Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

thenewguy1979

"The" Dog

.......may continue to go up till we ran out of money shorting themMight as well some NVDA short call vertical spreads ....

..what goes up ...

Sure like to see some of that action over here.Come on now. Let get some of what there's smoking over at NVDA over to TSLA please..... almost $50 pump in 2 days.

thenewguy1979

"The" Dog

Thanks @dl003posted an update on Patreon.

Any particular Long you have in mind. Was thinking +255C/-260C for 1/26.

We have plenty room above if ER send us a $50 dollar NVDA candle instead of to the ER:

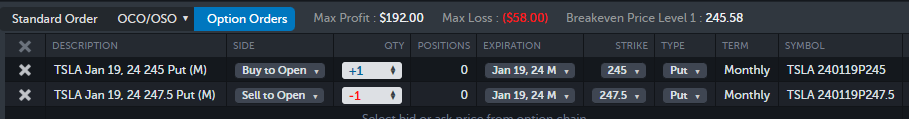

I already sold the -247.5P's.

a stop loss in case the stock go back down to 232. Which it hasn't. If it breaks 232 I'll just re-sell from a lower entry. 70% of my long is still in the green right now.But you set a close at b/e

ZenMan

Member

But you set a close at b/e

That b/e was probably more of a Stop Loss.

He still expects the stock to go up from here.

thenewguy1979

"The" Dog

that's a good play. 4 to 1 max win to loss ratio (if using spread). Betting on SP going up.

edit: also get paid upfront instead of waiting if doing traditional long.

edit: also get paid upfront instead of waiting if doing traditional long.

jeewee3000

Active Member

Today I closed my 01/26 -230cc's I opened last week (January 3rd) for 25% profit.

Holding shares and LEAPS into ER. Will possibly trim if we bounce.

Holding shares and LEAPS into ER. Will possibly trim if we bounce.

StarFoxisDown!

Well-Known Member

Sigh....June 2026 LEAPS finally open up trading but the stock is down so much from its relative high a month ago and volatility is dropped so much that the premium isn't not worth it to me to sell CC's.

The intent is clear to me, keep the stock below the 2+ year downtrend line with buffer to absorb any surprise positive news such as the CPI print incoming in anticipation of Q4 earnings in 2 weeks. The nonstop hit pieces and negative Tesla articles has noticeably increased in the past month.

Seems anything but a blowout earnings report will be treated negatively, and the stock will be punished. Even if TSLA meets expectations, I expect the stock to be sold off hard when they break the uptrend line from last Jan's low around earnings since it's now not that far from the current share price today. It'll be around 224-225/share by earnings date.

I just don't see Tesla having anything in terms of positive news to counter a pre-planned sell off except for Cybertruck production rate being higher than expected (doubtful) or Energy having a large jump in revenue recognition quarter to quarter while margins continue to improve (definitely possible). There's some talk that Tesla is trying to get V12 out before the earnings report but Wall St is simply going to ignore that. A FSD China release could definitely cause the surprise breakout but the rumors of that release being beginning of Jan have come and gone. Really just nothing to get excited about Tesla business-wise for the next 6 months at least.

The only silver lining is that a break of the uptrend low will probably turn a sell off into a major sell off down to possibly 150'ish area so would be good chance to close out my CC's, buy some more 2026 LEAPS and roll my current LEAPS. But I'd be taking on some risk in doing that and I prefer not to go down that road but it seems i should start to prep for that scenario playing out.

Part of me thinks I should just bite the bullet and sell CC's 2026 LEAPS on a handful of shares to get some cash before the stock goes into major selloff. But the other part of me knows that once the surprise catalyst come, whatever it may be, the stock will explode out of the gate

The intent is clear to me, keep the stock below the 2+ year downtrend line with buffer to absorb any surprise positive news such as the CPI print incoming in anticipation of Q4 earnings in 2 weeks. The nonstop hit pieces and negative Tesla articles has noticeably increased in the past month.

