CapitalismThis video is so unreal. Elon does not talk this way. He must be reading a prepared statement. It was not prepared by him. He is reading it like a robot.

What is going on?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

HG Wells

Martian Embassy

Software update.This video is so unreal. Elon does not talk this way. He must be reading a prepared statement. It was not prepared by him. He is reading it like a robot.

What is going on?

J

jbcarioca

Guest

In many jurisdictions underwriters use variables not directly related to loss risk but highly correlated with loss risk. Commonly used ones include marital status, credit score, employment stability and property ownership. Some such variables are used for screening, some for ranking and some for both.As a current P100D owner and very soon Plaid owner, I’m honestly thinking I might be better off with an insurance company that’s blissfully unaware of my driving habits beyond the conventional measures of age, accidents and tickets!

Contrary to popular belief, nearly all insurance and credit evaluation calculation use amazingly primitive statistical techniques. A tiny handful use modestly better techniques. Oddly there are a tiny number that use relatively more predictive data including history with comparable vehicle categories.

Clues about such practices can be elusive. Made more obscure is that such practices are rarely disclosed. The most obvious one is retrospective; if your insurance rates do NOT rise substantially when buying a Plaid, there is direct implication of vehicle class history inclusion.

Better techniques such as the emerging Tesla Safety Score and similar ones such as the Progressive Snapshot are harbingers of improvements that eventually will come. These will have the ability to draw direct inference of behavior and risk consequences rather than that ancient, tried and ‘true’ things like age, income, credit score, traffic citations and marital status.

Sometime we should begin to see Tesla beginning to benefit from those more direct behavior measures in their own insurance offerings. That will not happen in ‘Tesla time’.

cusetownusa

2022 LR5 MSM/Bl | 19"

Wasn’t there a Ford exec tweeting awhile back how Ford doesn’t have these issues? Lol. Anyone tweet him this article for a response?

Ford Recalls Over 38,000 Mustang Mach-E

Ford Mustang Mach-E are affected by a quite significant recall that concerns potentially improperly bonded windshields and sunroofs.insideevs.com

Favguy

Member

Moderator, please move this to a more appropriate place if not relevant, but it does relate to the 3rd largest individual shareholder, so maybe it's OK?

So I thought this guy was actually working on some real, advanced, quantum computing project until I saw this:

So can any mathematicians glean anything real amongst this gobbledygook? Is it above my level of understanding?, or am I right in concluding the guys a total kook and this is all B*****ks? (As far as computing equations go, people are free to believe what they want, spirituality wise)

So I thought this guy was actually working on some real, advanced, quantum computing project until I saw this:

So can any mathematicians glean anything real amongst this gobbledygook? Is it above my level of understanding?, or am I right in concluding the guys a total kook and this is all B*****ks? (As far as computing equations go, people are free to believe what they want, spirituality wise)

I don't know how legit he is with KQID but he's the best new Tesla hypeman to come along in a while.Moderator, please move this to a more appropriate place if not relevant, but it does relate to the 3rd largest individual shareholder, so maybe it's OK?

So I thought this guy was actually working on some real, advanced, quantum computing project until I saw this:

So can any mathematicians glean anything real amongst this gobbledygook? Is it above my level of understanding?, or am I right in concluding the guys a total kook and this is all B*****ks? (As far as computing equations go, people are free to believe what they want, spirituality wise)

Favguy

Member

Agreed, and no doubt he's been mega successful in life. I'm just trying to work out how much to take notice of his opinions and advice if he might be just a little bit nuts!I don't know how legit he is with KQID but he's the best new Tesla hypeman to come along in a while.

Pezpunk

Active Member

Total huckster nonsense. Makes the Timecube guy look like Stephen Hawking.Moderator, please move this to a more appropriate place if not relevant, but it does relate to the 3rd largest individual shareholder, so maybe it's OK?

So I thought this guy was actually working on some real, advanced, quantum computing project until I saw this:

So can any mathematicians glean anything real amongst this gobbledygook? Is it above my level of understanding?, or am I right in concluding the guys a total kook and this is all B*****ks? (As far as computing equations go, people are free to believe what they want, spirituality wise)

TheWalkingDad

Cybertruck 23' or bust.

Looks like deliveries of S have VINs now in the 447 range. Could be a 15k+ Model S delivery quarter...

AimStellar

Member

Artful Dodger

"Neko no me"

3 and Y are essentially fully ramped at Shanghai.

I don't think so. There are 3 lines at GF3: one Model 3 and 2 Model Y lines. Recently capacity was announced as 800/day 3s and 1,000/day Ys. I'd expect that to trend toward 800+1,600 as the 2nd Y line was just brought up about 6 weeks ago.

Further, I expect Tesla will continue to localize the supply chain thus increasing gross margin per vehicle, on top of any effects from increases in production.

