I'm posting here given its a weekend, but if you have comments on the model please reply in the Earnings Projections Thread: Near-future quarterly financial projections

Q419 Earnings Estimates:

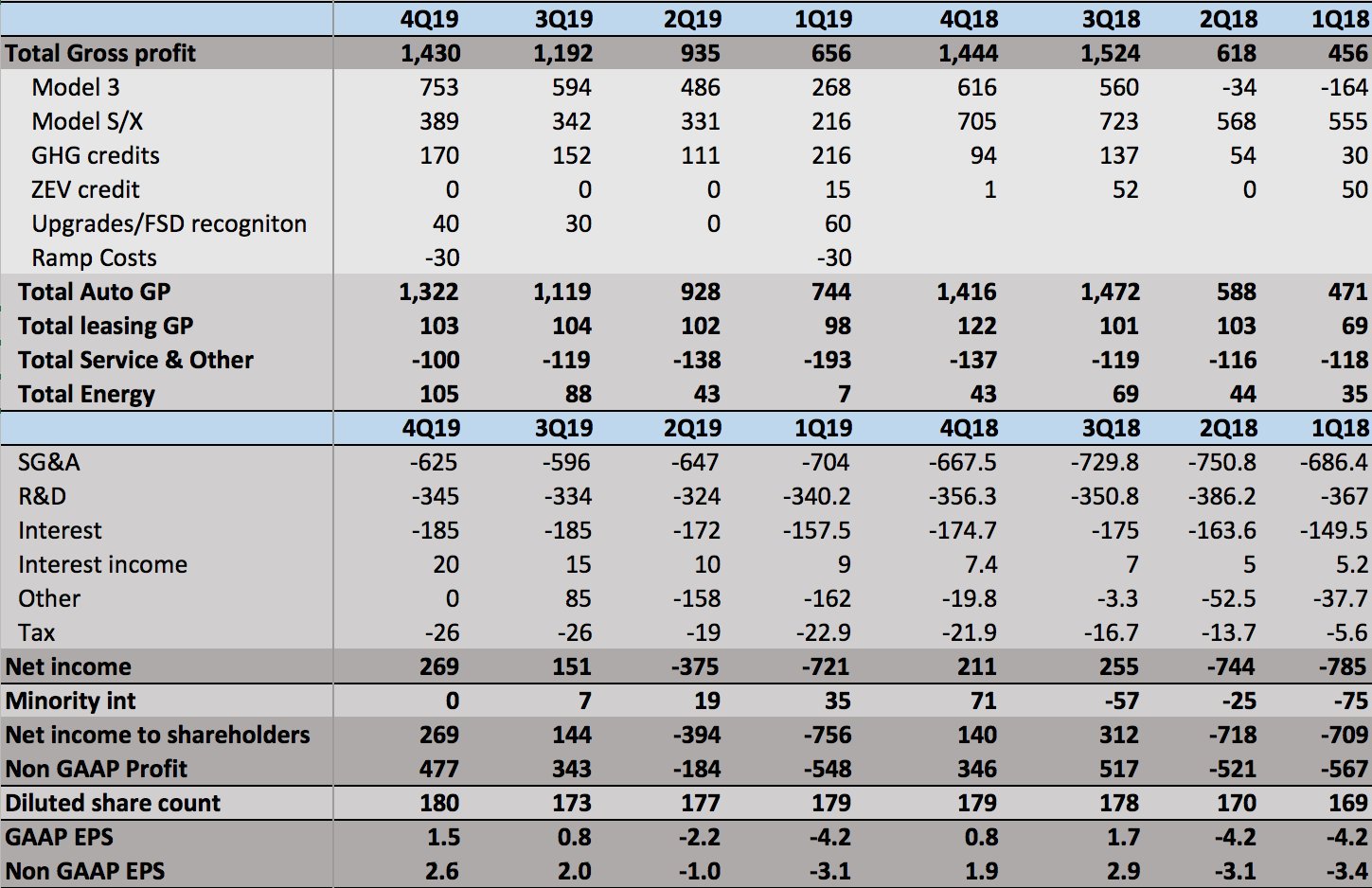

P&L

Revenue $7,325m (+$1,022m QoQ, +$100m YoY):

Gross Profit $1,430m

Opex $970m

Net Income $269m (+$58m YoY, +$118m QoQ)

GAAP diluted EPS $1.5, Non GAAP EPS $2.6:

Key Revenue & Margin Assumptions:

In this model I have kept Model 3 gross margins flat QoQ. This excludes credit revenue, one off software upgrades (Acceleration boost), deferred FSD recognition and China one off ramp costs which have all been broken out separately.

