intelligator

Active Member

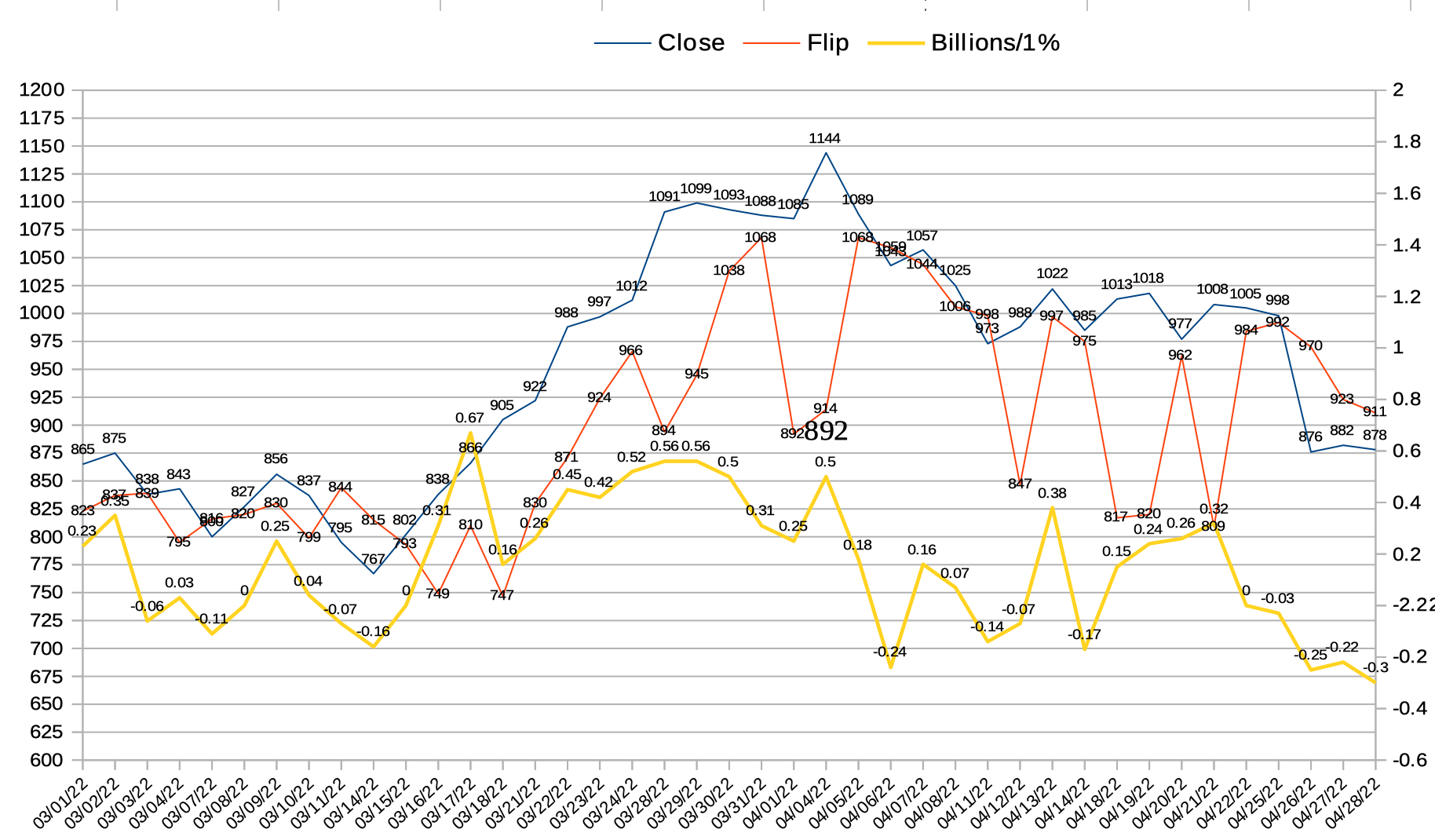

Not knowing the possible fallout from amzn and aapl earnings, I chickened out and closed what could've expired worthless. Anyone feeling 875 Friday EOD?  GLTA!

GLTA!

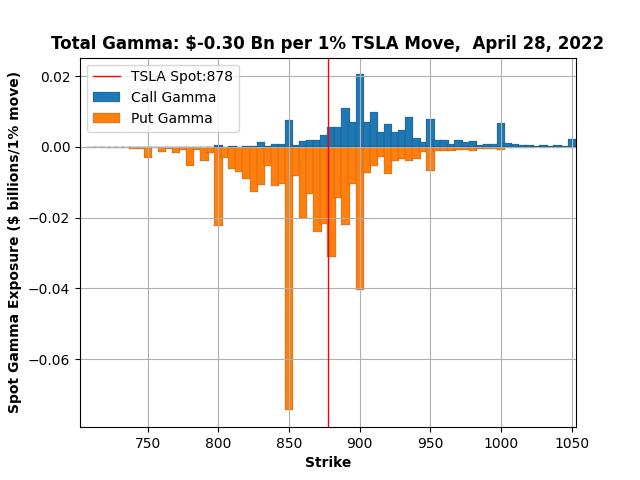

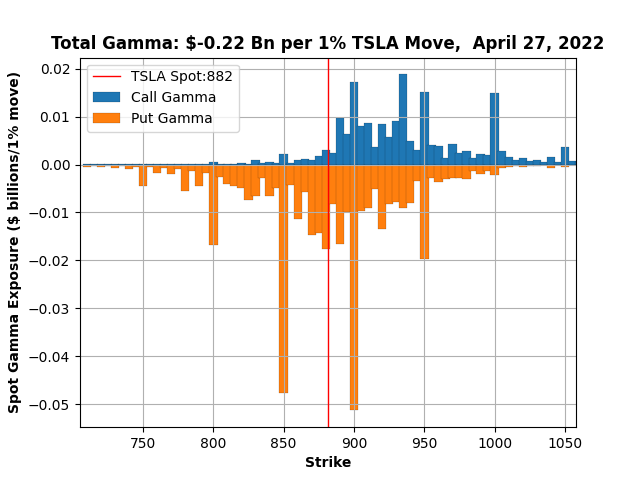

Below are the shifts from Wednesday to Thursday. Are these useful, helpful? I don't want to clutter the thread with nonsense. It helps me visualize the MM's daily moves. Wednesday to Thursday, some put gamma tightening between 850 (+) and 900 (-) , call gamma tightened as well, overall shift went back to the put side (-0.22 to -0.30) .

Given where we are sitting, looks like I am going to eat two 5/20 1200 calls that I could have sold for a third to a half , a month ago. Oh well. If we do get a strong pull back tomorrow, I may attempt to fill that loss by selling one far out ITM/ATM put; seems like a good low maintenance play with less likeliness to have the same outcome as the bought calls.

Below are the shifts from Wednesday to Thursday. Are these useful, helpful? I don't want to clutter the thread with nonsense. It helps me visualize the MM's daily moves. Wednesday to Thursday, some put gamma tightening between 850 (+) and 900 (-) , call gamma tightened as well, overall shift went back to the put side (-0.22 to -0.30) .

Given where we are sitting, looks like I am going to eat two 5/20 1200 calls that I could have sold for a third to a half , a month ago. Oh well. If we do get a strong pull back tomorrow, I may attempt to fill that loss by selling one far out ITM/ATM put; seems like a good low maintenance play with less likeliness to have the same outcome as the bought calls.