But that's not the big driver going forward at Giga Shanghai: Phase 3 will push production numbers to new highs for the next several years. WuWa video GF3.3 Sep 24 2021 Detail

How do you say "Model 2" in Chinese?

Cheers!

Nolimits

Member

I love this!!!!!

I think Plaid is about to break some more Nurburgring records. Modified this time. These are the same guys that modified the Pikes Peak Mdel S Plaid. View attachment 714375

They better be quick - season is gonna end soon, weather is quickly getting worse

Dancing Lemur

Hoopy Frood

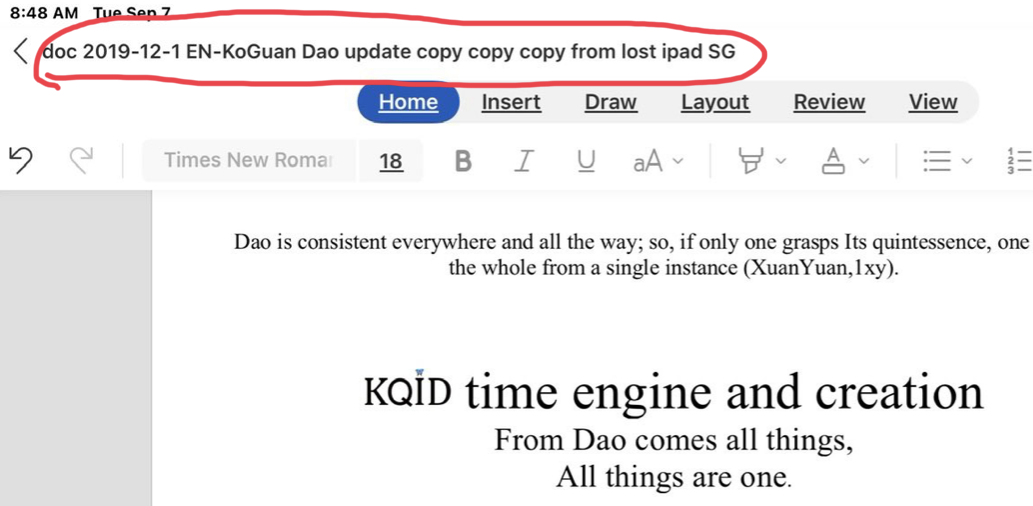

The question of KoGuan’s flakiness can be put to rest by the filename of his KQID “Time Engine” paper:

My Plaid is *431xxxLooks like deliveries of S have VINs now in the 447 range. Could be a 15k+ Model S delivery quarter...

Did you get the update and the button before subscribing?

Two cars with FSD got the button simultaneously.

Car with HW3 but basic AP got no software update.

I subbed that car yesterday so waiting for the button there.

It would benefit Tesla at some point to make an announcement that FSD beta is now available on car dashboards for those who buy FSD via fully paid or a sub. Here’s the link for 10k or 200/month..

jhm

Well-Known Member

How about Tesla set a record for self-driven car on Nurburgring?I think Plaid is about to break some more Nurburgring records. Modified this time. These are the same guys that modified the Pikes Peak Mdel S Plaid. View attachment 714375

JohnnyEnglish

Member

It will be really interesting to see the 'Installed Annual Capacity' table in the Q3 ER. Perhaps Shanghai could go from >450,000 to something like 800,000I don't think so. There are 3 lines at GF3: one Model 3 and 2 Model Y lines. Recently capacity was announced as 800/day 3s and 1,000/day Ys. I'd expect that to trend toward 800+1,600 as the 2nd Y line was just brought up about 6 weeks ago.

jhm

Well-Known Member

Agree. In earlier posts I discussed crashes with injuries as a better metric from which to extrapolate to deaths. Your point supports the contention that Tesla is likely to have a lower ratio of fatal crashes to crashes with injuries. As injuries are about 80 times more frequent than deaths, it takes much less driving data to show significantly lower injury rates vs average than lower fatality rates. But you have to have a credible case for why lower injuries actually means lower fatalities as well.Just like to point out that your statistics appear to based on deaths per mile travelled and that due to the energy absorption of Tesla's vehicles with large crumple zones, strong passenger compartments, etc., avoiding deaths is largely a function of following the speed limit and avoiding head-on collisions. Even the few battery fires we have seen in recent years were almost always the result of high-speed driving.

The bottom line is that the deaths/miles travelled should be a fairly easily metric for Tesla to master in the near future. I'm not saying FSD is easy, merely that it's pretty hard to die in a Tesla. From a objective perspective it would seem the number of injury crashes would be a more telling metric than number of deaths.

2daMoon

Mostly Harmless

Lars offers this week's highlights, a bevy of well deserved Teslaps, and his usual light-hearted coverage of current development to keep us entertained on Sunday.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K