Phhht. @Papafox is busy negotiating a good price for Kaua’i.Papafox is going to be a great read tonight.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Fantastic!!! That was so good it made me cry...Love this, can watch it over and over.

Also fitting today is Beethoven´s Ode To Joy. This version starts very slowly but picks up furiously in the end, just like TSLA over past few years:

killianss

Member

Congrats to all long!

I used to have 100% TSLA but greed got me away from it. I missed out $50k for the last two days..

Luckily still have a bit left so not all is lost.

is it still a buy at this price?

I used to have 100% TSLA but greed got me away from it. I missed out $50k for the last two days..

Luckily still have a bit left so not all is lost.

is it still a buy at this price?

How long until $10,017?

Did your friend ever pick up a new Model Y after rejecting the first one?

(I think it was you who mentioned that the first one had several issues.)

Artful Dodger

"Neko no me"

After-hrs still going hard. Now $1,397.00 at 16:39 ET

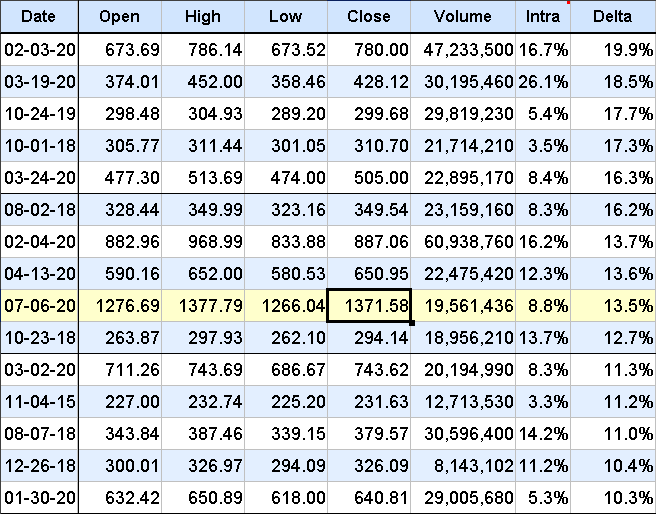

Here's how July 6th, 2020 ranked for Daily Gains, w. Intra-day gains also shown:

Of course, biggest all-time gainer today when ranked in USD rather than percent gain.

Cheers!

Here's how July 6th, 2020 ranked for Daily Gains, w. Intra-day gains also shown:

Of course, biggest all-time gainer today when ranked in USD rather than percent gain.

Cheers!

j0hn

Member

Hello fellow TMC'rs

I registered on this board in may 2017 after having been silently reading in the shadows for a year before that.

Because of all the knowledge shared here , and some fortunate SP action the last few weeks i just cashed out enough money to order myself and the wife a red with white interior M3.

With a options play i managed to make 6K into 32K , that with selling 30 shares today is enough to pay off the car in full.

I could have bought it a long time ago , but i was always confident that selling to early could mean it was going to be a very expensive car. I know it still can be , but that is why i still hold another 100 shares I think enjoying the spoils of war ( a.k.a. the shorts money) is important and very much look forward to ordering the 3 tomorrow morning.

I think enjoying the spoils of war ( a.k.a. the shorts money) is important and very much look forward to ordering the 3 tomorrow morning.

This board kept me informed about the health of Tesla , made me confident enough to hang in there in the difficult years and inject some extra cash during the corona dip.

My sincere thanks to everybody that contributes here,

John

p.s. i am so F*&king happy & Bought the lady some short shorts also

I registered on this board in may 2017 after having been silently reading in the shadows for a year before that.

Because of all the knowledge shared here , and some fortunate SP action the last few weeks i just cashed out enough money to order myself and the wife a red with white interior M3.

With a options play i managed to make 6K into 32K , that with selling 30 shares today is enough to pay off the car in full.

I could have bought it a long time ago , but i was always confident that selling to early could mean it was going to be a very expensive car. I know it still can be , but that is why i still hold another 100 shares

This board kept me informed about the health of Tesla , made me confident enough to hang in there in the difficult years and inject some extra cash during the corona dip.

My sincere thanks to everybody that contributes here,

John

p.s. i am so F*&king happy & Bought the lady some short shorts also

UnknownSoldier

Unknown Member

This would actually be really useful. I honestly have no idea how paying Estimated Taxes works and the deadline for the first tranche is July 15th. I'm trying to hold as long as I can before I sell and transfer money to the IRS...Yeah, I think we need a thread on tax strategy. I’ve got silly TSLA gains in my non-retirement account now. Seems likely that a 2021 regime change will bring an increased Cap Gains tax rate.

