I was extremely pleased with this presentation last night, although it didn't cover everything I expected. Notably, the promised incorporation of SpaceX and Boring company to Master Plan Part 3 was nowhere to be found tonight, which makes me wonder if more is coming later. We were told to look forward to the Master Plan white paper, the next-gen vehicle reveal event, and the next Impact Report, so tonight definitely was only the first in a series of info dumps. Also, the president of Mexico in his announcement on Tuesday of Giga Mexico said to expect more information next week, though it’s not clear about what. Probably water.

The big story for the car business last night is that they explained how they’re going to cut $15k+ from the cost to produce each car while slashing billions of dollars from the CapEx investments needed for each incremental 1M cars/year of production capacity. The goal of cutting the cost in half isn’t news, as that was effectively announced in 2020 on Battery Day when Tesla first officially announced intentions of a $25k car. What was news is explaining

how they’ll do this and showing, for the first time, actual data on cost trends for several of the major vehicle subsystems. Tesla showed us last night that they are the

only company in the industry that can produce compelling affordable EVs for the masses. The demand for a good $25k Tesla would be plenty for selling 20M per year, if not more (spread across multiple models around this price, of course). The question for me has been whether Tesla can actually make such a car with COGS of under $20k, and after Investor Day my confidence in that happening has majorly increased. $5k per car and 20M cars per year is $100B gross profit, and that’s before piling on subsidies and high-margin recurring software and services revenue. $10k per car, $200B. And will they stop at 20? After last night I’m more skeptical of that than ever.

Tesla was very clear in saying that the price elasticity of demand for Tesla products is extreme. That is, the quantity of orders is exquisitely sensitive to price. The was a strong hypothesis, but it’s now been experimentally tested with the price cuts. This has important implications for the strength of Tesla’s margins and total addressable market as they drop lower-priced models onto the market and gradually reduce S3XY prices over time as well. Tesla appears poised to DOMINATE the $25-45k market segment, and this is where most of the money is, especially if you can make like $5k or $10k per car. Prototypes are fun and exciting but what we really needed to know was the plan for resources, logistics and production cost and that’s what Tesla delivered. Don’t get mad that they fed us veggies and brown rice instead of candy. As a long term investor, the core of my thesis has always been that Tesla can make more cars than anyone in history with low OpEx overhead and strong gross margins as the lowest-cost producer. This is how the auto business can hit $100 or $200 billion annual earnings in the 2030s conservatively assuming level 5 autonomy development will have totally failed. In conjunction with Battery Day, Investor Day greatly reduced my remaining doubt that Tesla can do this.

Toyota originated a useful eight wastes framework that basically is the first principles of efficient industrial engineering:

- Overproduction

- Inventory

- Waiting

- Motion

- Transportation

- Rework

- Overprocessing

- Underutilized human potential

The more you eliminate these wastes, the more you can improve safety, quality, throughput, morale and cost. I recommend rewatching the manufacturing sections of the presentation with this list of wastes and consider all the ways Tesla is deleting them throughout the value chain. Like Pete Bannon said, they’ve found all kinds of ways to shave the carrot.

