Yeah, I'm starting to worry about even hitting 330 in December....$1200/400 by the end of the year seem impossible. I still have my $285 puts for tomorrow. I bought 5 shares today yey... I am also getting tired of this.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

intelligator

Active Member

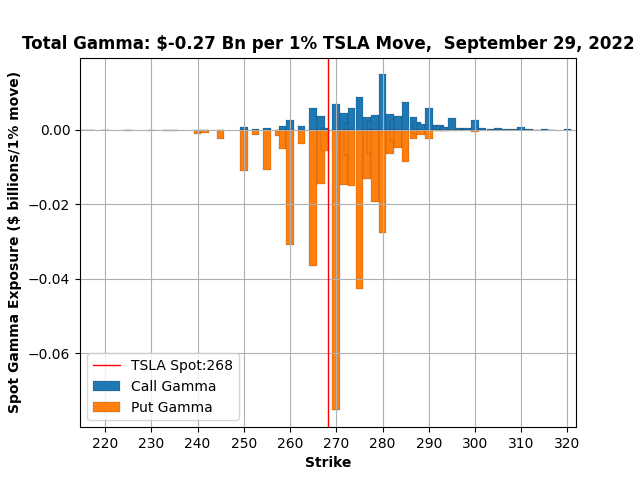

A few positive days and a huge negative, smooth operators. Not as bad as last Thursday, categorically today was a dump for sure. The hole at 268 isn't an error, it's a scaling problem with the graph when there's 2.5 between strikes, in this case 267.5 and 270. Gamma flip is 280, I'll be looking for a lift to move the 285/260 bps to next week and to again sell the call side I bought back during todays dip.

Something strange happened: Over night i got way more excess liquidity with IBKR .. they must have changed something in their margin calculations like a tweak to their "concentration penalty" or so.

just FYI ..

just FYI ..

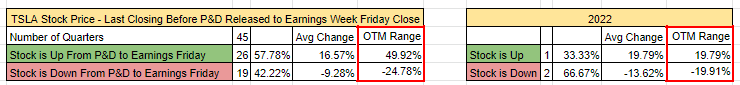

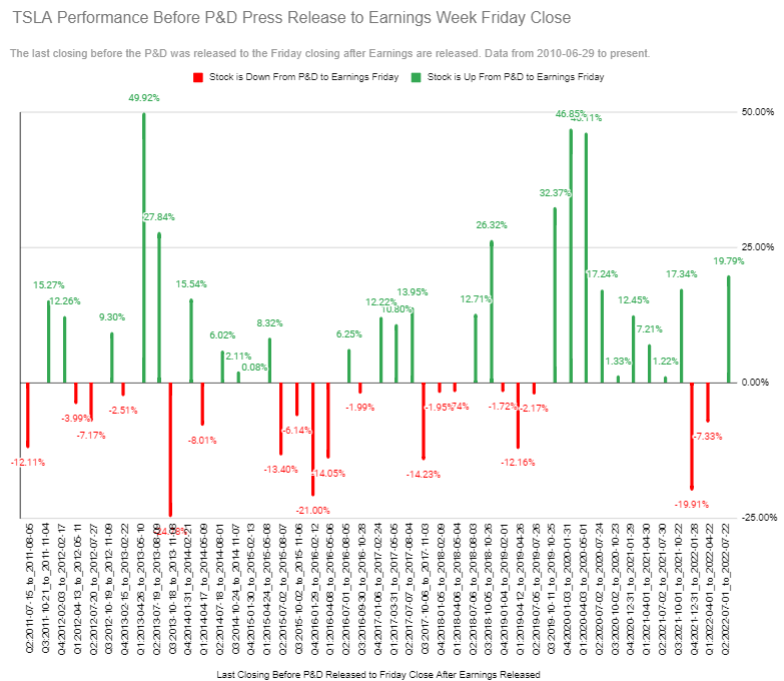

TSLA Performance Before P&D Press Release to Earnings Week Friday Close

rise of sp heading into earnings in 2022 isn't doing well, let's hope for a repeat of Jul

OTM in 2022 is -20% to 20% (today's Close to earnings week Fri Close)

for ex: if today's Close is 270, there is a chance of earnings week (Fri Close) being 216-324

not advice, do not use for trading, past performance is not indicative of future

rise of sp heading into earnings in 2022 isn't doing well, let's hope for a repeat of Jul

OTM in 2022 is -20% to 20% (today's Close to earnings week Fri Close)

for ex: if today's Close is 270, there is a chance of earnings week (Fri Close) being 216-324

not advice, do not use for trading, past performance is not indicative of future

Last edited:

Well, my 280 straddle was looking real good up until yesterday... just rolled the -c280's to next week, well STO 15x, will let this week's expire

Not decided what to do with 10x -p280 yet, hmmm, there's +$6 net on offer, that's OK... will likely roll to the same, then I've almost hit my weekly target with 75x more contracts too write after P&D (whichever way that falls...)

Edit: and rolled 10x -p280 to next week for +$7.2

Not decided what to do with 10x -p280 yet, hmmm, there's +$6 net on offer, that's OK... will likely roll to the same, then I've almost hit my weekly target with 75x more contracts too write after P&D (whichever way that falls...)

