Eh...gives me a chance to try to shake my new couch...This spring has been quite an effective campaign for Wall Street.

The option sellers in the other thread are seeing $900's in our near future and the main thread isn't even excited for a Gigafactory opening. Let alone billions in quarterly profits!

TMC sentiment now shifts with the passing breeze!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

I never got out... just pulled the covers up all the way.I'm going back to bed....

Wake me when it's over.

Lack of unbridled optimism about the very short term is not really a sentiment shift at least from an investor standpoint. Is anyone here doubting the long term success? You (and many others) comment so very much about the day to day (and even intraday) movements that I personally find a huge distraction from the actual investor conversations here. It's very welcome in the options thread though as that is all about the short term. I'm still very surprised that the daily posts about how that day's price movements (on a down day anyway) are clearly manipulated, and the comments about whether we are green or not at any moment in time are still allowed by moderators.This spring has been quite an effective campaign for Wall Street.

The option sellers in the other thread are seeing $900's in our near future and the main thread isn't even excited for a Gigafactory opening. Let alone billions in quarterly profits!

TMC sentiment now shifts with the passing breeze!

I'm pretty sure everyone here is very excited for a Gigafactory opening, it was just stated that it may have no effect on the short term price of the stock, which again, shouldn't really matter to anyone here.

My thinking here is not so much that there will be a 1:1 replacement. But that we can redirect *some* critical supplies to other facilities and be less likely to bump into supply constraints at those facilities.It is pure fantasy to think that Fremont, Berlin & Austin can pick up any of the Shanghai production in any meaningful way for this quarter. Austin & Berlin are limited by their own ramp curves, and Fremont is basically near capacity as it is. We all just need to accept that production lost from the Shanghai factory closure will only have any chance of being made up by the Shanghai factory itself once it reopens.

I agree, we won’t be seeing Austin + Berlin cranking out 2k cars/ day anytime soon to make up for that shortage.

Shortage of truck drivers according to Bloomberg:

Send those Canadian (or American) guys……..

I suspect many did not know about Berlin being ready and the stock seemed to respond nicely as I recall. For many, this was news and when the math on capacity projections begin.

Texas opening will trigger similar awareness with statements like "Tesla in Texas?" and "What's a 4680?" This is an oil state if anyone didn't notice. We all know it's happening, so we're a bit numb to the change I think. Texas could be the most shocked of em all.

For these reasons, I do think there's a play here this week, but I'm just a HODLer...

Texas opening will trigger similar awareness with statements like "Tesla in Texas?" and "What's a 4680?" This is an oil state if anyone didn't notice. We all know it's happening, so we're a bit numb to the change I think. Texas could be the most shocked of em all.

For these reasons, I do think there's a play here this week, but I'm just a HODLer...

The Leaf was not a Home Run. It was a bloop single; a ground rule double at best.Don’t know if this has been posted here.

Nissan Is Having a Tough Time Launching the Ariya EV

Nissan's been trying to hit another EV home run, but things haven't exactly gone according to plan.www.thedrive.com

Then the runner got stranded on third base.

Accident

Member

The market is now waiting for the FOMC minutes to be released today at 2PM. This is from the meeting in March, but there are always notes there that can move the market.I kind of think today is the part of aftermath of whenever the Fed talks from yesterday.

I really don't think folks should get their hopes up about the party tomorrow, at least re: stock movements.

I agree, I don't feel like the party will move the stock at all. Now earnings on the 20th, that's a different story....

Or automate the Semi. (OK, next year)Send those Canadian (or American) guys……..

And why call it a Semi? It should be a Full by then, no?

Gigapress

Trying to be less wrong

I’m no lawyer but we did learn a bit about US market power laws in my economics classes in college and here is my understanding. As far as I know, monopoly achieved solely by merit is legal.you have it correct ... obfuscate the monopoly power question ...hard to hit a moving target ... which is not clear to many at this point ... anyway i better stop this line of thinking ... as we don't want to give the Feds any ideas about anti trust ... any way we can agree to disagree and end it

The primary law that could affect Tesla in the USA is the Sherman Antitrust Act of 1890. It has a section specifying that “Every person who shall monopolize, or attempt to monopolize, or combine or conspire with any other person or persons, to monopolize any part of the trade or commerce among the several States, or with foreign nations, shall be deemed guilty of a felony”

Sounds bad for Tesla!

But not really, because, in Wikipedia’s words:

Courts would consider factors such as:

1) Tesla open-sourced all their patents for anyone who would use them in good faith.

2) Tesla has always actively encouraged other companies to make more EVs and batteries and solar and has historically helped companies like Toyota with making EVs and still has an open invitation to help anyone.

3) Tesla has made no attempt to collude with other companies for forming a price-fixing cartel.

4) Tesla is opening up the Supercharger network for non-Tesla EV drivers.

5) Tesla is working as hard as possible to increase quantity supplied instead of illegally restricting supply to raise prices to earn more overall revenue.

