You would rather buy at $200? I would rather buy at $100 or $50 even. In fact, I would rather buy in the $12 range if I had a chance.

Oh, wait, I did! I bought as much as I could handle at $12 and change. Maybe that's why I'm not running around waiting for $200 while saying it's still too expensive.

Friday, I bought a handful of the shortest-term call options I believe I've ever bought (exp. 10/28). They were also the least out of the money at $217.50. I'm not recommending this, but the price was good enough to take a gamble and I felt like gambling and am prepared to lose it all in exchange for a smaller chance at 3X or even 5X. These are the only options purchase I have made in 2022.

I'm the first to tell you that short term price movements cannot be predicted with any consistency but sometimes there is a confluence of events that move the odds in your favor. In this case, I believe the constant hammering TSLA has been subjected to as the MM's take maximum advantage of market weakness, had set TSLA up for a relief rally, at a minimum. And upcoming earnings provided potential for big profits relative to the risk even if the stock doesn't move big immediately upon the release/earnings call (hence the extra week on the exp.). However, with the recent rally they are up over 40% and most of the risk/reward advantage I saw has been priced in already. If I didn't want to gamble, I would just sell them all right now for a nice profit but that's not why I bought them!

If TSLA rallies enough before the close tomorrow I might sell half and leave the remaining ones as free lottery tickets. Otherwise, I'll stick with my original gamble with the entire amount. I don't think a strong rally is more likely than not, perhaps roughly 40/60, but the point is, no, I'm not expecting it to hit $200! Always buy when the getting is good. The trick is knowing when that is. A real pessimist will wait for earnings hoping for weak guidance and a better buying opportunity. But, if guidance is weak, is it really a better buying opportunity? At that point, you have to ask why, if your investment thesis is that we are on the early part of the adoption curve, Tesla's guidance would be weak. Always absorb shares identified as being a good value, don't wait and hope for the buying opportunity of a lifetime that may never come. Of course, the lower the price goes, without a corresponding drop in the expected value of the company, the bigger the position one can reasonably take.

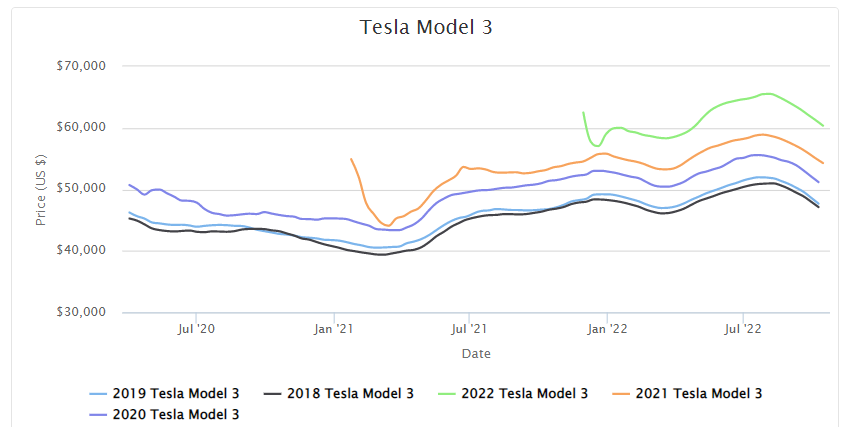

www.cargurus.com

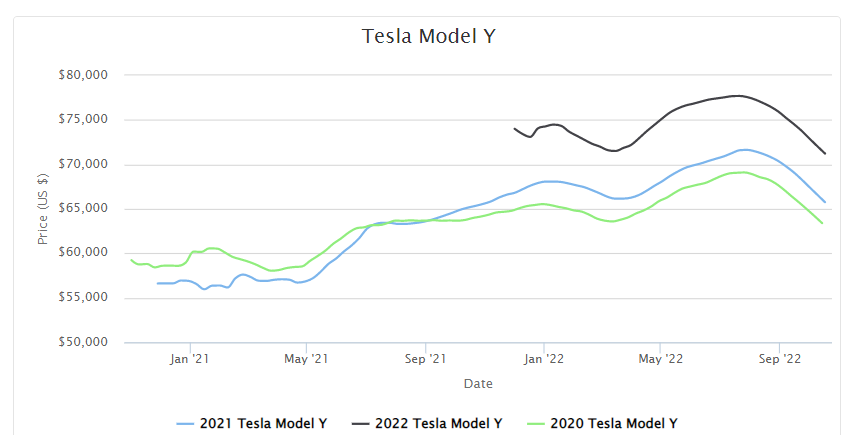

www.cargurus.com