Edit: and rolled 10x -p280 to next week for +$7.2

Last edited:

Well on the bright side that saves you the BTC trading fees...I had 9X 305 CSP in my mom's IRA for today. Was planning to roll today, but they were assigned last night.

so far, Cory has been right for weeks in predicting these 2 numbers: 283 and 270Well, my 280 straddle was looking real good up until yesterday... just rolled the -c280's to next week, well STO 15x, will let this week's expire

Not decided what to do with 10x -p280 yet, hmmm, there's +$6 net on offer, that's OK... will likely roll to the same, then I've almost hit my weekly target with 75x more contracts too write after P&D (whichever way that falls...)

283 is supp became res became supp became res

270 is supp or res if 283 fails

Someone must be dumping, because my -305p was also assigned last night!I had 9X 305 CSP in my mom's IRA for today. Was planning to roll today, but they were assigned last night.

TheTalkingMule

Distributed Energy Enthusiast

She can thank you at Thanksgiving when she's up 20%. (plus premium obviously!)I had 9X 305 CSP in my mom's IRA for today. Was planning to roll today, but they were assigned last night.

I think yesterday's huge move followed by two of those massive after-hours phantom spikes indicated a lot of early executions.

And probably at least part of the reason the NASDAQ is green today rather than flat/red. Ken Griffin and the other MM's already cleaned up overnight, now it's time to cover this week's mild shorting so they can do it all over again next week.

intelligator

Active Member

Bummer. I was fretting over these yesterday as well, managed to move mine for $1. Today I placed an order that filled for .01 to roll 285/260 BPS to next week ... I was a bit early but got there for the .01 and cost of transaction fee. I don't have anything expiring this week. Still have those rotting December 383.33 short leg BPS that I keep monitoring extrinsic; still has 2.8 left.I had 9X 305 CSP in my mom's IRA for today. Was planning to roll today, but they were assigned last night.

EDIT: December BPS details

Last edited:

R

ReddyLeaf

Guest

You’re welcome. I sold -c275s in the AM run up, thinking that was way out of reach, and expecting a close near 270. Then, after breaking 275, just before the big dump (around 273), I sold -p275s as a dare to the market. Walked away for coffee and toast, and, wam bam, the SP drops to 270. Now it’s rising again. Where do we end? At this point, I don’t care, but it will be nice to double my share count in one account. Still have those 10/21 -p/c300s, some underwater Dec/Jan +c200s, and Mar23 +c400s. Ready for liftoff next week.

dc_h

Active Member

Same boat. I rolled some 300P earlier in the week, will likely take delivery and sell out of the money calls. If earnings kick ass and delivery targets stay at 495,000 for Q4, the market will start raising price targets. Or macros continue to suck and Tesla lowers prices to gain market share and price stays in a 250-320 range until next year.Trying to decide what to do with my 9/30 285P's. I am considering taking assignment before P&D and selling some CC on them.

STO- -$260P / +$245P for next week - $4.15 each

Looking to close on Monday...

Bought a lot of calls for next week at $320 and $300 and now they are junk... Didn't manage them as we were managing a hurricane here in Florida, so not money well spent but I am leaving them alone.

Oh well, can't only have winners!

Cheers to A.I. day 2 and to surviving a hurricane!

Looking to close on Monday...

Bought a lot of calls for next week at $320 and $300 and now they are junk... Didn't manage them as we were managing a hurricane here in Florida, so not money well spent but I am leaving them alone.

Oh well, can't only have winners!

Cheers to A.I. day 2 and to surviving a hurricane!

I'm trying to decide what to do. If I open CC before close today for next Friday, it guarantees the SP climbs next week and I will look stupid for not waiting (but it will save the rest of my portfolio). If I wait for a Monday pop to sell them, it guarantees the SP drops so I make nothing on CCs, AND it crushes my portfolio.....

Seems like I should sell CCs today....

Seems like I should sell CCs today....

As you probably read, I rolled my -280 straddle to next week already, waiting for Monday to write calls, come what may... Already hit my profit target with what I have so no sweat if it's $1 per contract like last week for the -c300's, will take what's thereI'm trying to decide what to do. If I open CC before close today for next Friday, it guarantees the SP climbs next week and I will look stupid for not waiting (but it will save the rest of my portfolio). If I wait for a Monday pop to sell them, it guarantees the SP drops so I make nothing on CCs, AND it crushes my portfolio.....

Seems like I should sell CCs today....

R

ReddyLeaf

Guest

Ok, lost on the put side so rolled the -p275s to -p270s 10/07 for $4.20 credit (nope, didn’t plan that). Will let the -c275s expire.You’re welcome. I sold -c275s in the AM run up, thinking that was way out of reach, and expecting a close near 270. Then, after breaking 275, just before the big dump (around 273), I sold -p275s as a dare to the market. Walked away for coffee and toast, and, wam bam, the SP drops to 270. Now it’s rising again. Where do we end? At this point, I don’t care, but it will be nice to double my share count in one account. Still have those 10/21 -p/c300s, some underwater Dec/Jan +c200s, and Mar23 +c400s. Ready for liftoff next week.

I wanted to use the low SP to sell some juice BPSs for next week, but I can't risk an increased Margin requirement if the SP actually drops next week. So I will sit on my hands for the next 6 minutes....

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 6K