Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

ValueAnalyst

Closed

Thanks for this. I did immediately think that the Ioniq Electric was the likeliest competitor in the near future (especially once they increase the range and number produced, which is promised for next year).

I still think there's room for two companies producing good electric cars, though. I even think there's room for three!

Who do you think will be the three companies? How do you think market share among the three will pan out?

ValueAnalyst

Closed

Before I factor in Tesla's semi truck, I want to know more about it with regards to range and features. I also want to hear feedback from the trucking community about what they like or don't like about the prototypes and suggested use patterns.

Before I invested in Tesla several years ago, I had a good idea of how the Model S would work as a family car. The alpha prototypes alone convinced me that Model S was great value because it could transport people and a lot of stuff, provide road tripping capabilities, and be fun at the same time. Having the abilities of a compact crossover and sports car in the same package is enormously appealing. It works well for the customer.

Tesla can prove that to me with the semi when they demo their alpha prototype. They need to show me that it's better than what's on the market today. I don't take things completely on faith.

The same goes for the pickup.

Energy products have potential, but I'm not convinced of a mass ramp of deployments yet. If the various pilot projects go well and result in a flood of new orders I would revise my guesses.

Site announcements and some general guidelines on factory construction planning are what I need here.

Basically, there is a certain threshold of information and action that I need to see before adding a product line to my fuzzy model.

I understand where you're coming from, and luckily we can take such a conservative approach with Tesla, because the price is so much lower than intrinsic value.

Having said that, an investor with a more reasonable approach (i.e. with projected revenue and profits from possible future products and services, but discounted to present value using an appropriate discount rate that reflects execution risk) will always reach a more accurate intrinsic value estimate, which can then be used to invest ahead of you using OTM LEAPs, which you would be mispricing.

Ulmo

Active Member

I haven't been reading this forum for a while. My assumption is that we will experience:

The stock will go up a bit, because investors will know what's up. How much and when? How much and when. Yup. But the bears will be wrong! The bears will be very very wrong. And that already started. And it gets worse. But the bulls will listen to the real investors, and that is based on the consumers, who will look at this over-hyped rollie thingie, and then when they start coming out the factory over the next 9 months, all that goes to waste: it's just about the quality of the car. The sales numbers. The profit. Lots and lots of profits. But first, another decade of losses, instead, to build 6 new gigafactories. By then, the stock price will already be where it needs to be. It will be sometime in early 2018.

That's my prediction. And my predictions are usually wrong. Lots of roller coaster on the way to a somewhat better stock price next year. That's if things go OK.

This is a long term stock.

- Massive FUD on a scale we've never seen before. We're already seen many FUDsters setting up shop in every crevice over the last few days. For instance, every thread on TMC has one designated FUDster. That will go up times one million as soon as the bell on the NYSE dongs. And it will end at 1PM trading day. It's all FUD FUD FUD.

- Sell The News! Big time.

- Bears Bears Bears. They will claw at EVERYTHING, and they'll make up stuff and claw at it. Fake news fake news fake news like never and always before.

- The Model 3 IS NOT A MERCEDES S65. The Model 3 IS NOT A MODEL X. The Model 3 IS NOT A ROCKET SHIP. Bears will bear this home over and over and over again. And we'll even believe them. Sometimes. Fools, etc.

- People will get in them. One here, another there. An investor will get in one. DaveT will get in one. In the dark. Then in the sunlight. Then he can take it on errands. THEN:

The stock will go up a bit, because investors will know what's up. How much and when? How much and when. Yup. But the bears will be wrong! The bears will be very very wrong. And that already started. And it gets worse. But the bulls will listen to the real investors, and that is based on the consumers, who will look at this over-hyped rollie thingie, and then when they start coming out the factory over the next 9 months, all that goes to waste: it's just about the quality of the car. The sales numbers. The profit. Lots and lots of profits. But first, another decade of losses, instead, to build 6 new gigafactories. By then, the stock price will already be where it needs to be. It will be sometime in early 2018.

That's my prediction. And my predictions are usually wrong. Lots of roller coaster on the way to a somewhat better stock price next year. That's if things go OK.

This is a long term stock.

Last edited:

ValueAnalyst

Closed

Another year, more likely.

My read based on all the previous statements I've heard: they're not 100% sure they can get 10K/week out of the existing lines. They're pretty sure they can get 5K/week after working the bugs out, but 10K/week is *aspirational*, and if they can't, they have to duplicate part of the line. Even if they get to 10K/week they're still sold out until 2019. Musk think they can get 20K/week out of Fremont overall, but that may require duplicating everything, which they can't do before 2019. After that level of production, they run out of space at Fremont and have to build a second factory.

