Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Options prices don’t get updated after hours so for many of my positions, it’s the net AH jump that is most interesting.We ended 990 after-hours yesterday. So it is not that big of a jump premarket as it seems.

We ended 990 after-hours yesterday. So it is not that big of a jump premarket as it seems.

Everything is green in pre-market, I think today is going to be a very nice rally. Not just for TSLA but for pretty much everything else too.

Tslynk67

Well-Known Member

Well at least if Elon swoops-in and dumps 934,091 shares in open markets, and we drop 6% from here, then we're back at $940, could be worse!Everything is green in pre-market, I think today is going to be a very nice rally. Not just for TSLA but for pretty much everything else too.

I'd prefer him to be done sooner than later. I have family visiting over xmas and prefer not to be stuck to my screen thenWell at least if Elon swoops-in and dumps 934,091 shares in open markets, and we drop 6% from here, then we're back at $940, could be worse!

OT

@EV forever

perhaps, but if name is Skaffen-Amtiskaw, definately yes

Skaffen-Amtiskaw

Skaffen-Amtiskaw (Full Name: Fohristiwhirl Skaffen-Amtiskaw Handrahen Dran Easpyou) was a Culture offensive drone. During its career in Special Circumstances it was attached to Diziet Sma. It also appears in Use of Weapons.theculture.fandom.com

I haven't the faintest clue what you are trying to say here.

Yeah, really strong jump last night AH.Options prices don’t get updated after hours so for many of my positions, it’s the net AH jump that is most interesting.

What I find interesting aboutTesla fanshumans is one day they'll say Edmunds is a POS media company that no one cares about when an article like this comes out

Then next minute. O hey look Edmunds gave a model 3 an award!! Everyone look!

It probably isn't the same people making the posts but it really feels like some confirmation bias lol.

I still don't like them, but I'll take the good press. Maybe they wanted to gobble up some angry clicks from Tesla haters.

Tslynk67

Well-Known Member

A rather dangerous drone...I haven't the faintest clue what you are trying to say here.

Have you not read Banks? You need to read Banks to fully understand Elon's ambitions

@MaartenI haven't the faintest clue what you are trying to say here.

OT

(abject apologies for being obtuse, as i made the poor assumption of shared reading experiences, as a reader of that genre for 60+ years, that series struck me as quite relevant, and I forget many others have not the same background)

Elon names his drone ships after ships in Iain M Banks "Culture" series of novels

The "sentient" drones were various types

Skaffen-Amtiskaw was a drone in Special Circumstances and has a level of lethality that is very high, and barely restrained

I would suggest reading "Use of Weapons" and other books in that series, "Excession", "Look to Windward", "Consider Phlebas" to get a hint of Elon's thought processes since he was affected enough to name his ships after ships in the series

I personally liked "Sleeper Service" and suspect Elon may be using a variant of its processes. It won the battle by deploying a "cloud of warships" that didn't just overwhelm the enemy, it caused instant surrender, versus utter annihilation

(for a hint, do a spreadsheet of his 2018 options values)

Skaffen-Amtiskaw

Skaffen-Amtiskaw (Full Name: Fohristiwhirl Skaffen-Amtiskaw Handrahen Dran Easpyou) was a Culture offensive drone. During its career in Special Circumstances it was attached to Diziet Sma. It also appears in Use of Weapons.

Last edited:

Tslynk67

Well-Known Member

Sorry for the off-topic, but $TSLA holding up well while the QQ has been pulling-back a bit, now >4x the index ETF

RobStark

Well-Known Member

And as pointed out earlier, Ford’s single EV F150 transaction involves giving up a corresponding high margin ICE sale to further hamper their margins...for Ford:

Profit = (EV Vehicle profit) - (ICE Vehicle profit lost due to EV sale)

So, if Ford only loses $5,000 on each Lightning they sell, well, if that Lightning sale also loses them $15,000 ICE profit, each Lightning really costs them $20,000!

