Monday I was happy because the Hertz deal meant more people in EV seats (and Tesla seats specifically  ) and that is great to get relatively skeptical people used to EVs; plus it should counter the argument a bit that the 4.2 B deal doesn’t warrant a rise the market cap of more than 4.2 B. But now the deal with Uber is great in itself regarding the number of butts in seats. Hertz rents out a car a number of times per month, but the number of people traveling with an Uber per month is most likely larger. Also, it may soften up skeptical people or with a dislike for Elon/Tesla who wouldn’t elect to rent a Tesla as they are probably not going to reject their Uber ride when it shows up as a Tesla.

) and that is great to get relatively skeptical people used to EVs; plus it should counter the argument a bit that the 4.2 B deal doesn’t warrant a rise the market cap of more than 4.2 B. But now the deal with Uber is great in itself regarding the number of butts in seats. Hertz rents out a car a number of times per month, but the number of people traveling with an Uber per month is most likely larger. Also, it may soften up skeptical people or with a dislike for Elon/Tesla who wouldn’t elect to rent a Tesla as they are probably not going to reject their Uber ride when it shows up as a Tesla.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Iain

Member

It might help a driver decide on what they are going to buy. I’m not sure if a Tesla would be in the Uber black category but if it is they could test that market before committing.This Uber/Hertz deal only makes economic sense for somebody who doesn’t own a car and wants to make a few bucks for a short period of time. Say, a summer job.

For anyone thinking about Ubering for a longer stint, they’d be far better off leasing a Tesla. This rental cost is more than double leasing costs.

But with gas and maintenance savings, this deal will still be attractive to lots of people, which is yet another demonstration of the amazing economics of EVs.

See ya, ICE!

Don TLR

Active Member

Here’s a teaser while you wait for it to be built here maybe? We took ours down the Austin and Boca Chica and now planning another visit when Elon launches Starship again. All thanks to investing in TeslaWelp, I finally pulled the trigger and ordered my red Long Range Model Y. Black interior, tow hitch, 19" wheels.

It's time for me to not only be a shareholder but a customer too. I'm a multi-Teslanaire now due to TSLA, at some point I need to ease up on my frugal nature and enjoy a bit of my new found wealth, and what better way to do that than to own the very product I'm invested in and excited about. In the past two days I've earned three Model Y's worth of valuation, upon reflection it just seems stupid and silly of me to not buy a Model Y due to a couple of price hikes I can easily afford to absorb.

Expected delivery is in May 2022, time for the long wait!!!! I wonder what the share price will be next May when I take delivery of my first Tesla!!!!

Attachments

This is what I thought when I read the story. Then as the older Hertz Model 3s roll out to Uber, Hertz buys Model Ys to replace them.This might be a second use for Hertz. Rent to customers while the vehicles are new, then farm them out to the uber pool once the interior starts getting a little worn.

Buy new Teslas to replace the rental fleet.

MartinAustin

Active Member

On CNBC... Mark Fields did his best to say other manufacturers still have a chance, but wasn't very convincing IMO.

Then Mary Barra came on and Phil LeBeau asked her a lot of quite tough questions. Her answers weren't very strong IMO.

Then Mary Barra came on and Phil LeBeau asked her a lot of quite tough questions. Her answers weren't very strong IMO.

jeewee3000

Active Member

Germany's (and EU's) environmental laws aim to protect the environment in a general sense but also - and this is the emphasis - to prevent harm to the surrounding land and/or population.What's this PERMIT nonsense just to start production anyway? It's Tesla's factory, let them do what they want. It doesn't belong to the local 'gummint. At the very least, they need to compensate Tesla for the wasted production time.

In Belgium there is the current 3M - scandal. The company 3M has greatly polluted an area of at least 15 kilometers in diameter around its facilities in the city of Zwijndrecht. The pollution (mainly by a chemical called PFOS) has been kept under wraps, even after the local government knew about it since 2017. Only this summer (June 2021) the pollution was discovered merely by accident (huge roadworks in the region have uncovered this). Since June tests have pointed out that the population around the 3M site has huge traces of PFOS in their blood, way more than medically allowed/healthy. The effects are still up for debate, but in the long term cancer is the most likely outcome.

Now everyone is pointing the finger at everyone else, but the basic fact of the matter is that it was widely known since the seventies that PFOS was a hazardous pollutant. 3M disregarded public health purely to maximize profit/minimize costs. This is the same mindset you show forth in your comment "It's Tesla's factory, let them do what they want."

The building is indeed owned by Tesla, but that doesn't give one free reign to do as one pleases. Your "rights" (in this case the right of Tesla to produce and make a profit) are to be balanced against the rights of others (to live in a world with as little pollution as possible). The liberty of one person/company ends where the liberty of the other begins.

