Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

At least Brad (not his real name) is realistic

Dikkie Dik

If gets hard, use hammer

Someone calling themselves "facts chaser" says Mercedes' cheap BEV will have 25% more range than Model 3. OK...

FYI Fact Chaser is a known TSLAQ Troll.

This "Facts Chaser" is the new TSLAQ ring-leader. 24/7 FUD, lies and misinformationSomeone calling themselves "facts chaser" says Mercedes' cheap BEV will have 25% more range than Model 3. OK...

JupiterMan

Active Member

UK new car registrations jump 20% in August. SMMT (the industry body) have not updated their website with breakdown of manufacturers/models yet, but (surprisingly) good data.

Reuters article

Reuters article

China registrations - last plot (52-week cumulative) is most relevant IMHO:

UkNorthampton

TSLA - 12+ startups in 1

August is a low-sales month asUK new car registrations jump 20% in August. SMMT (the industry body) have not updated their website with breakdown of manufacturers/models yet, but (surprisingly) good data.

Reuters article

1) Registration Plates change in September - so March & September are the biggest months for sales (used cars seem younger when they are resold years later)

2) Fewer Teslas (all from China) - normally last month of quarter (September) is bigger

Still pretty marvellous...

Car Registrations

SMMT is the country’s primary source of data on the motor industry. Click here for the SMMT car registrations data published monthly

Attachments

Last edited:

FEERSUMENDJIN

Member

Yup, but the race leader can be Fkd by the establishment at any point in surprising ways. Just watched Le Mans 66 with an excellent example of this.Elon is going to get into those political stoushes on X and because of X from time to time.

It is another short term distraction, refer to my post above.

I am more interested in how the race leader is progressing, and not interested in any cheering or booing from the crowd.

cliff harris

Member

All joking aside, the cybertruck is genius marketing by Tesla. Not only does it appeal to the 'manly men', it also changes the brand in total for those potential buyers. Its pretty hard to argue that Tesla's are only for (to quite UK politicians) 'the lentil-munching wokerati' when that same company produces something that looks like its from a cyberpunk movie.

That will not only sell cybertrucks, it will mean the S,X,3 and Y have a broader appeal, because Tesla is no longer tainted by association with just California do-gooders.

In a way, its 100% part of the mission. At this point in the transformation to EVs, its an easy sell to get the ultra liberal, ultra left driver to choose an EV. Tesla are taking on the harder job of selling EVs to trump voters and climate-change deniers. If we are going to transition 100%, EVs have to appeal to everyone.

That will not only sell cybertrucks, it will mean the S,X,3 and Y have a broader appeal, because Tesla is no longer tainted by association with just California do-gooders.

In a way, its 100% part of the mission. At this point in the transformation to EVs, its an easy sell to get the ultra liberal, ultra left driver to choose an EV. Tesla are taking on the harder job of selling EVs to trump voters and climate-change deniers. If we are going to transition 100%, EVs have to appeal to everyone.

petit_bateau

Active Member

1. Directionally I think those of us (you, me, etc) that come at the data objectively, reach similar conclusions, i.e. this transfer is happening very fast and will be largely over by 2030. Details aren't really the point given the immensity of that conclusion. In their inner hearts, everyone that matters in auto industry gets this (and in fossil fuels). Those that don't get this will get culled. Some do get this but have failed to act in time - they too will get culled, but for the time being they are the loudest in spewing FUD in an attempt to buy themselves more time and a better golden parachute.I've been working on the formatting and slightly adjusting the curves in projections, the most recent version I had saved has 1M ICE/Hybrid in 2030 so not 100% conversion by then just 98.75% and that is with excluding commercial vehicles which might be slower to convert.

This is the slightly more pretty version I made this afternoon. I'm just not so sure about how deep the valley will be. So I lessened the dip and slowed the ICE draw down to have some straggler content in 2030.

I'm following JPR007s lead in assuming that pure EVs will increase demand past the high of 2017, but unlike him I'm not assuming growth all the way to 2040 and I'm not expecting growen above the 2017 peak to be as steep as he did. For now I'm leaving 2031-2040 out of it. I think a 6 year projection is far enough into the unknown to get the point across.

For now I've taken his EV data and inserted it as a portion of, not in addition to, any historical data I got from OCIA, if you think that is wrong please let me know.

so for example 2012 was 63.1 million in the OCIA data and I graphed it as 63.0 in one color and 0.1 in the other.

Also his 2021 number was obscured so I made a pure guess of 4.8 based on the height of the bar. Not having source data to work with.

