Va. Code §§ 46.2-770, § 46.2-771, and § 46.2-772

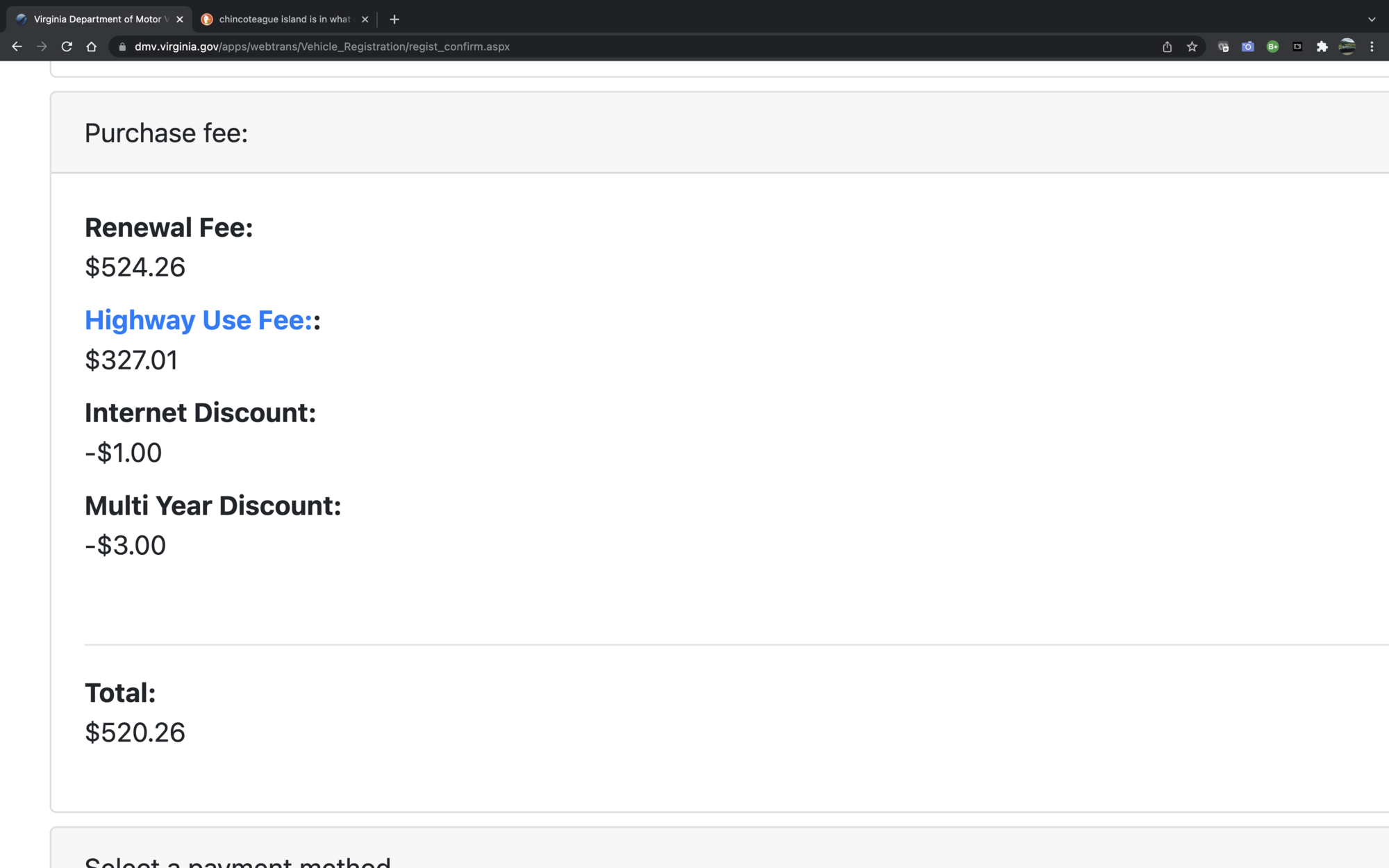

The purpose of the highway use fee is to ensure a more fair contribution to the Commonwealth Transportation Fund from fuel-efficient and electric vehicles using highways in the Commonwealth. The Commonwealth Transportation Fund is funded, in part, by motor fuels taxes. The highway use fee is effective July 1, 2020 and will be updated on a yearly basis.