Causalien

Prime 8 ball Oracle

To the many posters thinking about quitting. It is safe to quit whwn you are able to convert the winning into steady low risk investments that spills out income. When these income reaches 2x your current salary. It then makes perfect sense to quit.

For me thus transition took 3 years as you need to factor in the tax hit and think deep about the portfolio's composition.

For me thus transition took 3 years as you need to factor in the tax hit and think deep about the portfolio's composition.

I'm getting a 23kW grid tied solar installed, 26% tax credit will help with some short term cap gains.Yeah, I think we need a thread on tax strategy. I’ve got silly TSLA gains in my non-retirement account now. Seems likely that a 2021 regime change will bring an increased Cap Gains tax rate.

Sudre

Active Member

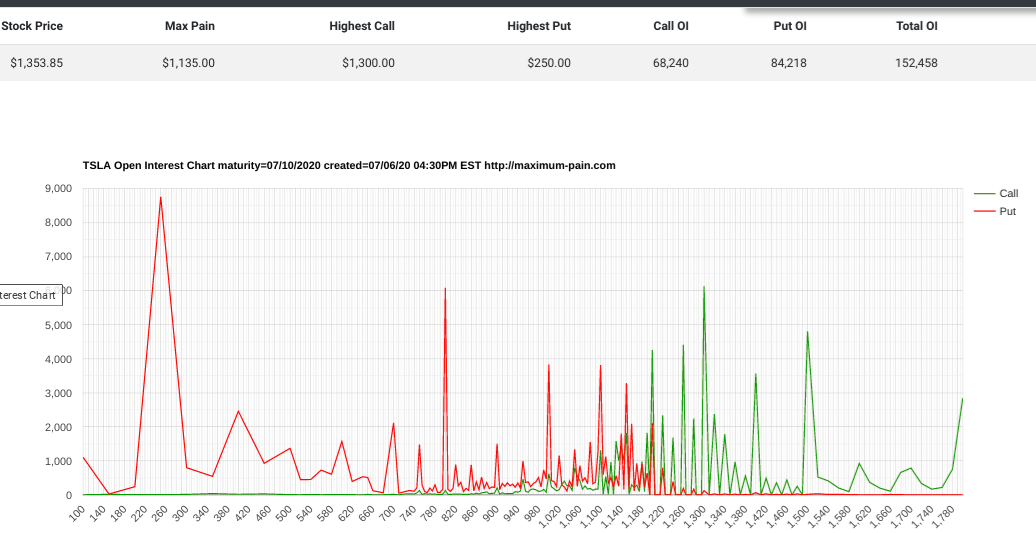

Today opened with Max Pain at 1135 but currently MMs are still feeling that pain. With the over 10% rise there will surely be margin calls tomorrow for shorts. The question is how liquid is the stock right now. I have NO INTENTIONS on selling what I have and even if I did, I am waiting until after ER. Who would risk it?

Open interest this morning:

