No chance. $.45 is like half the cost basis, or more. If Tesla needs to spin off battery production to get the tax credits, they will.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

EV and Battery Credits

- Thread starter Buckminster

- Start date

The law is not entirely clear. Rob said he doesn't know exactly how it will be interpreted. We'll find out. But I think it's extremely unlikely that Tesla's cells won't get the credit because they use them themselves rather than sell them to somebody else. We won't know until we know.

Profit taxes are just distributed differently.

But is that really how the US Tax system works for sales taxes?

Usually (at least for Europe) B2B transactions are tax neutral. Otherwise you could bump your profits by a whole tax rate for every upstream supplier level you integrate into your company. And that's explicitly not done by almost all mega corps that could easily afford it.

Rob's view (as I understand it), is that 4) is meant to be restrictive, not permissive. Under that view, since a car is not an eligible component, once the battery, which is eligible, is integrated into the car, it becomes ineligible.I read it as the eligible component is the battery or battery pack which is an integrated sub-component of the car.

It honestly seems pretty straightforward to me.

I agree with you it's permissive and is calling out that items do not lose individual eligibility if combined before sale.

Re cells/batteries and Rob:

I get why he is interpreting it that way, but I think the intent is to cover companies that make cells and combine them into batteries (modules) to call out the cells are still eligible.

This section does not say one cannot then combine the eligible component with something else before sale. IOW cells manufactured and integrated in modules and then sold are still cells sold. Otherwise, LG multicell modules are in doubt.

Futher, battery and thermal management systens are not eligible components; so, on a strict reading, self monitoring batteries/ modules would not be eligible.

To really encompass it, a Tesla is a car shaped pack.

This does block Tesla Energy from taking the credit on Tesla owned Megapacks, but allows it on 3rd party owned Mega and Power Packs.

Edit: also to cover active materials used in cells before sale.

I think the part Rob was concerned about is:

With his fear being that a car is not an eligible component, thus breaking the chain of applicability. However, I think the purpose of this passage is to explicitly ensure inclusion of all eligible components, not to exclude the final product.

This more favorable view is even more reasonable when one considers that item 4 applies to all products in the section (wind turbines, solar, inverters), not just electrodes, cells, and batteries.

Further, the credits are unlinked from the final item price, so the ultimate cost of the sold assembly is not in play. Only the raw material costs need special accounting treatment/ focus.

Edit: taking the conservative view to the extreme; under this clause, only the the sub components would be eligible, not the final listed item.

"a person shall be treated as having sold an eligible component to an unrelated person *only* if such component is integrated, incorporated, or assembled into another eligible component which is sold to an unrelated person"

Updates to US tax notes. I'm not lawyer or tax expert and this is not legal, tax or investment advice. Probably some of this is wrong. All I did was read the law (link) this morning and try to understand it and I’m sharing my notes.