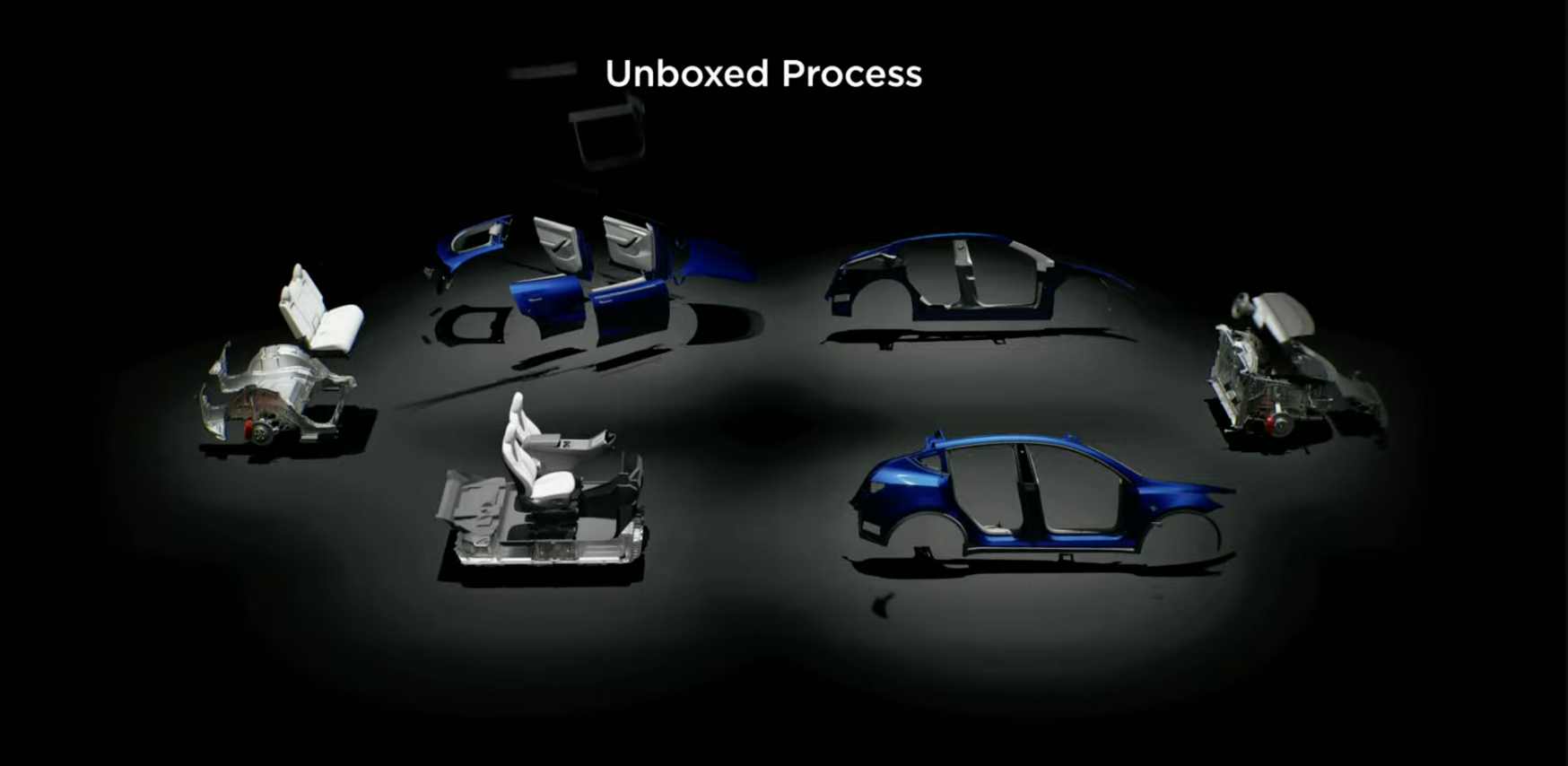

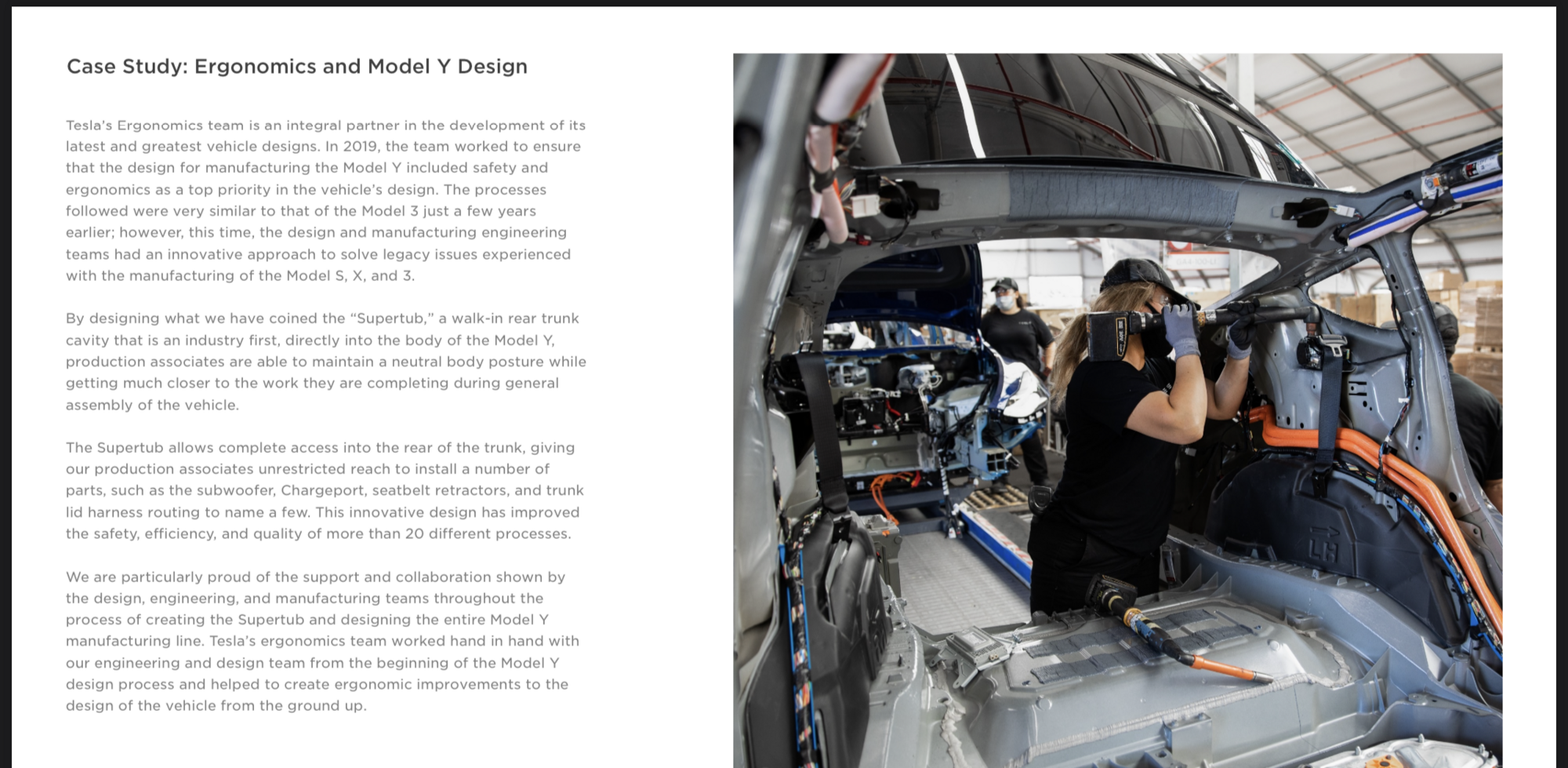

This slide and the build sequence animation was great. In 2020 I was impressed with the Supertub (see image below). Last year I was impressed when Munro Live showed us the Model Y structural battery pack assembly with the seat and everything built up atop it. Now Tesla has revealed they’re taking that concept to a whole new level by completing almost all of the general assembly work before mating the major structural elements. This is revolutionary from an access, ergonomics and safety standpoint. The body in white itself has traditionally been an annoying obstruction to general assembly because it’s basically a big enclosed cage. Humans have to lean and contort into awkward postures to get work done, and robots have to slowly and carefully move in and out of the openings. No more of that with this new design, and as Tesla noted this will improve the density of value-added operations per square meter of floor space by about 40%, even as it also deletes traditional non-value-added operations like putting the doors on multiple times. Lars mentioned "tested subassemblies". This is also key. Fixing problems is also a lot easier before they’re covered up with other hardware. Further, with the old way, most of the mass is being moved around without added value. With this new method, there's much less wasted motion and force. This will also further reduce the energy embodied in the manufacturing of each car.

