Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Nah ... my guess is Nibiru ...1 Astronomical Unit. Elon is from the Sun!

Antares Nebula

Active Member

Ignore the FUD and buy the dip?So the 20 biggest Tesla shareholders all (expect 2 which had an immaterially small decrease) added to their positions. Any lesson to learn from that?

SebastianR

Active Member

Thanks @Prunesquallor !

I did some digging into this, and was surprised at the conclusion. I posted this on the quarterly results discussion thread, but probably should be elsewhere, or its own thread. I am x-posting here as the feedback is quicker.

_____________________

Did a deep-dive into what FCA would have paid for pooling with Tesla, and the issue here is pretty involved relative to anything I read on MSM.

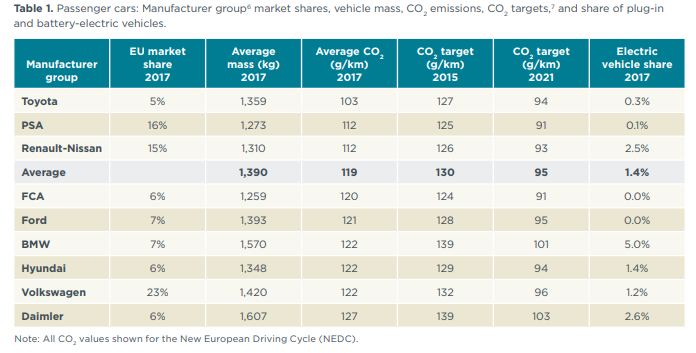

To set the stage, here are the targets that automakers have to hit in 2019, and where they are, as of 2017. The targets for 2019 are the same as 2015. They effectively go up in 2020 (ignoring worst 5%), and full compliance by 2021

Source: https://www.theicct.org/sites/default/files/publications/EU-LCV-CO2-2030_ICCTupdate_20190123.pdf

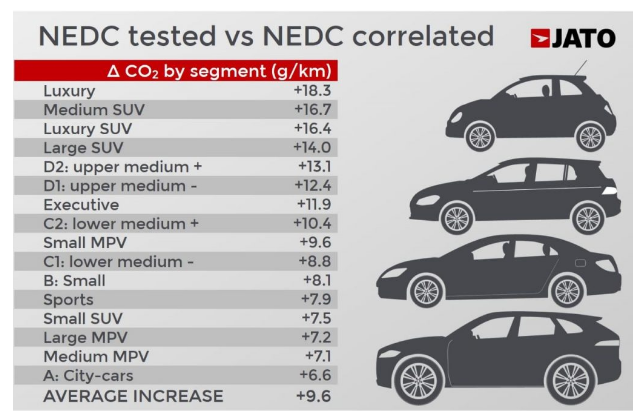

On the surface, 2019 doesn't seem like an issue as everyone is below target. But the devil is in the footnotes. Beginning 1/1/2019, EU mandated WLTP to replace NEDC, which is more realistic. This caused about a 25% increase in CO2 g/km of emissions on paper. So the bureaucrats came up with a NEDC-Correlated (NEDC-c) measure that converts back the WLTP numbers to NEDC-c. There is a good bit to read here, but effectively, the NEDC-c numbers are about 8% (10g/km) more than the old NEDC numbers.

Source: JATO Warns of Widening Disparity between WLTP Correlated NEDC Values and existing NEDC Data - JATO

So, this delta pushes FCA over the edge. Assuming the 10 g/km penalty, FCA ends up at 130 against a target of 124. Assuming some optimizations, they probably can optimize to 5 g/km in the hole. Now they sell around 900k per year in EU, which translates to roughly 95 Euro per g/km times 900k vehicles. That is 95*5*900,000 which is roughly 430 million Euro in fines for 2019.

This market gets pretty tight for everyone in 2019, except for Toyota. That doesn't leave a lot of options for FCA, leaving Tesla in a fairly decent negotiating position. Given this, I think ARK's $0.5B estimate is unlikely. I'd reckon they went roughly 50-50 for about a 200-250 million Euro deal. Interestingly, Tesla only needs about 45K deliveries to pull FCA into compliance. This explains them leaving the pool open, potentially for Ford. Ford probably decided to pass purely for reputational reasons or didn't want to help Tesla.

