Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

schonelucht

Well-Known Member

I'm not sure how to reply to this post diplomatically.

Why would you seek to do so. Speak up your mind. So do I.

Your post sounds like a post on seeking bs, long on emotions and short on facts, and you get a bunch of "likes". I think people should be a lot more careful about whose advice they follow when investing money!

But please be sincere. I do point out several facts. The cash position of SolarCity, the desperate latest solar bond, the currently non-productive factory with investments postponed, the shut off from the capital markets, the refusal of Tesla ABL backers to extend the same to SolarCity. SolarCity as a standalone company was toast. The implosion of their original business model. The muddled timeline on new products. The fact that the majority of the IP of their future projects will come from Tesla. I have not seen any credible refutation of that part of my argument. SolarCity may make money for Tesla in the future. But that's a separate discussion and a honest discussion on it would at least consider at what opportunity cost.

schonelucht

Well-Known Member

My point wasn't that I'm right and you're wrong, it was that I can, without knowledge or verification, make unsubstantiated claims just like you can.

But the point is that the facts contradict your position. If Elon was first taker, they would have had to disclose that right from the start due to the conflict of interest. It's all spelled out in the filings. But they didn't. Hence the only possible explanation remains that Elon was NOT first in line but the backstop on that loan. Btw, did you subscribe to it? Did anyone here?

MitchJi

Trying to learn kindness, patience & forgiveness

A year? More like 3 weeks. Their cash position at the end of the quarter was abysmal, they are not even able to sell a $125M debt at 6.5% for 18 months with a take-over deal by a well-funded company in the pocket except to insiders. They are not even getting a loan from those who have Tesla's inventory as a collateral. If not for Elon stepping in, they would be in breach of all sorts of debt convenants about now already. When that happens with this much liabilities on the books, it's game over. Those who think the timing of this deal is due to 'products' are deluding themselves. There are no products on the time line that require this close integration. Companies do and can work together very closely while keeping fully independent ownership (Panasonic and Tesla being a prime example). The reality is that the 'product lineup' of SolarCity is non-existent. Their original business plan was a hard sell on financially questionable deals to unsuspecting homeowners at a premium. Continued weakness and honest competition made that work for only a short while. Their own gigafactory is largely a paid-for-by-taxpayers extravaganza that will put out products for which the price premium will not reflect the added value. It's hopelessly postponed and manufacturing hiring promises to the state were instead filled with salespeople instead (seriously, solarcity boots are everywhere in the state). Now it's going to be 'beautiful' solar roofs, batteries and inverters. Basically all kinds of IP that comes from Tesla instead of Solarcity. Standalone they would be toast. Enough already.

Personally I didn't give a dime for SolarCity so I ignored it right up to the point where I couldn't because Tesla decided they needed to buy them. Since then I've been following the company and there is not a SINGLE shred of good news that came from the company. Not a single shred of good news. Financials went down even worse, product timelines more confusing, downsizing costs are looming, interest rates rising and capital markets closing willing to have to do less and less with the company.

My post was not directed at you, but towards people who might have been foolish enough to invest based the inaccurate opinions you presented.Why would you seek to do so. Speak up your mind. So do I.

Inaccurate opinions are not facts. You have not addressed the facts I presented with your opinions.But please be sincere. I do point out several facts. The cash position of SolarCity, the desperate latest solar bond, the currently non-productive factory with investments postponed, the shut off from the capital markets, the refusal of Tesla ABL backers to extend the same to SolarCity. SolarCity as a standalone company was toast. The implosion of their original business model. The muddled timeline on new products. The fact that the majority of the IP of their future projects will come from Tesla. I have not seen any credible refutation of that part of my argument. SolarCity may make money for Tesla in the future. But that's a separate discussion and a honest discussion on it would at least consider at what opportunity cost.

brian45011

Active Member

Sounds condescending; adults believe they are responsible for their decisions (when investing and otherwise.)My post was ... directed ... towards people who might have been foolish enough to invest based the inaccurate opinions you presented.

.

