Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

-

On today's TMC Podcast, we ask the question "What is the Tesla Cybercab?". Join us on YouTube live at 1PM and participate in the chat.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Why do you think it is not possible?60%?

How is that possible?

ev-enthusiast

Active Member

Here is a report from Global Equity Research’s Trip Chowdhry thinks Tesla Motors first-quarter numbers could be light thanks to the West Coast port strike.

Does anybody have some information on how long the port strike lasted and how long it took to get the entire supply chain up an running at full steam?

Does anybody have some information on how long the port strike lasted and how long it took to get the entire supply chain up an running at full steam?

Here is a report from Global Equity Research’s Trip Chowdhry thinks Tesla Motors first-quarter numbers could be light thanks to the West Coast port strike.

Does anybody have some information on how long the port strike lasted and how long it took to get the entire supply chain up an running at full steam?

My first-hand experience: I am not aware that it is resolved. If it is resolved, the ripples are still strong and it might take some time for full reestablishment of efficient movements.

Even businesses down under are affected. In the course of my job, I am waiting for some machinery and materials imported from US. The last correspondence on the shipments that I checked this week seems to indicate uncertain delivery times, stating port issues as a reason. The procurement people are trying to move shipments to the East coast, but there are difficulties in getting hold of shipments.

I would imagine that whoever got caught in the problem has similar experience.

Last edited:

Deutsche Bank cuts earnings estimates for Tesla

Deutsche Bank cuts 2015 earnings estimates for Tesla by 80%, from 52c to 11c.

FT article discusses Fed's dilemma "Dollar surge poses policy dilemma for FED".

Cheap Euro helped with the reversal in the Eurozone's slowdown. The prospect of FED raising rates pushes the exchange rates in the unfavourable direction for US exporters, squeezing their earnings.

US Fed runs monetary policy for the benefit of US economy. Devaluing world currencies against USD put a constraint on their desire to raise rates. A divergence between ECB easing monetary policy and US FED monetary policy is pointing towards EUD.USD parity. Not good for Tesla's sales in Europe.

With such backdrop, I would expect Tesla to focus on saturating US market at the expense of the rest of the world. Perhaps sales of D and X can help get closer to high US sales, low exports.

Deutsche Bank cuts 2015 earnings estimates for Tesla by 80%, from 52c to 11c.

The firm said the lowered estimate now reflects the car maker's exposure to the weakening euro. Deutsche analysts noted that 30% of the car maker's global sales are exposed to the euro.

The firm also cut its earnings estimate for 2016 to $1.75 per share from $2 per share. Deutsche's estimate falls below the consensus estimate of $4.20 per share.

The firm maintained its "buy" rating and a $245 price target on Tesla, but said the company's cost structure and car sale prices will "overwhelm" negative currency moves over the longer term.

FT article discusses Fed's dilemma "Dollar surge poses policy dilemma for FED".

Cheap Euro helped with the reversal in the Eurozone's slowdown. The prospect of FED raising rates pushes the exchange rates in the unfavourable direction for US exporters, squeezing their earnings.

US Fed runs monetary policy for the benefit of US economy. Devaluing world currencies against USD put a constraint on their desire to raise rates. A divergence between ECB easing monetary policy and US FED monetary policy is pointing towards EUD.USD parity. Not good for Tesla's sales in Europe.

With such backdrop, I would expect Tesla to focus on saturating US market at the expense of the rest of the world. Perhaps sales of D and X can help get closer to high US sales, low exports.

ev-enthusiast

Active Member

My first-hand experience: I am not aware that it is resolved. If it is resolved, the ripples are still strong and it might take some time for full reestablishment of efficient movements.

Even businesses down under are affected. In the course of my job, I am waiting for some machinery and materials imported from US. The last correspondence on the shipments that I checked this week seems to indicate uncertain delivery times, stating port issues as a reason. The procurement people are trying to move shipments to the East coast, but there are difficulties in getting hold of shipments.

I would imagine that whoever got caught in the problem has similar experience.

As far as I know the port strike ended in mid Feb.

Does anybody know how long it took to resolve the backlog of import (batteries, parts) and export (vehicles for Europe, APAC)?

Anybody with a Tradeview access to Zepol here (can not register free trial as my german email address is not accepted...)?

Looks like on can get pretty detailed and interesting reports from the Zepol web site...

The only chart I could get without registration is San Francisco port volume:

Tesla Motors in a more competitive position with driverless cars

Stifel analyst James Albertine reaffirmed buy rating and target sp $400.

Stifel analyst James Albertine reaffirmed buy rating and target sp $400.

Mr. Albertine notes that “Tesla is perhaps in a more advanced competitive position (as it relates to driverless technologies” than the analyst previously realized. He further added that Tesla called the self-driven car a “solved problem,” which shows the EV maker is very clear on its autonomous driving ambitions.

