That's the kind of personal attack I was referring to earlier.

saying you're brainwashed by john peterson is not a personal attack. it's an observation. going into all this apology nonsense is a distraction from my main point, which i will repeat further down.

i won't argue that we are seeing some crazy posts by a few tesla longs. this kind of thing always happens when a stock is going higher & especially in the midst of the market making all time highs. and yes, it is a contrarian indicator, it is a source of concern, and i strongly encourage you to get out of tesla if it bothers you enough.

in the meantime anything that can improve things should not be discarded. Especially if it has the potential to make money in the same time.

discarding technology and discarding an investment idea are two different things. as i said before, the stop-start technology is viable, but my opinion is any sensible person would discard it as an investment idea - and especially via either exide or axion. and yes, discarding an investment idea which has no potential to make money and is being promoted by an intellectual fraud is not "blinded tesla faith." it's common sense.

Exide has nothing special. Axion has. And as long as they have a special product that fits perfectly to some niches, they will be able to command higher prices / margins.

so now to the main point (and the title of this thread) which i will hammer on again, you and mr peterson are using nonsense arguments to try to convince us that start-stop has any investment value.

before you successfully diverted this thread to a soap opera, i had said start stop is a viable technology but it's a commodity product with low or zero margins. the two investment ideas that are being promoted by yourself and john peterson are exide and axion.

so you're leaving yourself out of the exide fiasco, and as i said before we've already seen no one step to the plate to give them any money. the stock has been underperforming for years, is burdened with a lot of debt, and is struggling to raise capital. so the market is speaking loudly, saying that there's no point in throwing capital at exide.

axion is even worse. it's a bulletin board stock first off. some may not be familiar with the bulletin board stocks (or the pink sheets), but these are the stocks of "boiler room" fame and they live in an exchange that may as well be "h.e.l.l." instead of "o.t.c.b.b.". as a class of equities no one would argue that these stocks are filled to the gills with fraudsters, hypesters, and criminals. any self-respecting company that has legitimacy works very hard to bring their accounting standards and capital up to the point of being able to list on a real exchange. historically a very small percentage of bulletin board stocks ever amount to anything. so if we refer to axion as a "garbage penny stock", it's not a judgement, it would simply be a factual description of its existence on the pink sheets.

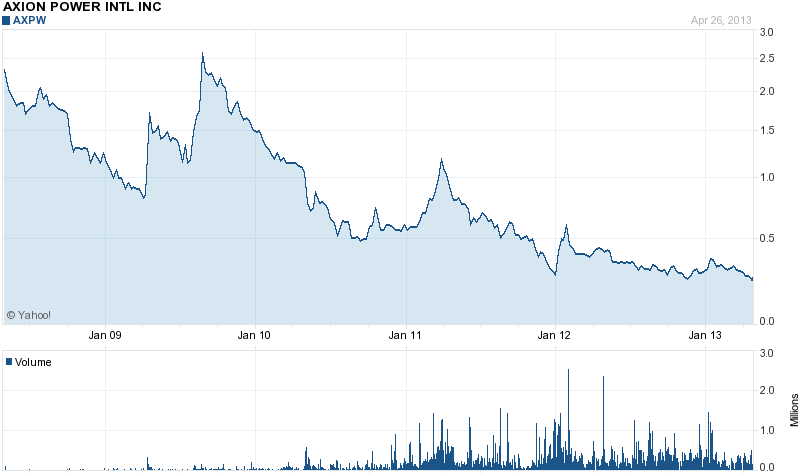

the performance of axion's stock is as horrible as most pink sheets. here's a chart. now as you look at the chart, remember that the last 4 years have been a crazy bull market. stocks like amazon trade for hundreds of dollars a share with little in the way of earnings. so what kind of garbage company would be breaking to new lows as in the midst of a multi-year bull market? how crappy are the companies that have lost 70% of their value since the bull market started in march 2009? we already know the answer nicu. it's you and john who should sit back over a beer & a smoke to figure that out.

maybe the only thing worse than axion's stock performance is its actual business performance. with $2 million of cash, it has less investment capital than probably a handful of us message board posters could scrap together. more than anything else, that speaks volumes about the company's true worth. but how about their typical earnings statement. here's a fabulous quote: "For the 2012, revenue was $9.8 million with a net loss of $8.6 million or $0.08 loss per share, compared to revenue of $8.1 million with a net loss of $8.3 million or $0.10 loss per share for 2011."

so with $2 million in the bank, there's a bulletin board company losing money hand over fist. and now you and john peterson are coming out to tell me this company is a game-changer of some kind.

excuse me while rotflmao.

the same story was going around a few years ago, when this technology was tested by bmw and i'd guess a few others. guess how many of those auto manufacturers have signed on for follow-on orders. hint, the number equals john peterson's credibility on this board. maybe if you guys were out parading johnson controls in front of us there would be some intellectual credibility to this discussion. i've never heard that stock mentioned from you and i am proud to say i didn't waste enough time reading peterson's garbage to remember if he mentioned it. there's no point in promoting johnson controls anyway, is there? it's too big of a company to be moved by the promotional activities of penny stock pumpers.

it's very clever how you divert any revelations of the nonsense promotions to be (a) personal attacks, (b) tesla-worshipping, or (c) closed-mindedness. the realities of exide and axion are pretty clear, they should both look like a waste of investment capital to any reasonable person. are you genuinely convinced by john peterson's nonsense about axion, or are you another penny stock promoter trying to pimp out the axion whore?

and you're long tesla too, or so you say. after reviewing your promotion of nonsense ideas, i wonder who cares if you are long or short tesla. you're out talking about all the people who are overly bullish about tesla, mortgaging their house to buy tesla, buying calls etc. well i'm sitting here thinking about what if we've got a penny stock promoter long a large cap stock? would that be a contrarian indicator?