If reservation numbers for Model 3 go up, it simply makes the wait longer, and this will continue to be true until 2019, even with the most optimistic assumptions. So they're going to be anti-selling straight through December 2018.

The sentence I bolded above makes it seem you believe 1m cars in 2019 is possible.

It's not clear to me yet that this is "one of the possible outcomes."

Ulmo

Active Member

Neroden,I hate to say this, but the majority of Americans can't really afford a car and should be taking the local light rail.

Except that most cities don't have any decent public transportation. Unlike in Europe where most cities do.

I've tried to commute on the Light Rail. It takes 30 minutes to go 10 blocks. It almost killed me with how slow it was. To do ONE ERRAND takes seven hours on the Light Rail. NO THANK YOU! I actually am more valuable than someone not allowed to work, eat, have friends, have home, have mates, and even have children. LIGHT RAIL IS DEATH. Light rail is only a program of destruction. NO WAY.

I don't have any idea what you're comparing it to out there where "Light Rail exists"; I assume you know what you're talking about, because you usually do, and I respect you a lot. I'm just demonstrating the usual experience of most the people in USA regarding light rail. Remember, I was the stupid one who actually tried it; almost no one is that stupid! It's cars for everyone in USA who wants to be anybody and do anything (unless they're IN Manhattan and independently wealthy, in which case, they use a taxi (well, Uber)).

Last edited:

ValueAnalyst

Closed

I hate to say this, but the majority of Americans can't really afford a car and should be taking the local light rail.

Except that most cities don't have any decent public transportation. Unlike in Europe where most cities do.

Majority of Americans will end up using all-electric fully autonomous ridesharing services in the longer term.

Similar to the 60:40 ratio among homeowners and renters, I expect some people to own cars in the future and rent it out to people who don't own cars.

I expect the ratio in automotive to be tilted more towards renters than in housing, because people don't feel the same level of emotional attachment to their cars they they do to their homes.

ValueAnalyst

Closed

Myusername, my current model has 100K Model S + X per year (together), 800K Model 3 per year, 100K semis, and a certain number of stationary batteries and solar roofs. This makes the stock worth more than the current price, and I really don't think there's much optimism bias there; I think they can do this *even during a recession*, which is not true of most companies' profits.

Now if you've got some other stock out there where you think you can make more than 8% return *during a recession*, sure, be my guest, that's probably better.

(The semi estimate is based on getting 25% of the US market pretty quickly, which should be really easy given the state of the competition and the fact that it was designed in collaboration with trucking companies; and also based on Tesla probably not wanting to bother to produce anything less than 100K per year. The battery and roofing estimates are based on selling as much as they can produce, based on previous statements about programmed production capacity, but at 10% gross margins.)

Comparisons with flaming trash fire companies like BMW are inappropriate. Just don't even. Any company which has most of its capital tied up in worthless internal combustion engines, and which is, *worse*, involved in a major fraud scandal, is going to have a seriously depressed stock price.

I have very similar projections in my model (slightly higher on model s/x combined sales), and agree with this post, especially comments around recession, 110%. This is a very important point for long-term shareholders.

neroden

Model S Owner and Frustrated Tesla Fan

Visit a country with decent mass transporation sometime. The US, indeed, is not one of them. :-( Sacramento's system is not particularly usable, though San Jose's is worse. San Fransisco's is barely on the edge of tolerable if you live in the right part of town.

(Though the fact is, in Manhattan, people take the subway if they're in a hurry; Uber's too slow. But Manhattan is the exception in the US.)

Practically anywhere in Germany will do to see what ought to be going on.

(Though the fact is, in Manhattan, people take the subway if they're in a hurry; Uber's too slow. But Manhattan is the exception in the US.)

Practically anywhere in Germany will do to see what ought to be going on.

This was actually a decision by Mark Tappening and Martin Eberhart before Elon Musk came on board.FWIW they did this because Musk researched all the car companies of the late 19th early 20th centuries and concluded that all the successful ones did this.

If you haven't viewed it yet, Mark does a great video on the early days of Tesla.

Practically anywhere in Germany will do to see what ought to be going on.

Not true.

Wow. Just wow.

Mike Smith

Active Member

Travis Kalanick is telling Uber CEO candidates he is 'Steve Jobs-ing' it, and will return

This is starting to look like American Apparel. Tesla Network's biggest competitor is in disarray.

