Which year will be more of a challenge for Tesla, 2022 the year past or 2023?I could go on, but the bottom line is that he just isn’t that smart.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

growler23

Member

Your dose of good news for the night:

(WaPo article, may be paywalled)

(WaPo article, may be paywalled)

Minerals are crucial for electric cars and wind turbines. Some worry whether we have enough.

The quote focuses on generation, but EV's are also mentioned in the article. There are apparently enough minerals earth for those too.Recent research has also shown that the amount of minerals required for the shift to renewable energy is significant — but falls well within the amount of reserves available. A study released recently by scientists at the University of California at Irvine and MIT found that current reserves of minerals like aluminum, copper, manganese, silver and more should support building enough wind and solar power to meet climate targets.

What’s more, the mining from those operations would not have an outsize impact on global warming. (One repeated critique of renewable energy is that the intensity of mining might counteract the emissions benefits of wind and solar.) According to the study, the materials required for the transition to low-carbon electricity would take up somewhere between 1 and 9 percent of the remaining carbon budget: a significant amount but one that wouldn’t

undercut overall climate goals.

Fighting through a bad ice storm here. Second full day without power. Both of us now facing our first bout of covid. Powerwall has been a godsend, but why can't it run my 1.8 kW Microwave? Inrush current? It just turns the turntable- no radar. Natural gas also keeping the fireplace going (apologies to the climate). Panels refused to generate today until 5 pm, despite enough light - some weird glitch there. Said refusal did not help the Powerwall but she is still at 60% so we will make it another day.

Temps warming now so all will be well. Thanks to the Tesla team (fill that in on your bingo card)

Temps warming now so all will be well. Thanks to the Tesla team (fill that in on your bingo card)

B

betstarship

Guest

Absolutely not! First principles thinking does not dictate your goals or whether a personal decision is logical or rational, it is merely a method of looking at things that helps you avoid thinking you know more than you do. It's more a world view than a tool. There is no downside to using it on every deliberate decision you make, other than it's very difficult to use deliberately, it's more of a habitual way of thinking that you can work towards improving. It can only improve your decision making to avoid the most common assumptions and pitfalls when making daily decisions.

Introspectively, does that make me less of a hard worker concerning the way I think about self improvement? I really don't know and have a decent sense of my limitations which is a healthy coping behavioral habit.

2daMoon

Mostly Harmless

Right on!I tend to follow the Socratic method myself. The more questions you ask, the more the person answering reveals themselves.

You cannot listen to an answer to a question that was never asked.

Edit: finished the sentence, duh

Last edited:

Well there is Jeopardy...Right on!

You cannot listen to an answer that was never asked.

2daMoon

Mostly Harmless

Absolutely not! First principles thinking does not dictate your goals or whether a personal decision is logical or rational, it is merely a method of looking at things that helps you avoid thinking you know more than you do. It's more a world view than a tool. There is no downside to using it on every deliberate decision you make, other than it's very difficult to use deliberately, it's more of a habitual way of thinking that you can work towards improving. It can only improve your decision making to avoid the most common assumptions and pitfalls when making daily decisions.

Agreed, and it may not be for everyone. It is a method that takes practice and application to have running full-time in the background.

For me, applying first principles is about being honest with myself. Mostly, in order to avoid making knee-jerk decisions based only upon emotion.

When it comes to emotions I have found having a "trust, but verify" attitude can often provide a distinct advantage.