6) Tesla’s acquisitions like Hibar, Maxwell, and Grohmann have been clearly for the purpose of integration and innovation that ultimately helps the end consumer and society as a whole.

7) Tesla has not contractually forbidden competitors from using Tesla products in ways that would impede competition.

8) Tesla has not merged with or acquired any competitors.

9) Tesla has not included non-compete stipulations of exclusivity in any of their supply contracts (e.g. Panasonic is free to sell battery cells to anyone else).

10) Most importantly, Tesla achieved dominant monopoly status by vision, audacity and world-class execution. Winning fair and square is perfectly legal. It’s not Tesla’s fault that competitors voluntarily, stupidly, and haughtily decided to give them 15 years of a head start while offering mostly derision and condescension towards Tesla until they woke up to reality.

At worst perhaps Tesla could be criticized in court for bundling FSD with vehicles and powerwall with solar, or for not allowing 3rd parties to access parts and repair instructions for servicing Tesla vehicles.

I understand that monopoly law tends to be similar in other major capitalistic jurisdictions like EU, UK, China, Canada, etc. I would still keep an eye out for this however because if antitrust suits do come someday it could reduce Tesla’s long term investment value. As I’ve said before, if Tesla is forcibly dismantled like AT&T or Standard Oil that would be bad for cost, rate of innovation and the customer experience.

Homework

Competition Law

US Antitrust Law

Sherman Act

US v. AT&T

Std Oil v. US

Sounds bad for Tesla!

But not really, because, in Wikipedia’s words:

“Over time, the federal courts have developed a body of law under the Sherman Act making certain types of anticompetitive conduct per se illegal, and subjecting other types of conduct to case-by-case analysis regarding whether the conduct unreasonably restrains trade.

The law attempts to prevent the artificial raising of prices by restriction of trade or supply. "Innocent monopoly", or monopoly achieved solely by merit, is legal, but acts by a monopolist to artificially preserve that status, or nefarious dealings to create a monopoly, are not. The purpose of the Sherman Act is not to protect competitors from harm from legitimately successful businesses, nor to prevent businesses from gaining honest profits from consumers, but rather to preserve a competitive marketplace to protect consumers from abuses.”

Courts would consider factors such as:

1) Tesla open-sourced all their patents for anyone who would use them in good faith.

2) Tesla has always actively encouraged other companies to make more EVs and batteries and solar and has historically helped companies like Toyota with making EVs and still has an open invitation to help anyone.

3) Tesla has made no attempt to collude with other companies for forming a price-fixing cartel.

4) Tesla is opening up the Supercharger network for non-Tesla EV drivers.

5) Tesla is working as hard as possible to increase quantity supplied instead of illegally restricting supply to raise prices to earn more overall revenue.

6) Tesla’s acquisitions like Hibar, Maxwell, and Grohmann have been clearly for the purpose of integration and innovation that ultimately helps the end consumer and society as a whole.

7) Tesla has not contractually forbidden competitors from using Tesla products in ways that would impede competition.

8) Tesla has not merged with or acquired any competitors.

9) Tesla has not included non-compete stipulations of exclusivity in any of their supply contracts (e.g. Panasonic is free to sell battery cells to anyone else).

10) Most importantly, Tesla achieved dominant monopoly status by vision, audacity and world-class execution. Winning fair and square is perfectly legal. It’s not Tesla’s fault that competitors voluntarily, stupidly, and haughtily decided to give them 15 years of a head start while offering mostly derision and condescension towards Tesla until they woke up to reality.

At worst perhaps Tesla could be criticized in court for bundling FSD with vehicles and powerwall with solar, or for not allowing 3rd parties to access parts and repair instructions for servicing Tesla vehicles.

I understand that monopoly law tends to be similar in other major capitalistic jurisdictions like EU, UK, China, Canada, etc. I would still keep an eye out for this however because if antitrust suits do come someday it could reduce Tesla’s long term investment value. As I’ve said before, if Tesla is forcibly dismantled like AT&T or Standard Oil that would be bad for cost, rate of innovation and the customer experience.

Homework

Competition Law

US Antitrust Law

Sherman Act

US v. AT&T

Std Oil v. US

Last edited:

TheTalkingMule

Distributed Energy Enthusiast

What would you have us discuss if not the day to day movements of the share price? Yes, we all bought shares of TSLA and are holding them. Yes, there is no better strategy than that. Doesn't make for very interesting conversation.Lack of unbridled optimism about the very short term is not really a sentiment shift at least from an investor standpoint. Is anyone here doubting the long term success? You (and many others) comment so very much about the day to day (and even intraday) movements that I personally find a huge distraction from the actual investor conversations here. It's very welcome in the options thread though as that is all about the short term. I'm still very surprised that the daily posts about how that day's price movements (on a down day anyway) are clearly manipulated, and the comments about whether we are green or not at any moment in time are still allowed by moderators.

I'm pretty sure everyone here is very excited for a Gigafactory opening, it was just stated that it may have no effect on the short term price of the stock, which again, shouldn't really matter to anyone here.

