Nikxice

Active Member

From austin, "Of course, any financial professional will tell you that this should be part of a balanced portfolio. They tend to approach it like toxic mortgage debt. I mean it is "scary" consumer debt. But, so what, this is what banks make billions off of. I can't square this with the idea that this is a risky new idea. This is the unriskiest, oldest banking concept there is."

Agree. Anyone who is willing to assume some financial risk should be able to share in the loan pie.

As to the recent LC IPO, it will probably take several years for the stock to pan out for investors. Although I only have a couple of hundred shares, I think the LC platform offers less volatility, along with a steady ROI. I'm curious to learn if LC maintained decent loan growth for Q1 2015. We should see the numbers soon. New loan notes tend to fall off considerably at the beginning and the end of each month. Towards the end of March, each time I logged onto LC I was only seeing 300 to 400 loans available. On the bright side, a deal was just announced teaming LC up with Citibank. Together they're looking to provide loans for subprime borrowers. I can just envision how thrilled my financial advisor will be to hear that news Not sure, but I'll bet that many LC investors act as their own advisors?

Not sure, but I'll bet that many LC investors act as their own advisors?

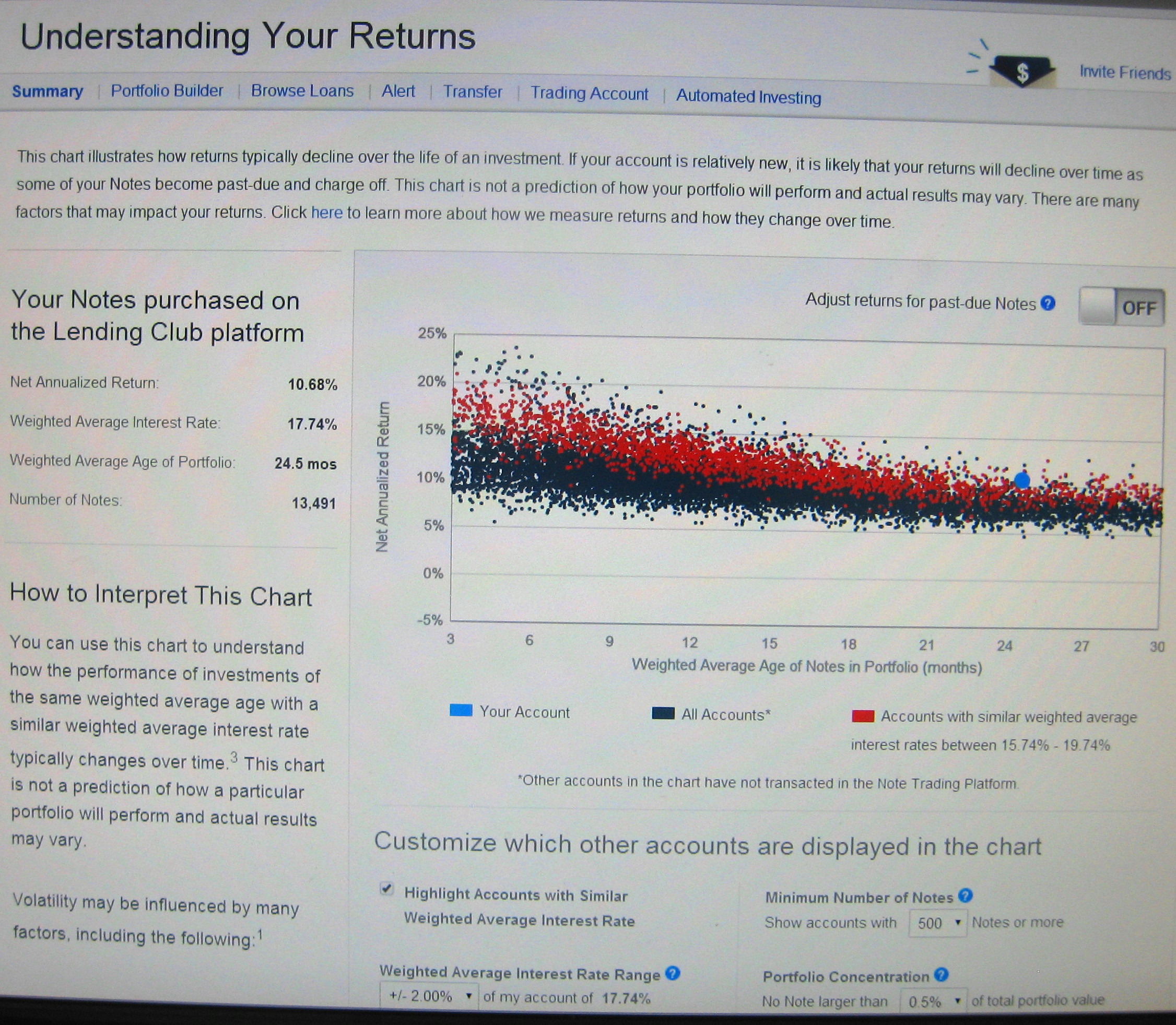

I'm attempting to post a screen photo of a graph that I find useful. This is from my LC IRA account. It can be accessed from the 'Account Summary' page and then clicking on 'Understanding Your Returns'. It gives me a quick comparison to others with a similar loan age average. You'll notice that it takes a couple of years for the graph to flatten out and produce a consistent ROI. This graph reflects my average loan age as 24.5 months, with a NAR of over 10%. My ANAR has increased to over 9.5% and it's undoubtedly more accurate. I stick with the LC default settings to predict ANAR. I think that the LC ANAR 'loss adjustment' calculator is realistic, so I haven't messed around with the customize feature. I'm currently only reinvesting the cash that my account produces, so my loan average will continue to age this year. I almost exclusively invest in 60 month loans. For more than one reason they offer a better ROI. Sometimes I'll tweak one of my filters, even to get .1% better. Recently I dropped my credit inquiries down from a max of 3 to 2 or less.