Without seeing the trader's book, it's all speculation. Some see it as a roll down of short calls to reap more premium while following the share price down with a safe ~$25 cushion.

Others see it as adjusting a hedge for a short equity position.

It was initially reported by one of the Najarian brothers as a bull call spread which is belied by the drop in open interest.

Dan Nathan of CNBC was quite specific in this video: the $255 calls were sold to close; $235 calls were bought to open. This is not consistent with speculation of "roll down short calls to reap more premium following the share price down with a safe ~$25 cushion", it is either rolling down bullish call position, paying additional premium for a safer bet, or adjusting hedge for a short stock position, paying additional premium to lower the buy stop.

Sounds condescending; adults believe they are responsible for their decisions (when investing and otherwise.)

Hmm, this sounds familiar...

Later CNBC's "Fast Money" trader Dan Nathan clarified that $255 calls were actually sold to close , while $235 were bought to open. So it was not a closing of the short position of $255 calls as you suggested.

So it looks like this is either a holder of bullish position of $255 calls decided to reduce the risk by paying additional premium and rolling the long call position from $255 to $235, or, as suggested by Dan Nathan, somebody with 1M short position paid additional premium to lower the buy stop to hedge the short position.

Well, Open Interest of 235 Calls yesterday were in the 11k range and stand at that range this morning (not 10,000 more). Meaning if 10k were already open and "moved" to another holder, then open interest hasn't shown someone else selling to open.

Open Interest of the 255 Calls yesterday were 10710 and this morning, are 4221.

I doubt this is anything more than a fund who also sells covered calls rolling them down to a lower money-making position (ie. they received over $2 on 255 OTM covered call sales Aug 18, bought back at .52 making $1.50). Then they wrote new covered calls at an improbable Oct strike @ 235 OTM and some counterparty took them in small blocks because the 235 trade yesterday was not made in big blocks but had good volume overall. And if pps hits 235 by Oct 21 (prior to ER, all the better and they'd possibly release their holding to a buyer of those shares). That is 10%+ upside from here. I would imagine that funds might want to push pps back to 225 and these calls gain a bit of value but will eventually close at 0 (pps not reaching 235 by Oct 21). How does it hit 235+? Possibly if SCTY deal is killed. Funds who are in the support position cannot sell shares - so they need to make money somewhere on covered calls. If someone is short, they might sell short puts to demark their buy-back points and may also buy calls OTM just in case to be safe but 235 is 10% higher and only a month away and doesn't seem sensible to do that (to me anyway). I would rather be buying next week's 220s or Sept 225s for protection.

I believe this is someone trying to make $1.50 or so every month while the pps has fallen but are still holding long shares. This is natural trading activity for someone with large holdings. Buying stock only, without excess income taken from covered calls is not complete trading and people miss out on such income if they do not participate in OTM call selling over time. I think this CNBC coverage and Jon Najarian 'talking up' the trade as "someone trying to get 20:1 gains" if the stock pops to 250 is misleading and market making. Also, if he thought he was finding something interesting, he looks foolish talking it up.

What I would look at is the volume at close yesterday as being more of an interesting catalyst - perhaps a bunch of short covering.

Last edited:

Well, Open Interest of 235 Calls yesterday were in the 11k range and stand at that range this morning (not 10,000 more). Meaning if 10k were already open and "moved" to another holder, then open interest hasn't shown someone else selling to open.

Open Interest of the 255 Calls yesterday were 10710 and this morning, are 4221.

I doubt this is anything more than a fund who also sells covered calls rolling them down to a lower money-making position (ie. they received over $2 on 255 OTM covered call sales Aug 18, bought back at .52 making $1.50). Then they wrote new covered calls at an improbable 235 OTM and some counterparty took them in small blocks because the 235 trade yesterday was not made in big blocks but had good volume overall. And if pps hits 235 by Oct 21 (prior to ER, all the better and they'd possibly release their holding to a buyer of those shares). That is 10%+ upside from here. I would imagine that funds might want to push pps back to 225 and these calls gain a bit of value but will eventually close at 0 (pps not reaching 235 by Oct 21). How does it hit 235+? Possibly if SCTY deal is killed.

