Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Buckminster

Well-Known Member

Papa states this clearly in response to my post:

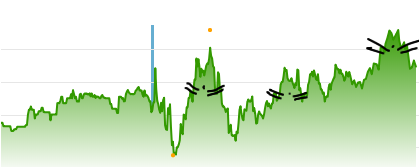

Chartists around the globe are scrambling to interpret the rare "triple cat pattern" spotted in TSLA's chart today

Papa is clearly baiting me. Wants me to make a fool of myself by stating 3 kittens playing with a ball of string theories could cause a Schrodinger's Stochastic Oscillator. You have to see it to believe it...I have never done any charting, but all this talk about TSLA being a coiled spring etc. has made me think I should have a go. I have prepared unsparingly (Teresa May would be proud) for many moments and have spent the last 12 minutes putting together my thesis. Here she goes:

TSLA closed at 370 last night. Firstly we need to account for the negatives. The dastardly upper class Tattinger band:

Taittinger Brut Réserve NV Fine wine - Waitrose Cellar

Down 27..

Then an inevitable upswing from crossing the Golden Snitch:

Harry Potter Golden Snitch Heliball

Up 25

Lastly a couple of Head and Shoulders:

Head & Shoulders Classic Clean 2in1 Shampoo 225ml

3.99X2=7.98

This leaves us at 377.98. If we can close above this figure - a short squeeze could just well occur.

I will have my vengeance Mr Fantastic!

Good piece. Carefully cited, 100% accurate.

Shows that as Musk lost his mind, due to stress, sleep deprivation, Ambien, and who-knows-what-else, he damaged the company. Thankfully not fatally.

I'm wiser than Elon Musk, but I would be likely to make *some* similar mistakes (I have some experience with stress and sleep deprivation). I would not, however, be unwise enough to arrogantly and ignorantly dismiss the expert opinions of people who know a lot more than me about a specific subject, though, and this is where Musk has really caused serious damage repeatedly. Musk is great when he does his homework, and worthless when he doesn't do his homework, which is unsurprising.

I agree. This article shouldn't be entirely dismissed as FUD but rather read with a heavy bullshit filter to remove the negative bias.

It seems clear that Musk pushed for an incredibly ambitious automation target and heavily ridiculed staff who spoke out against it. That said, he meets the majority of his insane goals and Tesla depends on someone at the top having the courage to attempt them. Tesla would not be where it is without the attitude that drove this (in hindsight) erroneous decision and I hope it doesn't dissuade Musk from pushing hard in the future - although, as you point out, some additional homework may be needed in the future before taking these risky bets.

So toes geography. It helps that Australia is closer to the equator than Europe/US when transitioning to solar. Panels produce a decent amount of electricity even in winter in Oz.Yes, there are a number of small countries that are making big switches - even larger ones like Germany. Regulations have been very important, though.

Tslynk67

Well-Known Member

OT

Here's a new song I recorded tonight with Tesla references as usual

"Free Tekashi Free Bobby

I be Agent 8 pull up the Tesla in the lobby"

and "Wings on my whip like I got Hermes riding shotty"

wings being a reference to X falcon wings

Agent 8 - FREE TEKASHI.wav

My kids would probably like that... Any chance of a prog-rock version for us oldies with some extended guitar solos and Mellotrons?

engle

Member

So happy to read this in Francais! Many happy kilometers to all who order in EU!

OT: I just added "rent a Model 3 Performance and drive it on the German Autobahn" to my bucket list!

(Most recent car I drove in Germany was a 1994 Benz E320 I picked up from Sindelfingen on 12/23/1993. We arrived too late to partake of the factory tour. I held my breath as I carefully drove my new RWD car on the Autobahn tires in chains I bought from Benz past cars that had slid off of the road during a snow storm. We drove to Vienna (wonderful), and eventually got to Geneva where we dropped it off for shipment to our US stealership. It was a great experience during the holidays!)

I have never understood this European thing of having stock held at a bank. Can you get the stock transferred direct from your bank to IB? You probably should. In the US I know three different ways to move stock between different custodians, but I guess things are different in Iceland.

You know, I haven't actually tried. Even doing the most trivial things with my bank related to stock has always been a pain. But I could try; it'd certainly make things a LOT easier.

The answer as to why I have stock held at the bank was because it was the first entity I could find that would actually let me buy US stock. Other advantages are the lack of a need for SWIFT transfers and the fact that you can feel confident that your bank isn't just going to run off with your money. But the fees are high, you can't buy options, etc.

