Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

TSLA Technical Analysis

- Thread starter Robert.Boston

- Start date

-

- Tags

- TSLA

ev-enthusiast

Active Member

Yesterday SP was down almost $50 from the 2 recent highs.About minus $20 since those 2 recent highs.

I don't want to make fun of anything just stating that this was a great opportunity to make some money and TSLA pays attention to Fib numbers and double tops/bottoms.

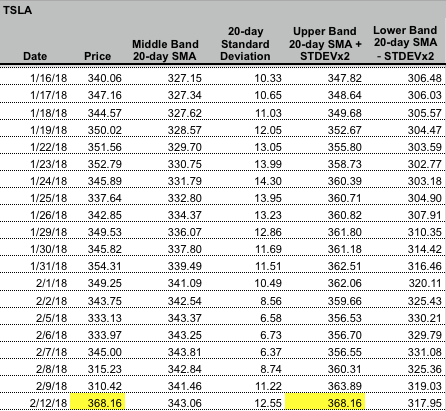

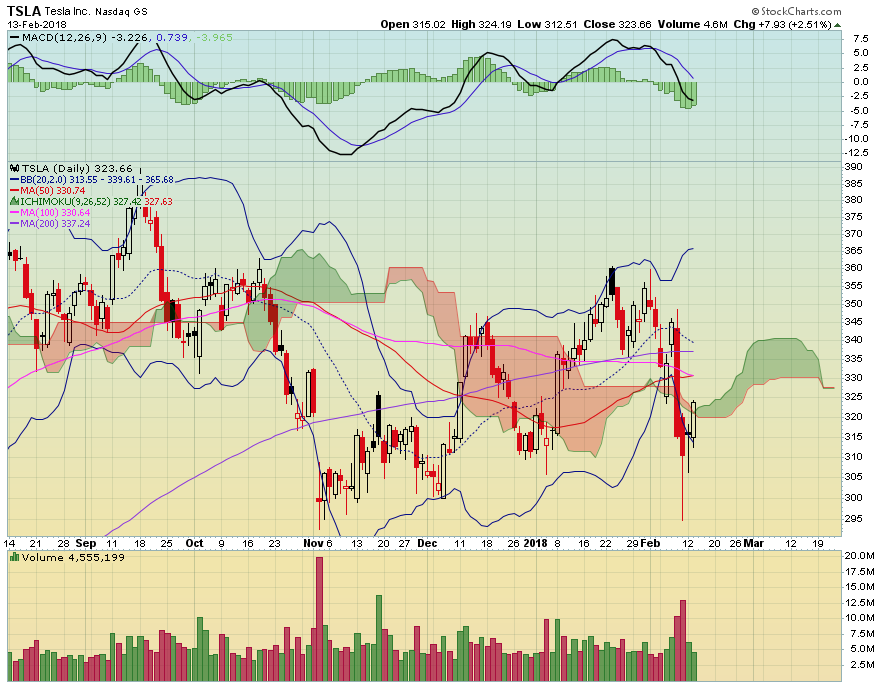

Check out the increase in the standard deviation for today. We only have to close up $5 on Monday to be back within the BB(20,2)