I believe this is someone trying to make $1.50 or so every month while the pps has fallen but are still holding long shares. This is natural trading activity for someone with large holdings. Buying stock only, without excess income taken from covered calls is not complete trading and people miss out on such income if they do not participate in OTM call selling over time. I think this CNBC coverage and Jon Najarian 'talking up' the trade as "someone trying to get 20:1 gains if the stock pops to 250 is misleading and market making.

The point is that according to the video I linked, the $255 calls were sold to close; $235 calls were bought to open. That is not consistent with your speculation. This indicates that somebody not trying to make more on premium, but actually paying additional premium to either move down bullish call position for a safer bet, or paying additional premium to improve a hedge for short stock position.

schonelucht

Well-Known Member

Wow, you’ve got quite worked up on this one. You are missing my point, though. Tesla spent R&D budget on the innovative battery pack architecture that resulted in increased energy AND power density while increasing efficiency, all with the same chemistry of the cell. The vast majority of R&D is already spent, and for small incremental budget Elon wants to scale this up to be used in Powerwall/Powerpack/Solar combination, both residential/commercial and utility scale. Not doing this in Elon’s mind is leaving money on the table. Most effective and quick way of doing this is using SolarCity. That is what I believe is impetus for the deal for Elon. This does not mean in any way that SolarCity was in perfect financial shape, or that Elon is very happy with the results of the Rives stewardship (look at what happened to their options). What it means is that he needs SolarCity to accomplish his TE plans, as he sees sizable potential there. That to me is the meaning of his “no brainer” comment.

Small cost? SCTY purchase is costing Tesla shareholders about $2.6B. Anyway, Elon and you are basically arguing that demand for TE products is a problem and that Tesla needs an in house partner to actually be able to open the market at scale. I believe that is nonsense. TE products were first to market in Australia and the Benelux without any SolarCity intervention, Germany is rolling out too, again without SCTY. Demand is not the problem. Tesla could put the Powerwall as is on Amazon, overnight delivery and it would be sold out instantly. Demand is not the problem to focus on. Pour that money in bringing production forward by just a quarter instead and worry about finding a good partner to sell excess capacity when you actually have it in 2020. Integrating a battery in a new or existing solar system is not rocket science. SolarCity brings exactly nothing to the table here except a few thousands hard bargain salespeople that will be fired anyway since they're such an awkward fit with the Tesla sales culture.

The innovations brought to the new battery pack architecture (bringing in spacecraft and electronics industries technologies) were brought from the concept to the production in about a year. This is type of speed and agility Tesla is built on, and Elon no longer though that they can achieve similar results going forward without the merger.

I am probably misunderstanding you here. Tesla Energy products have been in development since 2012.

Gerardf

Active Member

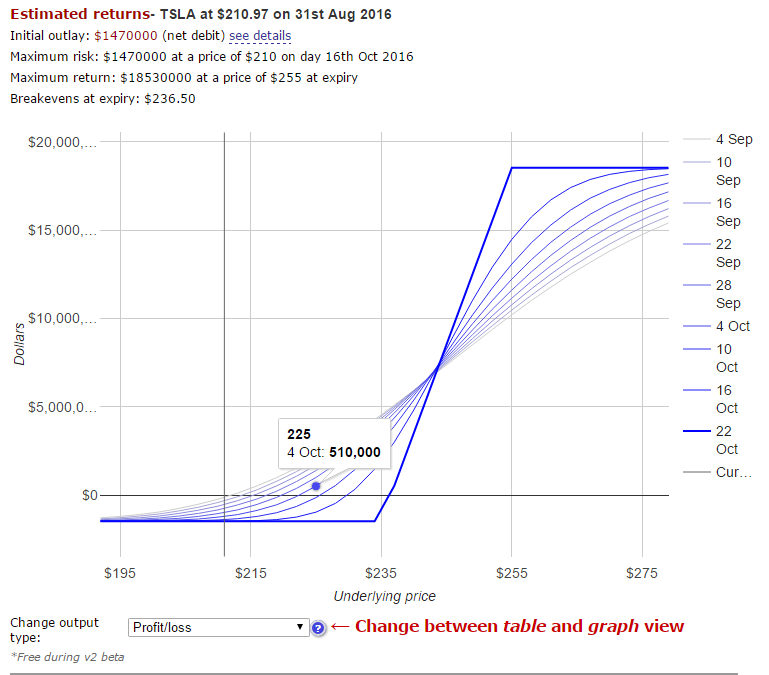

Lot of talk about that 235/255 spread here.