The real fun starts in 2020 though, where these 0 g/km EVs are pure gold. EU is on track to levy 95*30*15million (95Euro/g * 30 g/km shortfall * 15 million sales) in fines - Or a mindboggling 40 Billion every year. An EV at 0 g/km is worth 9k Euro (95*95) in avoided fines. Tesla could easily sell these credits for a small 10% haircut until it gets to 15-20% market share. And it gets progressively worse for the legacy manufacturers as the limits keep going down. No wonder the likes of LG Chem are playing hardball because next year, the European manufacturers don't have an option to not try building EVs.

Where the eff is the European Gigafactory?

Great analysis thanks a lot! I finally understand the urgency around the 2019 deal.

The story around 2020 gets even better if you consider the "Supercredits"

Reducing CO2 emissions from passenger cars - Climate Action - European Commission

Super credits

Manufacturers are given additional incentives to put on the market zero- and low-emission cars emitting less than 50 g/km through a “super-credits” system. This already applied between 2012 and 2015 and will apply again for the period 2020-2022.

For the purpose of calculating a manufacturer’s average emissions, such cars will then be counted as:

A cap on the contribution of super-credits to the target is set at 7.5 g/km per manufacturer over the three years.

- 2 vehicles in 2020

- 1.67 vehicles in 2021

- 1.33 vehicles in 2022.

I.e. Tesla's contribution will be EVEN MORE valuable in 2020.

Tl;dr: For 2019 I expect max 220 Mio contributions from FCA to Tesla.

For 2020 all bets are off and more car makers may join the pool (depending on how many Model 3 Tesla can deliver in EU).

I concur with your take: where the heck is the European Gigafactory?!?

One channel to try to get this going some...

View attachment 395483

vistacruiser7 on Twitter

If you agree, liking and/or retweeting would make it more likely this idea becomes visible to Musk and/or Tesla.

Great idea! Sell more cars, generate ride sharing revenue, ramp up the network.

Singer3000

Member

No European gigafactory yet because everyone agreed that Wall St is the evil empire and didn’t deserve fees from a cap raiseGreat analysis thanks a lot! I finally understand the urgency around the 2019 deal.

The story around 2020 gets even better if you consider the "Supercredits"

Reducing CO2 emissions from passenger cars - Climate Action - European Commission

I.e. Tesla's contribution will be EVEN MORE valuable in 2020.

Tl;dr: For 2019 I expect max 220 Mio contributions from FCA to Tesla.

For 2020 all bets are off and more car makers may join the pool (depending on how many Model 3 Tesla can deliver in EU).

I concur with your take: where the heck is the European Gigafactory?!?

Mars ☰mperor

Member

Tesla gives Fiat a wake up call: ‘fake’ electric cars can still manipulate EU emissions standards

(Intentional?) Loopholes for ICE makers in Europe.

(Intentional?) Loopholes for ICE makers in Europe.

bdy0627

Active Member

Why wouldn't every model 3 be sold nearly immediately? Sure, they have some inventory for the shops but nowhere near 11,000+. Why is it taking at least a few weeks to sell them at this point? The only place where backlog has been exhausted is in the U.S. With cash growing tight again, this is not the time to increase inventory.Disagree with the bolded section above. 11,400 is not a lot of model 3 inventory. Any other car model being produced and delivered globally at a current rate of 250k (increasing to 300-350k by year end) would have a far larger inventory number.

Why wouldn't every model 3 be sold nearly immediately? Sure, they have some inventory for the shops but nowhere near 11,000+. Why is it taking at least a few weeks to sell them at this point? The only place where backlog has been exhausted is in the U.S. With cash growing tight again, this is not the time to increase inventory.

That’s cars in transit.

