AAPL went from under a $trillion in MktCap to god-knows-what-now over the past few years all without introducing a single new type of product. All gains just from the mo-mo gravy train...

They scaled a very lucrative service business.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

AAPL went from under a $trillion in MktCap to god-knows-what-now over the past few years all without introducing a single new type of product. All gains just from the mo-mo gravy train...

I double checked the VW number before sharing that graphic - no idea on the others.WTF 105k BEVs did Toyota sell?

This says US sales of pure BEVs were a little under 15k, then another 25k or so of plug-in hybrids. DId they have another ~90k BEV sales somewhere else?

Toyota U.S. Electric Car Sales Increased By 10 Times In 2023

In Q4 2023, the Toyota group sold in the U.S. 16,657 plug-in electric cars (up 58% year-over-year), which represents 2.7% of the total volume.insideevs.com

Also does that Hyundai number include Kia? Seems like it should but then the 260k seems unreasonably low?

Hyundai Motor Group Snags 7th Place in Global EV Sales from Jan. to Sept.

Hyundai Motor Group, which controls both Hyundai Motor and Kia Corp., ranked seventh globally, posting sales of 378,462 electric vehicles (EVs), battery electrwww.businesskorea.co.kr

This says they were at 294k (pure BEVs) by end of September, so should be nearer 400k for the full year?

Apple has great profit margins though.

Apple's main expenses are categorized as R&D not COGS which is why their margins look artifically high. This is common with silicon valley software companies. Also, they get a bulk discount on the suicide nets outside the dorm windows of their china sweatshops...

ICramer on AAPL @ 3:40

I haven't watched this video in years - a different perspective each time. Classic

Apple's main expenses are categorized as R&D not COGS which is why their margins look artifically high. This is common with silicon valley software companies. Also, they get a bulk discount on the suicide nets outside the dorm windows of their china sweatshops...

Elon putting a plug in for India

‘Absurd’: Elon Musk on India not having permanent seat in UNSC

“Problem is that those with excess power don’t want to give it up,” Elon Musk, the world's richest billionaire said.www.hindustantimes.com

+ Regarding FSD V12 .

outside is the same, but inside ...

.... single end-to-end neural network trained on millions of video clips, replacing over 300k lines of explicit C++ code.

... giant leap ...

you don't need to. I sold 1000 shares at $213.

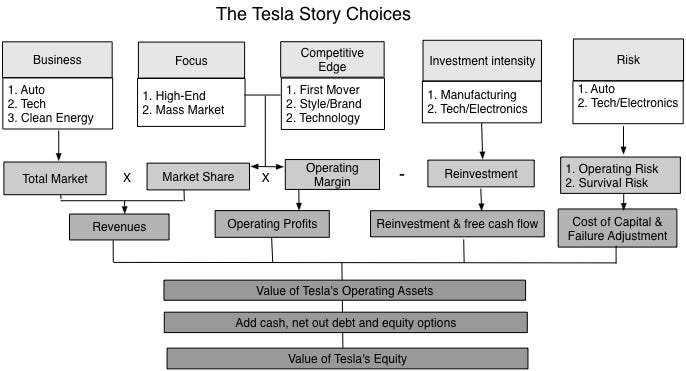

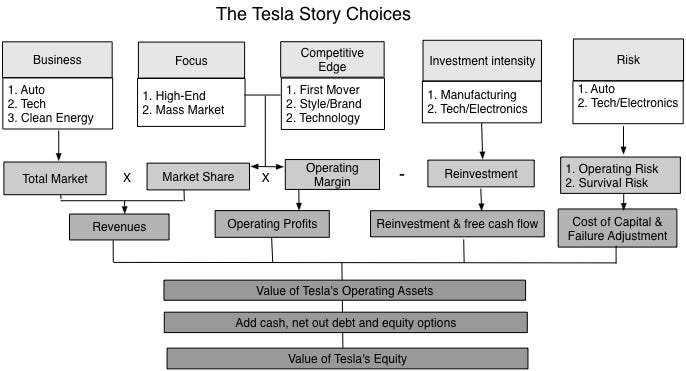

He has been so grossly wrong about Tesla from the start. He never understood it. He always wanted to model the company like every other company on the planet. He didn’t recognize who made Tesla different. Yet there were hundreds of us plebes right here on this forum without the fancy degree and industry reputation who KNEW he didn’t know what he was talking about.On the eve of earnings, I found it interesting reading this missive from “the dean of valuation” (Aswath Damodaran) posted after last earnings, who has been in and out of Tesla over the past decade (where he freely admits missing plenty of upside).

He has a dispassionate approach to investing, relying on his discounted cashflow models which he freely shares and states his assumptions.

Tesla in November 2023: Story twists & turns, with value consequences!

Growing pains!aswathdamodaran.substack.com

Includes this great chart in relation to price cuts:

(note that with current share price falling to a level that is closer to his fair value price, he also states that his model doesn’t include other potential revenue streams. Note it does include robotaxi, but doesn’t include Optimus, and doesn’t include insurance etc.)

View attachment 1011402

The competition is struggling to scale. Hyundai availability in Europe is hugely limiting and that is nothing to do with the charging infrastructure. Once BYD is building in Mexico however............Re de-throning of the model Y. It could happen, at least in North America, but not until most if not all of the superchargers are open to the general public. After that there really isn’t any special sauce limiting people to a model Y. I suspect Hyundai could be an early competitor for both the model 3 and model Y once they have access to the supercharger network. Teslas market domination will drop like a stone once they get the supercharger network available to everyone via the NACS plug or adapter. And that tap can never be turned off again.

Jmho.

nooks babyThe real question is why there are still permanent members in the UNSC.