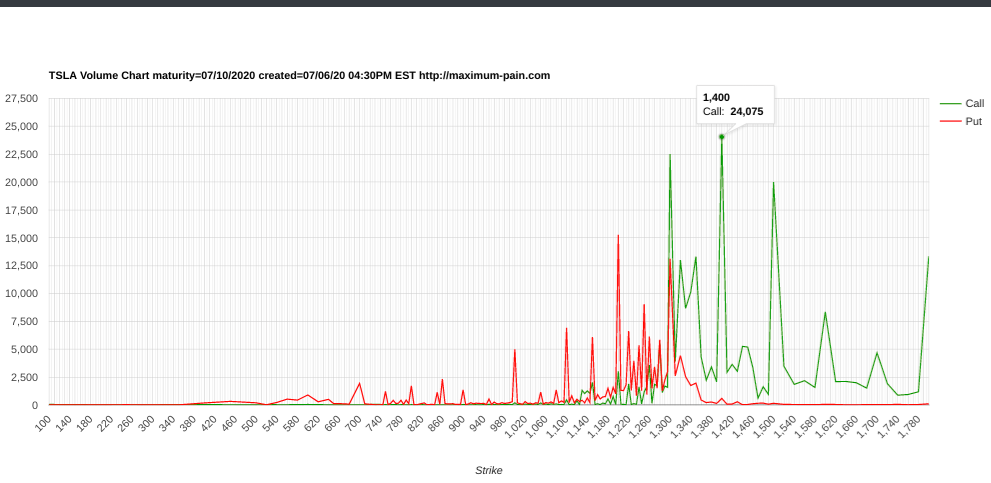

This is like a feeding frenzy but it's shorts and MMs doing the buying. Each time the MMs moved up to another tier of a higher Call strike it is blown by. It also doesn't look like anyone is real interested in taking that PUT bet either. This is going to cause a forced rise IMO because shorts need shares and option sellers need shares as people gobble up the higher and higher strike prices. I can picture this potential moving up drastically then calming back down. I have no clue where a peak will be or what "calm" will be since there is serious pressure from two directions.

Volume for today:

Sadly the pessimist in me is expecting some serious manipulation soon.

Open interest this morning:

This is like a feeding frenzy but it's shorts and MMs doing the buying. Each time the MMs moved up to another tier of a higher Call strike it is blown by. It also doesn't look like anyone is real interested in taking that PUT bet either. This is going to cause a forced rise IMO because shorts need shares and option sellers need shares as people gobble up the higher and higher strike prices. I can picture this potential moving up drastically then calming back down. I have no clue where a peak will be or what "calm" will be since there is serious pressure from two directions.

Volume for today:

Sadly the pessimist in me is expecting some serious manipulation soon.

This would actually be really useful. I honestly have no idea how paying Estimated Taxes works and the deadline for the first tranche is July 15th. I'm trying to hold as long as I can before I sell and transfer money to the IRS...

To the many posters thinking about quitting. It is safe to quit whwn you are able to convert the winning into steady low risk investments that spills out income. When these income reaches 2x your current salary. It then makes perfect sense to quit.

For me thus transition took 3 years as you need to factor in the tax hit and think deep about the portfolio's composition.

Might not be bad to create a general wealth/tax management thread.

dc_h

Active Member

Today opened with Max Pain at 1135 but currently MMs are still feeling that pain. With the over 10% rise there will surely be margin calls tomorrow for shorts. The question is how liquid is the stock right now. I have NO INTENTIONS on selling what I have and even if I did, I am waiting until after ER. Who would risk it?

Open interest this morning:

View attachment 561231

This is like a feeding frenzy but it's shorts and MMs doing the buying. Each time the MMs moved up to another tier of a higher Call strike it is blown by. It also doesn't look like anyone is real interested in taking that PUT bet either. This is going to cause a forced rise IMO because shorts need shares and option sellers need shares as people gobble up the higher and higher strike prices. I can picture this potential moving up drastically then calming back down. I have no clue where a peak will be or what "calm" will be since there is serious pressure from two directions.

Volume for today:

View attachment 561232

Sadly the pessimist in me is expecting some serious manipulation soon.

S&P fund managers may scream for some kind of manipulation because they are running into a freight train of bag holding thanks to low float and high amount of shorted shares whenever this inclusion gets announced.

adiggs

Well-Known Member

My only regret is that 80% of my shares are tied up in a retirement account and I'm too young (34) to take advantage of them early. Not a bad place to be in.

Good news. Look into SEPP:

Substantially Equal Periodic Payment (SEPP)

That stands for Substantially Equal Periodic Payments, and is a mechanism for getting money out of your IRA each year before 59 1/2. You'll still owe income tax, but not penalties.

Personally I wouldn't set something up myself without having a financial advisor involved. Fortunately, at least with Fidelity, if you have enough money with them, then they assign somebody to directly help with stuff like this.

I'm in a similar position as you (though I wish I was still 34), and am thinking I need to get something like this started this year (because I want to stop working for a paycheck this year), and we can't make it to 60 without something like this.

Krugerrand

Meow

Wrong about what? I wasn't aware he made any statements.

People like that spamming the board is annoying.

I'm sorry I periodically call you out for jumping all over people and overposting. It's nearly as annoying and IMO is what drove off half the good posters here.

Congrats to the longs! My Jeep got stolen Friday.....made enough today to buy 2.

FYI, you don’t need to police the thread.

And — only two?! Dude, where’s your conviction? I was up a whole fleet of Jeeps before pre-market was even over.

Next time people suggest there’s a demand problem, buy shares. Is advice.

TheTalkingMule

Distributed Energy Enthusiast

Margin bloodbath in the after hours too. Are we gonna crack $1400?

I think all this macro exuberance means we need to start spending more time in the Shorting Oil thread. This whole thing has gotta crumble at some point soon.

