Shanghai is gonna tell central not to F it up again ...Sigh, Tesla Shanghai shutdowns in 5...4...3...2...

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

The reason why wall street doesn't want to hear about optimus or FSD as those are "vision" products, or story products.Facebook PE is under 9. Did anyone predict that 3 years ago? Anything can happen as long as the fed is tightening.

The difference between Tesla and FB is that FB is spending 100% of their FCF on the metaverse which is insane. I'm not saying the the direction they are taking is insane, but almost 10B spend a quarter is insane for what they get! Tesla on the other hand spends so little on R&D despite all of their projects that Tslaq still thinks it's accounting fraud.

Sigh, Tesla Shanghai shutdowns in 5...4...3...2...

Zhengzhou is over 500 miles from Shanghai. I wouldn't panic just yet.

ZeApelido

Active Member

Last edited:

ElectricIAC

Good-Natured Rascal

Consider me shocked.

Knightshade

Well-Known Member

Kinda confused on the increase price for Model 3 to capture the $7500 credit idea Troy has...

He seems to believe they'll stop using CATL LFP cells in order to qualify- so what he thinks they're gonna switch SRs over to 2170s? 4680s?

And the LR would need to cut, not raise, the price to qualify given the 55k cap...in fact many speculated the suspension or LR orders in the US a while back was specifically to they could release a 55k version for January (giving buyers a MUCH lower net price of $47.5k on the LR).

I could see price bumps on the Y since the cap is 80k for SUVs, but the 3?

He seems to believe they'll stop using CATL LFP cells in order to qualify- so what he thinks they're gonna switch SRs over to 2170s? 4680s?

And the LR would need to cut, not raise, the price to qualify given the 55k cap...in fact many speculated the suspension or LR orders in the US a while back was specifically to they could release a 55k version for January (giving buyers a MUCH lower net price of $47.5k on the LR).

I could see price bumps on the Y since the cap is 80k for SUVs, but the 3?

ElectricIAC

Good-Natured Rascal

Kinda confused on the increase price for Model 3 to capture the $7500 credit idea Troy has...

He seems to believe they'll stop using CATL LFP cells in order to qualify- so what he thinks they're gonna switch SRs over to 2170s? 4680s?

And the LR would need to cut, not raise, the price to qualify given the 55k cap...in fact many speculated the suspension or LR orders in the US a while back was specifically to they could release a 55k version for January (giving buyers a MUCH lower net price of $47.5k on the LR).

I could see price bumps on the Y since the cap is 80k for SUVs, but the 3?

$53,790 to account for destination fee.

Not sure if order fee will play into it but if it does then $53,540.

The reason why wall street doesn't want to hear about optimus or FSD as those are "vision" products, or story products.

The difference between Tesla and FB is that FB is spending 100% of their FCF on the metaverse which is insane. I'm not saying the the direction they are taking is insane, but almost 10B spend a quarter is insane for what they get! Tesla on the other hand spends so little on R&D despite all of their projects that Tslaq still thinks it's accounting fraud.

Who would want to work for Facebook? Meta has lost its luster as a destination for talent and with it's stock underperforming for the past ~2 years, they have to be struggling to retain talent. Between the dropping share price and the company's reputation, they have to either be paying top dollar, getting the bottom of the talent pool, or both.

Tesla still seems to have quite a big draw in younger tech workers. Tesla is still very much perceived as a growth story even with the stock getting beat up recently.

If you just graduated from college and you have the choice of working at Meta and adding legs to Zuck's Avatar or working on the brains for an affordable humanoid robot... which do you choose?

While some people don't like Musk, I'm pretty sure everyone hates Zuck at this point.

Add to all this the fact that Tesla just seems to run a much much more efficient ship and squeeze 3x more out of every engineering dollar and there is a pretty large gulf in how far $10b goes.

B

betstarship

Guest

I just went outside of tech for a weekend on a roadtrip to a small town in the outskirts of nowhere.

My primary observations: Climate change is a way bigger problem than the tech industry/economy's progress in bringing more people along to that line of thinking and progress. There's more people suffering than there are thriving.

