So it's a negative. But then again it might be a positive. Got it.Tesla’s decision on adding non-structural 2170 packs in Austin is not a positive. It’s a very effective mitigation strategy of a slower than forecast 4680 ramp, but that does not make it a positive. If you think it is a positive, that would mean if Elon tweeted they don’t need 2170’s after all in Austin, you would have to view that as a negative.

Although not clearly stated, it seems apparent that the 4680 ramp is going slower than they hoped. In calls last year, they guided 100 GWh this year, while Elon and Drew stated they were shooting for a 200 GWh / year rate by the end of this year.

If you recall, the original plan was to use 4680’s at both Berlin and Austin, with 2170’s as a fallback if necessary. It was very good news that although they didn’t hit that target for Berlin, they at least did for Austin. Now we know they need the fallback for Austin as well.

On the other hand: What was encouraging was that I thought I recalled from the call that going slower on the 4680 ramp, enabled more improvements (or some other positive benefits). So it is possible the slower 4680 ramp was intentional and beneficial in the long run and not because of issues.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Hear hear!I have been in TSLA since 2012. Obviously done very well. Every time I try to "diversify" even a little, I lose money on the diversified stocks. I think it is better to invest solely in the one stock that you have studied and understand completely than just throw money here and there.

I can tell you my recent diworsification into GOOG has proved disastrous so far. And now with a PE of 22 and a conservative 30 plus percent growth rate. Obviously I am missing something….

TSLA baby! Only reason I can brag about me stock trading is the stock I don’t trade (options excluded) HODL.!

How about that action today? The damn SPY was down 3 percent and high flying TSLA was flat.

Woohoo!

Man I wish I I could go on a bender with Elon just once….

Artful Dodger

"Neko no me"

OT:

#WORTHTHEWAIT

Over the moon today! Got the phone call from Tesla, scheduled a delivery appointment in early May for my new made-in-Fremont white Model Y LR 7-seater, with FSD, tow-package, and standard wheels.

Tesla is honoring my reservation-day price, so it's about $15K CAD less expensive than the Model Y I order on Jul 28th, 2021. Thanks, Elon!

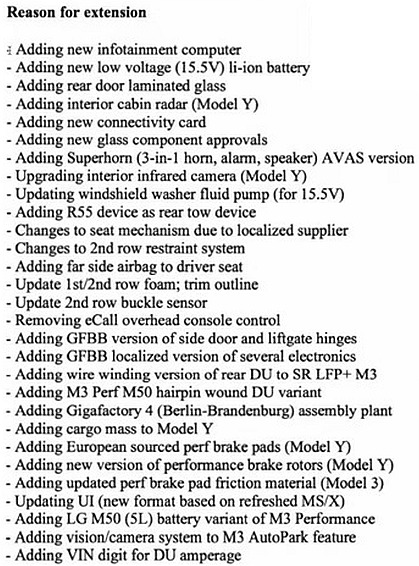

But this brand-new 2022 edition will come with an upgraded infotainment computer, lithium ion (15v) low-voltage battery (instead of a lead acid 12v), quiet double-pane side glass, and a whole raft of other updates: (for free!)

Will post more once it arrives. Cheers!

P.S. Paying all-cash, not selling any TSLA shares (for many years to come)

Tesla is honoring my reservation-day price, so it's about $15K CAD less expensive than the Model Y I order on Jul 28th, 2021. Thanks, Elon!

But this brand-new 2022 edition will come with an upgraded infotainment computer, lithium ion (15v) low-voltage battery (instead of a lead acid 12v), quiet double-pane side glass, and a whole raft of other updates: (for free!)

Will post more once it arrives. Cheers!

P.S. Paying all-cash, not selling any TSLA shares (for many years to come)

#WORTHTHEWAIT

I guess the bad news is that 4680 cannot keep up with Austin ramp. I guess the good news is that Austin ramp is outpacing 4680 supply. Anyway the start of the S-curve is not meaningfully contributing to profits or saving the world, so the important thing will be how fast they reach volume production. Does it really matter if it’s excess supply of LFP or 4680 in the cars or is the number of cars produced in Q3-Q4 what actually matters for profits and saving the planet? Imo the latter.