If anyone can give me an open URL for source data for global EV sales that I can use I might switch the historical EV bars.

View attachment 971028

2. There are good reasons why the auto-industry will restructure itself to deliver such a fast transfer in an endogenous manner, in a way that is now nigh-on unstoppable. However there is an additional exogenous reason that doesn't often get touched on, namely the absence of a reason to slow down as the end-of-the-S-curve draws nigh, near 2030. Ordinarily in an industry we would expect some slowdown as everyone worries about stranded capital invested into overcapacity. Ordinarily everyone gets their bet slightly wrong and industries do end up with some overcapacity and a subsequent glut, crash, etc; but nonetheless there does tend to be a degree of slowdown towards the cycle end. However in the case of auto the key limiting factor will of course be batteries, and the stationary storage sector will absorb every excess battery that is reasonably priced through until 2040. In other words there is little-or-no penalty from investing in additional cell capacity in the ~2030 period, provided one of course invests in dual-use (stationary/mobile) cell types such as modern LFP. That in turn means the cell constraint will experience no slowdown effect as we near 2030, quite the reverse. I have previously shown these two graphs that illustrate this:

However this graph below gives perhaps a better insight into the industrial dynamic at play. It shows how much additional battery manufacturing capacity I expect to come onstream each year, and which sector will be the primary taker of that capacity. These numbers were developed prior to the recent Shanghai Metals Market data that showed stationary to be running 3-5 years ahead of where I had thought they were (as the stationary data sources I had aggregated were - it seems - misleadingly low*), but nonetheless the point is clear : for the next 15-20 years there is little or no penalty (risk) if one does over-investment in competitive cell manufacturing capacity or its precursors.

(* I am still wondering what to do with that SMM data point for H1 2023. I wrote to SMM to ask for previous years/etc data in an effort to assure myself that the data was reliable, but I have received no response. I'd very much like to see some more data points before I accept it as credible. This stuff matters - for example I think that everyone has their learning curves out by a certain (somewhat material) amount as they have not correctly tracked historical cell volumes used in the mobility market. That is why I ran my own calcs, but (unsuprisingly, albeit regrettably) I got a very sniffy response from academia when I made that point and offered to share data on a quid pro quo basis. The error term will be larger if the SMM data is to be believed, as it means the stationary new-cell market has been of a material size for longer than has been previously thought, and so should also be included in aggregate learning curve calculations. Actual cell quantities used in stationary desperately need good global data in the open domain.)

3. I have seen no single open source EV reference. I have myself painfully put together the following table which goes back to 2000 which you (or anyone else) is welcome to use, but please cite me as a reference/source if it is used, so at least I can detect instances of circular data out there and not get confused by seeing my own unsigned reflection. (I am now sadly used to seeing the commercial report writers lifting me). There are some hidden lines in the table but those are really just arithmetic, let me know if you need anything vital. Everything in this flows from other point-sources one way or another. Inevitably there are some inconsistencies because of definitional/timing/etc issues but I do not think they are material. Here is the data from 2010-onwards. Let me know if you see any errors so I can fix them.

4. Are you actually using any modelling 'theory' to underpin your forecast, or are you just eyeballing it ? I have done both over the years, and the case of BEV adoption I am now tending to think that the match for S-curve models is sufficiently strong as to make them useful.

5. I have an open mind as to whether a "valley of death" will open up by way of premature reduction in ICE volumes. The OICA data for 2022 was essentially stable vs 2021, and I hear various snippets that suggest ICE volumes are growing in 2023.

Last edited:

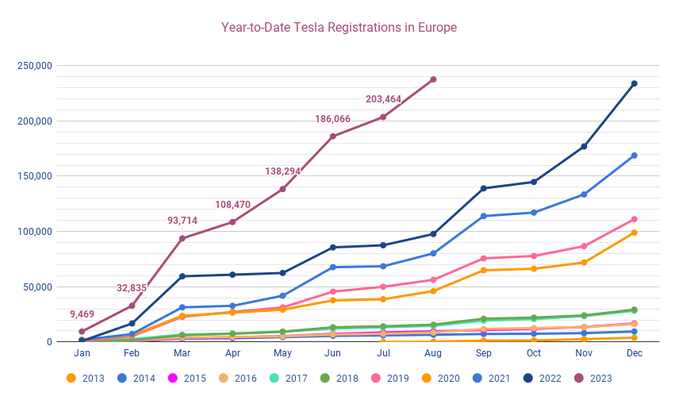

In Europe, Tesla has already surpassed in August its 2022 sales.