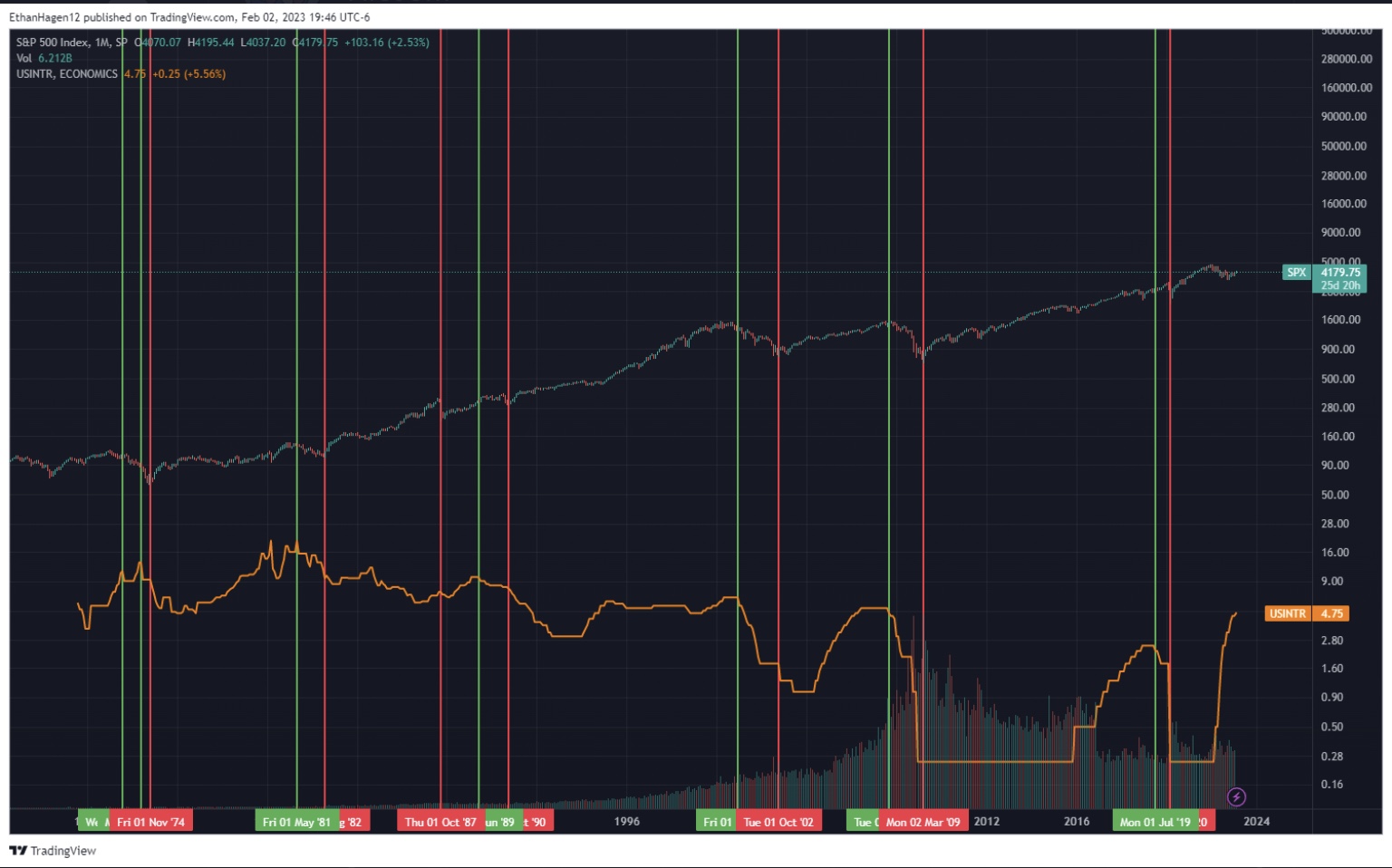

How historically the market typically bottoms after the Fed pivots has been widely discussed, but not always clearly illustrated.

In this interesting chart from 1970 to 2023, top line moving up is S&P500. Bottom line moving down is the Fed interest rate. Green vertical lines are when the Fed pivot from raising the interest rate to lowering them. Red vertical lines are where the market bottomed.

source tweet

In this interesting chart from 1970 to 2023, top line moving up is S&P500. Bottom line moving down is the Fed interest rate. Green vertical lines are when the Fed pivot from raising the interest rate to lowering them. Red vertical lines are where the market bottomed.

source tweet

FYI, I've decided to mainly use Twitter for the foreseeable future vs using this thread and @adiggs "be the house" thread, largely due to trolls and other difficult posters. I've had to ignore so many that it hurts.

I'll come here from time to time, but it is just not the place that makes me feel more informed and well rounded moreso than my Twitter feed.

Thank you for so much discord over the years and I wish all well!

I'll come here from time to time, but it is just not the place that makes me feel more informed and well rounded moreso than my Twitter feed.

Thank you for so much discord over the years and I wish all well!