My primary observations: Climate change is a way bigger problem than the tech industry/economy's progress in bringing more people along to that line of thinking and progress. There's more people suffering than there are thriving.

So Tesla sends a ship from China to Europe, it unloads a bunch of Model 3s for Europe markets. They load up a bunch of Model Ys from Berlin, which get shipped to Taiwan. The ship deadheads from Taiwan to China and repeats the loop... makes tons of sense. Taiwan just has no Model 3s coming in.

Arguably makes more sense than shipping from the US to Taiwan.

Tesla can capture some of that 7500 dollar tax credit by stripping out AP as standard on the LR. People will have to upgrade to it after the fact and given that the price is much cheaper post tax credit, many will jump onboard for standard AP, EAP, or full blown FSD since it'll be wide release.Kinda confused on the increase price for Model 3 to capture the $7500 credit idea Troy has...

He seems to believe they'll stop using CATL LFP cells in order to qualify- so what he thinks they're gonna switch SRs over to 2170s? 4680s?

And the LR would need to cut, not raise, the price to qualify given the 55k cap...in fact many speculated the suspension or LR orders in the US a while back was specifically to they could release a 55k version for January (giving buyers a MUCH lower net price of $47.5k on the LR).

I could see price bumps on the Y since the cap is 80k for SUVs, but the 3?

ElectricIAC

Good-Natured Rascal

Bring it back to EAP being the base paid tier like in the old days.Tesla can capture some of that 7500 dollar tax credit by stripping out AP as standard on the LR. People will have to upgrade to it after the fact and given that the price is much cheaper post tax credit, many will jump onboard for standard AP, EAP, or full blown FSD since it'll be wide release.

Or a sub model where bAP is $25/mo, EAP is $79/mo, and FSD is $199/mo like it currently is.

Zuck was forced to pivot after Apple completely destroyed a good portion of their cash printer by allowing people to disable search tracking. He feels that controlling the hardware and the software is the only way to move forward, hence fires everything at what he believes to be the future of internet.Who would want to work for Facebook? Meta has lost its luster as a destination for talent and with it's stock underperforming for the past ~2 years, they have to be struggling to retain talent. Between the dropping share price and the company's reputation, they have to either be paying top dollar, getting the bottom of the talent pool, or both.

Tesla still seems to have quite a big draw in younger tech workers. Tesla is still very much perceived as a growth story even with the stock getting beat up recently.

If you just graduated from college and you have the choice of working at Meta and adding legs to Zuck's Avatar or working on the brains for an affordable humanoid robot... which do you choose?

While some people don't like Musk, I'm pretty sure everyone hates Zuck at this point.

Add to all this the fact that Tesla just seems to run a much much more efficient ship and squeeze 3x more out of every engineering dollar and there is a pretty large gulf in how far $10b goes.

Of course Tesla is 1000 miles ahead, building almost everything in house to prevent any of these disruption moves by any of these companies. Imagine if Nvidia decides to license their FSD chips out in the future by taking a chunk of the robotaxi revenue from all these car companies? Car companies continue with their piss poor PE because they are just part assemblers, while everyone else making banks because they control the software and hardware. Tesla pretty much told all these players to go F themselves years ago.

The real power move is that Tesla will be licensing out their FSD to everyone because people will stop buying cars without autonomy after it's solved. Like Musk said, no one else is even trying to solve general autonomy and have to say with the latest .4, man is Tesla so close at having this path to full autonomy within a short period of time.

Anyways, Tesla is always steps ahead with these power moves well established years back while the world was still laughing at Musk for building the first gigafactory....

Last edited:

Stock price got you down, Bunky? "Competition is coming" got you worried?

This video argues that you can relax, despite the billions that competitors are spending to catch up. Tesla has something that money alone can't buy: exceptional talent.

Many folks don't understand the power of exceptional talent, even after seeing rockets land on barges. But they will.

This video argues that you can relax, despite the billions that competitors are spending to catch up. Tesla has something that money alone can't buy: exceptional talent.

Many folks don't understand the power of exceptional talent, even after seeing rockets land on barges. But they will.

