The Worker's Council is a required thing, but that is not a Union. The IG Metall Union wants their foot in the door as well.I thought Tesla Berln already worked out their deal with their “workers council”

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

SpeedyEddy

Active Member

Thanks, but I just used the +25% (within) and (outside)-25% (knowing it can get to be far more either way, but to the downside there will be plenty of room to roll. I guess I wil roll both of them more than once, collecting premium.

tivoboy

Active Member

I’m well aware of what the workers council is, and is not.The Worker's Council is a required thing, but that is not a Union. The IG Metall Union wants their foot in the door as well.

SpeedyEddy

Active Member

correct, but a strike will build pressure and that still could happenThe Worker's Council is a required thing, but that is not a Union. The IG Metall Union wants their foot in the door as well.

intelligator

Active Member

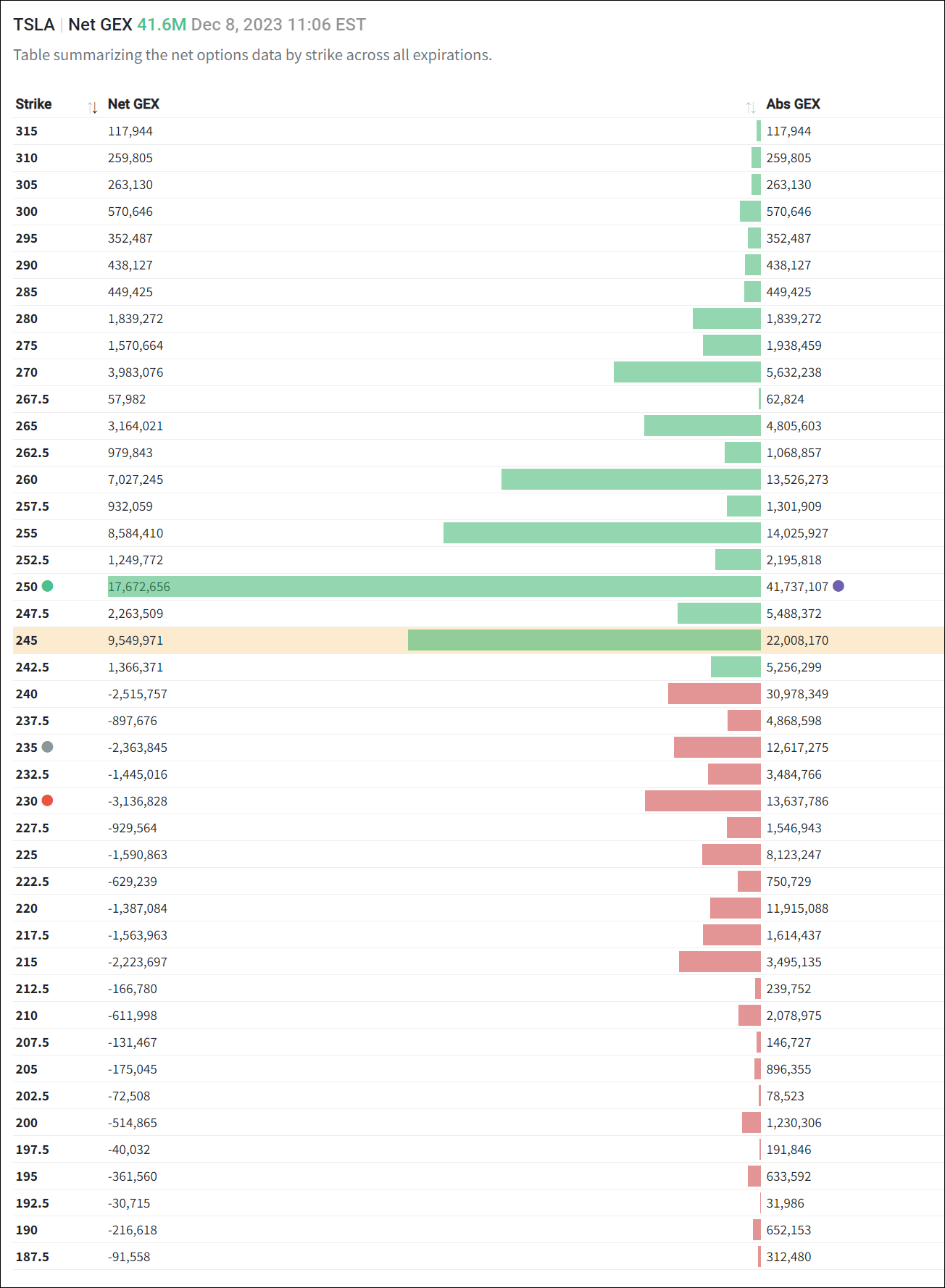

Added +250/-265c exp 12/15 for the upside

travelled this week, made .65 Tuesday morning with 12/8 cc STO/BTC same day. Half hour ago I set a STO -c265 for 1.00, hit at high side of 244, added an order to BTO +250 for 2.00 which will hit near 238 , if we see that today. The aim is to get this spread filled at net 1.00 debit ... GLTA, signing out for the weekend.