Furthermore, the (EV Vehicle profit) is strained because it must be shared with their dealers.... It's (EV dealer wholesale price) - (Cost to produce)

So Tesla's advantage here is:

While Tesla's gross margins are industry leading and trending upwards, legacy auto must trend downwards long before it can recover and recovery is NOT guaranteed.

- No ICE sale lost for each EV sold

- No sharing of manufacturing profit with dealers

- Economies of scale beyond all other EV manufacturers

- Continued profitability enhancements through mfg

56% of Ford Lightning Reservation holders are new to brand. Only about a quarter own a F-Series truck. For 79% Lighting will be first BEV. For those that already own a BEV about half own a Tesla. Ford is not losing money on Ford Lightning.

Ford Shares F-150 Lightning Customer Survey Results

Ford highlights interesting results of the survey among F-150 Lightning retail reservation holders (there are now more than 160,000 of them).

They are not building more Lightning trucks faster because they don't have the batteries. Ford set up a joint venture with battery cell maker SKI to build 3 GF in the USA to make 129 GWh/year of batteries. The first is expected to come online in 2025.

By the end of 2023 Ford projects it will make Mach-E at a run rate of 200k/year. The whisper number at the beginning of the year was 50k Mach-e this year. The actual number will be ~65k. It is using battery cells from LG's Polish factory.

Ford has put the EV Explorer and Aviator on hold. Because, you guessed it, they don't have the batteries. What was going to go to Explorer EV and Aviator EV production will instead go to Mach-e.

At this point Ford BEV production is battery cell constrained. Not lack of will. This is the result of poor planning. The new regime at Ford headed by Jim Farley has only been in place for 13 months.