Fred42

Active Member

I'm wondering how Twitter can be better than this thread.FYI, I've decided to mainly use Twitter for the foreseeable future vs using this thread and @adiggs "be the house" thread, largely due to trolls and other difficult posters. I've had to ignore so many that it hurts.

I'll come here from time to time, but it is just not the place that makes me feel more informed and well rounded moreso than my Twitter feed.

Thank you for so much discord over the years and I wish all well!

Electroman

Well-Known Member

While I sympathize with his arguments and I can see how one can fall into the Tesla is finished trap, there is one point he makes which is completely idiotic especially for someone who follows Tesla and Elon so closely.In conclusion - it’s all just one big narrative; a story told to fit an outcome.

Beware the stories you tell yourself. All of it is a never ending fiction. The stories your parents told you and you’ve hung onto your whole life and definitely the stories being told to you by ‘the street, the media, the market, et al’ - those too. All limiting, all keeping you from realizing your full potential.

He made this point a couple of times that, Elon bailed out on Tesla by selling his shares and that means he has lost conviction. This is 100% far from truth. Elon sold only because he had to because he was forced to buy Twitter. He had no other choice to fund his acquisition that he desperately wanted to get out of, but forced by the courts. I am sure some of those pledged to invest perhaps bailed out. So his sale of Tesla stocks in NO way implies he has lost conviction and is bailing out. That is NOT who Elon is.

For that argument alone this guy lost my sympathy.

Didn’t you buy $150 LEAP calls a couple months ago? What do you do with those, now that they‘re in the money? Do you just ‘neglect’ those for a period of time or do you roll them? What are your criteria for deciding?Tesla by cutting prices across the world is going for a winner takes all strategy

those who listened to previous earnings calls knew this was bound to happen

reducing vehicle prices and making them more affordable is a deliberate Tesla strategy, not a reaction to decreasing demand

what most do not get is this: Tesla is going to price out everybody including BYD when it comes to quality

within next few years Tesla will be the last man standing

Tesla market cap likely to be in several trillions eventually

my approach to continue being a successful Tesla investor: deliberate benign neglect of my Tesla holdings

not investment advice

I’m genuinely curious as I bought some too. Not soliciting advice of course.

Twitter has massive depth but massive signal to noise ratio. This forum has (arguably) tighter focus but lacks the depth Twitter has.I'm wondering how Twitter can be better than this thread.

This thread is “better” than Twitter so long as the signal to noise ratio is better here. If the signal to noise ratio approaches that on Twitter, the forum loses it’s edge.

Spoiler response:Your dose of good news for the night:

(WaPo article, may be paywalled)

The quote focuses on generation, but EV's are also mentioned in the article. There are apparently enough minerals earth for those too.

Fighting through a bad ice storm here. Second full day without power. Both of us now facing our first bout of covid. Powerwall has been a godsend, but why can't it run my 1.8 kW Microwave? Inrush current? It just turns the turntable- no radar. Natural gas also keeping the fireplace going (apologies to the climate). Panels refused to generate today until 5 pm, despite enough light - some weird glitch there. Said refusal did not help the Powerwall but she is still at 60% so we will make it another day.

Temps warming now so all will be well. Thanks to the Tesla team (fill that in on your bingo card)

If all else fails, you can retreat to your (hopefully) fully charged MY buttoned up in your garage and stay warm in camp mode. Edit: Do NOT try this with ICE.

Just finished my second round of Covid, but with Paxlovid. Barely any symptoms.

Last edited:

2022. They had to deal with supply chain issues, china Covid issues, raw material price changes, starting to ramp two gigafactories simultaneously, and they were still battery cell constrained for most of the year.Which year will be more of a challenge for Tesla, 2022 the year past or 2023?

2023 hopefully won’t have the first two problems, the third will hopefully get better. In theory, the factory ramps should be easier now than they were in 2022. Elon also appears to be a good place mentally about Tesla. I am cautiously optimistic that March 1st will be as interesting strategically as battery day was a couple of years back.

I think this year will ramp nicely. March 1st followed by what looks like is going to be a solid Q1 in late April. The only possible fly in the ointment is a possible recession. That bears watching, but my guess is that we will hit that soft landing the fed has been trying to engineer. But my crystal ball isn’t any better than most.

StealthP3D

Well-Known Member

What Ford is doing is the smart play.

