Nice defense of 300. Curious what happens between now and Q3 deliveries. Will look closer later tonight to see how confident I am of a bottom. Newborn baby has been occupying my time. Probably a good thing to not pay much attention to TSLA.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

-

Tesla's Supercharger Team was recently laid off. We discuss what this means for the company on today's TMC Podcast streaming live at 1PM PDT. You can watch on X or on YouTube where you can participate in the live chat.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Fact Checking

Well-Known Member

As for switching from ARM to x86, I wouldn't bet on it. Maybe from ARM (cheap licensing) to RISC-V (zero cost licensing), but going to x86 doesn't make a lot of sense when you're already building custom silicon.

I agree that it makes little sense to use x86 within the module/blade itself.

What I was speculating about: if AP already runs on their x86 host CPU, and the Nvidia computing module runs purely the neural networks, then they could have saved the ARM complication in the AP module itself.

But if the current Nvidia ARM core runs significant parts of Autopilot (and maybe other high level vehicle control loops), then their AI-chip likely contains an ARM core as well, to be sw compatible.

Do we know where the high level AP code is running?

ZeApelido

Active Member

OK, fine, but given slightly different parameters, $TSLA could have been much higher and $AMZN could have flatlined.

It's all very easy in hind-sight.

Yes, but a good method is to take your "risky" trading money and allocate it across some companies in proportions relative to your model of their future valuation (potential price appreciation) and confidence in them ( probability distribution of your estimate). If you have enough knowledge about multiple high growth companies, this would fare very well and give you less stress. Problem is most of us know Tesla way better than other equities so our weighting is too skewed.

Tslynk67

Well-Known Member

Yes, but a good method is to take your "risky" trading money and allocate it across some companies in proportions relative to your model of their future valuation (potential price appreciation) and confidence in them ( probability distribution of your estimate). If you have enough knowledge about multiple high growth companies, this would fare very well and give you less stress. Problem is most of us know Tesla way better than other equities so our weighting is too skewed.

Problem for me is that I don't give a duck about any other companies. I'm all-in Tesla and will remain that way.

K_Dizzle

Member

This was shared with me today by a former Tesla bull who became disenchanted with EM/Tesla/TSLA and moved his TSLA money into other stocks......I still hold a good sized position in TSLA but it does make one understand why diversification is a good idea:

Arun Chopra CFA CMT on Twitter

Yea diversification is good, however to me that’s a big argument to move my Amazon holdings to Tesla

Jayjs20

Member

Dip dip, every day.

Please drip one more day on Monday. I'm having a good chunk of money being transferred to my investment account again.

Please drip one more day on Monday. I'm having a good chunk of money being transferred to my investment account again.

Please drip one more day on Monday.

You mean Tuesday. Monday's Labor Day. I need rest from this roller-coaster ride. The point someone made about people realizing this sale price over the holidays is very real. Calm before the storm (up).

Driver Dave

Member

Yea diversification is good, however to me that’s a big argument to move my Amazon holdings to Tesla

I made a lot of money on Apple, Facebook, and then Tesla from getting out of mutual funds and diversification and placing bigger bets on what I'm an early customer of, and thus what I know, and what I see growing 10 years out.

I think you can make some money on the market via safe comfortable diversification.

But I'll hold that you make more money by bigger bets on specific stuff you know.

But yes, the harder part is when to get out. That's been really hard now-a-days during this boom. Things keep on going. Ug.

I would think Amazon at 2k - that's a get out point.

And move over to and sit tight for TSLA at 2k!

Hey folks,

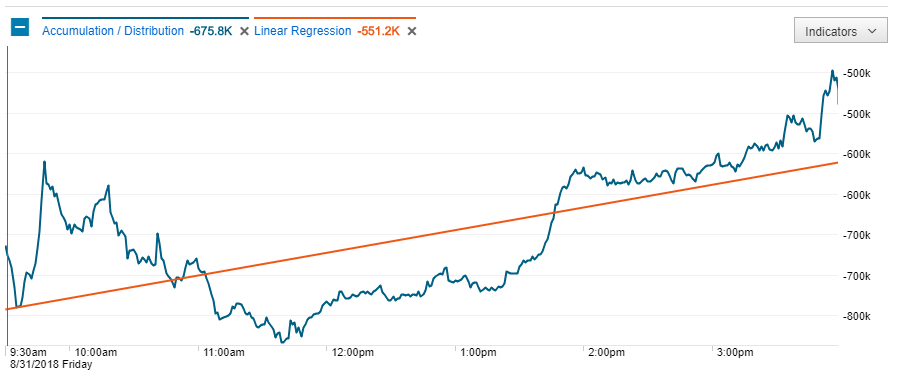

Ever since the latest EPT (another TLA!), I've noticed a big negative push right when the market opens and right when the market closes... today was no exception. If you look at the volume it's a big long U every day.

What's up with that? Kinda curious...

Ever since the latest EPT (another TLA!), I've noticed a big negative push right when the market opens and right when the market closes... today was no exception. If you look at the volume it's a big long U every day.