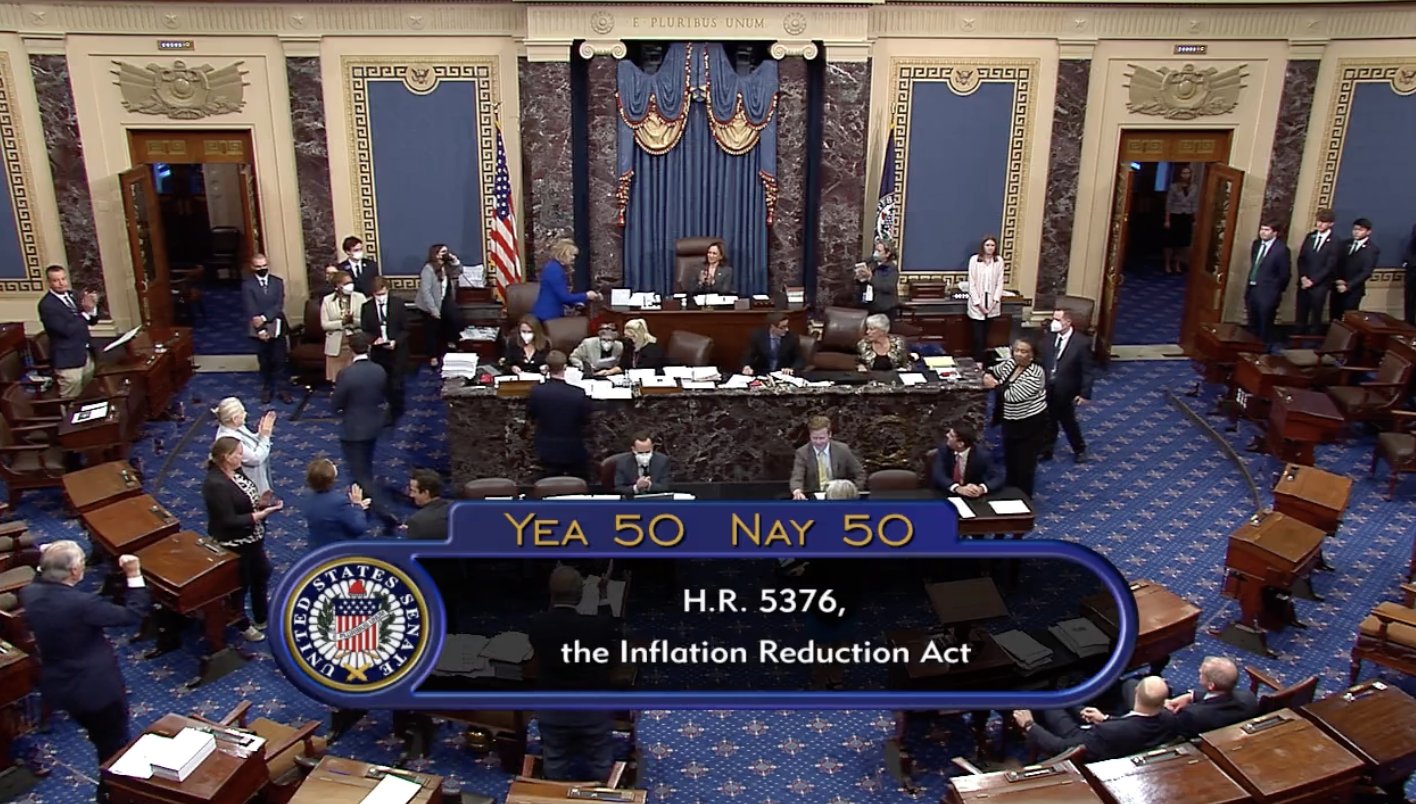

View attachment 848941

1) I had a summation error in the total cumulative benefit (bottom right corner of the table). Thanks @heltok. The formulas for summing each year's estimated benefit and the cumulative sums for each year were correct, so this mistake only affected the bottom-right cell in the table.

2) The Advanced Manufacturing tax credit of $45/kWh actually starts phasing out in 25% increments before expiration after 31 Dec 2032.

- 100% ($45/kWh) from '23 through '29

- 75% ($33.75/kWh) in '30

- 50% ($22.5/kWh) in '31

- 25% ($11.25/kWh) in '32

This makes a big difference to the potential total impact of the law if it stays as is, because Tesla’s exponential growth means most of their batteries will be sold in the later years of the credit scheme. However, I think the government is underestimating the total ten-year expenditure required to support this law all the way past 2030. Maybe they're expecting it to be changed in the next few years if Republicans take control of Congress and the Presidency. In any case, I'm pretty confident that the law is likely to stay as is at least through Biden's term, which ends in Jan 2025, because Biden has veto power over any bills that would revise the credit scheme, and also the Democrats currently have the majority in both houses in Congress.

3) The 15% alternative minimum tax (AMT) for corporations does not affect Tesla’s ability to take advantage of the Advanced Manufacturing Production credit, which includes the $45/kWh battery credit plus other credits like solar photovoltaic production. This aligns with what @Usain had learned from Bradford Ferguson.

- The credits "shall be treated as making a payment against the tax imposed by subtitle A...equal to the amount of such credit."

- Subtitle A is the one for "CORPORATE TAX REFORM" and it's where the new 15% AMT is legislated

- Because the credits are tax payments and not taxable income deductions, the credits not only could reduce Tesla’s total average US tax rate below 15%, but also Tesla might even end up paying a negative effective tax rate in the US because they will be generating so much credit value. If so, Tesla would receive a tax refund payment from the IRS.

- For an entity like Tesla that would be subject to the 15% AMT, direct payment doesn’t apply to all of the credit types, but the 45X credit for $45/kWh for battery production is eligible.

As @The Accountant identified yesterday, under Section 6418 of the law, Tesla has the alternative option of selling their credits to other entities, similar to how they sell ZEV credits. Unlike ZEV credit revenue, this revenue would not be considered taxable income so it would go straight to profit. However, I don't see any obvious reason why Tesla would choose to transfer credits when they could claim 100% of the credit value by applying it to their own taxes. If they transferred credits, they'd have to spend time and resources on the process of negotiation and doing the transaction, and they'd also have to give away a portion of the value to the other party. The only advantage seems to be getting the cash sooner than waiting for a tax refund. Still, it's nice that this is possible in case Tesla is unable to claim the credits for itself for some obscure reason I'm not aware of, or in case Tesla wants the money immediately.