Pacific Crest note on Tesla: It's your standard bipolar debate dripping with pessimism

The title reflects Tesla stock becoming a battleground between doubters and believers, with few neutral parties.

Pacific Crest maintains outperform ratings and $293 price target.

Overview of PC bull case

The analyst carried out small scale research, with the takeaways:

The analyst cites bear case: demand is not sustainable, recent execution hiccups and China market problems.

The title reflects Tesla stock becoming a battleground between doubters and believers, with few neutral parties.

Pacific Crest maintains outperform ratings and $293 price target.

Overview of PC bull case

While we are tempering our expectations slightly on FX and Model X gross margins, an on-time Model X, a Model 3 announcement and Gigafactory updates could all send shares meaningfully higher. We think the time to own TSLA is now.

The analyst carried out small scale research, with the takeaways:

(1) you’d be hard pressed to find any product more adored by its owners;

(2) the vast majority are emphatic that they’d buy another when a lower-priced model is released.

The analyst cites bear case: demand is not sustainable, recent execution hiccups and China market problems.

Pacific Crest note on Tesla: It's your standard bipolar debate dripping with pessimism

The title reflects Tesla stock becoming a battleground between doubters and believers, with few neutral parties.

Pacific Crest maintains outperform ratings and $293 price target.

Overview of PC bull case

The analyst carried out small scale research, with the takeaways:

The analyst cites bear case: demand is not sustainable, recent execution hiccups and China market problems.

Thanks for posting: I believe both the bull and bear case are legitimate but we know the bull case is true (and will happen) and that the bear case is 'fixable'. Demand is not an issue long term as we get into model3 and EVs become more popular. Execution hiccup was real but is fixable as TM learns to ramp and supply chain improves (ex: port strike over) and China demand is not what TM/EM thought it would be so there is work to be done there (charging infrastructure/cultural learning curve/central government support/partnership/alliance with Chinese company) but they are fixable.

CSLA cuts ratings on Model X margin outlook

CSLA cuts ratings on Model X margin outlook

CSLA revised TSLA ratings from outperform to underperform and cut price target from $275 to $220. Longer term the analyst consider the stock attractive due to signs of progress in China and a promising stationary storage opportunities.

CSLA cuts ratings on Model X margin outlook

“We see risk to near-term earnings from lower initial Model X margins, which in light of Tesla’s recent execution issues and together with investor concerns around demand, could limit this year’s upside potential,” Andrew Fung, a CLSA analyst in New York, wrote in a research note.

CSLA revised TSLA ratings from outperform to underperform and cut price target from $275 to $220. Longer term the analyst consider the stock attractive due to signs of progress in China and a promising stationary storage opportunities.

The Most Attractive Employers for Engineering Students

Forbes article, The Most Attractive Employers for Engineering Students in 2015, provides a list of employers that engineering students aspire to work for.

1. NASA

2. Google

3. Boeing

4. Tesla

5. Space X

6. Lockheed Martin

7. Walt Disney

8. Apple

9. Exxon Mobil

10. General Elecric

The most attractive employers for business students:

1. Google

2. Walt Disney

3. Apple

4. Nike

5. JP Morgan

6. EY

7. Goldman Sachs

8. Deloitte

9. PWC

10. FBI

Forbes article, The Most Attractive Employers for Engineering Students in 2015, provides a list of employers that engineering students aspire to work for.

1. NASA

2. Google

3. Boeing

4. Tesla

5. Space X

6. Lockheed Martin

7. Walt Disney

8. Apple

9. Exxon Mobil

10. General Elecric

The most attractive employers for business students:

1. Google

2. Walt Disney

3. Apple

4. Nike

5. JP Morgan

6. EY

7. Goldman Sachs

8. Deloitte

9. PWC

10. FBI

Tesla Motors research coverage started at Argus

Argus issues a note on Friday and started coverage of TM, with a HOLD ratings.

Four analysts have rated the stock with a sell rating, eight have given a hold rating and fourteen have issued a buy rating to the company’s stock.

Tesla Motors presently has an average rating of Hold and an average price target of $256.19.

Argus issues a note on Friday and started coverage of TM, with a HOLD ratings.

Argus states in its report that while Tesla shows strong potential in the future, its recent performance has not been very enviable after it reported disappointing quarterly earnings.

Four analysts have rated the stock with a sell rating, eight have given a hold rating and fourteen have issued a buy rating to the company’s stock.

