Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

H&R Block 2019 missing form 8911, again (EV Charger Credit)

- Thread starter vjason

- Start date

solardudesf

Member

Are you using the online version? When I use the TurboTax 2019 version installed on my computer it still says "The Energy Efficient Vehicle Charging Station Area Will Be Ready Soon." Think I still just need to have some patience and wait until the 20th.Its up on TurboTax....filing right now.

Super_Popular

Well-Known Member

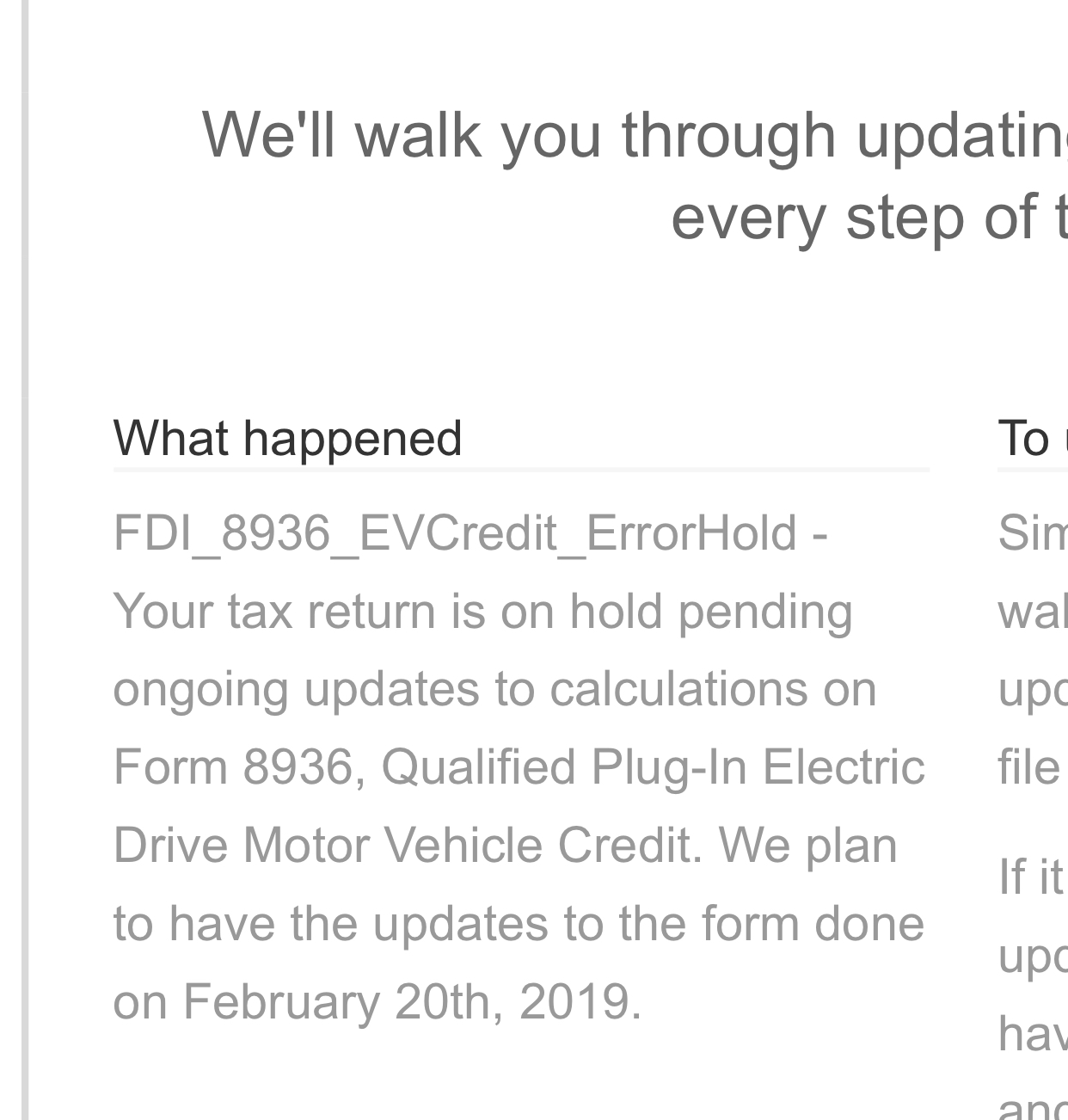

My Federal and State returns were rejected because the feds form still want ready. TurboTax said the feds will have the form ready on the 20th

willow_hiller

Well-Known Member

Seems like Turbotax has both 8936 and 8911 live and working today. If you put $7,500 in the credit box at the end of the 8936 questionnaire, it is correctly dividing by 50% or 25%.

willow_hiller

Well-Known Member

Welp, it was all calculating correctly, but the return still got rejected. Turbotax has really dropped the ball on this...