Here is where the law says that the clean energy credits earned by an "applicable entity" are equivalent to tax payments:

Tesla is not generally an “applicable entity” according to the definition, but for the 45X Advanced Manufacturing credits (and credits for clean hydrogen and carbon oxide sequestration) Tesla would be eligible per the special rules:

Transfer of credits is governed by Sec 6418. Here's the key passage with respect to Tesla:

As someone who is not a lawyer or tax professional, I found Part 8 confusing to read, so I may have misinterpreted it, but this law firm says it too.

4) Other credits that affect Tesla's business positively but aren't in my table because they're smaller and harder for me to estimate.

5) Credits for stuff Tesla might do, or might partner with other companies to do, in the future:

- Battery electrode active materials

- 10% of cost

- Solar photovoltaic material, cell, module and inverter manufacturing credits

- $40/kW for thin film photovoltaic cells and crystalline photovoltaic cells

- $12/square meter for photovoltaic wafers

- $3/kg for solar-grade polysilicon

- $0.40/square meter for polymeric backsheet

- $70/kW for solar modules

- For inverters per watt:

- Clean electricity production

- $3/MWh with adjustments for inflation over time

- Expires after the later of 2032 or the first year in which greenhouse gas emissions from the production of electricity in the United States have dropped by at least 75% from 2022 baseline emissions levels

- Clean energy investment

- 6% of cost

- Solar farms, batteries

- Residential clean energy

- Previously was 26% credit for solar systems

- Now bumped back up to 30% until '33 with phaseout after that until '35 expiration

- Batteries (e.g. Powerwall) now included in eligible expenses

- Residential heat pumps

- Residential or commercial energy efficiency upgrades

- New energy efficient home construction

- Carbon dioxide sequestration

- Hydrogen production

Home heat pumps and heat pump water heaters are eligible for a 30% tax credit for individuals, up to $2k maximum. So a $6700 heat pump could get a 30% discount through 2032. We already know Tesla intends to enter this market eventually, and this tax credit may accelerate Tesla’s entry.Tesla's home heat pumps supposedly will be part of integrated thermal management and energy efficiency systems for buildings, so this government support will be substantial if and when Tesla starts selling these products in the US. I also remember rumors from 2020 that Tesla was involved with Brookfield for an experimental residential real estate development project to make a suburban subdivision near Austin. The New Energy Efficient Home credit had expired at the end of '21, but this law pushes back the deadline to 31 Dec 2032 and increases the creditSpaceX is working on making methane from CO2 captured from the atmosphere. They would also need hydrogen for the chemical reactions to transform the CO2 to CH4, so it looks like SpaceX will get these subsidies. If Tesla gets involved at all (they are apparently planning to scale up their own electric utility in Texas…) then Tesla too will get subsidies for CO2 sequestration and clean H2 production.6) The new $4k individual tax credit for pre-owned clean vehicles will not apply to Tesla, at least any time soon, because it is restricted to vehicles sold for less than $25k and right now used Tesla cars sell for at least double that. This tax credit is clearly directed more at helping people under the $75k income limit buy a more affordable economy EV like a Leaf or Bolt.

7) Overall, I’m still shocked that the US government actually passed a law with this much support for sustainable energy and fighting climate change. It’s not perfect, like how it gives the full $7.5k tax credit for hybrids, but on the whole this is a big deal and it will attract a bonanza of investment in North American production of the entire value chain of renewable energy from mines to end user to recycling. The biggest subsidies are going to clean vehicles, batteries, home solar & storage, home energy efficiency upgrades, and heat pumps, all of which are right in Tesla's wheelhouse now or a few years from now. It will come at substantial taxpayer cost though and the longevity of the law is questionable especially as we get to the later years of the 2020s and find that renewable energy (and Tesla) has scaled a wee bit faster than the Congressional Budget Office had planned for.

America has some of the highest per-capita energy consumption in the world, a large domestic oil&gas industry, and many prominent political leaders denying or dismissing the risks of continued dependence on fossil fuels. We went rogue and pulled out of the Paris Climate Accord in 2017. We invented the silicon photovoltaic cell in the 50s and the lithium-ion battery in the 70s, but then seemed content to put these technologies on the shelf and let the Japanese, Chinese and Koreans run with the tech for decades. I seriously did not expect this level of commitment to happen *ever*, let alone in 2022. I think the best case realistic outcome is that the law lasts until at least 2025, giving at least three solid years for a blitz of investment (that we’ve already seen beginning as soon as this law was signed) and then by 2026 that has hopefully established the industry enough that a diminished future credit schedule doesn’t have too much negative impact.

Super cool if this happens so quickly, but it is the gov...

