Tesla hires GJ for Optimus ad …. Priceless

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Tesla is philanthropyI thought the majority of the questions during the call today were good. The one from Dan Levy about Tesla's mission for affordable sustainable transportation vs industry leading margins and profits and pricing was fair. While I think most here understand the alternative of lowering prices and margins is bad for everyone because the product backlog is already approaching 1 year at these high prices, imagine the customer experience of waiting 2 or more years if they reduced prices.

Anyway, my thought after that question is how long before the anti Tesla media (most media) goes after Tesla with the greed narrative questioning "how dare they", and point to Tesla's record high margins while their compassionate altruistic legacy competitors settle for pennies....all to elicit their negative narrative? Mark my words, it's coming...

Jon McNeill past Tesla exec saying positive things about this quarter on CNBC. Saying Robotaxi profit could be 250k each If done well.

Talking about smelting down wheels to make casting.

Elon is an amazing time manager.

Talking about smelting down wheels to make casting.

Elon is an amazing time manager.

2daMoon

Mostly Harmless

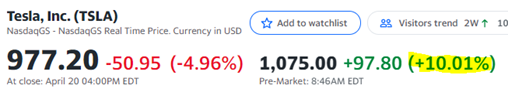

Shhhhh!Closing in on +10% pre-market

Keep it on the down low or everybody's gonna want one too.

Closing in on +10% pre-market

U mean like a 100$ 's

~ 50 $ due to MM dip yesterday

The Accountant

Active Member

Nothing like +10% premarket with a cup of coffee in the morning:

I'd be curious to see the net impact on congestion. More miles driven for sure (not more cars in total) but also fewer accidents, fewer people randomly swerving on a highway (causing a small backup for hours at this spot) etc.BUT, traffic would then become a nightmare. Yes, robotaxis will reduce the number of cars in the world, but there will be way more cars on the road at any given place and time if it’s cheaper than mass transport.

thx1139

Active Member

JupiterMan

Active Member

over a ten year life cycle that feels about right.. numbers on this, at scale, should be stunning.Jon McNeill past Tesla exec saying positive things about this quarter on CNBC. Saying Robotaxi profit could be 250k each If done well.

2daMoon

Mostly Harmless

Nothing like +10% premarket with a cup of coffee in the morning:

View attachment 796092

You are doing a great service by reminding me to get my morning cuppa.

Thank you!

Wow, right at 8:30 AM some serious buying started going on, it almost hit $1080 already. It will be curious to see how the stock action plays out today after such a serious earnings beat.

Krugerrand

Meow

He and the rest of them should just keep doing it this way. I’m not interested in seeing a SP plummet because they are as equally bad modeling but from the other side by always over estimating.Looks as if the analyst Garrett Nelson tries to value Tesla like a traditional auto manufacturer building seasonality into his model.

He has $4.11 EPS for Q4 2023 and then for the next 3 quarters he has lower numbers of $3.22, $3.65 and $3.84. How would this be possible for Tesla?

FYI: Where he has $15.25 GAAP EPS for 2024, I have $33.69 (more than double his number).

View attachment 796083

Carry on being wrong to our advantage. Yes, it can delay the SP but we wouldn’t know what to do with ourselves if TSLA was always accurately priced. Some would have nothing to complain about, there’d be no need of an accountant, and I’d have to stop being smug when being proven right over and over again. Yeah, that sounds awful. Carry on Garrett.

colettimj

Member

I posted on Tuesday to the Supercharger thread.Yes there was contrary to a previous reply. Zack specifically said that supercharger build out had already accelerated recently and would continue to accelerate.

and you can see this in numbers in the quarterly report.

View attachment 796027

Tesla set records for stations/connectors for any Q1 in North America (but not overall):

Supercharger data through Q1 2022 for North America. Record number of new locations and stalls for any Q1.

(Disclaimer: data was pulled from supercharge.info, which is not official data from Tesla)

New locations per quarter

New stalls per quarter

So, will someone call a Senator who will call the NHSTA to fabricate a new recall or investigation today? (sorry, I'm bitter)

SageBrush

REJECT Fascism

The clever part is where those 2170s are coming from, my guess:-

- Some Model 3s out of Fremont using LFP packs.

- Panasonic possibly making more 2170s at GF Nevada

- Energy storage Powerpack, Megapack, now using LFP - (the really clever part).

The 2022 Q1 'deck' published yesterday says that Giga-Austin will soon be able to make both 4680 and 2170 cell based cars. Since (so far as I know, anyway) Austin is not making Model 3, that implies 2170 into Model Y. If the Model Y SR+ model continues to use 4680, then it sounds like the Model Y LR is destined to get 2170 in Austin during the ramp.

StealthP3D

Well-Known Member

Couldn’t make the call and will catch up tomorrow. Was their any discussion on accelerating Supercharger buildout?

Yes, they said they are accelerating the buildout of new Superchargers to accommodate both the rapid growth of the Tesla fleet and also the planned opening of the network to non-Tesla EV's, both in Europe and the US. I don't think they mentioned China specifically but, obviously, that will continue it's expansion as well.

This morning I read an article that presented Ford as a threat to Tesla in the EV space and claimed Ford "maintained" a network of 70K chargers in the US. Can you believe it? They actually tried to make people think a large, supposedly reputable company like Ford actually maintained this mish-mash of third-party chargers dotting the country. The media has zero shame, they would rather push a false narrative.

Contrary to what was said on the call, it looks like the rate of supercharger growth is not accelerating at all. If anything, it is decelerating a bit:Yes there was contrary to a previous reply. Zack specifically said that supercharger build out had already accelerated recently and would continue to accelerate.

and you can see this in numbers in the quarterly report.

View attachment 796027

New Stations

Q2 2021: 267

Q3 2021: 288

Q4 2021: 222

Q1 2022: 248

New Connectors

Q2 2021: 2385

Q3 2021: 2381

Q4 2021: 2217

Q1 2022: 2159

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K