I would argue unbridled optimism in the short term is the primary pastime of a proper TMCer. Preferably so unbridled around earnings that it's borderline psychotic. It is tradition!

Then quickly back to rational analysis.

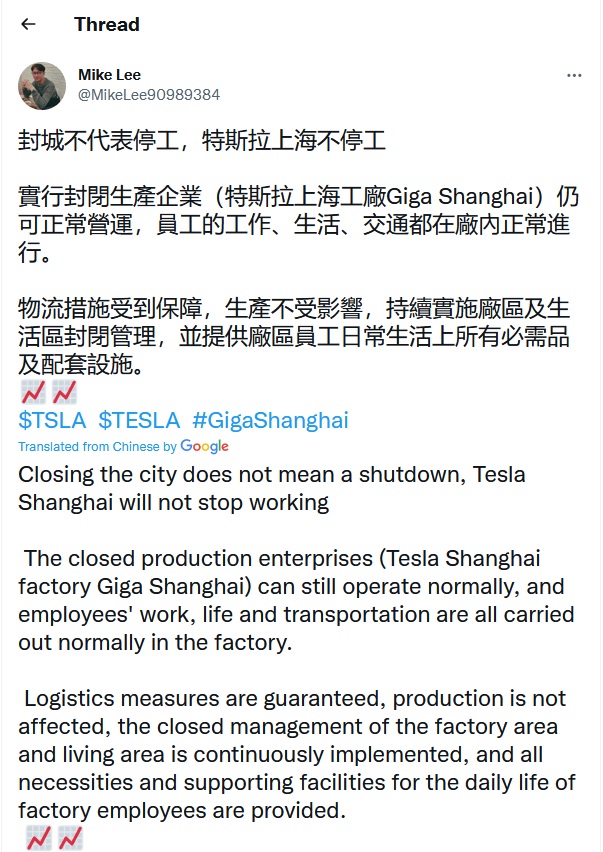

Apologies if I missed the post below. I wonder myself what exactly it means to be shutdown. Is the factory deserted?

Anyway do not know who this guy is and you can find anything you want on the internet. If it were true and verifiable, one would think that TSLA would be going strong, but maybe it is doing exactly that given the ridiculous macros. I certainly cannot say. Obviously if true, it is BAF for the medium term definitely.

Anyway do not know who this guy is and you can find anything you want on the internet. If it were true and verifiable, one would think that TSLA would be going strong, but maybe it is doing exactly that given the ridiculous macros. I certainly cannot say. Obviously if true, it is BAF for the medium term definitely.

It's the same argument against OT topics. This isn't just a chat room.What would you have us discuss if not the day to day movements of the share price? Yes, we all bought shares of TSLA and are holding them. Yes, there is no better strategy than that. Doesn't make for very interesting conversation.

I would argue unbridled optimism in the short term is the primary pastime of a proper TMCer. Preferably so unbridled around earnings that it's borderline psychotic. It is tradition!

Then quickly back to rational analysis.

Getting close to OT (I think light discussion is relevant as most of us think Tesla will be dominant but understand if MODs disagree), but as long as Tesla avoids using market power to take over adjacent verticals then they should be ok. Say if Tesla EVs had a majority of market share, and Tesla required (or made it difficult) to use 3rd party chargers.I’m no lawyer but we did learn a bit about US market power laws in my economics classes in college and here is my understanding. As far as I know, monopoly achieved solely by merit is legal.

MS is a good example. Windows got a pass, but they were forced to include other web browsers in the OS so MS wouldn't own browsing by default.

TheTalkingMule

Distributed Energy Enthusiast

I'm not going to hedge my exuberance just because Ken Griffin needs the SP to be $1035 this week.It's the same argument against OT topics. This isn't just a chat room.

Hedging expectations to to protect from emotional letdown is simply another distortion of reality.

Billions in profits are in the mail. Get excited.

Hey (from under the covers) does anyone know when the cyber rodeo tomorrow is going to start? Surely after market close. As such I would think any major announcements made would effect Friday's SP, not Thursday's.

We know Tesla Shanghai shut down or slowed production at least temporarily at the end of the quarter.Apologies if I missed the post below. I wonder myself what exactly it means to be shutdown. Is the factory deserted?

Anyway do not know who this guy is and you can find anything you want on the internet. If it were true and verifiable, one would think that TSLA would be going strong, but maybe it is doing exactly that given the ridiculous macros. I certainly cannot say. Obviously if true, it is BAF for the medium term definitely.

View attachment 790646

Rob Maurer also said they would give employees notice when they would return to work.

Shutdown is definitely affecting production to some degree or another.

Doors open at 4, presentation begins at dusk. Hoping for some kind of exciting announcements regarding the Cybertruck that will hopefully rally the price on Friday.Hey (from under the covers) does anyone know when the cyber rodeo tomorrow is going to start? Surely after market close. As such I would think any major announcements made would effect Friday's SP, not Thursday's.

coolmanfever

Member

can we watch Cyber Rode live stream online somewhere?

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K