I hope this thread can continue to generate interest for this type of product. Many owners might think they don't have the time, but once you've got an account set up you don't have to spend time on the website. The auto loan features make it a breeze. Good luck!

Agree. Anyone who is willing to assume some financial risk should be able to share in the loan pie.

As to the recent LC IPO, it will probably take several years for the stock to pan out for investors. Although I only have a couple of hundred shares, I think the LC platform offers less volatility, along with a steady ROI. I'm curious to learn if LC maintained decent loan growth for Q1 2015. We should see the numbers soon. New loan notes tend to fall off considerably at the beginning and the end of each month. Towards the end of March, each time I logged onto LC I was only seeing 300 to 400 loans available. On the bright side, a deal was just announced teaming LC up with Citibank. Together they're looking to provide loans for subprime borrowers. I can just envision how thrilled my financial advisor will be to hear that news

I'm attempting to post a screen photo of a graph that I find useful. This is from my LC IRA account. It can be accessed from the 'Account Summary' page and then clicking on 'Understanding Your Returns'. It gives me a quick comparison to others with a similar loan age average. You'll notice that it takes a couple of years for the graph to flatten out and produce a consistent ROI. This graph reflects my average loan age as 24.5 months, with a NAR of over 10%. My ANAR has increased to over 9.5% and it's undoubtedly more accurate. I stick with the LC default settings to predict ANAR. I think that the LC ANAR 'loss adjustment' calculator is realistic, so I haven't messed around with the customize feature. I'm currently only reinvesting the cash that my account produces, so my loan average will continue to age this year. I almost exclusively invest in 60 month loans. For more than one reason they offer a better ROI. Sometimes I'll tweak one of my filters, even to get .1% better. Recently I dropped my credit inquiries down from a max of 3 to 2 or less.

I hope this thread can continue to generate interest for this type of product. Many owners might think they don't have the time, but once you've got an account set up you don't have to spend time on the website. The auto loan features make it a breeze. Good luck!