Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

UnknownSoldier

Unknown Member

Elon still appears at the annual meeting. I think that's fine. Earnings calls aren't supposed to be interesting.Good call… very tight and a lot to be proud of. Liked the tone and direction, but think Elon needs to join at least once per year… a lot of what was discussed was by the folks executing extremely well and understand the plan, but Elon introduces some intrigue and drama which I actually missed.

Can you tell us what these numbers are?Real fundamentals vs "next Tesla" fundamentals.

I used to think that getting the legacy automakers on board with EVs was essential. Earlier in Tesla's history, it was thought that perhaps Tesla's primary contribution would be to stimulate the larger car companies to manufacture EVs. Indeed, the Roadster helped motivate the development of the Chevy Volt and the Nissan LEAF.Biden has been tied to electric cars since his days with the ATVM loan program. To make mass adoption of EVs successful, he needs the UAW and the Detroit automakers to buy in.

Now, however, I'm thinking that mass EV adoption is possible if Tesla and newer upstarts (Chinese companies, Rivian, Lucid, etc.) simply bury the legacy companies. Tesla's ability to scale is only getting better. Perhaps Tesla could be producing many more than 20 million vehicles per year by 2030.

JusRelax

Active Member

Real fundamentals vs "next Tesla" fundamentals.

Can you tell us what these numbers are?

Correct me if I'm wrong, but I believe they are the closing price as of October 19th, 2021 in comparison to the 52-wk high.

Cramer's new power house. TAN stocks. Tesla, Amazon, Netflix.

Just a couple weeks ago Cramer was pumping Ford and quite soft on Tesla.

Now *after* Tesla crushes the quarter’s earnings he’s pumping Tesla again?

I don’t know why people even quote that guy.

Tough and sad really, if I forecast accurately, for Pete. It’s a bit like Colin Powell (may he rest in peace) and WMD at the UN; taking one for the team and destroying his own credibility and ending his career in the process.Didn’t see this posted yet. Apparently Pete Buttigieg was quoted as asking Elon to call him if he has any concerns about the appointment of Missy Cummings - Buttigieg invites Elon Musk to chat after he claims NHTSA adviser pick is biased against Tesla. I'm of 2 minds here. First, this is mostly political - trying to douse the flames coming from a growing fire. And second, I like that there is heat around this. Maybe it will put a check on decisions made w/o strong facts. I doubt it will cause a change in direction in appointment though.

Sorry Pete. I finally have the freedom to state my opinions—OMG so centrist!!—without threat to my career (in the US no less! FFS) but I won’t bother you with them. Funny thing, by a twist of fate in the stock market, I’m also in the position to express my opinion with checks.

“You don’t know what you don’t know” applies not only to the technical part of FSD, but also to the regulatory part.Its pretty sad there are no clear regulatory goals for that yet, they just dont seem to be able to keep up.

There should be a standard set of tests to pass and a real world miles to accident rate etc

Artful Dodger

"Neko no me"

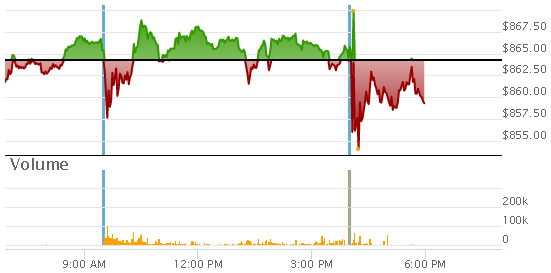

Let's get the NASDAQ After-hrs summary into the permanent record:

This page will resume updating on Oct 21, 2021 04:00 PM ET.

Note that After-hrs volume was 19.25% of Wednesday's total volume, which was in turn only 80.1% of Tuesday's volume. IMO, definately a knee-jerk 'sell-the-news' reaction, with the tepid After-hrs short volume speaking even louder as to the quality of Tesla's 2021 Q3 Results.

Looking forward to the 10-Q. This may be the first year that Tesla does not need to do a Cap Raise. It also looks like FCF will be sufficient to fully ramp both new Gigafactories, and to pay down the last of Tesla's long-term debt. Remarkable result!

Tesla also appears to be on track to unlock the final milestone required to unlock last remaining tranche of the 2018 CEO compensation plan in 2022 Q1 (I estmate they'll reach $75B annualized revenue as long as the deliver at least 56K vehicles from the two new factories in Q1, and Fremont+Shanghai simple continues at Sep 2021 production rates).

Combined with retiring long-term debt, this will substantially decrease Tesla's quarterly Interest + SBC expense leading to much better GAAP earnings. Tesla is becoming a money printing-press on an industrial scale.

Cheers to the Longs!

TSLA After-Hours Quotes

Data last updated Oct 20, 2021 08:00 PM ET.This page will resume updating on Oct 21, 2021 04:00 PM ET.

| Consolidated Last Sale | $851.8 -14.00 (-1.62%) |

|---|---|

| After-Hours Volume | 2,070,471 |

| After-Hours High | $875.4 (04:05:42 PM) |

| After-Hours Low | $851.59 (07:59:40 PM) |

Note that After-hrs volume was 19.25% of Wednesday's total volume, which was in turn only 80.1% of Tuesday's volume. IMO, definately a knee-jerk 'sell-the-news' reaction, with the tepid After-hrs short volume speaking even louder as to the quality of Tesla's 2021 Q3 Results.