This new sequence is also much more parallelizable than the Model Y line and the smaller subassemblies allow 33% more people and robots to simultaneously operate on each vehicle.

My big question with respect to this new assembly sequence is exactly why no one else has done this before. Is it only feasible with an EV architecture? Are castings or structural battery packs required to make it practical?

After seeing what Tesla presented I think this plan is probably better than a complete full-body casting, which is really just a better way to complete the old design flow.

If you haven’t worked in manufacturing you might not realize just how terrible wire harnesses are from fabrication to assembly to troubleshooting to service. They are often one of the worst and most frustrating aspects of building products. Tesla showed last night a strong trend of reducing wiring in the vehicles and a path to reduce even more in Gen 3. I won’t rehash what they said but it’s a big deal for the low-voltage system.

Tesla has continually said manufacturing will be their long term competitive advantage and this event was mostly about manufacturing. They showed us how they'll

make Gen 3, not the cabin design and sheet metal and shape. That stuff is relatively easy and everyone in the industry knows how to do it.

One aspect I think Tesla understated or maybe doesn't see…The beginning of the presentation covered what is needed to transition the world to sustainable energy, with an implied assumption that there will be a one-for-one replacement of current applications. I think this is a profoundly inaccurate assumption. My thesis remains that overall energy consumption is actually going to increase many times over, despite the greater efficiency of electric motors compared to any

Carnot heat engine. Whenever supply of any fundamental factor of production increases such that it’s cheaper, better and more available, economies consume more of it. This will happen with clean energy, and it already has been happening with thermal energy sources since the beginning of the First Industrial Revolution. We consume far more joules of coal/oil/gas per capita than we ever did with less-efficient traditional biomass like wood. The long-term cumulative numbers presented last night should be viewed as a baseline scenario showing it’s technically and economically possible to get humanity off of fossil fuels by 2050, but it’s not presenting the magnitude of the true long-term opportunity of energy and the new ways we will use it.

What else we got that stood out to me:

- Hard historical data showing what we've thought and proving what the Munro team has been claiming all along: that Tesla's innovation has been aggressively reducing costs in every major vehicle subsystem.

- Digital twin and digital thread principles are deeply embedded in everything Tesla does, and the shift to using exclusively custom Tesla-designed microcontrollers is the final step to unleashing the full power of this strategy because Tesla engineers will now have total control over the brains of the car. Tesla showed a deeper glimpse than ever into their incredible data management and end-to-end software integration.

- FSD Beta collision rate finally revealed. Human-supervised FSD Beta has decidedly NOT increased risk for customers or others sharing the road. 6x lower collision rate. One could argue that even with fewer collisions there may be an elevated risk of catastrophic failure, but seeing as there have been zero reports of deaths or injuries, I’m inclined to believe that the collisions that have happened on FSD have not been especially serious compared to the statistical norm for human drivers.

- As far as I can remember, this is the first time we've heard any detail directly from Tesla about Factory Mode. Joe Justice has talked about it extensively but I still have some skepticism for stuff he claims because it seems like he tends to exaggerate. Hearing it straight from Tesla was great news. Tesla is basically using the car’s display as visual quality control, a new twist on the traditional Andon concept. Joe Justice has also talked a lot about Tesla’s software-style continuous integration testing in the factory and Tesla also mentioned this last night. It’s the right approach in my opinion.

- Lots of miscellaneous bits of technical info that the people who insist on negativity seem to have completely missed

- Specifics on just how cheap superchargers are

- Clear guidance that the crazy OpEx cost control we’ve seen is likely to continue as business scales, implying amazing leverage is coming

- Powertrain: No rare-earth metals, $1k cost, agnostic to battery chemistry, 75% less SiC

- 48V for all low-voltage components, completely leaving 12V behind

- Zero cross-car power wires by moving away from centralized control to local controllers (edge computing). Ethernet (much lighter weight than the old wires) will route data between microprocessors.

- Advanced in-house electromagnetic physics simulation software that is faster and more accurate than any commercially available options

www.youtube.com