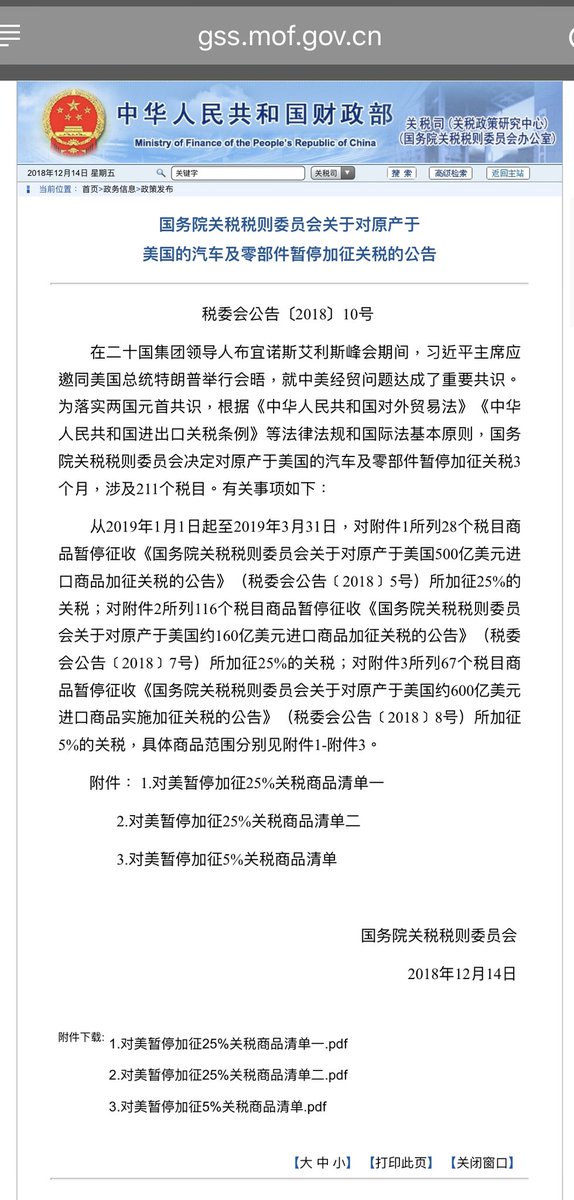

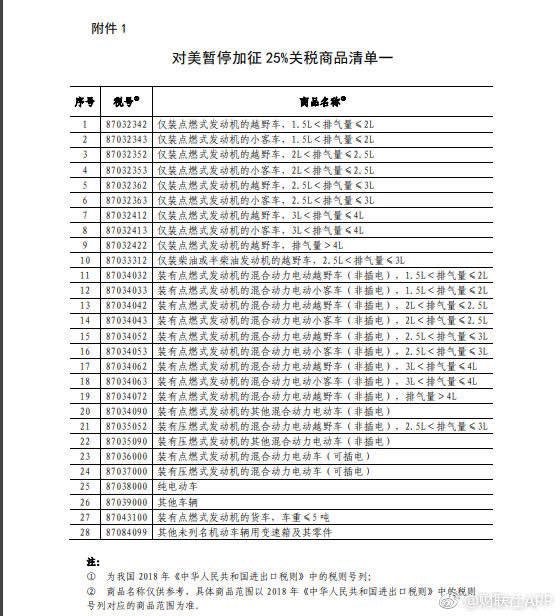

More good news:

1m1 minute ago

1m1 minute ago

Breaking: With the approval of the State Council(China), State Council Customs Tariff Commission decided to suspend tariffs on cars and parts originating in the United States for 3 months from Jan 1, 2019. http://gss.mof.gov.cn/zhengwuxinxi/zhengcefabu/201812/t20181214_3093439.html … And import duty back to 15% for Tesla $TSLA

0 replies0 retweets1 like

Twitter. It's what's happening.

RobStark

Well-Known Member

Tesla should prioritize China during the guaranteed 3 month window.

Try to exhaust the Chinese backlog.

Might be back to 40%. Or higher on April Fools.

Try to exhaust the Chinese backlog.

Might be back to 40%. Or higher on April Fools.

UnknownSoldier

Unknown Member

Tesla doesn't have do anything with China now, they are building Gigafactory 3 in Shanghai!Tesla should prioritize China during the guaranteed 3 month window.

Try to exhaust the Chinese backlog.

Might be back to 40%. Or higher on April Fools.

Well, unless that $33,000 Xiaopeng knockoff is able to satisfy China's entire EV market before GF3 opens.