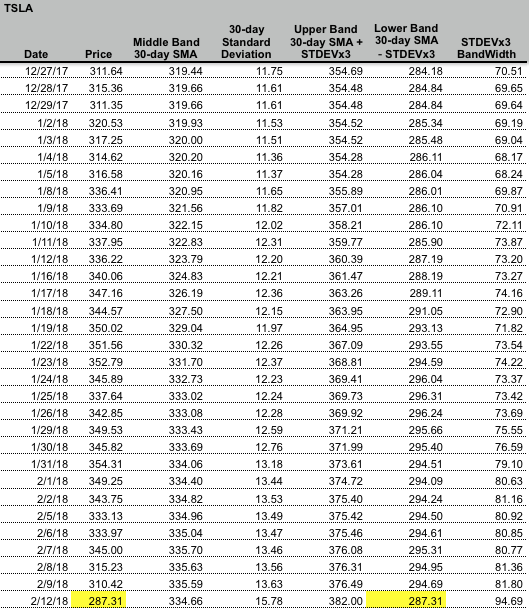

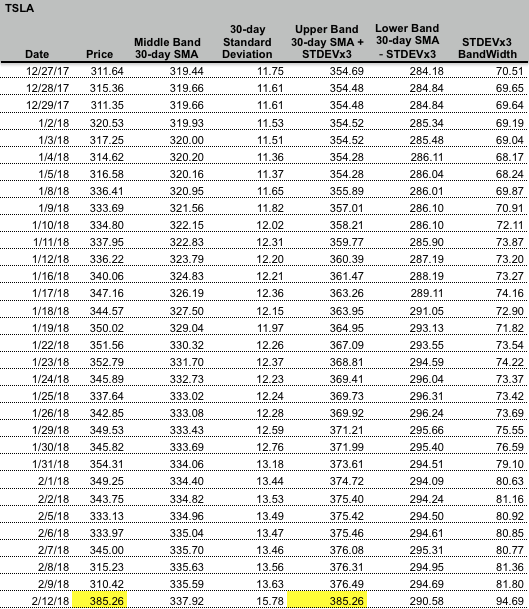

The BB(30,3) is still saying, "what drop?" but we are trading pretty close to the bottom. Some may be inclined to leverage up if SP crosses (or gets close to) the lower BB(30,3) on Monday.

The BB(30,3) is still saying, "what drop?" but we are trading pretty close to the bottom. Some may be inclined to leverage up if SP crosses (or gets close to) the lower BB(30,3) on Monday.

Here's my take on current SP actions based on my interpretation of Elliot Waves.

My first premise is that the September high was the peak of a truncated wave 5. So we've been in a corrective cycle since September '17. First corrective cycle has been a Zig-Zag pattern which bottomed in November '17.

Instead of exiting out into a new motive wave, TSLA entered into a new second corrective cycle. This time a Flat pattern. Typically Flat patterns end with the bottoming C [C1 in this case], somewhat lower than the A [A1 in this case]. So based on this analysis we should be ending the second corrective cycle (Flat) and moving into the next cycle.**

The question is, what is the next cycle? Based on EW, there can be triple corrective cycles, so theoretically we could move into another corrective cycle... or pop into a new Motive cycle (classic 1-5 waves). Using what we know of latest ER/CC, I think that we are going to go into a triple corrective cycle pattern. We'll have to see how that one forms out at this point. Since we already have a ZZ and Flat pattern, the last one left would be a Triangle pattern... we shall see.

**I am not saying today was the end, since based on the weekly candles, next week may bottom again in the 290s, possibly 280s. Depending on how it forms it could be a bottoming reversal week.

I was just looking at that chart again. There is a possibility that we are actually in an expanding Triangle corrective pattern not a Flat. This is a 5 wave (A-B-C-D-E) pattern. Either way, the E low portion would be in a similar point. Not sure if it changes much.

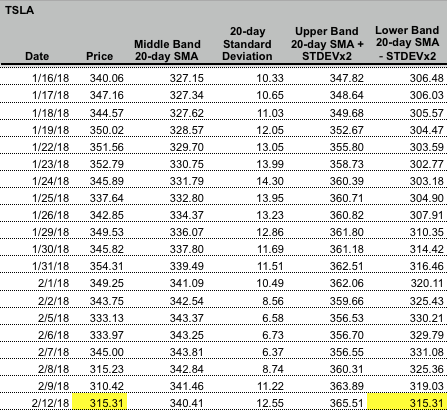

This is the last several days price action. Last two days long red candle with flat bottom, showing the intense selling pressure, followed by a moderate red day with long lower wick. Showing bottoming signs. Nonetheless, the closing price for both days are at the lower 3SD of the Bollinger Band (light blue line), and below the 2SD.