2170s are going into LR and performance YsI guess the bad news is that 4680 cannot keep up with Austin ramp. I guess the good news is that Austin ramp is outpacing 4680 supply. Anyway the start of the S-curve is not meaningfully contributing to profits or saving the world, so the important thing will be how fast they reach volume production. Does it really matter if it’s excess supply of LFP or 4680 in the cars or is the number of cars produced in Q3-Q4 what actually matters for profits and saving the planet? Imo the latter.

4680s are going into SR model Ys. As of today, there are no LR and performance 4680s.

SR Y will be one of the highest selling skus and this is set to ramp along with 4680s. A 2170 SR Y will most likely fall below 250 miles of range which is not happening (the SR we got in the U.S for a split second had 244mi of range).

So you cannot conclude that 4680s are not keeping up with the ramp when Elon said battery supply is not a problem for 2022. So the ramp for SR Y is going according to their plan. It's speculation to say that 2170 lines are going into Austin due to 4680 ramping problem when LR/P model Ys have year long back logs and there are PLENTY of 2170 packs sitting around which were designed to be inside of a LR/P to begin with.

Last edited:

More about stock diversification ... if you look at many sectors, you often find one huge winner and many other also rans. It's pretty obvious at this point that the automotive (not just EV) winner is going to be Tesla. I think 2023 is the year that Tesla will be the biggest North American auto manufacture in terms of cars manufactured ... bigger than GM or Ford. And their margins are incredible. Tesla is now a world leader in volume manufacturing across any industry.

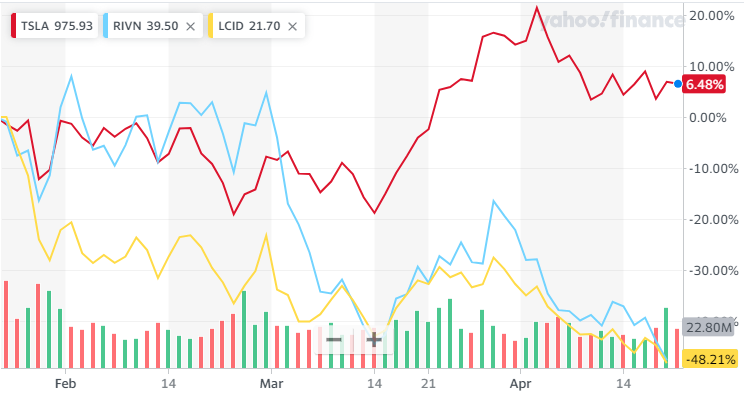

Meanwhile, let's look at the stock price of the best two EV startups for the last three months:

Both Rivian and Lucid have yet to prove that they can ramp to even 20,000 units a year, let alone the huge real volume leap that Tesla made with Model 3 at 200,000+/year. Both companies are making mistakes, Rivian with their pricing snaffus (not raising their prices early enough and then deciding to keep them low for the first 55,000 customers, forgoing $1B in cash), and Lucid with their tiny market (their cars are really expensive).

And then, never forget what Elon just recently said, "I've never been so bullish on Tesla that I am today". Yikes. Add that to his oft stated observation that Telsa is a collection of growth startups, not just an auto manufacturer, and you do think that 3x valuation is right around the corner.

Meanwhile, let's look at the stock price of the best two EV startups for the last three months:

Both Rivian and Lucid have yet to prove that they can ramp to even 20,000 units a year, let alone the huge real volume leap that Tesla made with Model 3 at 200,000+/year. Both companies are making mistakes, Rivian with their pricing snaffus (not raising their prices early enough and then deciding to keep them low for the first 55,000 customers, forgoing $1B in cash), and Lucid with their tiny market (their cars are really expensive).

And then, never forget what Elon just recently said, "I've never been so bullish on Tesla that I am today". Yikes. Add that to his oft stated observation that Telsa is a collection of growth startups, not just an auto manufacturer, and you do think that 3x valuation is right around the corner.

FIFY.But everyone on this forum knows what's what and how it will end. Elon has said Tesla could become the world's most valuable company and if you do the analysis rather than follow the crowd, you reach the same conclusion. Itsalmostinevitable

Electroman

Well-Known Member

Which points to:2170s are going into LR and performance Ys

4680s are going into SR model Ys. As of today, there are no LR and performance 4680s.