Super_Popular

Well-Known Member

Yes, TT is not calculating the tax credit dates correctly. I bought my car last March and it's telling me my credit is $1875 when it should be $3750.

TT is aware of the issue as multiple people had called about this issue when I was on the phone with them. They are supposed to have it fixed tomorrow.

TT is aware of the issue as multiple people had called about this issue when I was on the phone with them. They are supposed to have it fixed tomorrow.

Super_Popular

Well-Known Member

Ok so Tesla told me to go back on to TT and put in the $7500 and not the $3750 and that TT would correct the amount and that worked!

so if you are using TT and dont get the full $7500 just put that in anyway and TT will do the math.

Fingers crossed!

so if you are using TT and dont get the full $7500 just put that in anyway and TT will do the math.

Fingers crossed!

Travis Denardo

VTHokie195

I spoke to H&R Block over their chat feature about form 8911, right after the previous software/form update on 2/14. The lady had to check on things for several minutes, but she said the form wasn't fully ready from the IRS and they expect it to be loaded in the 3/5 update of the software.

I'm impatiently waiting until then as my taxes have been ready for 3 weeks to submit, outside of form 8911.

I'm impatiently waiting until then as my taxes have been ready for 3 weeks to submit, outside of form 8911.

Super_Popular

Well-Known Member

Travis Denardo

VTHokie195

Both my Fed and State returns were accepted.

Try TT, H&R has always sucked and costs more.

I think I will next year. I bought it because it was half the cost for my business (LLC) and personal taxes, but I didn't like the software itself. Already filed the business taxes, so just need to get through it for personal and will consider switching back for 2020 taxes.

darknavi

Member

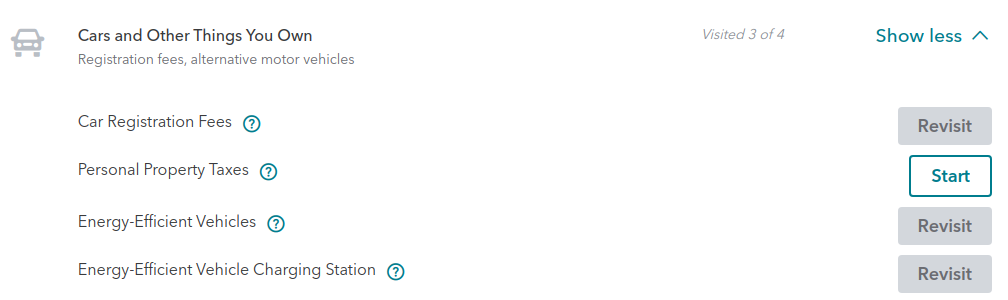

Our lady at H&R Block insists that the 8911 form is for business use only. I may be walking away if I can't manage to convince her to file it.

Travis Denardo

VTHokie195

Our lady at H&R Block insists that the 8911 form is for business use only. I may be walking away if I can't manage to convince her to file it.

I just chatted with them again and specifically asked if it would be available for personal tax use in the next update (3/5). She said yes and confirmed the next update. I'll hold until 3/6 hoping it comes out by then.

Super_Popular

Well-Known Member

BluestarE3

Active Member

I have a feeling that up-and-down the chain of command at H&R Block, the word is that 8911 is a business-only form and that has been their stance for years, so I'm not optimistic for 2019. I'll be pleasantly surprised if they do, but it's looking like I'll be switching to TurboTax after having used H&R Block's software for decades (back when it was owned by Kiplinger).Our lady at H&R Block insists that the 8911 form is for business use only. I may be walking away if I can't manage to convince her to file it.

ahecht

Member

Form 8911 just became available today through the IRS Free File Fillable Forms: Welcome to Fillable Forms

Travis Denardo

VTHokie195

New update from H&R Block today on Form 8911 (software updated today):

Via chat:

Thank you so much for holding. Seen the program was not giving the answer I was looking for, I ask one of my advisor. Apparently the Form is only available for Business, they do not supported in on the regular software because customer do not use it. But, you can download the Form on the IRS website, but on doing so, you have to print and mailed.

Via chat:

Thank you so much for holding. Seen the program was not giving the answer I was looking for, I ask one of my advisor. Apparently the Form is only available for Business, they do not supported in on the regular software because customer do not use it. But, you can download the Form on the IRS website, but on doing so, you have to print and mailed.

Super_Popular

Well-Known Member

willow_hiller

Well-Known Member

My return is sitting in limbo with the IRS.

Ditto. It will be 2 weeks since it was received by the IRS tomorrow... Looking back at last year I saw some refunds took the full 21 days, but I hope it doesn't take that long for us...

Similar threads

- Replies

- 47

- Views

- 11K

- Replies

- 52

- Views

- 33K

- Replies

- 4

- Views

- 12K