Words of HABIT

Active Member

Mr Market mayhem will play in TSLA's favour. These aren't the droids you are looking for. Move along now.today's futures look scary

Words of HABIT

Active Member

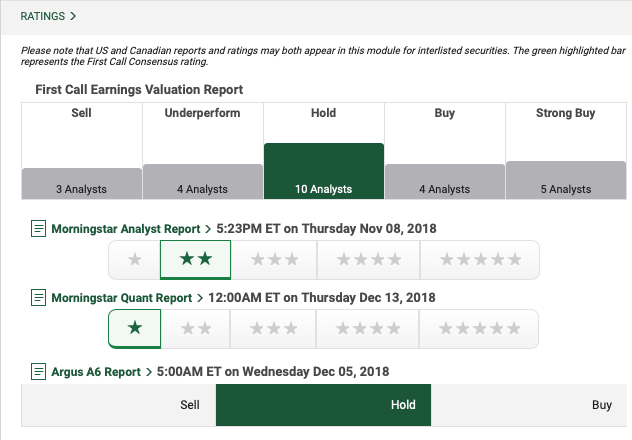

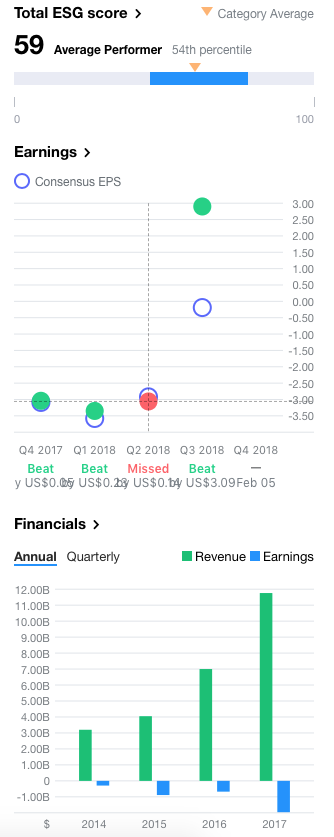

O'K, so I'm new to Tesla but overheard one of my friends go on and on about this company. What is all this Tesla optimism talk. They sell electric cars, right? Let's see what all the fuss is about. Let's check my TD Waterhouse account, what do they say...

Ouch, that does not look good. Nasty in fact. I thought my friend says this was a winner, a company with tremendous potential. Let me check Yahoo Finance to verify...

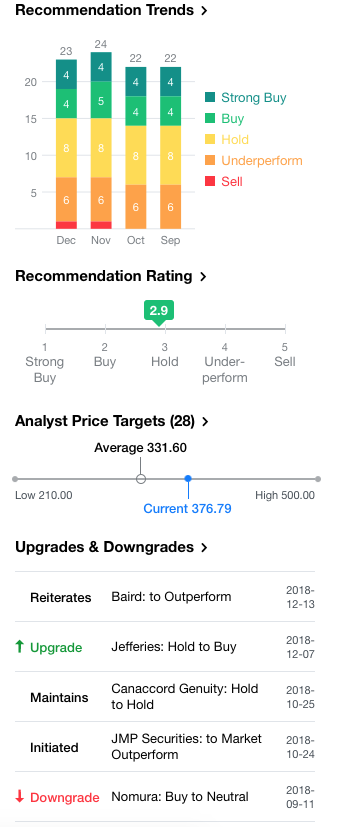

Wow, according to Yahoo Finance, losing money (although good strength in earnings) and analyst recommendations have gotten worse in the last four months, still rated an average of HOLD even after a solid beat third quarter. Consensus is overbought. Yahoo is not showing their forecast for Q4 which is really odd. I've got to question why my friend thinks Tesla is a good buy. My research doesn't add up and all the negative information I hear on the radio and new channels tells me they can't all be wrong. Didn't think an upstart from California could take on the 100 year old auto industries and beat them at their own game. I see so many green vehicle plates on the road and only like 1% are Tesla. All the other Auto manufacturers already have this segment covered.

The above scenario is being played out countless times across the globe. The general population will have no idea what hit them in a couple of months. They will be absolutely shocked. They will want a Tesla and many will want TSLA stock. I'm sure of it. Absolutely. My money is riding on it.

Ouch, that does not look good. Nasty in fact. I thought my friend says this was a winner, a company with tremendous potential. Let me check Yahoo Finance to verify...

Wow, according to Yahoo Finance, losing money (although good strength in earnings) and analyst recommendations have gotten worse in the last four months, still rated an average of HOLD even after a solid beat third quarter. Consensus is overbought. Yahoo is not showing their forecast for Q4 which is really odd. I've got to question why my friend thinks Tesla is a good buy. My research doesn't add up and all the negative information I hear on the radio and new channels tells me they can't all be wrong. Didn't think an upstart from California could take on the 100 year old auto industries and beat them at their own game. I see so many green vehicle plates on the road and only like 1% are Tesla. All the other Auto manufacturers already have this segment covered.

