IBKR does not issue margin calls. They liquidate.Real life data point. Margin cushion 9.25% remaining - and I thought I was being conservative ;(

Now I may have to really scramble for mo' cash. Anyone knows what IBKR's modus operandi is? Do I have a 1 day respite or are they going to automatically liquidate if margin gets to zero? Or should I transfer cash right away? (not advice accepted)

Now to check on Schwab's margins. Any hints -not advice/ advice - there too galdly accepted.

View attachment 863349

View attachment 863350

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Inflation has peaked and will continue to grind down over the next nine months short of oil prices spiking to 150 - 200. Can’t say when it will hit 2%.

I'm not sure I agree with that. The CPI numbers are up across almost all key metrics, that was very unexpected. If inflation had truly peaked I'd expect to see many of those metrics down, not up. I think that's what is causing the overly negative market reaction, we haven't peaked, not quite yet. Certainly trending towards it though as inflation is starting to flatline.

I'm not sure I agree with that. The CPI numbers are up across almost all key metrics, that was very unexpected. If inflation had truly peaked I'd expect to see many of those metrics down, not up. I think that's what is causing the overly negative market reaction, we haven't peaked, not quite yet. Certainly trending towards it though as inflation is starting to flatline.

I'm just tired man, im 95% invested, down all time now. The portfolio isn't what I would call small either.Talking about short term moves. Already said we may well be lower a month from now.

My point is these ‘hot readings’ are rounding errors at this point. The importance of them lies in what the FED will do, but the FED is already a known quantity. We are definitely getting 125 basis points this year. Known quantities are not usually what moves the market hard in the short term. Fear mongering certainly does.

There is no way to know what the CPI reading will be in December, but it will be at that time that continued misses may translate into more and higher rate increases, in which case more panic selling would make sense.

It's just a real grind. I'm not overly bearish but I'm just tired and also annoyed at how stupid J Powell is. He literaly said inflation was transitory and it isn't, it's so sticky that even after all these rate hikes it's still not peaking. I mean to be this wrong but be in such a senior position is very impressive.

Isn't the FUD from Musk wonderful?

Not closing on TWTR deal

Tweeting about selling cologne to pay for TWTR.

All the bobbleheads making paraistic money over such things and buybacks

even the bullisht utubers stir the FUD pot to get eyeballs.

I'd like to thank everyone that has not started a utube churnnel

Not closing on TWTR deal

Tweeting about selling cologne to pay for TWTR.

All the bobbleheads making paraistic money over such things and buybacks

even the bullisht utubers stir the FUD pot to get eyeballs.

I'd like to thank everyone that has not started a utube churnnel

ZeApelido

Active Member

This isn't what I expected to happen for the end of this year.

ZenMan

Member

IB gives no grace period. They will start liquidating within minutes of your margin going negative. You probably have at most an hour to try to salvage something. Try buying some 190 puts expiring tomorrow to give you some breathing room.Real life data point. Margin cushion 9.25% remaining - and I thought I was being conservative ;(

Now I may have to really scramble for mo' cash. Anyone knows what IBKR's modus operandi is? Do I have a 1 day respite or are they going to automatically liquidate if margin gets to zero?

To be clear with my previous comments:

I am NOT calling a bottom.

I am not advocating this as a buying opportunity.

I do not recommend margin use.

The correct time to have really feared inflation was last September. Ask yourself what the real fear should be now.

I am NOT calling a bottom.

I am not advocating this as a buying opportunity.

I do not recommend margin use.

The correct time to have really feared inflation was last September. Ask yourself what the real fear should be now.

Same here, man. I am getting killed. And I was stupid enough to introduce margin into one of my acounts that is getting blasted now.I'm just tired man, im 95% invested, down all time now. The portfolio isn't what I would call small either.

It's just a real grind. I'm not overly bearish but I'm just tired and also annoyed at how stupid J Powell is. He literaly said inflation was transitory and it isn't, it's so sticky that even after all these rate hikes it's still not peaking. I mean to be this wrong but be in such a senior position is very impressive.

And yeah, these FED heads….

A few possibly useful thoughts-

- Be careful what you bid on, you might get it.

- Do not use margin.

Am I the only one who wakes up, checks the stock price vs. my open bids for shares and LEAPS and frantically lowers all my bids most mornings lately*? The only reason I have anything left to buy with is my slow motion, painful selling of older LEAPS and even slower buying of January 2025 LEAPS. My account balance is a fraction of what it was at it's peak, but I've been riding this roller coaster a few years now; sincerest of hugs to all my comrades in a similar situation.

Life has become an exercise in rolling out LEAPS. Yes, perhaps I never learn, still playing with options. But at least I learned never to use margin unless I have a pile of cash ready to deposit...

*Often to wish, at the end of the day, that I'd not lowered my bids quite so much... only to be vindicated a week later as the stock price drops a bit further.

(Edited drastically for clarity)

- Be careful what you bid on, you might get it.

- Do not use margin.

Am I the only one who wakes up, checks the stock price vs. my open bids for shares and LEAPS and frantically lowers all my bids most mornings lately*? The only reason I have anything left to buy with is my slow motion, painful selling of older LEAPS and even slower buying of January 2025 LEAPS. My account balance is a fraction of what it was at it's peak, but I've been riding this roller coaster a few years now; sincerest of hugs to all my comrades in a similar situation.