This is starting to look like American Apparel. Tesla Network's biggest competitor is in disarray.

schonelucht

Well-Known Member

Now that the dust has settled a bit. My take (investment point of view only, customer pov is different)

I LIKE

* Tesla sticks to schedule on M3 first deliveries July target

* Pricing mostly right : high enough at first for getting to positive margins quickly, low enough to keep demand up later

* Refrained from adding technological surprises that may complicate production and delivery

* Positive press reception

* Standard model needs a smaller battery than estimated

I DISLIKE

* Slower roll out of premium models, pressuring gross margins 2018 Q1 and Q2

* Controlled delivery to selected customers on NDA basis signals low confidence

* No progress on EAP or FSD erodes lead on assisted driving tech

* Late international roll out does not put screws on European manufacturers

I am currently out of TSLA : I anticipate the chance of a bump due to this reveal to be about equal to chance for a decline due to Q2 shareholder results (which may be bad). I will be more aggressive once again as Semi reveal approaches. That is going to be more sizzle and less steak which usually attracts more stock buyers for TSLA than high steak, no sizzle events like the M3 reveal. Good luck to you all!

I LIKE

* Tesla sticks to schedule on M3 first deliveries July target

* Pricing mostly right : high enough at first for getting to positive margins quickly, low enough to keep demand up later

* Refrained from adding technological surprises that may complicate production and delivery

* Positive press reception

* Standard model needs a smaller battery than estimated

I DISLIKE

* Slower roll out of premium models, pressuring gross margins 2018 Q1 and Q2

* Controlled delivery to selected customers on NDA basis signals low confidence

* No progress on EAP or FSD erodes lead on assisted driving tech

* Late international roll out does not put screws on European manufacturers

I am currently out of TSLA : I anticipate the chance of a bump due to this reveal to be about equal to chance for a decline due to Q2 shareholder results (which may be bad). I will be more aggressive once again as Semi reveal approaches. That is going to be more sizzle and less steak which usually attracts more stock buyers for TSLA than high steak, no sizzle events like the M3 reveal. Good luck to you all!

2

22522

Guest

I have very similar projections in my model (slightly higher on model s/x combined sales), and agree with this post, especially comments around recession, 110%. This is a very important point for long-term shareholders.

You had asked a question about Net Promotion, and I am listening to an audio book by the person who invented it later today to see if it is useful. If you look at the Model 3, you will see that great product is the cornerstone to Net Promotion.

I have not seen anyone, on any part of this forum, that recognizes how good the car is.

Let's go back to the idea of product comparisons, maybe that will help people see how good it is, but before that it is important to appreciate that the tactile and visual senses are a direct connection to the brain, that Elon talks about. The Model 3 is a half step toward that direct connection, with the forward view and steering feedback. Not unlike a violin.

The best product analogy I know of is the Maxxis Minion DHF (Down Hill Front) bicycle tire, yes, a bike tire. It is called a Minion because it does exactly what you tell it to do, and if there are issues, it tells you that, too.

This manufacturer's description is accurate:

"Just run a DHF". How many times have you heard or said this when asking about tire advice? For over a decade, the Minion DHF has been the tire to beat when racing your friends on Saturday or the clock on Sunday. The tread pattern behind countless championship wins is now available in a high-volume plus tire design so you can make new memories with an old friend.

Designing great products reduces development expenses by half, as you don't have to design it again. Every other manufacturer that sells the same annual volume will have twice the development expense because their market life will be half (read VW). By the way, I understand the Model 3 accepts 3 battery modules and the low range model uses two. I expect the performance model to have a high rate battery in one of the positions. So there might be a model with all slots filled, but intermediate range, like 275 miles.

The other part of great products is customer experience. Because the Model 3 provides a direct connection to the brain, and good safety, some customers will be able to have experiences like this one (supported by Minion tires and a good suspension).

Hill is 10 seconds up at one point. That kind of gap is unheard of, but this is the same sort of gap the Model 3 now has on competitors. As self driving comes to fore, car companies will invest less and less in the driver experience. The Model 3 will likely be the last mass market driver's car. The accountants at other companies will not let their designers close the gap - handcuffed.

The tactile aspects of the Model 3 will, through net promotion, push the stock price to $1100. They need to shift the early product mix to support a younger demographic to see this, so that is not an advice. It is not clear that the business people at Tesla really want to win. The product people do. The Model 3 makes this obvious.

Last edited by a moderator:

Model 3 isn't what Tesla said it would be. Model 3 is too good, and that may be a problem, or not.

First off, Model 3 is significantly bigger than promised. It is not 80% the size of Model S (L x W x H), it's 88.5% Model S size. Model 3 interior dimensions are very close, not to the BMW 3 Series, but rather to the BMW 5 Series. And, for the price, Model 3 out techs and out performs comparable BMW 5 series cars.