As I am trying to learn about options, I have tried to look into that spread, and put the numbers in a calculator.

Call Spread calculator

I like the Oct. 4th line of the result, that is when the Q3 deliveries will be published. > 225 is surely not impossible by then.

Still an expensive bet of course

As I am trying to learn about options, I have tried to look into that spread, and put the numbers in a calculator.

Call Spread calculator

I like the Oct. 4th line of the result, that is when the Q3 deliveries will be published. > 225 is surely not impossible by then.

Still an expensive bet of course

Integrating a battery in a new or existing solar system is not rocket science.

Yes it is, actually hard for an existing system to "add a battery". A string inverter from SMA, ABB (PowerOne) and others cannot just have a battery installed into it. Things like grid disconnect must occur, inverter replacement with one that works with batteries better must be done, wiring for standby circuits must be setup (ie. tear apart your breaker panel, install a 2nd one, route wires for critical circuits, etc). To install a "$3000" battery into a solar array already net-metered, grid-tied is at least a $10,000 job. From permit to inverter replacement to wiring to sign-off. Not easy. And what do you get? 6.4 kWh of daily cycling "arbitration" for TOU people in California who are trying to pay for the system? The time to pay back the price of adding a battery can be fairly long, especially if rate plans change during the term and you lose the arb. The one saving grace is that some folks are able to take a 30% Federal tax credit for a battery install.

Now, if you are getting a fresh solar roof done and want to add a battery, you get the SolarEdge inverter that supports battery and price of that added battery is less. It allows for 5000W of standby power coming from both an active Solar PV and battery set even while the grid is down. Splendid.

Economically the SolarEdge + battery solution works out ok in areas where daily arbitrage math pays off. In fact, it looks like SolarEdge Solar PV without battery still can offer daytime backup power! But who wants just mid-day backup power? You want 24x7, multi-day, handle cloudy-days power if you would want to sustain a multi-day grid outage. That means far more than one powerwall. There is a thread here on TMC where someone did just that and will have a zero electric bill, some level of battery standby service (though a few second failover delay so you do go dark for seconds during a grid failure) and daily TOU rate arbitrage using net-metering and daily cycling. But the guy only has one powerwall, so sustaining a long-term grid outage with 24x7 power is iffy. Will have daytime standby power every day it is sunny, though. Two powerwalls would have made slightly more sense for him.

My new solar and Powerwall installation

You need a good reason to install a battery. Having 100,000 USA "interested" records in a database taken from the point of April 29 2015 and onward is not entirely vetted out as actual buyers. Someone should weed that database of junk and come up with "qualified buyer lists". You know, the "Leads"... The Glengarry leads. The good leads.

Last edited:

nor mine 33990 (yet)

Small cost? SCTY purchase is costing Tesla shareholders about $2.6B. Anyway, Elon and you are basically arguing that demand for TE products is a problem and that Tesla needs an in house partner to actually be able to open the market at scale. I believe that is nonsense. TE products were first to market in Australia and the Benelux without any SolarCity intervention, Germany is rolling out too, again without SCTY. Demand is not the problem. Tesla could put the Powerwall as is on Amazon, overnight delivery and it would be sold out instantly. Demand is not the problem to focus on. Pour that money in bringing production forward by just a quarter instead and worry about finding a good partner to sell excess capacity when you actually have it in 2020. Integrating a battery in a new or existing solar system is not rocket science. SolarCity brings exactly nothing to the table here except a few thousands hard bargain salespeople that will be fired anyway since they're such an awkward fit with the Tesla sales culture..

