I need advice on dealing with an accident in Canada.

First of all, sorry for my bad English.

Last week I was parked on the street in front of a public park and was playing when my Tesla app alerted me and I looked at the live sentry and saw that the car in front of me had hit my car while backing up.

I immediately sent a voice message to leave a contact number, wait for me, and went straight to my car, and when I arrived about 15 minutes later, the offending car had already driven away.

The accident damage seems minor, but this is a 3-month-old Model X that I've been waiting a year and a half for. It really breaks my heart.

Since he didn't leave any information, I called 911 and the police were immediately dispatched, and the police spoke with the other party using the license plate captured in the Sentry footage.

The police gave me the other driver's name, phone number, driver's license number, insurance company, and policy number, as well as the incident number.

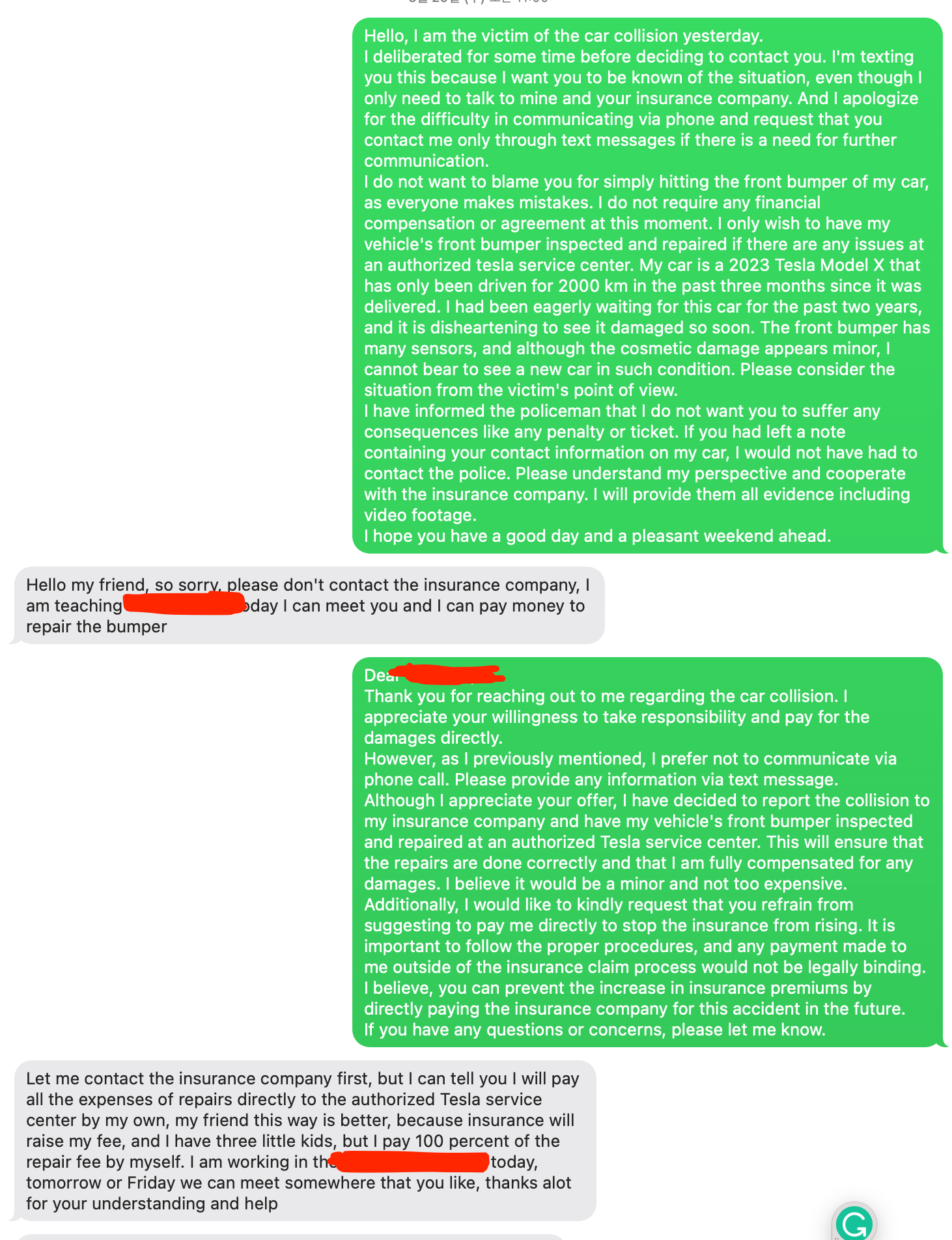

I then texted the other driver to discuss compensation, and he told me not to contact his insurance company and that he would pay 100% of the repair costs.