2170 going into LR & Perf Y means, 4680s energy densities have not materialized yet. Which is not good news for CT & Semi.

The fact that 4680s are going to SR tells us that 4680 cost efficiencies are already on-par with 2170 which is good news for bottom line.

Nope, we cannot conclude that either. We are not sure if the Model Y SR can only fit that many 4680s. We just know that they can hit 280 miles for the SR 4680s when the original SR can only hit 244 miles (my assumption is that with the price hit of a SR variant, COGS is similar for both of these SRs).Which points to:

2170 going into LR & Perf Y means, 4680s energy densities have not materialized yet. Which is not good news for CT & Semi.

The fact that 4680s are going to SR tells us that 4680 cost efficiencies are already on-par with 2170 which is good news for bottom line.

I don't remember the video I saw but this guy was explaining how the max range on the Model Y with 4680s fitted to the max would be 380mi of range. It was posted here 10s of pages back

What we can conclude is that Tesla knows the Model Y SR will be the best selling SKU. They have this in mind giving it the 4680s. They also feel that this cheaper variant will need to generate a healthy margin, hence giving it the 4680s as well. Tesla feels like they cannot hit the range of 250 miles+ with the 2170s while making a good margin since it'll be a much cheaper ASP. Sure Tesla can supply a 2170 with 280mis but it will destroy their margins.

Last edited:

Nope, we cannot conclude that either. We are not sure if the Model Y SR can only fit that many 4680s. We just know that they can hit 280 miles for the SR 4680s when the original SR can only hit 244 miles.

I don't remember the video I saw but this guy was explaining how the max range on the Model Y with 4680s fitted to the max would be 380mi of range. It was posted here 10s of pages back

What we can conclude is that Tesla knows the Model Y SR will be the best selling SKU. They have this in mind giving it the 4680s. They also feel that this cheaper variant will need to generate a healthy margin, hence giving it the 4680s as well. Tesla feels like they cannot hit the range of 250 miles+ with the 2170s while making a good margin since it'll be a much cheaper ASP. Sure Tesla can supply a 2170 with 280mis but it will destroy their margins.

Yeah, I think Tesla is just trying to make the most of the limited supply of 4680s currently available.

nativewolf

Active Member

I think what you can take away is that they don't have many 4680. I don't think you can conclude anything more. We have no idea what margins the 4680 is delivering and I don't think Tesla knows anything yet because...there are not many 4680s. We don't really know performance we don't really know margins, capacity, etc. They could be limiting everything til they have data back on performance and safety, etc. Who knows.Nope, we cannot conclude that either. We are not sure if the Model Y SR can only fit that many 4680s. We just know that they can hit 280 miles for the SR 4680s when the original SR can only hit 244 miles.

I don't remember the video I saw but this guy was explaining how the max range on the Model Y with 4680s fitted to the max would be 380mi of range. It was posted here 10s of pages back

What we can conclude is that Tesla knows the Model Y SR will be the best selling SKU. They have this in mind giving it the 4680s. They also feel that this cheaper variant will need to generate a healthy margin, hence giving it the 4680s as well. Tesla feels like they cannot hit the range of 250 miles+ with the 2170s while making a good margin since it'll be a much cheaper ASP. Sure Tesla can supply a 2170 with 280mis but it will destroy their margins.

The only thing we know is not enough 4680. Well to artful dodgers POV, it highlights Teslas amazing ability to be agile and shift to an unplanned but available and understood battery. Austin was not supposed to use the 2170. So the fact that they have gone to the trouble to take this step indicates it is serious. It also demonstrates an agile organization.

jhm

Well-Known Member

Tesla could buy Ally Financial for a small premium over $14B.That's a question for @jbcarioca to expound upon. I hope he keeps his reply to less than 100 pages, though.

Ally used to be GMAC Finance. It's tried to be a full service bank, but most it just does auto financing.