"The White House could handle the approval as soon as the end of next week, the sources said."

I had to do some digging to find what this is about. The Teslarati article (taken from Reuters) doesn't do a very good job at explaining the implications.

But after reading just a bit about the existing program, what I glean is that this will be yet another huge mandate to pay Tesla for doing what it was going to do anyway. Tesla will will be able to sell RINs (credits) to oil refiners who don't use enough renewables in their fuel blends. Tesla may also earn RINs for its charging infrastructure.

It's always been deliciously ironic that the dirty, polluting ICE manufacturers have to pay Tesla. But now the fossil fuel industry has to pay Tesla as well.

Add to that the EV tax credits, battery manufacturing credits, and maybe soon, lithium refining credits. I'm just blown away by how much the new laws and regulations are favoring Tesla to the tune of billions and billions of dollars.

Tesla is becoming a huge vaccum cleaner that sucks money from everything it touches.

Referring to:

This looks interesting. Two pick-me-ups in one day!

EPA could make EVs eligible for Renewable Fuel Standard credit, boosting incentives

Electric Vehicles could be eligible for the Renewable Fuel Standard Credit, which would add yet another incentive to an EV purchase.www.teslarati.com

Confirmation that IR Act eligibility requirements will be met

Looks like non-US car makers are pushing hard to get in on the IRA money

U.S. EV incentives could be vastly expanded via new Senate Bill

A bill recently proposed to the Senate could make substantial changes to the Inflation Reduction Act's EV incentives structure.www.teslarati.com

Nice thread detailing some possible additional tax credits from IRA amendment for building Superchargers.

- 30% tax credit.

- Limited raised from $30k to $100k

- If stall cost is $75k, Tesla will received $25k credit.

- Retroactive to start of 2022, so Tesla could recognize ~ $100 million in Q4 for this year.

- Doesn't include the credits for energy storage systems (Megapack battery backups).

So yeah, basically Tesla's entire business model is going to be financially supported by the U.S. government. Terrible investment.

This is almost certainly why we haven't seen "Secret Master Plan - Part Trois" yet, even though Elon told us he was working on it nearly a year ago.

Elon Musk on Twitter: "@DoctorJack16 Master Plan (mé·nage à) Trois is all about tonnage" / Twitter

Right now, Elon is waiting for the IRS and Commerce Dept to finalize rules for the IR act incentives, especially the one for battery production. Once the Gov't commits in writing, then it's time for Elon to go public with Part Three.

The plot thickens

If true China Demand stories can be put to rest.

Not sure that's a valid approach:

(B) APPLICABLE PERCENTAGE.—For purposes of subparagraph (A), the applicable percentage shall be— ‘‘(i) in the case of a vehicle placed in service after the date on which the proposed guidance described in paragraph (3)(B) is issued by the Secretary and before January 1, 2024, 40 percent,

(3) REGULATIONS AND GUIDANCE.— ‘‘(A) IN GENERAL.—The Secretary shall issue such regulations or other guidance as the Secretary determines necessary to carry out the purposes of this subsection, including regulations or other guidance which provides for requirements for recordkeeping or information reporting for purposes of administering the requirements of this subsection. ‘‘(B) DEADLINE FOR PROPOSED GUIDANCE.—Not later than December 31, 2022, the Secretary shall issue proposed guidance with respect to the requirements under this subsection.’’.

Whatever they release this year is the guidance (and it's scope is limited to admin anyway)

Looks like LFP will qualify (not sure if they did before). Tesla still seems well positioned to take advantage of this.

So they government is pretty much saying the only way a car classifies as an SUV is if it has 3 rows.

Sure hope Tesla has the supplies for the 3rd row variant. If so, I predict practically all trims will be for the 3rd row except for the newly introduced standard range Y that will come in under 55k.

For everyone else like Ford, they’re screwed. The Mach E can’t fit a 3rd row. It would have to be completely redesigned.

Edit: actually

I smell a lawsuit coming from not just Tesla but Ford and other auto makers. Can’t have the ID 4 getting the SUV classification while the 2 row Y and Mach E don’t qualify. Not sure what the government is thinking here. They’re just opening themselves up to lawsuits

What are the downsides to making 3rd row standard? Underfloor storage is maintained and they fold down. Cost is probably <$1k to Tesla. Upside would be a reduction in the number of variants.If they add 3rd row it's an SUV.

If they remove 2nd row (or lock it in the down position?), it's a van.

If they alter the suspension to do the following, it's also an SUV

Similar threads

- Replies

- 7

- Views

- 244

- Replies

- 0

- Views

- 171

- Replies

- 17

- Views

- 696

- Replies

- 51

- Views

- 7K