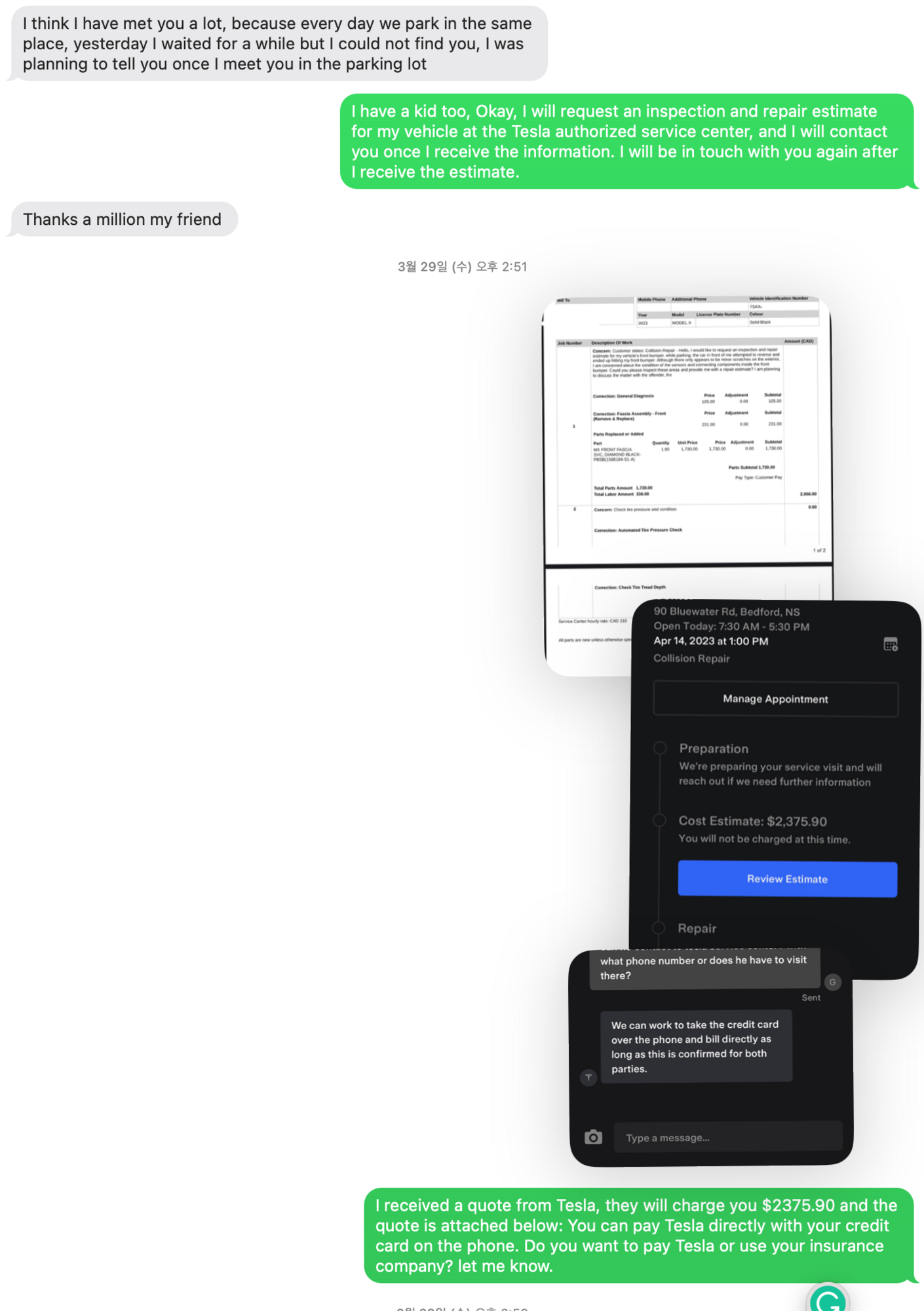

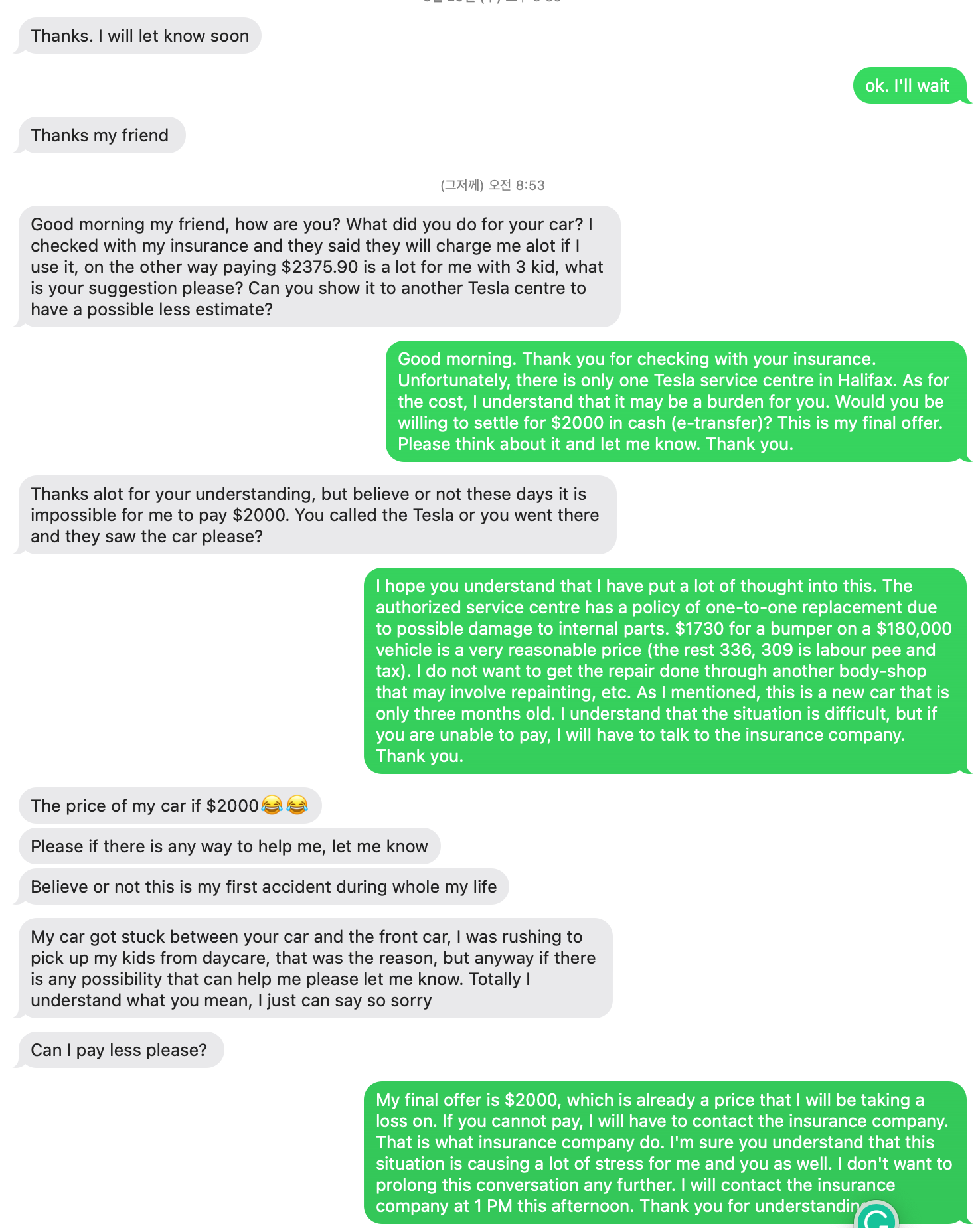

When I sent him the estimate I got from Tesla Center, he said it was a lot of money, so I asked for $2000, but we didn't end up settling.

Even if he had left his contact information on my window, I had no intention of going through with it, so I contacted my insurance company.

My common sense told me that the his insurance company would take care of the repair.