It is interesting to compare the Model 3 that Tesla is actually delivering today with the base BMW 530i.

Price:

BMW 530i $51.2k

Model 3 $50.0k [long range, Premium pkg, multi-coat paint]

Head room:

BMW 530i 38.8"/37.5"

Model 3 40.3"/37.7"

Leg room:

BMW 530i 41.4"/36.5"

Model 3 42.7"/35.2"

Shoulder room:

BMW 530i 58.7"/55.9"

Model 3 56.3"/54.0"

Wheels:

BMW 530i 18"

Model 3 18"

Top Speed:

BMW 530i 130 MPH

Model 3 140 MPH

0-60 time:

BMW 530i 6.0 Seconds

Model 3 5.1 Seconds

Curb Weight:

BMW 530i 3,746 Pounds

Model 3 3,814 Pounds

The BMW 530i is a bigger on the outside (wider, longer and taller) than Model 3, but inside, these cars are similar size. The long range Model 3 Tesla is delivering now accelerates quicker, has a higher top speed, and COSTS LESS than the BMW 530i when similarly equipped.

What this means is that the initial Model 3 is positioned, not against the entry level BMW 3 Series, Audi A4, Mercedes C Class, but rather against the entry level BMW 5 Series and its competitors.

Going forward, Tesla is more likely to upgrade Model 3 [dual motor / performance versions / full autonomy] and less likely to significantly cheapen / dumb-down Model 3, based on past experience with Model S.

Tesla is positioning to 'cream skim' the high end of the BMW 3 Series - Audi A4 - Mercedes C - Class - Lexus 3xx market and annihilate the BMW 5 Series, Audi A6, Mercedes E Class.

One big question is whether there will be enough of these 'premium customers for Tesla to reach their sales target. Another is what will this decimation of the high margin ICE car market space do to legacy carmakers.

-- by Randy Carlson at SA

First off, Model 3 is significantly bigger than promised. It is not 80% the size of Model S (L x W x H), it's 88.5% Model S size. Model 3 interior dimensions are very close, not to the BMW 3 Series, but rather to the BMW 5 Series. And, for the price, Model 3 out techs and out performs comparable BMW 5 series cars.

It is interesting to compare the Model 3 that Tesla is actually delivering today with the base BMW 530i.

Price:

BMW 530i $51.2k

Model 3 $50.0k [long range, Premium pkg, multi-coat paint]

Head room:

BMW 530i 38.8"/37.5"

Model 3 40.3"/37.7"

Leg room:

BMW 530i 41.4"/36.5"

Model 3 42.7"/35.2"

Shoulder room:

BMW 530i 58.7"/55.9"

Model 3 56.3"/54.0"

Wheels:

BMW 530i 18"

Model 3 18"

Top Speed:

BMW 530i 130 MPH

Model 3 140 MPH

0-60 time:

BMW 530i 6.0 Seconds

Model 3 5.1 Seconds

Curb Weight:

BMW 530i 3,746 Pounds

Model 3 3,814 Pounds

The BMW 530i is a bigger on the outside (wider, longer and taller) than Model 3, but inside, these cars are similar size. The long range Model 3 Tesla is delivering now accelerates quicker, has a higher top speed, and COSTS LESS than the BMW 530i when similarly equipped.

What this means is that the initial Model 3 is positioned, not against the entry level BMW 3 Series, Audi A4, Mercedes C Class, but rather against the entry level BMW 5 Series and its competitors.

Going forward, Tesla is more likely to upgrade Model 3 [dual motor / performance versions / full autonomy] and less likely to significantly cheapen / dumb-down Model 3, based on past experience with Model S.

Tesla is positioning to 'cream skim' the high end of the BMW 3 Series - Audi A4 - Mercedes C - Class - Lexus 3xx market and annihilate the BMW 5 Series, Audi A6, Mercedes E Class.

One big question is whether there will be enough of these 'premium customers for Tesla to reach their sales target. Another is what will this decimation of the high margin ICE car market space do to legacy carmakers.

-- by Randy Carlson at SA

Last edited:

RobStark

Well-Known Member

Weirdly, there is, but GM is refusing to ship the Bolt to the countries where the demand is located.

I diagnose a bad case of "Who Killed the Electric Car" here....

It doesn't get ~$15k worth of ZEV credits in those countries.

Plus it cost more to ship to those countries than to California.

Making it a fire dumpster proposition.