Find out if you are making money on EVs and work on fixing the problem, staff in the Model E division can't ignore the true picture.

The EV part of the business has a free hand to pursue their agenda, and are only accountable for their results.

If the EV division makes progress, that is apparent to all.

If the ICE division is slowly dying and racking up losses, that is apparent to all.

So each division of Ford knows what their biggest problem is, and they know who needs to fix it,

On the surface, it looks more like a strategy to make it easier for the CEO and the rest of management to continue getting performance bonuses and other compensation, even as parts of the business are bleeding money. Divide and conquer those performance bonuses. And, yes, I know the BoD is supposedly independent, but it rarely ever is. When the company is healthy and growing, management knows doing a good job for the company will leave them well rewarded. But a characteristic of failing companies is that management starts to think about how their decisions will affect them personally as the ship goes down.

It would not surprise me at all if this new structure greatly assists with that.

Last edited:

Wasn't a soft landing something very difficult to achieve, like very low odds? This is sounding much more optimistic. Has something changed? Was Elon incorrect that the Fed is overshooting it?I think this year will ramp nicely. March 1st followed by what looks like is going to be a solid Q1 in late April. The only possible fly in the ointment is a possible recession. That bears watching, but my guess is that we will hit that soft landing the fed has been trying to engineer. But my crystal ball isn’t any better than most.

I still expect a recession - partly based on my repeat encounters with younger folks not wanting to work OR go to school anymore, and are still living for free in a rental. They no longer want kids, a home, nor a car. They will live on $1 per day in a self-sustaining solar tent, and cash will stop flowing in general.

Meanwhile, Tesla thrived in the past 2 years through seriously hard times... so what's another recession, ha!

Could it also be in preparation to split the company completely and let ICE go under? Didn't Johnson and Johnson just try to separate out baby powder legal issues in a similar way (but then wasn't allowed as I understood it)? I'm sure it's complicated having dealerships, unions, and pensions.On the surface, it looks more like a strategy to make it easier for the CEO and the rest of management to continue getting performance bonuses, even as parts of the business are bleeding money. Divide and conquer those performance bonuses. And, yes, I know the BoD is supposedly independent, but it rarely ever is. When the company is healthy and growing, they know doing a good job for the company will leave them well rewarded. But a characteristic of failing companies is that management starts to think about how their decisions will affect them personally as the ship goes down.

It would not surprise me at all if this new structure greatly assists with that.

dhanson865

Well-Known Member

Competition for Tesla Solar and Tesla vehicles (indirectly on the last part).

IQ8 microinverters are the core of the charger and it is compatible with CCS or Chademo.

If Tesla doesn't respond with a bidirectional option it will be a draw away from the Tesla ecosystem.

New video and White Paper listed on the site.

IQ8 microinverters are the core of the charger and it is compatible with CCS or Chademo.

If Tesla doesn't respond with a bidirectional option it will be a draw away from the Tesla ecosystem.

New video and White Paper listed on the site.

StealthP3D

Well-Known Member

Which year will be more of a challenge for Tesla, 2022 the year past or 2023?

I don't know, that depends upon the batteries. Unfortunately, we don't have very good visibility on that except for the positive forward-looking statements and general confidence management has been pretty consistent with.

Therefore, without more reliable info to the contrary, I'm going to trust that they know what they are talking about. I figure, worst case scenario, it just takes longer to get there but I sense a genuine near-term confidence that the remaining issues are not of the kind that won't be solved relatively quickly. In fact, looking at the really big picture in a world where 4680's never panned out (forgetting for a moment that this makes zero sense), Tesla wouldn't completely crash and burn in the long-term, even if they had to continue buying cells as they have done historically, we just wouldn't get the hypergrowth we were expecting.

Investing is all about risk/reward and I like the ratio I'm seeing, especially at current valuations. The short-term is always a crapshoot, which is why I don't play the short-term.

StealthP3D

Well-Known Member

FYI, I've decided to mainly use Twitter for the foreseeable future vs using this thread and @adiggs "be the house" thread, largely due to trolls and other difficult posters. I've had to ignore so many that it hurts.

I'll come here from time to time, but it is just not the place that makes me feel more informed and well rounded moreso than my Twitter feed.

Thank you for so much discord over the years and I wish all well!

I can't blame you one bit!

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K