I think all this macro exuberance means we need to start spending more time in the Shorting Oil thread. This whole thing has gotta crumble at some point soon.

I feel as if Tesla stock is one of the only things I have going for myself.

Working in the entertainment field I’m HELLA unemployed, on unemployment. $ is good when we work but stale now.

Ive owned for a while. I remember when I hit 10K in $ growth in the stock. Thought I’d hit the Big Time. Now I’m faced with decisions about what to do. I could trade it all in and buy a M3 which is what I hear a lot of y’all have done who have been in since the beginning. I could also look into buying a house, which is smarter, but the stock would have to go 4x to avoid a mortgage(which is my dream.

turned 32 on the 2nd of this month. Seemingly lost without Elon. Need a big win and freedom from the banks.

Any advice, stories, input, good or bad, I wanna hear it.

thanks all!

I think many people here (even with all that wealth), would trade places just to be 32 again. As has been stated before, time is a precious resource. Use it wisely. (Good health and youth is priceless IMO.)

Id buy a house (once you have good income) and do a 30 year mortgage with these low rates. If you do want a Tesla, buy used.

When I bought my Model S, I cashed out TSLA shares to do so. Now I could have bought a Model S in every color offered, with those gains. Ugh. Oh well. As others have said, buying the car actually made me want to invest more over time. So I do have more shares now than when I bought the car.

Last edited:

lafrisbee

Active Member

Beat me.

Anyone?

Come on...give me your scenario.

Who in here has had better dumb luck than me buying this as their first purchase of TSLA when you consider percentage increase over time.... I'd gladly swap places with any of you that were able to HODL from the initial offering but I still might beat you on percentage increase over time... I could not have done it. I didn't. I did not see Tesla as ever possibly being the champion of EV's. I saw he was making advancements with his AAA battery powered fancy cars, but till the cybertruck I thought he was going to get squashed So I never even considered investing in TSLA. And so many of you did. And then how in the hell were you able to HODL! Some of the FUD I read in the short time I have held the stock made me feel I had done something wrong, really wrong. If you all weren't here (and I wasn't here to read you and gather a better perspective) I would have sold several times in the past 6 months.

And you guys. You are nuts. And strong, and smart. and lucky.

I am lucky too!

Symbol

TSLA $1,371.58

Price When Added 644.4574

Date Added 01/30/2020

Change Since Added +112.83%

So in less than half a year from my initial stock purchase I more than doubled my money.

So who did better than me?

I tell ya who.... quite a few guys in the Tesla Truck Forum. Their bragging made me investigate Tesla. They were posting how their investment in TSLA stock was going to pay for their Cybertrck. (And now we know it wasn't bragging because it is fact.)And one of them led me here...and you all sounded like you knew what you were doing so I played along.

Thanks to Elon for engineering a vehicle that got me interested in TSLA. And thanks to all the retail investors on the The Cybertruck Forum and so many of you here.

Anyone?

Come on...give me your scenario.

Who in here has had better dumb luck than me buying this as their first purchase of TSLA when you consider percentage increase over time.... I'd gladly swap places with any of you that were able to HODL from the initial offering but I still might beat you on percentage increase over time... I could not have done it. I didn't. I did not see Tesla as ever possibly being the champion of EV's. I saw he was making advancements with his AAA battery powered fancy cars, but till the cybertruck I thought he was going to get squashed So I never even considered investing in TSLA. And so many of you did. And then how in the hell were you able to HODL! Some of the FUD I read in the short time I have held the stock made me feel I had done something wrong, really wrong. If you all weren't here (and I wasn't here to read you and gather a better perspective) I would have sold several times in the past 6 months.

And you guys. You are nuts. And strong, and smart. and lucky.

I am lucky too!

Symbol

TSLA $1,371.58

Price When Added 644.4574

Date Added 01/30/2020

Change Since Added +112.83%

So in less than half a year from my initial stock purchase I more than doubled my money.

So who did better than me?

I tell ya who.... quite a few guys in the Tesla Truck Forum. Their bragging made me investigate Tesla. They were posting how their investment in TSLA stock was going to pay for their Cybertrck. (And now we know it wasn't bragging because it is fact.)And one of them led me here...and you all sounded like you knew what you were doing so I played along.

Thanks to Elon for engineering a vehicle that got me interested in TSLA. And thanks to all the retail investors on the The Cybertruck Forum and so many of you here.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M