Gas prices are inflated here partially because many gas stations are starting to use gas sales as a profit center, versus their history of using gas to lure customers to their attached convenience shops. I expect this practice to continue in the US until the whole fleet of vehicles is converted to electric. No clue what oil will trade for during this conversion. I expect price shocks and a bit of chaos, but maybe it will go smoothly? I don't expect SA and OPEC to go down without a fight.Gas prices in China are currently as inflated in China as they are everywhere else. If the demand for gas goes up without the supply increasing the price goes up.

Energy underpins inflation for most things. Gas prices up go up, so do feed prices, so do food prices.

Chinas is not nearly as tightly controlled of an economy as you are suggesting.

The Shanghai clique was elevated to Xi's inner circle recently. I wouldn't be so sure that Shanghai is forced to lock down again like they did in Spring. I, too, was concerned about this just last week. I'm less concerned now, after talking to friends in the region. That doesn't mean it won't happen, but I'm not losing sleep over this.Sigh, Tesla Shanghai shutdowns in 5...4...3...2...

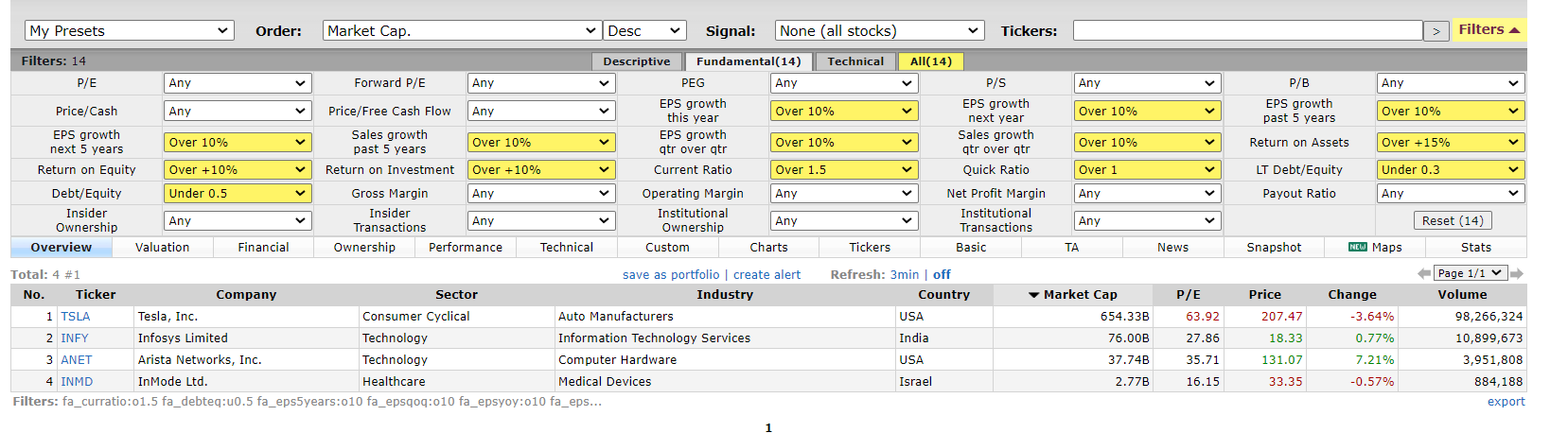

TSLA is in a league of its own as far as financials go. Only 3 other companies meet my half-decent criteria.