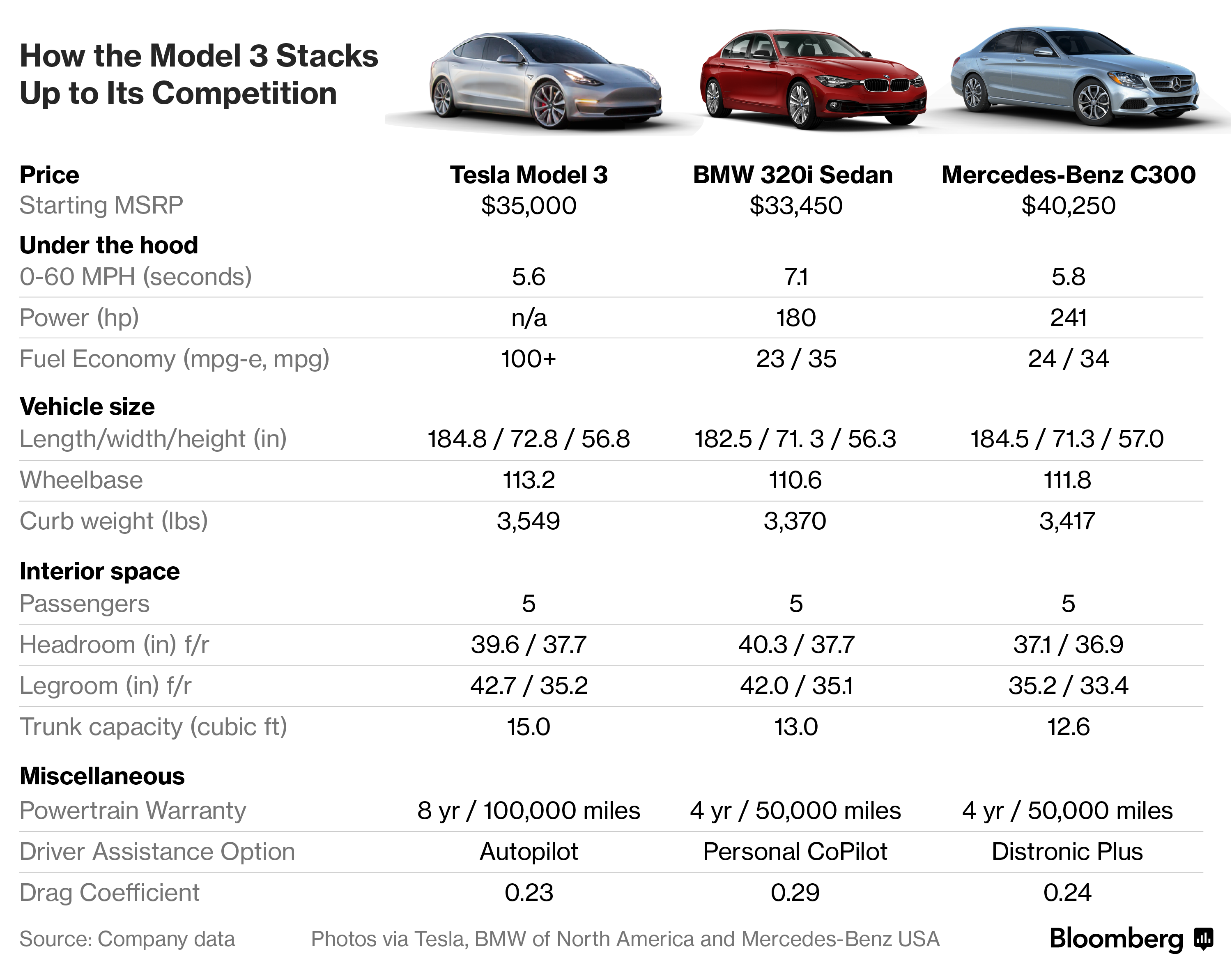

What blows my mind is, how deeply the notion of "big and heavy" is rooted in my mined when talking about current Teslas vs the competition. That was usually the only point i concede in arguments due to the simplified truth, that for an acceptable range you need a fairly big and heavy battery pack.

However this chart clearly shows, that in size, the 3 is right there with the competition: it's as long and high as the C class and just 1.5 inches wider. More importantly, it's just 4-5% heavier than the German duo. Tesla has come such a long way!

- Status

- Not open for further replies.

Similar threads

- Replies

- 8

- Views

- 1K

- Replies

- 6

- Views

- 11K

- Sticky

- Replies

- 461K

- Views

- 50M

- Locked

- Replies

- 27K

- Views

- 3M