This is a continuation pattern which suggests that Monday will likely still be below the lower 2SD... but as we have seen here... likely not stay at the 3SD. I examined TSLA price history, and typically two red candle days touching/closing at the lower 3SD is followed by a smaller red or green day which moves up from the lower 3SD but stays below the 2SD. The fourth day is typically closer to the lower 2SD, or within and above. The exception is Sept 2016 where the SP started to come back, but then kept going for around 5 days or so at the lower 3SD.

So I’m guessing that Monday will close below or at the lower 2SD... that being said the bands are expanding, so the lower 2SD may be at 315 or so. By Tuesday it may be within the lower 2SD band, especially as the bands continue to expand. These should be closing prices, so intraday I have no idea...

bdy0627

Active Member

Even though the 50 SMA is about to golden cross the 100 SMA, it's pretty flat now. I don't have trend lines on here, but we have quite a bit of resistance above us. The 50 SMA is at $330.7 and the 100 SMA is at $330.6. Just above those, the 200 SMA is at $337.2. I think we would need quite a bit of volume to punch all the way through those. Plus, shorts will likely attack at those levels, trying to ensure a rejection. I'm anticipating a rejection, ping ponging us back down into the lower $320s. I will probably sell a few of my March calls there and buy shares unless it looks like we've got volume and will shoot above. I may be wrong to sell them there, but I really regret it when I'm still holding shorter term calls as we drop down again.

bdy0627

Active Member

Is there a charting site that automatically lists the fib levels? I use StockCharts and there doesn't seem to be a way to automatically show fib levels.The Russian stuff certainly didnt help. But we barely wicked above the fib at 342.50 and moved down, which is what I and my friends that trade kind of expected. It feels natural and I wouldnt worry based on the movements today. But the market is fickle and unpredictable. Ive moved entirely into J20s, I ended up selling my J19 350s and 400s today around 338 and rolled them into a smaller number of J20s. It wasnt my original intent, but I am trying to be a hair more conservative than I have been in the past. Hopefully we get reasonable macros come Tuesday and move to retest the fib again.

Is there a charting site that automatically lists the fib levels? I use StockCharts and there doesn't seem to be a way to automatically show fib levels.

Try: www.tradingview.com

On the left hand axis/template lists there is one for Fib levels (Gann’s fans, etc...). Looks like a stylized fan. I don’t use the site much, so cannot attest to how good it is for the Fib stuff.

Is there a charting site that automatically lists the fib levels? I use StockCharts and there doesn't seem to be a way to automatically show fib levels.

It all depends on how you define top and lows. There is no such thing as a standard or "we all agree on" fib level.

bdy0627

Active Member

There's my issue. I don't follow charting closely enough to define that. I need help from those that do.It all depends on how you define top and lows. There is no such thing as a standard or "we all agree on" fib level.

bdy0627

Active Member

Thanks! It still requires defining where to plot from. I'm not sure what to use for that.Try: www.tradingview.com

On the left hand axis/template lists there is one for Fib levels (Gann’s fans, etc...). Looks like a stylized fan. I don’t use the site much, so cannot attest to how good it is for the Fib stuff.

Thanks! It still requires defining where to plot from. I'm not sure what to use for that.

See if this helps:

Understanding Fibonacci

PS—he uses the tradingview platform, so his examples will kind of show you how to use the Fib ratio too.

Last edited:

Thanks! It still requires defining where to plot from. I'm not sure what to use for that.

I’ve been reading a book on Fibonaccis—> Fibonacci Trading by Carolyn Boroden. So far pretty good and accessible. Lots of charts and practical stuff.

bdy0627

Active Member

Thanks! I'll check that out.See if this helps:

Understanding Fibonacci

PS—he uses the tradingview platform, so his examples will kind of show you how to use the Fib ratio too.

dc_h

Active Member

Any updates here? We keep topping around here and 359. If we don’t break out, are we likely to break back down to 300?

I like Jesse’s commentsAny updates here? We keep topping around here and 359. If we don’t break out, are we likely to break back down to 300?

Some views on current price action

Similar threads

- Replies

- 0

- Views

- 137

- Replies

- 21

- Views

- 6K

- Replies

- 4

- Views

- 395

- Replies

- 3

- Views

- 926