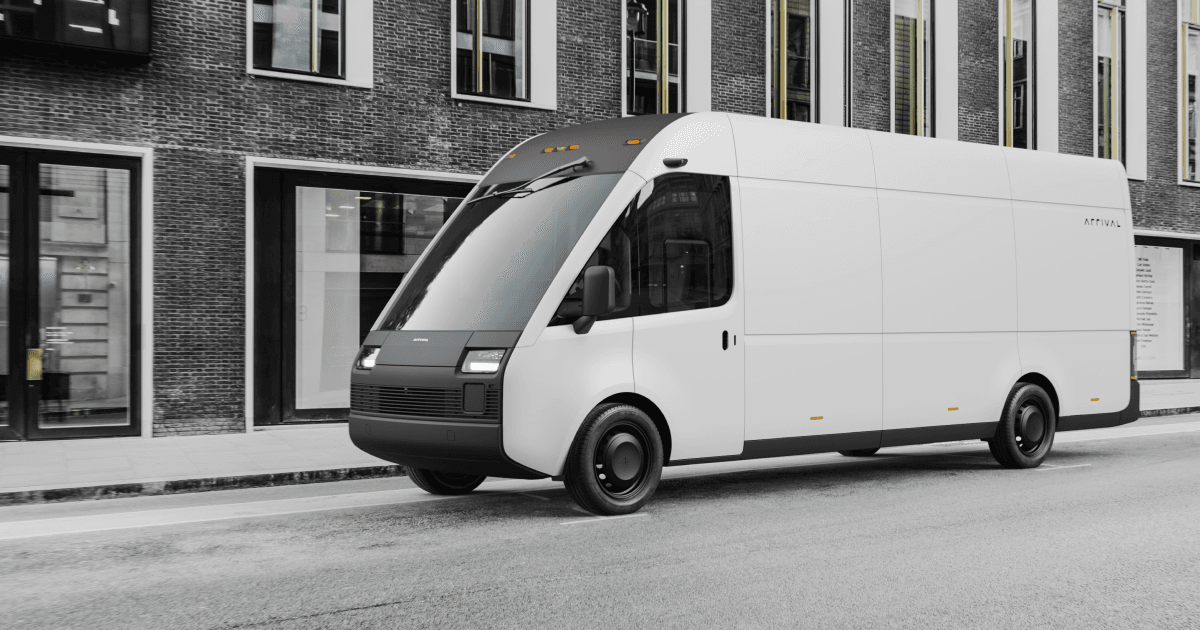

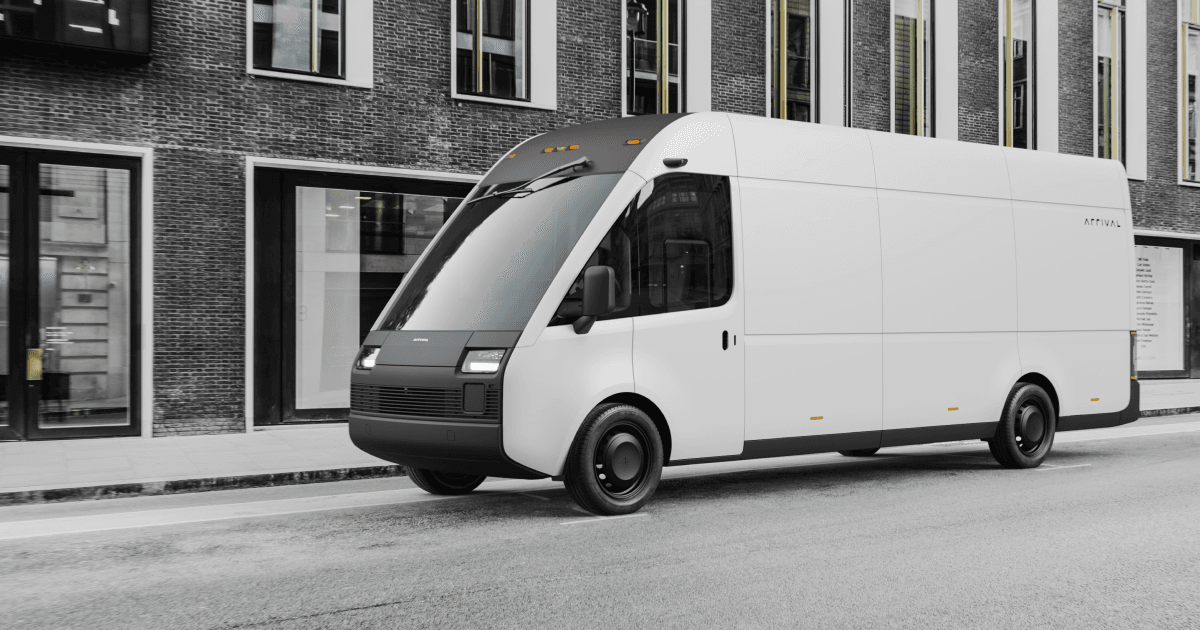

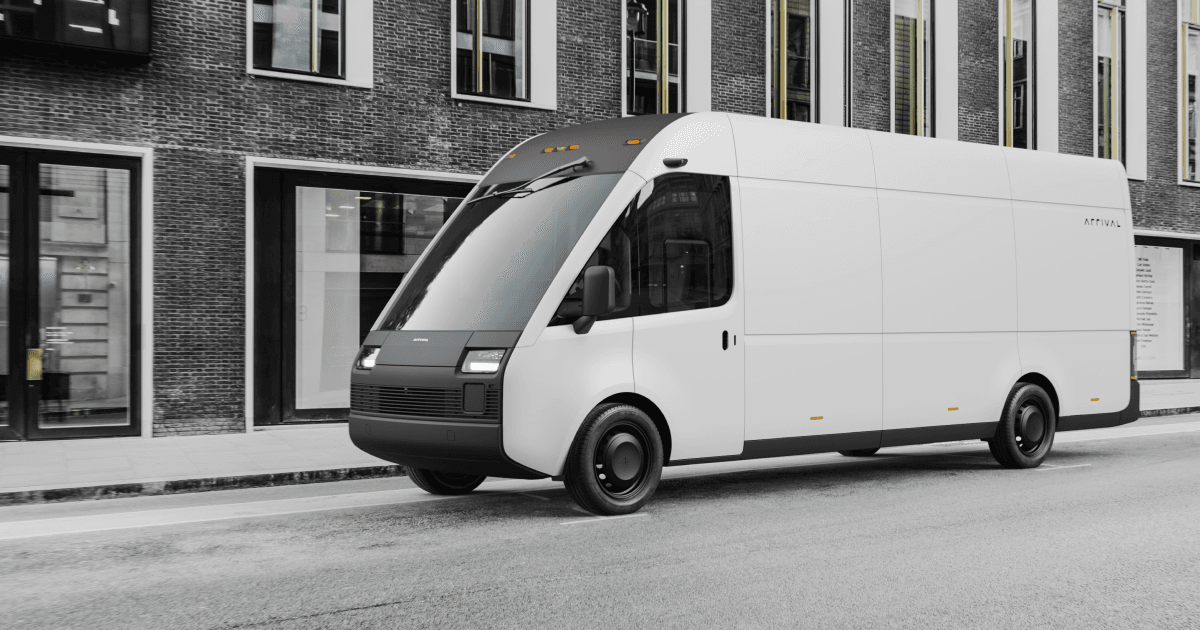

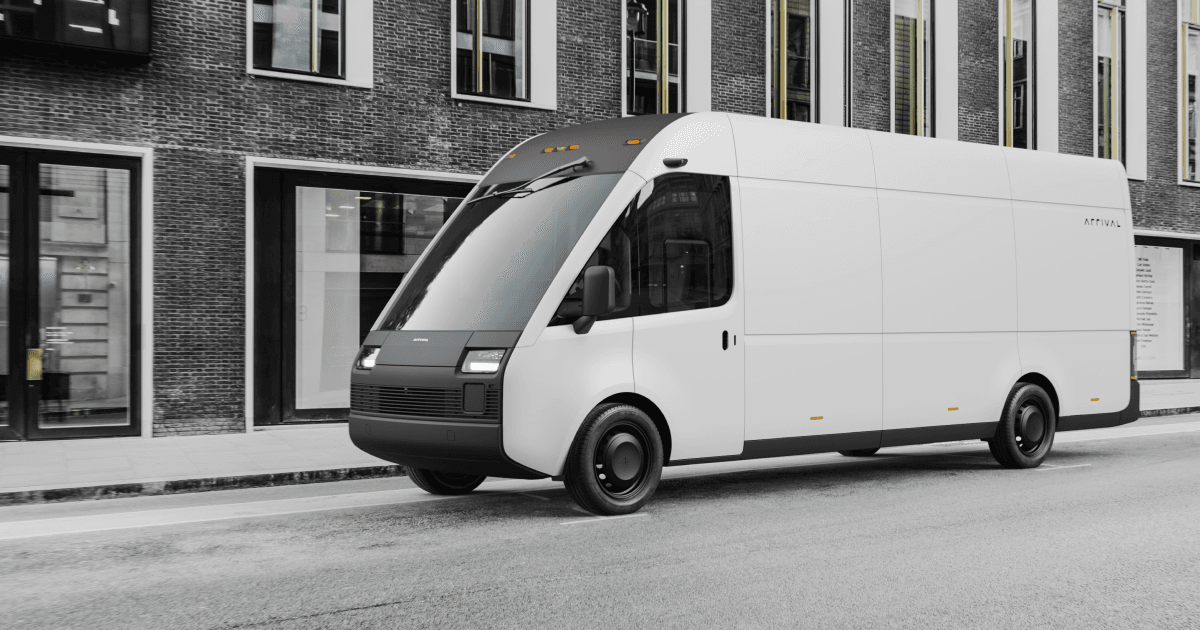

Arrival release details of their JV with Uber

arrival.com

arrival.com

Arrival | Zero-emission solutions

We're delivering zero-emission solutions for your city. Urban utility vehicle. Beautiful, functional, affordable and sustainable.

Is that 129 GWh/ year total or each factory?They are not building more Lightning trucks faster because they don't have the batteries. Ford set up a joint venture with battery cell maker SKI to build 3 GF in the USA to make 129 GWh/year of batteries. The first is expected to come online in 2025.