Maybe since next week's GEX wall moves up to $250 it's just going to wait to try next week, BUT next week has a few land-mines such as OPEX, key inflation data, FOMOC, etc. and who knows what else.

It won't be boring, that's for sure!

It won't be boring, that's for sure!

Ok, then why did you bring it up when someone mentioned that the Union, IG Metall, might get involved?I’m well aware of what the workers council is, and is not.

Kind of hum drum compared to the fancier trades many are doing, sticking to what I have a feel for (CC), at 10:36 —

- btc 4 x 8Dec$260 at $0.02 (99%)

- sto 4 x 22Dec$260 at $3.00

thenewguy1979

"The" Dog

Being chickened is the secret of longevity in this game….mmmm chickenAnd chickened out of C 247.50 for .57 leaving me .20 net gain, enough for a nice main dish (Together with the two other calls make it a weekend of fun!)

Sidelines - being the house is much more fun. Way less profit but way less risk and more consistent winning. All my sold contract for the week going into earning for Roku, LuLu, and GME are in green.

Tesla Stock posturing again. Maybe MM really want to weed out the 245C holder?? Little dog might need to bite the beast in the ass again to get it going.....

Next week:

Tuesday Pre-Market: CPI

Wednesday Pre-Market: PPI

Wednesday Afternoon: FOMC Decision (but much more importantly, Q&A)

There are probably some round-trip opportunities to be had during such a busy week.

Tuesday Pre-Market: CPI

Wednesday Pre-Market: PPI

Wednesday Afternoon: FOMC Decision (but much more importantly, Q&A)

There are probably some round-trip opportunities to be had during such a busy week.

Thursday:

So $244 rejected for now, lower high from yesterday...yada yada...let's see if it can beat yesterday's HOD.

On pop STO:

10x -C260 12/15 @$1.80

10x -C265 12/15 @$1.15

10x -C270 12/22 @$1.70

BTC here, 4th round-trip, gained approx 3x than just holding. The volatility can be fun if you’re cautious and not greedy. As of now going into weekend flat on near-term CCs unless we test highs again.

TexasGator

Member

Ok, first very safe move based on MA4x divergence upward:

STO march 15 2024 P180 expected to even sustain a -25%! $3.47 catch (if direction confirmed I will move Up and out)

BTO march 15 2024 C 290 @ $9.35 in a 1:3 ratio with foresaid -P, so in fact a free call.

inspired by SpeedyEddy, did similar except STO 5x Jan 26 2024 p200, and BTO 6x Jan26 2024 C300. basically a wash

edit: the -P are backed by the Mar 15 2024 p150, which helps not tie up much $

thenewguy1979

"The" Dog

So basically we going to the moon (300+) is the projection? If not, the p200 pay for the free ride up. Unless we dump hard past 200 - good move.inspired by SpeedyEddy, did similar except STO 5x Jan 26 2024 p200, and BTO 6x Jan26 2024 C300. basically a wash

edit: the -P are backed by the Mar 15 2024 p150, which helps not tie up much $

Damn, wrote this three hours ago, but forgot to post it...

OK, decided to sort out this week's expiries, can't be bothered staring at the ticker for the next six hours...

BTC 60x -c240 @$2.91 (net +$1.29)

BTC 30x -p240 @$0.95 (net +$8.40)

STO 40x 12/15 -p240 @$5.1

STO 60x 12/15 -c245 @$5.2

Hoping to let today's 100x -c260 expire (saves $250 in broker fees...)

If we get any kind of pop above $250 then will look to sell 100x -c260

OK, decided to sort out this week's expiries, can't be bothered staring at the ticker for the next six hours...

BTC 60x -c240 @$2.91 (net +$1.29)

BTC 30x -p240 @$0.95 (net +$8.40)

STO 40x 12/15 -p240 @$5.1

STO 60x 12/15 -c245 @$5.2

Hoping to let today's 100x -c260 expire (saves $250 in broker fees...)

If we get any kind of pop above $250 then will look to sell 100x -c260

thenewguy1979

"The" Dog

Damn, wrote this three hours ago, but forgot to post it...

OK, decided to sort out this week's expiries, can't be bothered staring at the ticker for the next six hours...

BTC 60x -c240 @$2.91 (net +$1.29)

BTC 30x -p240 @$0.95 (net +$8.40)

STO 40x 12/15 -p240 @$5.1

STO 60x 12/15 -c245 @$5.2

Hoping to let today's 100x -c260 expire (saves $250 in broker fees...)

If we get any kind of pop above $250 then will look to sell 100x -c260

The Strangles are close ITM. Please share exit plan Max? That truly a big dog move exp 12/15

ZeApelido

Active Member

I got bored staring at the ticker. Went into the backyard to trim a tree. Ended up cutting down half of it. I'm scared for the wife to get home....

What your wife sees when she gets home:

Reposting in case my question got lost in pile yesterday:

When TSLA is expected to rise, what's better for capturing upside, sold puts (-P) or bought calls (+C)?

And any NFA suggestions for strike/DTE on either?

Trying again…

@Max Plaid any thoughts you can share on this?

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 6K