Looking forward to the 10-Q. This may be the first year that Tesla does not need to do a Cap Raise. It also looks like FCF will be sufficient to fully ramp both new Gigafactories, and to pay down the last of Tesla's long-term debt. Remarkable result!

Tesla also appears to be on track to unlock the final milestone required to unlock last remaining tranche of the 2018 CEO compensation plan in 2022 Q1 (I estmate they'll reach $75B annualized revenue as long as the deliver at least 56K vehicles from the two new factories in Q1, and Fremont+Shanghai simple continues at Sep 2021 production rates).

Combined with retiring long-term debt, this will substantially decrease Tesla's quarterly Interest + SBC expense leading to much better GAAP earnings. Tesla is becoming a money printing-press on an industrial scale.

Cheers to the Longs!

Last edited:

Tslynk67

Well-Known Member

I believe that Elon needs to remain CEO in order to receive his compensation tranches, once these are done then this would be the moment to re-jig thingsElon wouldn't be leaving as Technoking, just as CEO. The whole reason he wants to step down as CEO is so he can focus on being Technoking. The only reason he hasn't done it yet is because he couldn't find the right person to be CEO, but Zach seems to be the guy.

insaneoctane

Well-Known Member

Maybe Pete let the cat out of the bag with that comment....It was nice to hear Andrew from CNBC push Pete Buttigieg to answer if and why the administration has had an apparent "beef" with Elon and Tesla. Pete didn't completely answer the question directly and explained that they want to see all auto manufacturers succeed.

"All auto manufacturers" will definitely not succeed if the administration doesn't find ways to change Tesla's current trajectory...

insaneoctane

Well-Known Member

Would [INSERT GOVERNMENT AGENCY/EMPLOYEE HERE] be held liable for [ANY ACTION OR INACTION WHATSOEVER] in the US....Would NHTSA be held liable for excessive morbidity and mortality in the US when FSD is shown to decrease both in other countries?

I thought I'd highlight what you really asked so you could see the humor in it!

Artful Dodger

"Neko no me"

So Fremont capacity is now 600k with room to expand and Shanghi is listed as >450k.

I've been assuming that Shanghi, Berlin and Texas will all have larger capacity than Fremont b/c green field design, larger footprints and no low volume S + X. I think that still holds, but starting to wonder what the capacity of those plants really is. 800k? 1m?

Based on Giga Shanghai results, both new Gigafactories will be capable of 800 Models Y per day per line, with 2 lines planned for each site within the existing building footprint.

Also like Shanghai, Tesla will bring up 1 line first at each site, followed by the 2nd line in about a year, for a total of 1,600 Models Y per day at all 3 new-build Gigafactories. This will require local battery cell production, but Tesla is on track to achieve that by Q4 2022.

So 2 lines * 800 Models Y per day * 3 Gigafactories * 339 days per year of production is over 1.62M Models Y per year run rate by the end of 2022. This easily matches Elon's assertion that Model Y will become the largest selling car by volume in about a year (compare to Toyota Corolla peak at 1.26M units in 2015).

Did you notice that the 1.6M per year production level is reached WITHOUT Fremont? This gives Tesla time to retool and renovate the old NUMMI site once the initial rush of demand for Model Y is satisfied. Good times*!

Cheers!

*P.S. Yes, I know Jimmy Walker. He and I ran a half-marathon together in Aug 1980. I last saw him while walking around Victoria harbor in Oct 2004.

Tesla’s global brand value increased over 100% in one year, the first time any brand has ever increased by triple digits.

Ain’t seen nothing yet.

www.prnewswire.com

www.prnewswire.com

Ain’t seen nothing yet.

Tesla Leapfrogs the Competition in Interbrand's 2021 Best Global Brands Report

- Tesla (#14) makes the biggest leap up the table and is the fastest growing brand of the past year with an unprecedented 184% increase in brand value after...

Last edited:

Flex. Manufacturing.

apple.news

apple.news

Tesla launches new website to flex its manufacturing muscle and help with humongous hiring effort — Electrek

Tesla has launched a new website to flex its manufacturing muscle, which Elon Musk believes is Tesla’s biggest strength.

Thekiwi

Active Member

But he’ll receive another juicy CEO compensation package once the current one is complete, he will probably retire as CEO once he is ready to head to mars (Some time in the early 2030s I would guess)I believe that Elon needs to remain CEO in order to receive his compensation tranches, once these are done then this would be the moment to re-jig things

Tslynk67

Well-Known Member

Probably, but the next package will probably replace the CEO clause with TechnokingBut he’ll receive another juicy CEO compensation package once the current one is complete, he will probably retire as CEO once he is ready to head to mars (Some time in the early 2030s I would guess)

What a great earnings report and zero drama, boring almost, love it!

Stock essentially flat, which is a very pleasant surprise from the normal wild gyrations...

It may not be about Teslas trajectory. It may be about changing the failing trajectories of traditional auto manufacturers struggling to come to terms with the fact they must completely transform into EV manufacturers.Maybe Pete let the cat out of the bag with that comment....

"All auto manufacturers" will definitely not succeed if the administration doesn't find ways to change Tesla's current trajectory...

Government incentives are all about making it clear that ICE is a dead end. They must invest heavily to weather this transition. Incentives will fill the showrooms with buyers wanting EVs. This will make the enormous disruption coming at them more of an opportunity if they can rally to it. It won’t be easy on the workers.

Tesla is fine. No need for auto incentives IMO. Be nice to have some solar roof incentives in the works.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M