I wouldn’t give Jim Farley too much credit, just a few years ago he was poking fun at Tesla for being a science project. This was before he was CEO, but it seems pretty clear he wasn’t ahead of the industry.At this point Ford BEV production is battery cell constrained. Not lack of will. This is the result of poor planning. The new regime at Ford headed by Jim Farley has only been in place for 13 months.

He does at least seem to be focused on moving the company in the right direction now though.

Essential for Mars too, so I imagine Mr. Musk has given exactly this sort of thing more than a passing thought.Philly is about on par with the solar potential of where these tornadoes hit in KY, and I did 13kWh yesterday. My panels are completely covered in construction dust, oriented east/west, and the system is only 6.6kw with a 5kw inverter.

I'm confident my 20 panels oriented ideally and without dust all over them would produce nearly double in a field in Kentucky tomorrow.

Regardless again, it's doable because solar scales to effectively infinity. As do megapacks. Construction could be done in parallel, so the emergency capacity is only limited by the open space available. In this case the town impacted is w miles across and surrounded by farmland on all side for miles.

I'm a little surprised to see TMC posters not think solar + storage can't scale sadly and be deployed quickly. It's not terribly complicated and could be manufactured specifically to be plug n play.

RobStark

Well-Known Member

Is that 129 GWh/ year total or each factory?

I wouldn’t give Jim Farley too much credit, just a few years ago he was poking fun at Tesla for being a science project. This was before he was CEO, but it seems pretty clear he wasn’t ahead of the industry.

He does at least seem to be focused on moving the company in the right direction now though.

129 GWh total for USA. 2nd factory projected to come online in 2026.

I think they are piggybacking onto VW in Europe for batteries but not clear.

In China they are just buying on the open market. Like everyone else ,including Tesla so far, are doing.

Praising Tesla/Elon Musk 24/7 isn't a requirement to be an effective CEO of a competing automaker.

I think we should judge CEOs on the decisions they make given the hand they are dealt. So far so good for Jim.

Well at least if Elon swoops-in and dumps 934,091 shares in open markets, and we drop 6% from here, then we're back at $940, could be worse!

If he dumps it , Santa gonna pick it up

Per the sales pattern, he is likely done for the week. (anything possible though)

Arrival release details of their JV with Uber

Arrival | Zero-emission solutions

We're delivering zero-emission solutions for your city. Urban utility vehicle. Beautiful, functional, affordable and sustainable.arrival.com

lol, that's a short Renault Espace IV. Or I. With a battery.

UkNorthampton

TSLA - 12+ startups in 1

Shows some of the advantages of EV design - more legroom in rear than Rolls-Royce, footprint of a VW Golf. More EV awareness>>more EV / Tesla demandArrival release details of their JV with Uber

Arrival | Zero-emission solutions

We're delivering zero-emission solutions for your city. Urban utility vehicle. Beautiful, functional, affordable and sustainable.arrival.com

Just need more cells, more Teslas & also some Boring Company tunnels. All in progress, great future for everyone, especially Tesla stockholders

BioSehnsucht

Model 3 LR

I'm reminded of this scene from fight club, only instead of recalls it's whether to even produce the vehicle and at what price to do it.And as pointed out earlier, Ford’s single EV F150 transaction involves giving up a corresponding high margin ICE sale to further hamper their margins...for Ford:

Profit = (EV Vehicle profit) - (ICE Vehicle profit lost due to EV sale)

So, if Ford only loses $5,000 on each Lightning they sell, well, if that Lightning sale also loses them $15,000 ICE profit, each Lightning really costs them $20,000!

Furthermore, the (EV Vehicle profit) is strained because it must be shared with their dealers.... It's (EV dealer wholesale price) - (Cost to produce)

So Tesla's advantage here is:

While Tesla's gross margins are industry leading and trending upwards, legacy auto must trend downwards long before it can recover and recovery is NOT guaranteed.

- No ICE sale lost for each EV sold

- No sharing of manufacturing profit with dealers

- Economies of scale beyond all other EV manufacturers

- Continued profitability enhancements through mfg

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K