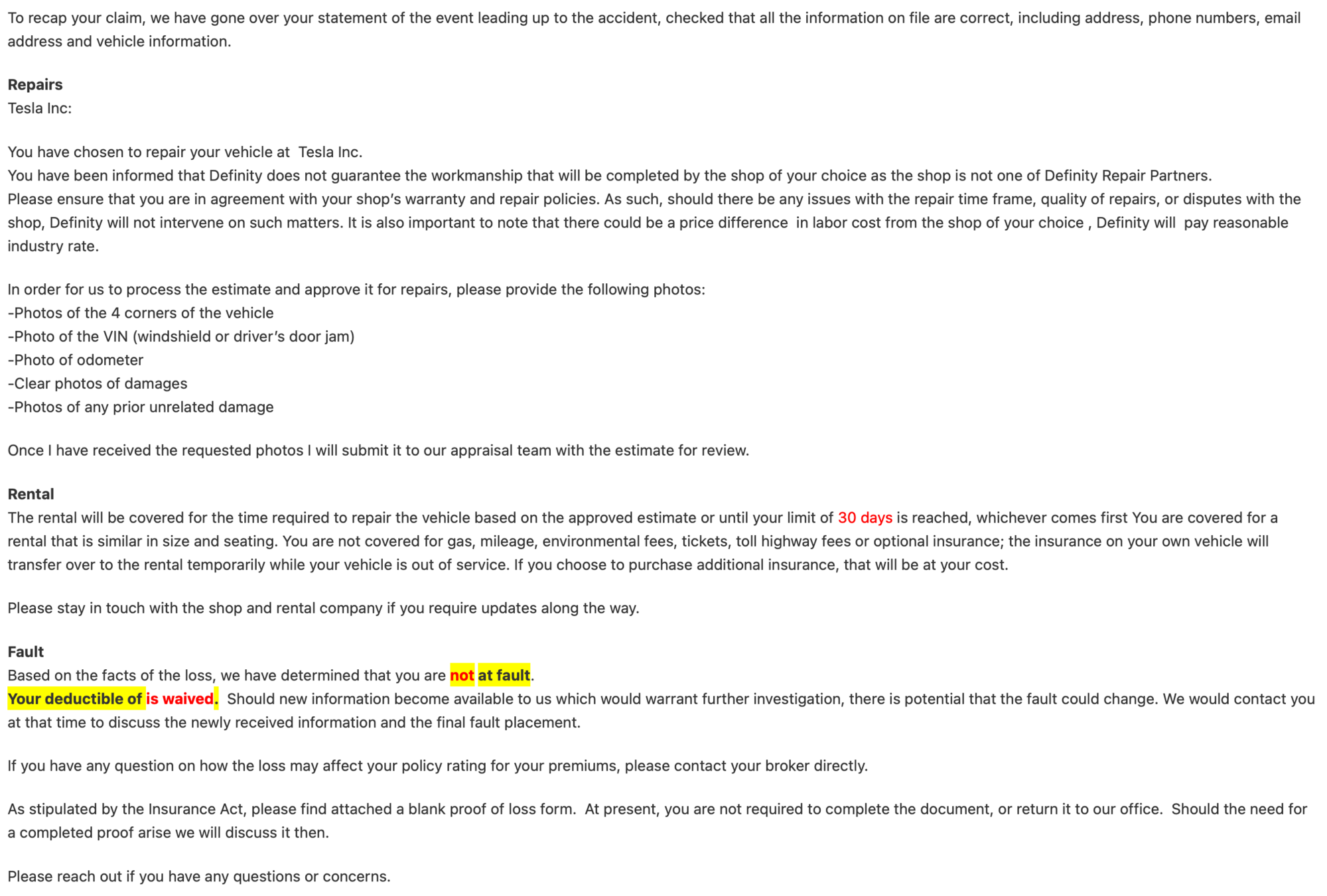

However, the email I received from my insurer made it sound like my insurer is handling the repair and that it would affect my future insurance rating for my premiums.

Is this normal in Canada, NovaScotia?

This is my first time dealing with insurance in Canada, so I'm not sure how the system works.

What should I do?

Thank you for reading this long article and for your time.

First of all, sorry for my bad English.

Last week I was parked on the street in front of a public park and was playing when my Tesla app alerted me and I looked at the live sentry and saw that the car in front of me had hit my car while backing up.

I immediately sent a voice message to leave a contact number, wait for me, and went straight to my car, and when I arrived about 15 minutes later, the offending car had already driven away.

The accident damage seems minor, but this is a 3-month-old Model X that I've been waiting a year and a half for. It really breaks my heart.

Since he didn't leave any information, I called 911 and the police were immediately dispatched, and the police spoke with the other party using the license plate captured in the Sentry footage.

The police gave me the other driver's name, phone number, driver's license number, insurance company, and policy number, as well as the incident number.

I then texted the other driver to discuss compensation, and he told me not to contact his insurance company and that he would pay 100% of the repair costs.

When I sent him the estimate I got from Tesla Center, he said it was a lot of money, so I asked for $2000, but we didn't end up settling.

Even if he had left his contact information on my window, I had no intention of going through with it, so I contacted my insurance company.

My common sense told me that the his insurance company would take care of the repair.

However, the email I received from my insurer made it sound like my insurer is handling the repair and that it would affect my future insurance rating for my premiums.

Is this normal in Canada, NovaScotia?

This is my first time dealing with insurance in Canada, so I'm not sure how the system works.

What should I do?

Thank you for reading this long article and for your time.