So the permits are not nonsense. Surely the needle can sometimes lean too much towards bureaucracy but I prefer that scenario over lawlessness, where hasty decisions lead to abuse by bad actors and a society picking up the pieces years later. (Case in point: the Volkswagen emission scandal)

Krugerrand

Meow

I’ve had TSLA on a 9 year hold rule.8 week hold rule applies /IBD/Leaderboard

View attachment 726225

SunCatcher

Member

Waky waky... just about time to go to "work"!

Approaching a million shares traded before the market even opens. Buckle up for another wild day's ride at TSLAland!

Approaching a million shares traded before the market even opens. Buckle up for another wild day's ride at TSLAland!

Last edited:

StealthP3D

Well-Known Member

How many times did she tell you tou should have sold at $900 9 months ago when TSLA got back in the $600? Did she realize tou were right HODLing?

My wife is a big believer in buying as much of possible of good companies and holding until the company's growth is showing signs of slowing down (or there is an even better opportunity elsewhere) because she has seen how well it works with her own eyes. It's pretty rare to become fabulously wealthy by trading (and for everyone who does it, there are two people who lose it all). She knows the way you win at this game is to keep those itchy trigger fingers far, far from the sell button and to focus on how many shares are owned, not how much they are worth at any given moment. In other words, our investment philosophies are aligned about as perfectly as they could be. So I think you are mixing her up with someone else's significant other.

Last edited:

Tslynk67

Well-Known Member

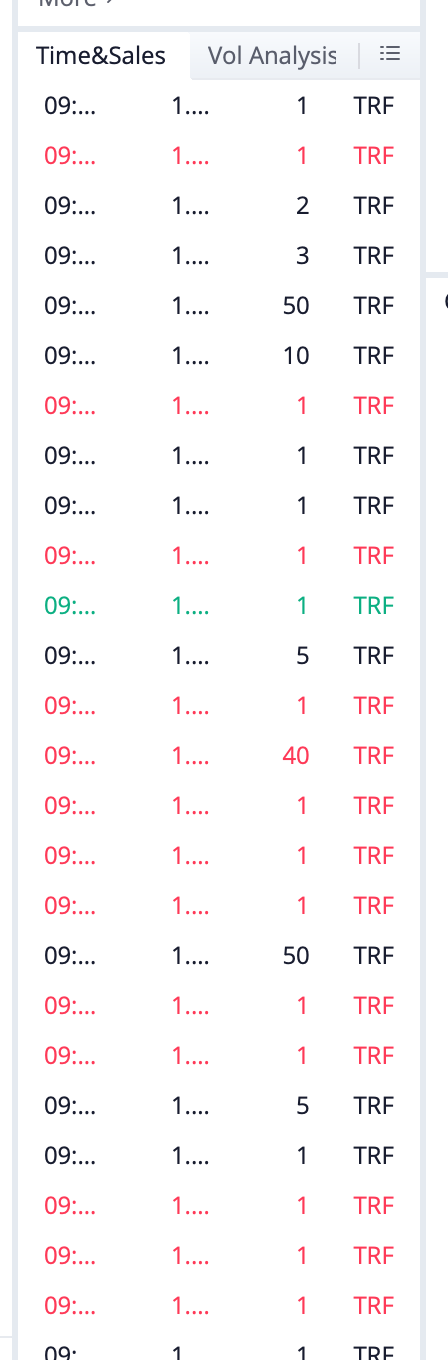

Hey @Artful Dodger - I'm just watching the PM orders passing by and see loads of single-share trades from "TRF", which indicated non-exchange

So that implies to me Hedgies manipulating, right?

It was the sam in AH yesterday, singe share after single share on "TRF"

So that implies to me Hedgies manipulating, right?

It was the sam in AH yesterday, singe share after single share on "TRF"

ZeApelido

Active Member

Highly engaging twitter thread on Tesla by one of the smartest people/analysts in tech

Oh Thin Skin Ben? I apparently was blocked for this comment a month ago.

Dude has been saying Tesla does nothing special for 4 years.

I’ve had TSLA on a 9 year hold rule.

makes sense ... Kats have nine lives

TheTalkingMule

Distributed Energy Enthusiast

Funny how the S-curve works, even here we weren't quite ready to flip the switch to being mainstream. Now within 12 months you can probably select an EV-only Uber option nationwide in the US and a Tesla will show up. Maybe a year later and it's a robotaxi. We are there folks.