"Fuel-efficient vehicles" are defined as vehicles that have a combined fuel economy of 25 miles per gallon (MPG) or greater, while, "electric motor vehicles" are defined to mean vehicles that use electricity as the only source of motive power.

In addition to a vehicle's combined MPG rating, two other factors are considered when calculating highway use fees: (1) the fuels tax rate at the time the vehicle is registered, and (2) the average number of miles traveled by a passenger vehicle in Virginia.

Electric vehicles are required to pay a fixed highway use fee, which is currently $109.00, to reflect the amount in fuels taxes electric vehicles will not pay during a single year due to not purchasing motor fuel.

The highway use fee for fuel-efficient vehicles, or vehicles manufactured in a year in which the average combined MPG rating for all of the vehicles produced in that year is 25 MPG or greater, is calculated to reflect the difference between the amount of fuels tax that the vehicle pays in a single year, based on its combined fuel efficiency, and the fuels tax paid by a vehicle with a combined fuel efficiency of 23.7 MPG.

DMV uses the combined fuel rating as provided by the manufacturer to determine if a vehicle is subject to the highway use fee. If the combined fuel rating is not available for a vehicle, DMV uses the estimated average fuel economy as determined by the U.S. Environmental Protection Agency (EPA) for all cars of the same model year and all trucks of the same model year with a gross weight between 6,000 and 10,000 pounds.

The following vehicles are exempt from the highway use fee:

The purpose of the highway use fee is to ensure a more fair contribution to the Commonwealth Transportation Fund from fuel-efficient and electric vehicles using highways in the Commonwealth. The Commonwealth Transportation Fund is funded, in part, by motor fuels taxes. The highway use fee is effective July 1, 2020 and will be updated on a yearly basis.

"Fuel-efficient vehicles" are defined as vehicles that have a combined fuel economy of 25 miles per gallon (MPG) or greater, while, "electric motor vehicles" are defined to mean vehicles that use electricity as the only source of motive power.

In addition to a vehicle's combined MPG rating, two other factors are considered when calculating highway use fees: (1) the fuels tax rate at the time the vehicle is registered, and (2) the average number of miles traveled by a passenger vehicle in Virginia.

Electric vehicles are required to pay a fixed highway use fee, which is currently $109.00, to reflect the amount in fuels taxes electric vehicles will not pay during a single year due to not purchasing motor fuel.

The highway use fee for fuel-efficient vehicles, or vehicles manufactured in a year in which the average combined MPG rating for all of the vehicles produced in that year is 25 MPG or greater, is calculated to reflect the difference between the amount of fuels tax that the vehicle pays in a single year, based on its combined fuel efficiency, and the fuels tax paid by a vehicle with a combined fuel efficiency of 23.7 MPG.

DMV uses the combined fuel rating as provided by the manufacturer to determine if a vehicle is subject to the highway use fee. If the combined fuel rating is not available for a vehicle, DMV uses the estimated average fuel economy as determined by the U.S. Environmental Protection Agency (EPA) for all cars of the same model year and all trucks of the same model year with a gross weight between 6,000 and 10,000 pounds.

The following vehicles are exempt from the highway use fee:

- Vehicles with a combined miles per gallon rating less than 25 MPG;

- Autocycles;

- Motorcycles;

- Mopeds;

- A vehicle with a gross weight greater than 10,000 pounds;

- A vehicle that is owned by a governmental entity;

- A vehicle registered under the International Registration Plan (IRP).