Sorry, but you are again missing my point. The cost is for the properly scaling Powerwall / Powerpack generation II, following the scaling of the new automotive battery packs. This has nothing to do with the cost of acquisition of SolarCity.

Scaling up of the Powerwall/Powerpack was held up by finalizing the generation II design, testing, validation and subsequent implementation of production at the GF - demand has nothing to do with it. Elon believes that he needs SolarCity for proper and expedient integration of gen. II PowerPacks and PowerWalls with Solar, distribution and installation network. He did not talk about using SolarCity sales, quite the opposite - he was talking about using Tesla stores to sell the solar products.

I am probably misunderstanding you here. Tesla Energy products have been in development since 2012.

You are - I was talking about bringing new innovative battery pack architecture of P100D over to tesla energy products. The final production version of this architecture is little more than a week old.

Last edited:

Lot of talk about that 235/255 spread here.

As I am trying to learn about options, I have tried to look into that spread, and put the numbers in a calculator.

Call Spread calculator

I like the Oct. 4th line of the result, that is when the Q3 deliveries will be published. > 225 is surely not impossible by then.

View attachment 192432

Still an expensive bet of course

Just to clarify, the subject bet turned out to be not the bull spread, but either roll-down of the bullish $255 call position to $235 (paying premium for reducing the risk), or paying additional premium to improve hedging of the short stock position. The information from the initial CNBC video was apparently erroneous, per the later video that I linked in my posts

Last edited:

schonelucht

Well-Known Member

Yes it is, actually hard for an existing system to "add a battery".

This is not hard. It is standard electrical work that any installer worth his or her salt should be able to deal with just fine. It may be costly due to whatever local setup you have but really totally independent from the name on the side of said installer's van.

You need a good reason to install a battery. Having 100,000 USA "interested" records in a database taken from the point of April 29 2015 and onward is not entirely vetted out as actual buyers. Someone should weed that database of junk and come up with "qualified buyer lists". You know, the "Leads"... The Glengarry leads. The good leads.

Let's worry about demand once they can actually produce the thing in any meaningful quantity. Germany alone installs more residential storage solutions yearly than total Powerwall production to date. All without SolarCity.

This is not hard. It is standard electrical work that any installer worth his or her salt should be able to deal with just fine. It may be costly due to whatever local setup you have but really totally independent from the name on the side of said installer's van.

Let's worry about demand once they can actually produce the thing in any meaningful quantity. Germany alone installs more residential storage solutions yearly than total Powerwall production to date. All without SolarCity.

Oh - yes, not hard "physically" but hard "economically". I was showing the hard case of paying for new inverters, new charge controllers and the batteries in order to "add" batteries to an existing system. There are like 30-40 companies or more worldwide (unknowns in China probably 30-50 there too) which do battery systems. UPS systems themselves were part of datacenters back to the 1970s and 1980s so it isn't "hard", but just costly. The press coverage of batteries in the home kept using headlines like "Utility companies will be killed off once everyone has a battery in their home." Click-bait coverage of home batteries has tried to create a market through fear in some cases - of "utilities raising rates every year - don't allow that, get batteries!" or similar. Similar to the gold sellers trying to get people to buy gold and silver. And the pick and shovel people making the most money selling products to the "gold miners" of the 1850s.

The ones who win in this scenario are the installers and electricians, inspectors and municipalities - making money on the permitting, the electrical work, the racking and the labor. So, in general a good jobs program underlies the "new smart grid". Good for our kids who enter the electrical trade. Reminds me of the guy who came out to spec a "free Blink L2 charger" in 2013 at my house. $1100 to install 25 feet of wire and mount the free blink charger. He drove a shiny, expensive truck too

FredTMC

Model S VIN #4925

noDid Elon publish AP8.0 post on Tesla.com? He said he would yesterday via tweet.

CALGARYARSENAL

Member

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Replies

- 2

- Views

- 1K

- Replies

- 19

- Views

- 1K

- Replies

- 20

- Views

- 3K