I was actually caught off guard when Elon said batteries NOT being the limiting step 2 calls ago. It has always been batteries batteries batteries. My take is that CATL ramped way faster than Tesla expected, and has taken over way too many shipped cars in the last year that 2170s became of excess when there's not enough powerwall chips (remember that Tesla stop taking orders for solar roof due to chip shortages). The energy side is low on chips but not low on batteries. So Tesla has guided for 60% growth with or without 4680s which means it is their intentions to use 2170s in anyway they can because there's an excess.I think what you can take away is that they don't have many 4680. I don't think you can conclude anything more. We have no idea what margins the 4680 is delivering and I don't think Tesla knows anything yet because...there are not many 4680s. We don't really know performance we don't really know margins, capacity, etc. They could be limiting everything til they have data back on performance and safety, etc. Who knows.

The only thing we know is not enough 4680. Well to artful dodgers POV, it highlights Teslas amazing ability to be agile and shift to an unplanned but available and understood battery. Austin was not supposed to use the 2170. So the fact that they have gone to the trouble to take this step indicates it is serious. It also demonstrates an agile organization.

The point is having more 4680s doesn't generate more cars for 2022. So maybe they don't have "enough" but what is enough when there's an excess of other form factors?

jhm

Well-Known Member

This is true of many Teslanaires. Tesla swings up more than one's annual salary in a day. Why the heck am I still working? Swings back the next day. Oh, yeah, guess I'll keep working.Yes, one wonders about the effectiveness of an incentive plan where tranches are worth less than his daily fluctuations in net worth.

thx1139

Active Member

That and when they fill the structural pack the only way to have the same range as the Fremont LR is to software limit. Can get close, but not the same. So until they can make more then enough Model Y LR 4680s why do it at all? Crank out more Model Y SR+ they will all get sold. I dont believe at battery day Tesla thought they would see the demand for Model 3 and Model Y we have today. I believe the demand is even beyond the projections they were making and even the most optimistic of us made. Add in demand for CT and Tesla needs to be able to be flexible and why not use 4680s for higher amount of SR+ and the CT. Model Y LR with 4680 gets Tesla nothing. More Model Y SR+ and CT ramping faster along with Model Y 2170 gets Tesla far more.Yeah, I think Tesla is just trying to make the most of the limited supply of 4680s currently available.

It's regional. I'm using Tesla finance in the UK and have the option to purchase at the end of the financing agreement. Given the value differential between having FSD and not, financing with the option to buy is like owning a call option.I figured they had to do it for their no-buyout leases. What about for purchases?

Guilty.....some days I am looking for things to buy which are 'like to have'.....other days, I am seeing what is buried in the back of the freezer to eatThis is true of many Teslanaires. Tesla swings up more than one's annual salary in a day. Why the heck am I still working? Swings back the next day. Oh, yeah, guess I'll keep working.

They said a lot on the earnings call:

- Pack design was de-risked, will phase in performance and density

- Battery day was a 5 year plan, plan is going well

- Texas was 1/5 the CapEx, labor and utility costs are lower

- Working on yield and rate

- 4680 structural pack will be best in class by next year (when semi and Cybertruck are in production)

- Have cell inventory to support 2022 volumes

- Berlin going 4680 later this year, but can hit volume targets with 2170

- Excess cells allowed a more deliberate (slower) 4680 ramp (preempting: broken gets fixed, jankity lasts forever)

- Austin can fall back to 2170 but likely won't need to with volume production by Q4, possibly late Q3

- 4680 is not a factor in building 1.5 million this year, need 4680 next year

Martin Viecha

Okay. Let’s go to the next question. Next question is, how are the current 4680s performing versus expectations set during the Battery Day in terms of expected range increase and dollars per kilowatt hour?

Elon Musk

Yes.

Andrew Baglino

Yes. We’re working in all the areas we shared on Battery Day, and we have sort of consistent progress across all of those areas towards achieving the five-year cost trajectory goals for the cost within our control, but we do not control all the commodity costs. So, that’s an exception I needed to call out.

Similar to Model 3, it will take us several years to get rate and yields to the point where everything that we’ve discussed is achieved. Our priority was on simplicity and scale during our initial 4680 and structural battery ramps. And as we attain our manufacturing goals, we will layer in new material technologies we are developing and higher-range structural pack provisions.

