCTY COGS somehow found its way into TSLA in 2015.

I don't understand why it is wrong to include 2014 and 2015 TE installation. That's basically what "to date" means. Using that $430/kWh, those two years had 38 MWh. More maybe included if Tesla was giving sample tests or deep discounts to those who used them basically as beta testers. And in fact those two years were the years when TE actually had positive margins btw.No, it is not wrong. It is wrong to include 2014 and 2015 in the calculation because it was very low volume production of initial iteration of TE products which has no bearing on gross margins going forward.

I'm not contending this point. As I was using it as well.The upper boundary for TE sales in 2016 is obviously 300MWh + 98MWh = 398MWh

For the PPA, I admit I am not very familiar with this so maybe you can help me with a few questions.You are making fundamental mistake in your calculation.

1. Did Tesla used this in 2015?

2. Does this apply to Powerpack?

dandurston

Member

Fred/Electrek:

For what it's worth, this link works for me:

And this link doesn't.

For what it's worth, this link works for me:

Google cache of VW article on Electrek

And this link doesn't.

Buddyroe

Active Member

I don't disagree with anything you said. In fact, I whole-heartedly agree. The S is a wonderful vehicle. Even as a style of vehicle that people aren't currently buying, the S has sold amazingly well. And it did so without ANY funky gimmicks. Just regular ole doors. And why wouldn't it? It's a great looking car that does what a sedan is suppose to do - and has all the advantages of being electric.

The X on the other hand, is a TOTALLY different animal. It is WAY overpriced due to the FWDs and other things Musk put on it that will not increase sales even one car (those who don't want FWDs and can't afford the $100k price tag will be FAR greater than those who buy the X because of those doors). It is a warranty nightmare which is overburdening the service centers and killing Tesla's reputation for good customer service. Musk said the sales of the X and the S would be about 50-50 - even with the higher price of the X, because more people wanted an SUV. Boy was he wrong!

This is the golden age of the SUV. Tesla should be selling twice as many (thus having a massive back-log), with a much higher gross margin. Instead, they are barely selling. People are begging Tesla to take them back (just go read the X forum). And lately, the Tesla For Sale page is filling up with X's for sale.

Oh, and did I mention that the X was delayed almost 2 years due to those doors that are now costing Tesla millions in warranty repairs and lemon buy-backs?

It's an incredibly wasted opportunity and a terrible blunder in the life of Tesla. But, it's NOT too late. Fix the damn car and use the same model as the S - sexy car that is dependable and does what it is suppose to do (the current X's seat don't even fold down!!), and be an EV to boot!

It's that simple.

There needs to be a "I don't like this post, because I don't WANT it to be true, but it is" button. Everyone clicking the disagree button, but not a single person saying which part they disagree with. You can't disagree with the entire post because most of it is facts.

Zhelko Dimic

Careful bull

There needs to be a "I don't like this post, because I don't WANT it to be true, but it is" button. Everyone clicking the disagree button, but not a single person saying which part they disagree with. You can't disagree with the entire post because most of it is facts.

Huh, you're good, 13 dislikes!

That's what you get for criticizing our perfect, never-make-a-mistake, fearless leader, in this not-a-bull-chamber forum

- Status

- Not open for further replies.

Similar threads

- Replies

- 8

- Views

- 1K

- Replies

- 6

- Views

- 11K

- Sticky

- Replies

- 462K

- Views

- 51M

- Locked

- Replies

- 27K

- Views

- 3M