I think flat margin QoQ is likely conservative - Tesla has consistently reduced production costs QoQ & > production drives > margins (fixed cost leverage, < staff hours/car, supplier scale saving passed on). Main risks are larger one off GF3 headwind & more +ve one offs in Q

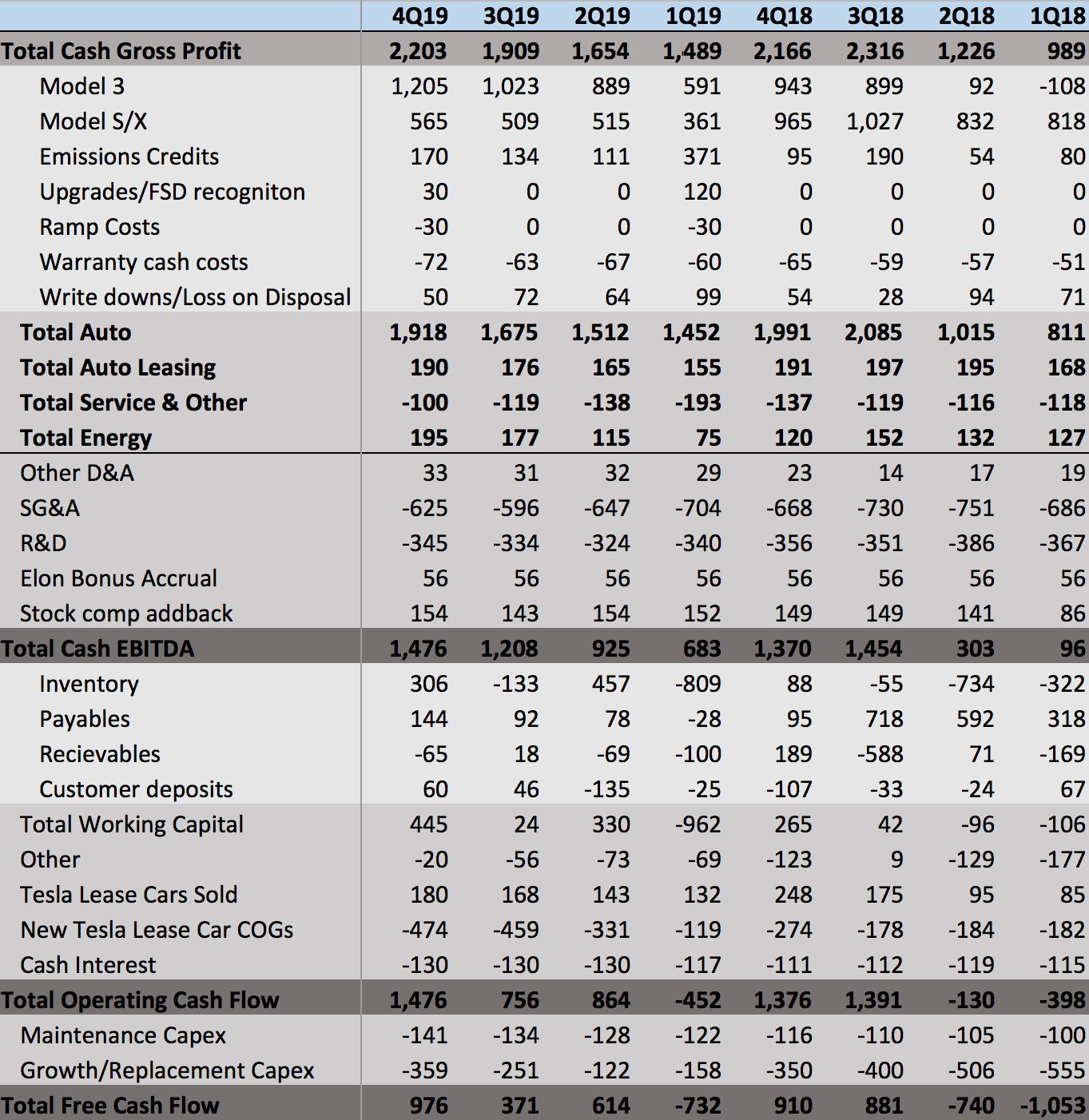

Cash Flow

Operating Cash Flow: $1,476m ($1,031m before Working Capital)

Free Cash Flow: $976m

My cash flow statements use different presentation & include many estimates for past Q line items but Operating Cash Flow & Free Cash Flow for Q4 uses Tesla definition.