Elon Musk

I think maybe, in a nutshell, I think it probably is fair to say that 4680 and structural pack will be competitive with the best alternatives later this year. And we think we’ll exceed the best alternatives next year.

Andrew Baglino

Yes. I mean we have some good existing proofs, right? Like we’ve built the facility here in Texas, like we know how much we spent on capital equipment in the facility. And it’s more than 5x less than prior technology installations. So, we’re saving huge on CapEx, on utilities and personnel. We know what those loads are and how many people are needed to run what is basically in a highly automized factory. And we have massive reductions in both of those. So, like the cost model is well understood. It’s really about rate and yield, which will come in time, as Elon said, over the course of this year and next.

Elon Musk

Yes.

Martin Viecha

All right. And maybe the last question from investors is, what is the current run rate of 4680 cell production at Fremont and at Giga Texas? What do you expect run rates of 4680 to be in Fremont and the Giga Texas or Berlin at the end of the year?

Elon Musk

Well, Berlin is using the 2170 nonstructural pack. So, they’re not constrained by 4680. They will transition to 4680 hopefully later this year, but current billing production does not to require that. We also have, just as a risk mitigation, 2170 nonstructural pack capability in -- here at Giga Texas as well. But -- if things go according to plan, we will be in volume production with 4680 sometime perhaps towards the end of the third quarter and certainly in the fourth quarter. Is that accurate?

Andrew Baglino

Yes. And the other thing I would add is like with the China COVID shutdown and the semiconductor bottlenecks we had through Q4 and hence a little bit in Q1, we have sizable cell inventory at the moment, and excess cells to support the 2022 volume targets you described. So, that gives us the ability to be pretty deliberate in the 4680 ramp where we can maximize learning step by step, take engineering downtime to upgrade key pieces of equipment and modify the structural pack design to improve reliability, all while achieving what you just said, so.

Elon Musk

Yes. 4680 output is not a risk to achieving 1.5 million vehicles produced this year, but it would become a risk next year if we do not solve volume production by early 2023, but we’re highly confident of doing so.

Words of HABIT

Active Member

And Ford and GM (all OEM) following the EV start ups downward from early March. They are all just entering and must first pass through the Valley of Death in order to earn their stripes, and many won't make it out alive. Tesla is battle weathered and more the better for having come out of this Great Abyss (from June 2017 to December 2019) and now standing on the other side looking at a very bright and green future. I hope more EV manufacturers can join Tesla soon, more the better, but those can expect a slow slog through the trenches. Tesla has shown them the way and hopefully they can take those lessons, that Tesla learned the hard way, to heart. For OEM and EV start ups, It is their only chance of survival.More about stock diversification ... if you look at many sectors, you often find one huge winner and many other also rans. It's pretty obvious at this point that the automotive (not just EV) winner is going to be Tesla. I think 2023 is the year that Tesla will be the biggest North American auto manufacture in terms of cars manufactured ... bigger than GM or Ford. And their margins are incredible. Tesla is now a world leader in volume manufacturing across any industry.

Meanwhile, let's look at the stock price of the best two EV startups for the last three months:

View attachment 796556

Both Rivian and Lucid have yet to prove that they can ramp to even 20,000 units a year, let alone the huge real volume leap that Tesla made with Model 3 at 200,000+/year. Both companies are making mistakes, Rivian with their pricing snaffus (not raising their prices early enough and then deciding to keep them low for the first 55,000 customers, forgoing $1B in cash), and Lucid with their tiny market (their cars are really expensive).

And then, never forget what Elon just recently said, "I've never been so bullish on Tesla that I am today". Yikes. Add that to his oft stated observation that Telsa is a collection of growth startups, not just an auto manufacturer, and you do think that 3x valuation is right around the corner.

PS. Congratulations to @Artful Dodger on her new Model Y. Exciting times. As with Elon, I have never felt more positive about Tesla than I do today.

Words of HABIT

Active Member

With increases in US interest rates, the Greenback will become a safe haven against other currencies. Case in point, although TSLA was down 0.37% today, the CADUSD=X was down 1.02 so my TSLA investment in CAD$ was up 0.65% today. I expect this trend to continue. I remember getting my first mortage at 8.5% interest and thought it was a great deal because a year earlier it was 18%. Yikes.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K