Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

I don't think it's a fade. Doesn't feel like a fade. Initially there was a rush of call buying that pushed the stock up. Then, people un-"familiar with the matter" sold as it's OPEX and 180 just seemed like a good price. However, those calls were bought; there had to be a reason. They must be anticipating something over the weekend and don't mind these peasants selling on a Friday cuz they know Monday will go the way they want. We are still trading a lot higher than before the call buying commended.

If I'm right, the structure we're seeing will soon yield to a more vertical variation with shallow retracements few and far in between.

If I'm right, the structure we're seeing will soon yield to a more vertical variation with shallow retracements few and far in between.

thenewguy1979

"The" Dog

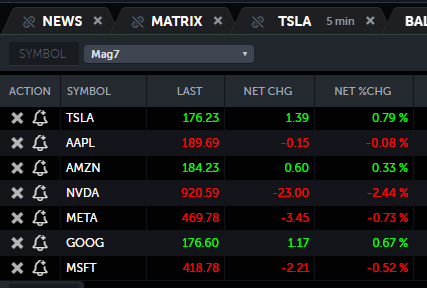

Compared to Macro and Others Mag7 we are the top dog today.

As a whole we're still holding onto some gain....the juices are there.

SPY also completed it retracement to 527.

Adding some more C on the retracement. Let see if we rocketed Monday or sputter out of gas

As a whole we're still holding onto some gain....the juices are there.

SPY also completed it retracement to 527.

Adding some more C on the retracement. Let see if we rocketed Monday or sputter out of gas

jeewee3000

Active Member

Positioned for next week. Done trading and working for the week. Cheers to all, and in particular @Max Plaid

bmd00

Member

When I see these long upper wicks on the green days, most importantly May 13th (the day of the supposed end of correction), it tells me there’s hesitation from the bulls. Whereas on the red days, the bears are in control from start to finish. Perhaps this is telling us we may not be quite ready yet to start the next leg up. Shouldn't there be a convincing day that proves the bulls are back? Like Apr 27th, 2023. This recent price action appears to be the bears just taking the day off, not the bulls having won the stock back just yet.There's another path

View attachment 1048087

This path is also bullish, even though it'll take longer to break out.

There's also a bearish path, which will be completely invalidated if we trade above 188. I don't give this bearish path any weight at all. However, to torment participants, I think 188 initially will reject the stock, but eventually, 1 of 2 things will happen:

a. We follow the path above

b. We retrace to low 180s before going up again

Orval is such a great beer! Skål!Positioned for next week. Done trading and working for the week. Cheers to all, and in particular @Max Plaid

View attachment 1048135

tivoboy

Active Member

Wonder twins power activated, Form OF a Double Top."TSLA afternoon fade activated"

View attachment 1048114

Daily:

View attachment 1048115

Weekly:

View attachment 1048119

tivoboy

Active Member

Says the dog that is literally 6 inches off the ground.. i mean you’re ONLY outpacing a Dachshund by about 1”Compared to Macro and Others Mag7 we are the top dog today.

As a whole we're still holding onto some gain....the juices are there.

SPY also completed it retracement to 527.

Adding some more C on the retracement. Let see if we rocketed Monday or sputter out of gas

View attachment 1048132

Wonder twins power activated, Form OF a Double Top.

STO a few -C215 TSLA 7/19/24 @3.75

Seem next week can run a bit but just in case not, plus counting on chop and retrace anyway between now and then.

tivoboy

Active Member

When is a Chimay, NOT a Duvel but IS an Orval.. They all get the same glass. ;-). I miss Belgium, OFTEN.Positioned for next week. Done trading and working for the week. Cheers to all, and in particular @Max Plaid

View attachment 1048135

You forgot the coaster BTW.

tivoboy

Active Member

And here, silly me, I thought those were HAND RESTS. ;-)

tivoboy

Active Member

Scardy cat.STO a few -C215 7/19/24 @3.75

Seem next week can run a bit but just in case not, plus counting on chop and retrace anyway between now and then.

OptionsGrinder

Member

Closed this week’s -180CC’s at the close yesterday.. didn’t do anything today. Will let price action early next week dictate next options move. Current plan is to wait until we get above 180 to sell any cc’s, and if we don’t get that, will only sell cc’s below 180 if we break 171 and 168, to preserve capital since at that point we would likely see further downside

Closed this week’s -180CC’s at the close yesterday.. didn’t do anything today. Will let price action early next week dictate next options move. Current plan is to wait until we get above 180 to sell any cc’s, and if we don’t get that, will only sell cc’s below 180 if we break 171 and 168, to preserve capital since at that point we would likely see further downside

Good plan. What CC's do you have in mind if we get above $180?

jeewee3000

Active Member

It was a Chimay glass and I specifically hid the lettering since that is a sin.When is a Chimay, NOT a Duvel but IS an Orval.. They all get the same glass. ;-). I miss Belgium, OFTEN.

You forgot the coaster BTW.

tivoboy

Active Member

Clearly I’ve spent too much time in Belgian bars and restaurants…It was a Chimay glass and I specifically hid the lettering since that is a sin.

Sounds like a diplomatic incident to me...When is a Chimay, NOT a Duvel but IS an Orval.. They all get the same glass. ;-). I miss Belgium, OFTEN.

You forgot the coaster BTW.

My beer glass shelf...

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K