Seems anything but a blowout earnings report will be treated negatively, and the stock will be punished. Even if TSLA meets expectations, I expect the stock to be sold off hard when they break the uptrend line from last Jan's low around earnings since it's now not that far from the current share price today. It'll be around 224-225/share by earnings date.

I just don't see Tesla having anything in terms of positive news to counter a pre-planned sell off except for Cybertruck production rate being higher than expected (doubtful) or Energy having a large jump in revenue recognition quarter to quarter while margins continue to improve (definitely possible). There's some talk that Tesla is trying to get V12 out before the earnings report but Wall St is simply going to ignore that. A FSD China release could definitely cause the surprise breakout but the rumors of that release being beginning of Jan have come and gone. Really just nothing to get excited about Tesla business-wise for the next 6 months at least.

The only silver lining is that a break of the uptrend low will probably turn a sell off into a major sell off down to possibly 150'ish area so would be good chance to close out my CC's, buy some more 2026 LEAPS and roll my current LEAPS. But I'd be taking on some risk in doing that and I prefer not to go down that road but it seems i should start to prep for that scenario playing out.

Part of me thinks I should just bite the bullet and sell CC's 2026 LEAPS on a handful of shares to get some cash before the stock goes into major selloff. But the other part of me knows that once the surprise catalyst come, whatever it may be, the stock will explode out of the gate

Last edited:

tivoboy

Active Member

Maybe you BUY them, before you sell them?Sigh....June 2026 LEAPS finally open up trading but the stock is down so much from its relative high a month ago and volatility is dropped so much that the premium isn't not worth it to me to sell CC's.

The intent is clear to me, keep the stock below the 2+ year downtrend line with buffer to absorb any surprise positive news such as the CPI print incoming in anticipation of Q4 earnings in 2 weeks. The nonstop hit pieces and negative Tesla articles has noticeably increased in the past month.

Seems anything but a blowout earnings report will be treated negatively, and the stock will be punished. Even if TSLA meets expectations, I expect the stock to be sold off hard when they break the uptrend line from last Jan's low around earnings since it's now not that far from the current share price today. It'll be around 224-225/share by earnings date.

I just don't see Tesla having anything in terms of positive news to counter a pre-planned sell off except for Cybertruck production rate being higher than expected (doubtful) or Energy having a large jump in revenue recognition quarter to quarter while margins continue to improve (definitely possible). There's some talk that Tesla is trying to get V12 out before the earnings report but Wall St is simply going to ignore that. A FSD China release could definitely cause the surprise breakout but the rumors of that release being beginning of Jan have come and gone. Really just nothing to get excited about Tesla business-wise for the next 6 months at least.

The only silver lining is that a break of the uptrend low wil probably turn a sell off into a major sell off down to possibly 150'ish area so would be good chance to close out my CC's, buy some more 2026 LEAPS and roll my current LEAPS. But I'd be taking on some risk in doing that and I prefer not to go down that road.

intelligator

Active Member

"downside protection" , if we go down rather than up? Trying to figure out why you'd not sell into strength. Maybe answered my own question?STO here ~$235 a few of each for downside protection:

-C300 6/26/24 @10.75

-C350 1/17/25 @16.95

-C400 1/17/25 @10.65

thenewguy1979

"The" Dog

a stop loss in case the stock go back down to 232. Which it hasn't. If it breaks 232 I'll just re-sell from a lower entry. 70% of my long is still in the green right now.

Not worry about getting assigned early? That a $13 gap based on current SP even though expiration is a week away.

Jim has been selling into strength for the last month or so. How do you know that 235 wasn't it?"downside protection" , if we go down rather than up? Trying to figure out why you'd not sell into strength. Maybe answered my own question?

I wish I'm assigned early. Tonight if possible please.Not worry about getting assigned early? That a $13 gap based on current SP even though expiration is a week away.

Arul

Member

Short call means naked calls. ie selling calls for more than the number of shares you have ?BTC all overnight CC's for +$3,700, up $5,400 for the week so far.

Will reopen some if we lose $234 and hold below.

View attachment 1007352

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K