In my former life I negotiated procurement contracts between S&P100 corporate buyers and travel suppliers. I can tell you for certain that Hertz making this deal caught the attention of procurement heads and CFOs who make the annual commitment to one rental group at set corporate rates. A LOT of these people will now insist on Hertz because of their EV fleet. Hertz now gets the price benefit of exclusivity, likely on the order of 20% more profit than the competition who are racing to the bottom on midsized ICE. Smart move.

Initially I just thought Hertz was doing this as a re-IPO gimmick and I tipped my hat to them. Hearing about Uber this morning only reinforced that. Now that I've sat and pondered it, they've made a pretty bold move that should pay off nicely out in the real world.

My favorite EV application idea has always been a hub-less car rental scheme for Oahu, Hawaii. Build out smart charging infrastructure so vacationers simply request an available car wherever they happen to be standing and are guided to the closest one. Meanwhile, the car sits there soaking up cheap excess solar/wind supply and could even be feeding back to the grid for balance or at night when they're not in demand. This might be the next type of thing Hertz could explore. I know for a fact that Avis was looking into this type of product with Waymo a few years ago, and I assume has since dropped it.

In my former life I negotiated procurement contracts between S&P100 corporate buyers and travel suppliers. I can tell you for certain that Hertz making this deal caught the attention of procurement heads and CFOs who make the annual commitment to one rental group at set corporate rates. A LOT of these people will now insist on Hertz because of their EV fleet. Hertz now gets the price benefit of exclusivity, likely on the order of 20% more profit than the competition who are racing to the bottom on midsized ICE. Smart move.

Initially I just thought Hertz was doing this as a re-IPO gimmick and I tipped my hat to them. Hearing about Uber this morning only reinforced that. Now that I've sat and pondered it, they've made a pretty bold move that should pay off nicely out in the real world.

My favorite EV application idea has always been a hub-less car rental scheme for Oahu, Hawaii. Build out smart charging infrastructure so vacationers simply request an available car wherever they happen to be standing and are guided to the closest one. Meanwhile, the car sits there soaking up cheap excess solar/wind supply and could even be feeding back to the grid for balance or at night when they're not in demand. This might be the next type of thing Hertz could explore. I know for a fact that Avis was looking into this type of product with Waymo a few years ago, and I assume has since dropped it.

TheTalkingMule

Distributed Energy Enthusiast

Curious to see if we have a tree shaking again this morning after a nice little run up pre-market/early market or if we can continue the climb.

Goldman hiking their target to $1125 on top of Morgan Stanley at $1200 really puts a floor on this thing. I expect more covering/capitulation and a big time struggle to keep us under $1050 going into the close Friday.

Do you have a camera in my house??Waky waky... just about time to go to "work"!

Approaching a million shares traded before the market even opens. Buckle up for another wild day's ride at TSLAland!

View attachment 726275

View attachment 726277

View attachment 726278

View attachment 726280

I wouldn't use MS and GS Pt numbers as any kind of floor. Their sp was in the 900s but that didn't stop Tesla going down to the 500s earlier this year.Goldman hiking their target to $1125 on top of Morgan Stanley at $1200 really puts a floor on this thing. I expect more covering/capitulation and a big time struggle to keep us under $1050 going into the close Friday.

10 year dropping as everyone is blowing out earnings is a good thing however.

Paracelsus

Active Member

This would make sense given how the current bill has moved the goal posts considerably from the original Green New Deal which would have funded the transition towards renewables with 2 Trillion dollars and created public ownership of that infrastructure to an incredibly watered down and underfunded version that creates a path for the Old Paradigm to upgrade their operations while the public pays for them to make the modernization upgrades towards more efficient renewables that they should have done on their own years ago.In a recent video, @DaveT suggested there was a corporate piece to the proposed EV tax credit. I only see that for chargers with a quick search, but I haven’t read the proposed bill in detail, and all the news on it seemed to be consumer-focused. So I’m not sure.

This is much more than just a bailout for non-visionary ICE mfg’s. It is also a bailout plus a major subsidy for existing grid operators IMO. It really sucks that visionary leadership like Vermont’s Green Mountain Energy that have already developed programs to incentivize the installation of residential energy storage with Powerwalls on their own now have to watch the Warren Buffett-sized grid owners get handed federal money to do the same. No surprise that Warren is moving towards renewables now since we are all going to pay to help him do so………..because that’s exactly how DC treats all of the investors and operators with the largest carbon footprints in the world IMO.

The original Green New Deal was awesome, and we should revisit its content and vision often in hopes of pushing the needle in that direction instead of accepting compromise as a final solution. Thank goodness the economics of Renewables is moving faster than DC can move so that some of the pioneers of this new paradigm will be rewarded more than they will eventually be penalized.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M