Antares Nebula

Active Member

If you want to talk about all the stars aligning in Tesla's favor in 2019-2020:

- Model 3 sales stabilize and continue to grow

- Model S refresh and S,X sales stabilize

- Signif improvement in Autopilot

- Tesla Energy growth spurt

- Solar Roof launch

- Pickup reveal

- Semi, Roadster, Model Y launch

>> And then the kickers:

- Hundreds of millions this year from EU emission req pools; signif increase next year (per @generalenthu and @SebastianR above), AND

- USA EV vehicle tax credit re-instated (bills have been introduced in Congress, but have to see given Trump)

How high do you think the stock will go in 2020? (Talk about a complete 180!)

- Model 3 sales stabilize and continue to grow

- Model S refresh and S,X sales stabilize

- Signif improvement in Autopilot

- Tesla Energy growth spurt

- Solar Roof launch

- Pickup reveal

- Semi, Roadster, Model Y launch

>> And then the kickers:

- Hundreds of millions this year from EU emission req pools; signif increase next year (per @generalenthu and @SebastianR above), AND

- USA EV vehicle tax credit re-instated (bills have been introduced in Congress, but have to see given Trump)

How high do you think the stock will go in 2020? (Talk about a complete 180!)

Last edited:

Carl Raymond

Active Member

No European gigafactory yet because everyone agreed that Wall St is the evil empire and didn’t deserve fees from a cap raise

More the case I feel that in order to do the nth job better than the (n-1)th job, you have to do them sequentially.

Reveal has a history with Tesla...

Remember the Elon hates yellow, so there are no safety markings episode?

Tesla's defense of workers' safety triggers fiery Twitter rebuttal from Reveal

It's been a lot more than that.

First they claimed that Tesla didn't use yellow caution tape, because Elon hated yellow (30 seconds searching on Google Imaged can debunk this), nor beeping forklifts because Elon hates the sound (a couple minutes searching on YouTube can debunk this).

When called out on this, Reveal apologized, issued a formal retraction, and haha I'm just kidding, they went straight into their next hit piece, alleging that Fremont is a safety hazard hellhole and is hiding injuries off the books. This triggered a Cal-OSHA investigation. The only thing the investigation found wrong was a single cord someone might trip over, and was fixed immediately.

Next Reveal came out with two sob stories - a worker legt permanently disabled due to fires started by welding galvanized steel (metal fume fever), and another who got an electric shock so powerful that it sent him flying through the air across the room. Except that metal fume fever is a zinc overdose causing flu-like symptoms and only lasts until your body metabolizes the zinc (a couple days to a week), and shocks launching people flying through the air like Superman only happens in cartoons.

On and on and on. There was a great article last year (Detroit Free Press I think) which noted how, despite their denials, Reveal's hit pieces precisely tracked UAW, down to quouting the same "experts" and focusing complaints on the same targets at Tesla (for example, a particular brand of adhesive) at the exact same time.

Last edited:

Pras

Member

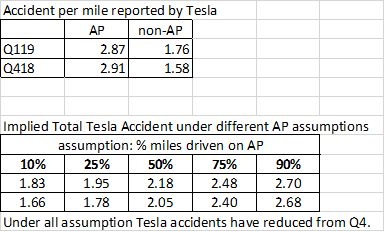

I did some sensitivity analysis on Tesla's reported accident in Q1-19. It seems Tesla's total accidents (AP + non-AP) have reduced per mile. As for the very slight uptick in accident rates in miles on AP, it can mostly be attributed to more difficult parts of driving that are now done on AP (e.g. lane merge, on ramp, etc.). Elektrek as usual is reporting the story in a more negative way that AP accidents are increasing.

So conclusion is that with increasing usage of AP the total accidents are reducing.

Edit : the measure is million miles per accident.

So conclusion is that with increasing usage of AP the total accidents are reducing.

Edit : the measure is million miles per accident.

Attachments

Last edited:

bdy0627

Active Member

No it's not. That's already accounted for. The 11,000+ is cars that have been produced but not sold.That’s cars in transit.