My Cash Gross Profit Line = Gross Profit plus non cash cost addbacks for Depreciation, Warranty Reserve and Net Deferred Revenue

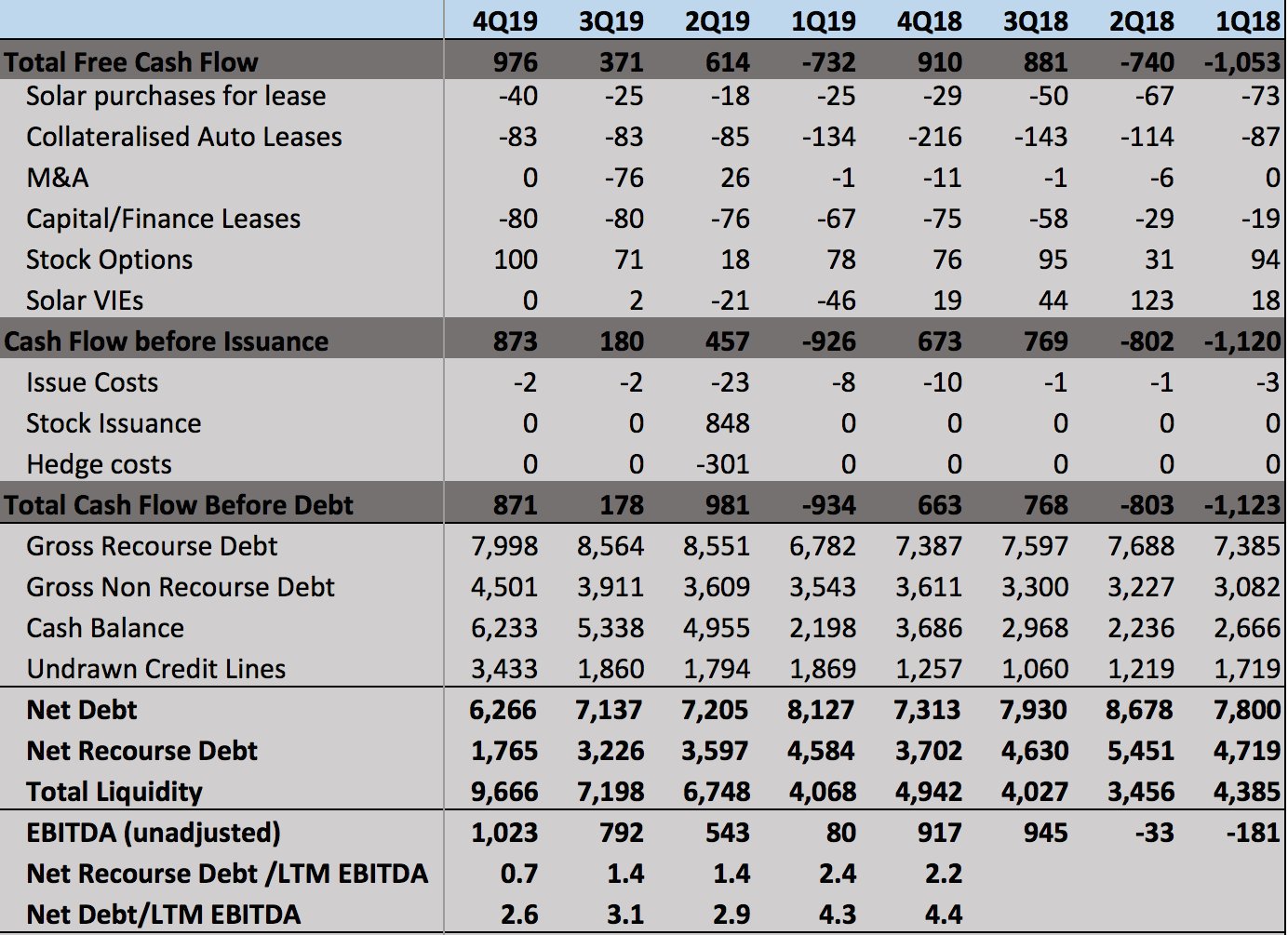

Net debt down $871m QoQ to $6,266m.

Net debt/EBITDA down to 2.6x from 4.4x at 4Q18.

Net recourse debt down more than half YoY to $1,765m from $3,702m at 4Q18. This includes $4,200m converts which are all in the money (but not convertible until 3 months before maturity).

Q4 Total Liquidity: $9,666m.

Including $6,233m unrestricted cash and $3,433m undrawn bank lines.

I would expect to see credit rating upgrades after Q4.