What's up with that? Kinda curious...

today, no matter the _price_ action, the Accumulation/Distribution line says ~120,000 shares were bought at slightly higher prices, today

If you calculate the CLV = (((Close-Low)-(High-Close))/(High-Low)) using 1 minute values vs single day values, selling in morning, buying in afternoon,

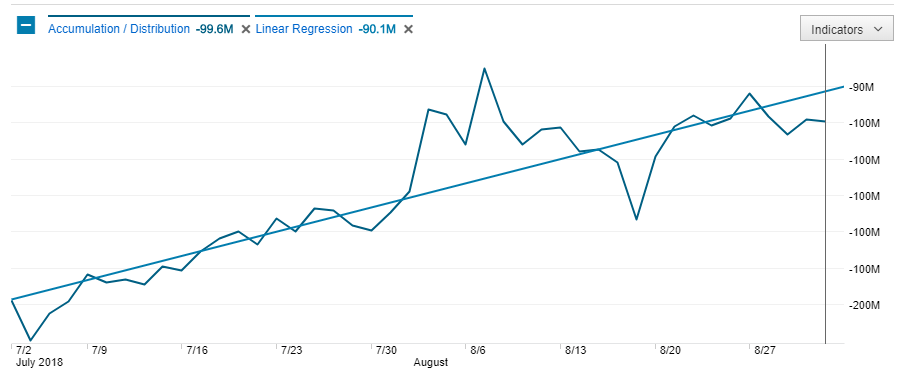

Overall, about 60,000,000 Since 7/2, quiet buying in some form, even though mostly _flat_ over August. AND this is pretty related to "market action" and a _visual_ representation of price action, which is market action

If you calculate the CLV = (((Close-Low)-(High-Close))/(High-Low)) using 1 minute values vs single day values, selling in morning, buying in afternoon,

Overall, about 60,000,000 Since 7/2, quiet buying in some form, even though mostly _flat_ over August. AND this is pretty related to "market action" and a _visual_ representation of price action, which is market action

Last edited:

tivoboy

Active Member

that usually means more sellers than buyers.Hey folks,

Ever since the latest EPT (another TLA!), I've noticed a big negative push right when the market opens and right when the market closes... today was no exception. If you look at the volume it's a big long U every day.

What's up with that? Kinda curious...

cheshire cat

Member

"Early" train gauge was based on mostly wooden coal mine "truck" gauge which ended up (& still is 4ft 11 1/2 inches ) despite probably our greatest engineer Isambard Kingdom Brunell's attempts to take it to 6 ft with the Great Western railway. What is the USA standard?Cart widths were set by having two horses/cows/goats/ox walk next to each other....

that usually means more sellers than buyers.

Duh... I meant do you think it's a planned attack/algorithm or something along those lines? I don't see it in earlier time periods. Just seems strange to me...

tivoboy

Active Member

Well, there was a point where someone said "free upgrade" but no detail about what that required. Was is EAP or EAP and FSD (already paid for) or EAP plus FSD (not paid at purchase but paid for after the fact). Or if one has EAP and now buys FSD, they will put in the new hardware for free as well. That's what I'm referring to hasn't been confirmed. If there is a link with absolute definition I'd love to read it. Thanks.Elon confirmed that during the last ER.

Problem for me is that I don't give a duck about any other companies. I'm all-in Tesla and will remain that way.

If you are young, are well paid, have little to no debt or other obligations (college for kids) then I agree that going 'all in' on one stock/company that you believe in, while risky, is certainly a strategy that can make you incredibly wealthy, though with great risk.

Not lecturing here, just indicating that we all have different risk/reward/obligations. If you are happy, I am happy for you.

Yea diversification is good, however to me that’s a big argument to move my Amazon holdings to Tesla

I have had my share of losses (GATT..double Ugh) but 'luck' (not skill) in early investment in TSLA allowed me to take some TSLA money off the table in 2014 and diversify into several other stocks.

Joe F

Disruption is hard.

In this thread, it's Market Action, but, that train has left the station a while ago.What is the USA standard?

cheshire cat

Member

Sorry. Eight and a half inches (George Stephenson)"Early" train gauge was based on mostly wooden coal mine "truck" gauge which ended up (& still is 4ft 11 1/2 inches ) despite probably our greatest engineer Isambard Kingdom Brunell's attempts to take it to 6 ft with the Great Western railway. What is the USA standard?

cheshire cat

Member

Closed till Tuesday as I understand it unless you're outside the US ------ there are other people "out there"In this thread, it's Market Action, but, that train has left the station a while ago.

MarcusMaximus

Active Member

Well, there was a point where someone said "free upgrade" but no detail about what that required. Was is EAP or EAP and FSD (already paid for) or EAP plus FSD (not paid at purchase but paid for after the fact). Or if one has EAP and now buys FSD, they will put in the new hardware for free as well. That's what I'm referring to hasn't been confirmed. If there is a link with absolute definition I'd love to read it. Thanks.

Well, what was said, at the time, was that it would be a free upgrade for anyone who purchased FSD, and that it was absolutely necessary for FSD. Given that it’d be pretty pointless to buy an FSD upgrade that doesn’t actually give you FSD if you don’t have the right hardware, it’s reasonable to assume that anyone who buys it will get the hardware(though it is, of course, possible that they’ll raise the cost of doing so, as they already did recently).

OK, fine, but given slightly different parameters, $TSLA could have been much higher and $AMZN could have flatlined.

It's all very easy in hind-sight.

Ah, the good 'ol "cherry pick the start date" technique...

Agreed it is totally what time frame you set in your graphing but would you rather be in in TSLA since 2014...or NVDA, AMD, AMZN, AAPL, NFLX, etc....? Yes, there are ones that TSLA compares favorably against since 2014....many....

I will not liquidate my holdings in TSLA at this point but the overall point that original copy/paste tweet was making is fairly poignant for all of us waiting for us to break out of the 280-380 range.

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 106

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Poll

- Replies

- 1

- Views

- 12K