Tesla Motors presently has an average rating of Hold and an average price target of $256.19.

ev-enthusiast

Active Member

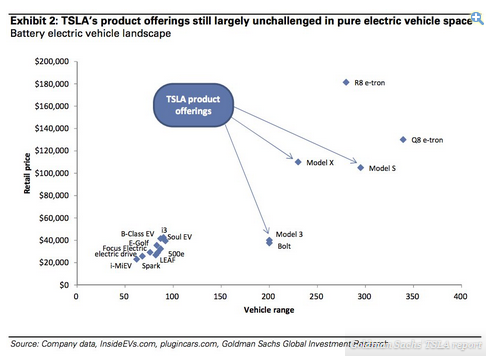

Few more tid bits on Goldman Sachs coverage of Tesla, as reported by Business Insider:

Ratings neutral price target $214

GS chart shows Tesla leaving competition in the dust as far as range is concerned.

Ratings neutral price target $214

Analyst Patrick Archambault and his team says one of the electric car maker's advantages is its industry-leading battery packs, which the company has regularly improved upon, distancing themselves from competitors.

GS chart shows Tesla leaving competition in the dust as far as range is concerned.

aznt1217

Active Member

Few more tid bits on Goldman Sachs coverage of Tesla, as reported by Business Insider:

Ratings neutral price target $214

GS chart shows Tesla leaving competition in the dust as far as range is concerned.

View attachment 76595

Haha Audi they need another dimension for timing and availability .

Haha Audi they need another dimension for timing and availability .

and horses$$t capacity.

Same old FUD today from Bank of America Merrill Lynch and presumably their auto analyst John Lovallo: Bank Of America's 10 Most Explosive Stock Picks - (ACT), Anadarko Petroleum Corporation (NYSE:APC) | Benzinga

10. Underperform: Tesla Motors Inc TSLA 0.16%

Analysts believe that Tesla "lacks any real technological advantage over its competitors" and see a significant Q1 loss, an increase in the company's already-bloated cashburn and a questionable delivery outlook.

10. Underperform: Tesla Motors Inc TSLA 0.16%

Analysts believe that Tesla "lacks any real technological advantage over its competitors" and see a significant Q1 loss, an increase in the company's already-bloated cashburn and a questionable delivery outlook.

Here is what Bank of America Merrill Lynch's John Lovallo had to say about TSLA over 25 months ago while it was trading in the thirties shortly after I bought my shares: What Wall Street thinks of Tesla - The Tell - MarketWatch

As reported in MarketWatch on February 21, 2013:

BofA’s John Lovallo II : He cut the stock to underperform from neutral and lowered his 2013 profit estimate to 10 cents from 30 cents a share. “We believe meaningful challenges lie ahead for Tesla and expect demand for electric vehicles to remain tepid until technology evolves and consumers aren’t forced to pay a premium or sacrifice convenience.” His price target is $30.

As reported in MarketWatch on February 21, 2013:

BofA’s John Lovallo II : He cut the stock to underperform from neutral and lowered his 2013 profit estimate to 10 cents from 30 cents a share. “We believe meaningful challenges lie ahead for Tesla and expect demand for electric vehicles to remain tepid until technology evolves and consumers aren’t forced to pay a premium or sacrifice convenience.” His price target is $30.

Same old FUD today from Bank of America Merrill Lynch and presumably their auto analyst John Lovallo: Bank Of America's 10 Most Explosive Stock Picks - (ACT), Anadarko Petroleum Corporation (NYSE:APC) | Benzinga

10. Underperform: Tesla Motors Inc TSLA 0.16%

Analysts believe that Tesla "lacks any real technological advantage over its competitors" and see a significant Q1 loss, an increase in the company's already-bloated cashburn and a questionable delivery outlook.

I wish I could read their true thoughts, since I don't get Lovallo and BoA...and they disqualify themselves more and more with their notes/ratings. Do they really believe their own words (which would signal really bad research & analysis) or is it a strategic decision to talk TSLA down continously (which would mean they're clearly advocates of the past and/or a dirty fossil fuel future)?

aznt1217

Active Member

Here is what Bank of America Merrill Lynch's John Lovallo had to say about TSLA over 25 months ago while it was trading in the thirties shortly after I bought my shares: What Wall Street thinks of Tesla - The Tell - MarketWatch

As reported in MarketWatch on February 21, 2013:

BofA’s John Lovallo II : He cut the stock to underperform from neutral and lowered his 2013 profit estimate to 10 cents from 30 cents a share. “We believe meaningful challenges lie ahead for Tesla and expect demand for electric vehicles to remain tepid until technology evolves and consumers aren’t forced to pay a premium or sacrifice convenience.” His price target is $30.

This guy doesn't give up.

Similar threads

- Replies

- 20

- Views

- 3K

- Replies

- 41

- Views

- 7K

- Replies

- 52

- Views

- 33K

- Replies

- 4

- Views

- 12K