The above scenario is being played out countless times across the globe. The general population will have no idea what hit them in a couple of months. They will be absolutely shocked. They will want a Tesla and many will want TSLA stock. I'm sure of it. Absolutely. My money is riding on it.

Europe: Orders open now in France, Belgium, Norway, Switzerland, Austria

Jesus, where is Germany ???

cricketman

Member

And we can now design in Spain! Woohoo!

Decisions, decisions, do I pay an extra EUR10,000 to get to 100km/h 1 second faster? Red with white seats or blue with black seats? Argggh!

Decisions, decisions, do I pay an extra EUR10,000 to get to 100km/h 1 second faster? Red with white seats or blue with black seats? Argggh!

And the next one ...

"Deutsche Bank starts Tesla with a Hold rating, $375 price target Deutsche Bank analyst Emmanuel Rosner started Tesla with a Hold rating and $375 price target. Rosner said Tesla's strong Q3 results demonstrated a "large improvement in manufacturing execution and profitability." The analyst believes this positive momentum is sustainable in the near/mid-term as the "major manufacturing bottlenecks appear to be resolved and demand has shown little evidence of trailing off." He does not see major competition for Tesla until 2020/2021, leaving Tesla in a "league of its own" through at least mid-2020. However, Rosner calls Tesla's autonomous driving technology more uncertain, and has concerns for the stock longer term once the company fills its Model 3 pipeline."

Deutsche Bank starts Tesla with a Hold rating, $375 price target TSLA - The Fly

"Deutsche Bank starts Tesla with a Hold rating, $375 price target Deutsche Bank analyst Emmanuel Rosner started Tesla with a Hold rating and $375 price target. Rosner said Tesla's strong Q3 results demonstrated a "large improvement in manufacturing execution and profitability." The analyst believes this positive momentum is sustainable in the near/mid-term as the "major manufacturing bottlenecks appear to be resolved and demand has shown little evidence of trailing off." He does not see major competition for Tesla until 2020/2021, leaving Tesla in a "league of its own" through at least mid-2020. However, Rosner calls Tesla's autonomous driving technology more uncertain, and has concerns for the stock longer term once the company fills its Model 3 pipeline."

Deutsche Bank starts Tesla with a Hold rating, $375 price target TSLA - The Fly

Fact Checking

Well-Known Member

A portion of the bears and shorts invested in Tesla obviously is not really and somehow interested in making money if we look at the losses in the billions they made already (see Ighors tweets). Clearly some are just not the smartes and did not do their homework and because of that lost but at the stage we are at, near ATH with only positive information to come its for some more than just not been smart to stay.

While "Montana Skeptic", notorious anti-Tesla FUD-ster on Twitter was doxxed earlier this year and he was found to be deeply connected to the web of Big Oil consulting firms - and he also immediately stopped spreading the FUD once doxxed, which suggests that the doxxing hit close to home - I think he's more of the exception. About 90% of the trolls I see all around the web are of two types:

- People with obvious ICE car industry background,

- people with obvious U.S. financial industry background,

- cargo cult idiots emulating the former two.

Hence my working hypothesis that most of the shorts are U.S. hedge funds - types like Andrew Left, Mark Spiegel or Jim Chanos. There's possibly hundreds or thousands of various funds that bought into the anti-Tesla hype and they are not talking, at least not publicly. The shorting funds are also concentrated around NY - which was an early fortress of Tesla FUD, going back to a hit piece in the NYT in 2013...

Most of the power generation industry will I think support Tesla in the end: Tesla gives them independence from coal, natural gas and oil, which is a big deal because coal/gas/oil is a big drain on profits. Power generation and distribution companies will be a lot more independent by creating and storing energy themselves - and that is why many are already investing big into wind and solar energy. Building battery storage is the next obvious step for them.

So I think most of the shorts are NY hedge funds plus their European counterparts - and this is also I think part of the reason why FUD articles in the Washington Post and the New York Times were the most effective - they had the biggest effect on 'weak longs' and 'opportunistic shorts' with significant funds but only a marginal understanding of Tesla - both dominantly present in the U.S. financial industry.

Last edited:

Analyst007

Member

I bought 20x DEC14 370 Put Option yesterday at the hight of 377. Wish me luck for today, but long-term I'll plan to reentry in Tesla. But I hope cheaper at around 330-350.

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 141

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Poll

- Replies

- 1

- Views

- 12K