JupiterMan

Active Member

the flattening of the delivery wave is very evident in that graph, comparing 2023 with all previous years.In Europe, Tesla has already surpassed in August its 2022 sales.

View attachment 971134

Big thanks to @hobbes and @Troy for maintaining this, while the rest of the internet is talking about "demand issues", we here know the realityIn Europe, Tesla has already surpassed in August its 2022 sales.

View attachment 971134

Someone calling themselves "facts chaser" says Mercedes' cheap BEV will have 25% more range than Model 3. OK...

FYI Fact Chaser is a known TSLAQ Troll.

Well now - so much cynicism!This "Facts Chaser" is the new TSLAQ ring-leader. 24/7 FUD, lies and misinformation

I applaud the gentleman - chasing facts is a laudable action.

I do wonder, though: What would happen if he ever were to catch one? We may never get the chance to find out.

Artful Dodger

"Neko no me"

No idea if it is intentional or not, but timing the massive S/X price cut with the international launch of Highland was sort of fortuitous in masking the big negative that Highland is so far non-existent in the USA.

Indeed, in his latest interview with Herbert Ong, Jeff Lutz said he thinks something may have "broken" with the Fremont rollout place. I think this conjecture is based on Jeff's earlier statement that "Model 3 is now a Global Product". I disagree with this to the extent that Model 3 has always had regional differences in componentry, and Tesla only (mostly) ships only one factory's output to any one particular region.

BREAKING: Why Tesla Did What They Did and Tesla China Sales Up! | Brighter with Jeff Lutz

So I think that the plan in Fremont is just different. We still don't know the purpose of the large concrete foundation now under construction, as seen in recent "Met God in Wilderness" drone videos. It's certainly large enough to host another gigapress or two, and most notably, we did not see any new foundations at Giga Shanghai in 2023-H1.

With less expensive labor in Shanghai than in Fremont, and with this being a mid-life refresh for Model 3 before the next Gen platform introduces the 'unboxed' manufacturing method, it probably makes more sense to keep the cheaper Shanghai line running, and cut COGS on the more expensive Fremont line.

Either way, Wall-E was going to seize any 'bad news' opportunity for a quick buck (as they do), while Tesla is setting themselves up for long-term success. I know which camp I'm in!

Cheers to tthe Longs!

P.S. Anybody know how many Models S/X were sold over the holiday weekend?

Todd Burch

14-Year Member

I ordered pretty quickly over the weekend out of fear that prices would come back up within days.P.S. Anybody know how many Models S/X were sold over the holiday weekend?

I’m curious to hear how the high margin FSD take rate was affected by the 20% price drop.

I don't think we will ever know. Tesla has always kept its take rate secret.I’m curious to hear how the high margin FSD take rate was affected by the 20% price drop.

The FSD price drop is weird though. The only explanation I can think of is that they want to increase the take rate because they need the data from more drivers using FSD on Hardware 4. This would also explain why Tesla suddenly allowed FSD transfers.

But none of the motivation is clear because Tesla ain't talkin'.

Knightshade

Well-Known Member

How does "minimal driver intervention" align with the "Robotaxi" concept

It doesn't- that was one of the points of my last post (that got mostly positive feedback but 3 unexplained disagrees)- it suggests RT is further away than at least the most bullish seem to think it is.

Maybe the term "driver" will end up somewhat similar to what Waymo does - i.e. "remote" intervention (like a drone pilot) of some kind.

Waymos never are "driven" remotely in any legal or SAE sense- the remote support does things like directing to a different route, not physical remote piloting- the "driver" remains the car in those cases. But I've also never seen any suggestion Tesla intends to do any kind of centralized remote assist like that either. So when Tesla says driver intervention, they almost certainly mean human in seat.

Any ideas on if the language change on FSD indicates a deferred revenue accounting claim for the currently held FSD funds?

Mentioned that in said post as well... I'd expect that full FSD revenue to anyone who bought post ~march 2019 would be possible at least in any geo city streets is delivered without the "have to specially ask for it" beta partitioning of releases.

They still wouldn't be able to recognize full revenue from the pre-march-2019 buyers since those folks were promised at least L4 and that remains a future product.

Lost Wages should be a great test for the above... not to mention great marketing for Tesla!

FWIW I think Vegas is perhaps the most ideal possible use for the Boring setup (heavy traffic, but between only a relatively small # of places, in a relatively compact geographic area). The idea it'd solve traffic everywhere seems... less realistic for a variety of reasons best discussed in the TBC threads specifically. But I agree it's excellent free marketing for Tesla.

Buckminster

Well-Known Member

Your guess is as good as mine. If indeed you believe something will be coming.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K