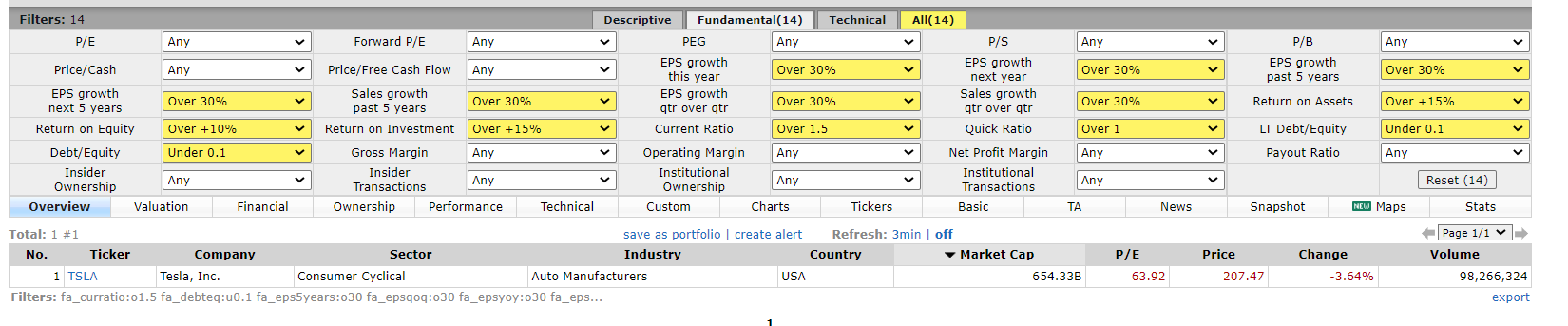

Bumping the majority of these criteria up to the maximum allowed by finviz and TSLA is the last ticker standing.

I'm not worried.

Bumping the majority of these criteria up to the maximum allowed by finviz and TSLA is the last ticker standing.

I'm not worried.

B

betstarship

Guest

TSLA is in a league of its own as far as financials go. Only 3 other companies meet my half-decent criteria.

View attachment 871904

Bumping the majority of these criteria up to the maximum allowed by finviz and TSLA is the last ticker standing.

View attachment 871907

I'm not worried.

How dare you with that UX

ElectricIAC

Good-Natured Rascal

Gas prices are inflated here partially because many gas stations are starting to use gas sales as a profit center

The margins on gas are microscopic for end retailers and are often chewed up by bank fees.

Larger stores like QT or Buc-ee’s rely on volume somewhat but the c-store is still the big get.

Fred42

Active Member

VW gives up on ridesharing. Intro to Autoweek article follows.

Volkswagen became the latest automaker to sell its car sharing business unit, WeShare, to an outside company, in this case the startup Miles Mobility. The sale of the car sharing venture, not long ago hailed as a future source of revenue by a number of large automakers, follows sharp cuts in the operations of other car sharing arms launched in the previous decade.

www.autoweek.com

www.autoweek.com

- VW sells WeShare car sharing startup to Miles Mobility, becoming the latest automaker to shed its car sharing venture.

- The automaker will fold its 2000 EVs, which were offered in Berlin and Hamburg, into Miles Mobility's operations.

- Lack of profitability has driven rapid consolidation in the car sharing industry, which first appeared on the scene in the late 2000s as an alternative to car rentals.

Volkswagen became the latest automaker to sell its car sharing business unit, WeShare, to an outside company, in this case the startup Miles Mobility. The sale of the car sharing venture, not long ago hailed as a future source of revenue by a number of large automakers, follows sharp cuts in the operations of other car sharing arms launched in the previous decade.

Here’s Why VW Is Throwing in the Towel on Car Sharing

Here's why VW has given up its car sharing EV business, selling the startup, and what this means for this type of MaaS venture.

ElectricIAC

Good-Natured Rascal

VW gives up on ridesharing. Intro to Autoweek article follows.

- VW sells WeShare car sharing startup to Miles Mobility, becoming the latest automaker to shed its car sharing venture.

- The automaker will fold its 2000 EVs, which were offered in Berlin and Hamburg, into Miles Mobility's operations.

- Lack of profitability has driven rapid consolidation in the car sharing industry, which first appeared on the scene in the late 2000s as an alternative to car rentals.

Volkswagen became the latest automaker to sell its car sharing business unit, WeShare, to an outside company, in this case the startup Miles Mobility. The sale of the car sharing venture, not long ago hailed as a future source of revenue by a number of large automakers, follows sharp cuts in the operations of other car sharing arms launched in the previous decade.

Here’s Why VW Is Throwing in the Towel on Car Sharing

Here's why VW has given up its car sharing EV business, selling the startup, and what this means for this type of MaaS venture.www.autoweek.com

From WeShare to WeFold.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K