Life has become an exercise in rolling out LEAPS. Yes, perhaps I never learn, still playing with options. But at least I learned never to use margin unless I have a pile of cash ready to deposit...

*Often to wish, at the end of the day, that I'd not lowered my bids quite so much... only to be vindicated a week later as the stock price drops a bit further.

(Edited drastically for clarity)

Last edited:

ZeApelido

Active Member

Yer I was also stupid enough to sell "far OTM" puts which were margin secured. They aren't far OTM Anymore.Same here, man. I am getting killed. And I was stupid enough to introduce margin into one of my acounts that is getting blasted now.

And yeah, these FED heads….

And another thing, Elon is also doing my head in. I don't think anyone has mentioned this yet but he literally posted on twitter saying he had a bad feeling about the economy, then orders the company to reduce the work force / stop office hiring.

Then he goes and offers above market price for Twitter. Who actually does that? Imagine firing people from your company then going to buy a stock that makes no money for above market price.

Artful Dodger

"Neko no me"

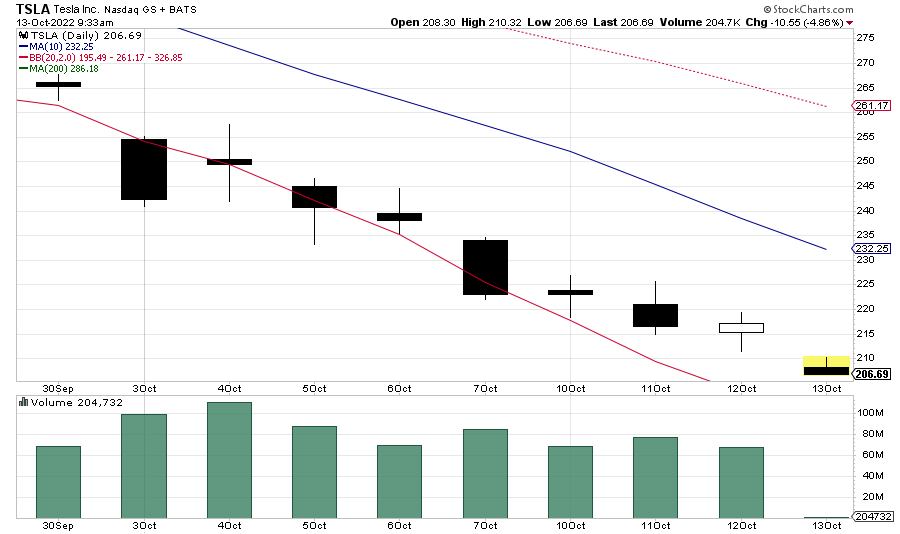

Well, MMs and hedgies have piloted this ship into port with crafted skill. As a reminder to all, Stats for TSLA:

Dry powder in the hold... Deck-chairs!

EDIT: New 52-week Low SP set at 09:33 ET (now let's see which holds the day: fear, or greed).

EDIT2: 52-week Low now at $206.24 as of 09:34 ET)

- 52 Week Low $206.86

- 52 Week Low Date05/24/22

| TSLA Pre-Market Low: | $208.07 (09:17:39 AM) |

|---|

Dry powder in the hold... Deck-chairs!

EDIT: New 52-week Low SP set at 09:33 ET (now let's see which holds the day: fear, or greed).

EDIT2: 52-week Low now at $206.24 as of 09:34 ET)

Last edited:

Runarbt

Active Member

You talking about the Idra 9000ton casting press? It is for the rear casting as it need to be huge to handle the loading capacity.IDRA casting press machines don't make exoskeletons.

I've been wondering, what the heck do they really need the 9000 ton press for to make the Cybertruck? It's supposed to need bending machines to origami the flat stainless sheets into body shapes, not load-bearing castings like an H-beam truck or auto. It bothers me hearing that IDRA presses make the "body" of the car when the body of most cars is stamped sheet metal.

I wonder how to move this post to the engineering thread?? Can I do that myself?

On the plus side, my account is so much smaller now that a 5% dip doesn't hurt nearly as bad as it once did.

Edit. I don't think this is all that funny.

Edit. I don't think this is all that funny.

Last edited:

So...now stonk go up?Well, MMs and hedgies have piloted this ship into port with crafted skill. As a reminder to all, Stats for TSLA:

Just like a well-handled brigantine, the pirates have arrived at the intended destination precisely on time. So now:

- 52 Week Low $206.86

- 52 Week Low Date05/24/22

TSLA Pre-Market Low: $208.07 (09:17:39 AM)

Dry powder in the hold...

Deck-chairs!

Same here, man. I am getting killed. And I was stupid enough to introduce margin into one of my acounts that is getting blasted now.

And yeah, these FED heads….

I'm also FED up.

Favguy

Member

Well the days low so far has dipped just below the 52 week low, so mission accomplished for the pirates...So...now stonk go up?

What is the significance of matching the 52 week low AD?Well, MMs and hedgies have piloted this ship into port with crafted skill. As a reminder to all, Stats for TSLA:

Just like a well-handled brigantine, the pirates have arrived at the intended destination precisely on time. So now:

- 52 Week Low $206.86

- 52 Week Low Date05/24/22

TSLA Pre-Market Low: $208.07 (09:17:39 AM)

Dry powder in the hold...

Deck-chairs!

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K