Singer3000

Member

12 months ago you could have written:If you want to talk about all the stars aligning in Tesla's favor in 2019-2020:

- Model 3 sales stabilize and continue to grow

- Model S refresh and S,X sales stabilize

- Signif improvement in Autopilot

- Tesla Energy growth spurt

- Solar Roof launch

- Pickup reveal

- Semi, Roadster, Model Y launch

>> And then the kickers:

- Hundreds of millions this year from EU emission req pools; signif increase next year (per @generalenthu and @SebastianR above), AND

- USA EV vehicle tax credit re-instated (bills have been introduced in Congress, but have to see given Trump)

How high do you think the stock will go in 2020? (Talk about a complete 180!)

- stable production of Model 3 and profitable/cashflow positive. S&P here we come

- 10k per week production before year end!

- convertible bond repaid in cash

- Model Y reveal

- supercharger v3

- Solar roof and Tesla energy $$$$!

- $35k Model 3 launched

- FSD features come on line (coast to coast journey?)

- 100% owned plant in China rumoured to be approved?

I don’t mean to be a Debbie Downer but I suggest you temper any share price expectations in a time period as short as 12-months. Tesla will achieve some of what you say and miss in others. The only thing that will affect positively the share price and break us out of range is the relentless march of profit and cashflow, which if you’ve been paying attention you’ll know is a far less certain process today than even 1-month ago.

Words of HABIT

Active Member

This Aston Martin Rapide E is James Bond's new car. Let's hope the baddies don't have Teslas otherwise Bond is toast.

It's James Bond who should drive a Tesla, a Roadster 2 with Spacex package. No other car would suit him better.

if I only had street parking without elec power hookup at home, I would not have purchased my M3. Current EV offerings are not ideal for everyone/situation...yet.Ok but that’s not what I said. I said almost no one knows Joe Rogan outside the US. Tesla is known outside of the US, hence about half its sales being international.

What I did say was that the perception of the company and its products it’s very different outside the early adopter and aspirational fanboy bubble of which we are all a part.

By a mile the best halo advertising Tesla has at its disposal is the success of SpaceX. But some direct brand enhancement that cuts further than generation YouTube wouldn’t go amiss. I think 100% EV adoption is an inevitability and that Tesla will be front and centre of that. But it needs Joe Average to think the same and not worry that the company will go under before the warranty expires.

For instance, I know someone that has sufficient interest from my constant blathering that they’ve been to a store and are considering a test drive. And yet they still didn’t know about the Supercharging Network and said they’re not too interested in a test drive until the local government puts charging points on every lamppost. Something is going wrong when a prospective buyer (with off street parking at home!) walks out a store with that perception.

Antares Nebula

Active Member

What does Yoda know about Tesla? He lives in a completely different universe.

bdy0627

Active Member

If you want to talk about all the stars aligning in Tesla's favor in 2019-2020:

Love the enthusiasm but here's a possibly more realistic take:

- Model 3 sales stabilize and continue to grow - Ok

- Model S refresh and S,X sales stabilize - S could easily remain somewhat down due to 3; X will be cannibalized by Y

- Signif improvement in Autopilot - Ok

- Tesla Energy growth spurt - they have been saying this for a while, but they need lots of cells for all the vehicle growth

- Solar Roof launch - Maybe? Still seems very expensive compared with panels, at least in the midwest

- Pickup reveal - this should be cool

- Semi, Roadster, Model Y launch - Semi and Y should see some prodx by the end of 2020, not roadster

>> And then the kickers:

- Hundreds of millions this year from EU emission req pools; signif increase next year (per @generalenthu and @SebastianR above), AND

- USA EV vehicle tax credit re-instated (bills have been introduced in Congress, but have to see given Trump)

How high do you think the stock will go in 2020? (Talk about a complete 180!)

Last edited by a moderator:

Singer3000

Member

You misread me. The person in question DOES have access to power hookup at home. And yet was still concerned about lack of public charging. Despite living in a country with fairly ample suoerchargers.if I only had street parking without elec power hookup at home, I would not have purchased my M3. Current EV offerings are not ideal for everyone/situation...yet.

brian45011

Active Member

Now I just wait for the stock to rise to 381 influenced by MXWL. . .

Exchange offer extended to May 14, 2019, per Fidelity.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K