Excluding the new construction going on, it's great to see Phase 1 humming along so well. Nearly all the loading bays are full, vehicles aren't backing up in the loading area. Looks like they're running a tight ship and this money printer is just getting better and better."(July 9) Tesla Gigafactory 3 new architectural lighting system has been installed" | Jason Yang | 2 hours ago

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Artful Dodger

"Neko no me"

OT:

July 11 Falcon 9 • Starlink 9/BlackSky Global

Launch time: 1454 GMT (10:54 a.m. EDT)

Launch site: LC-39A, Kennedy Space Center, Florida

A SpaceX Falcon 9 rocket is expected to launch the tenth batch of approximately 60 satellites for SpaceX’s Starlink broadband network, a mission designated Starlink 9. Two Earth observation microsatellites for BlackSky Global, a Seattle-based company, will launch as rideshare payloads on this mission

Launch time: 1454 GMT (10:54 a.m. EDT)

Launch site: LC-39A, Kennedy Space Center, Florida

A SpaceX Falcon 9 rocket is expected to launch the tenth batch of approximately 60 satellites for SpaceX’s Starlink broadband network, a mission designated Starlink 9. Two Earth observation microsatellites for BlackSky Global, a Seattle-based company, will launch as rideshare payloads on this mission

Last edited:

I’m a big fan (and patron) of Rob and his level headed podcasts, so I’m looking forward to his analysis of the S&P inclusion process. I already found very interesting what he said in the first minutes of yesterday’s episode. According to Rob the 61% rise since just before the P&D report could be a sign of frontrunning: funds and other investors buying shares to be able to sell them to S&P index funds. This could imply that the actual inclusion will not cause another run up.

Stock is only up ~33% since the P&D report. A lot of the 61% rise in the past 2 weeks happened before the P&D and was macro related.

Tslynk67

Well-Known Member

Advice (for once) don't go out drinking on Thursday evenings and get 20 pages behind, because I'm STILL 20 pages behind ($1500 has just fallen!!)

So WTF was all that about? Crazy! I can only guess that the MM's gave up on $1400 - I see quite a few puts had accumulated there end of the week, so probably not longer worth the money to fight it. Then the induced short covering and FOMO likely pushed it through $1500.

Seen some sob-stories of covered calls going ITM, well my story is that I sold 2x 24/7 c1520's a week back for $15 each and bought a couple of core share at $1135 with the premium. Then we got massive moves up to the $1400 range and I started to sweat a bit, but the calls were stubbornly staying high-priced around $70.

Anyway, yesterday I decided to buy them back and transferred $40k into my account, stalled my price and bought them when the stock was in the $1380's for a $10k net loss. With the $26k I had left over in cash, I bought a 16/10 c1380 for $250. Then all hell broke lose and when the dust settled at the end of the day, the call is now trading in the $340's - so I already regained the loss

My advice, make a decision sooner rather than later and act. Better to loose $10k than loose 100 shares at a "low price" of $1500.

Now back to catching-up.

Oh, thanks mods for banning that troll, was a lot of scrolling making my fingers tired.

P.S. I'm very happy my $1400 prediction was totally wrong - Monday's going to be interesting...

So WTF was all that about? Crazy! I can only guess that the MM's gave up on $1400 - I see quite a few puts had accumulated there end of the week, so probably not longer worth the money to fight it. Then the induced short covering and FOMO likely pushed it through $1500.

Seen some sob-stories of covered calls going ITM, well my story is that I sold 2x 24/7 c1520's a week back for $15 each and bought a couple of core share at $1135 with the premium. Then we got massive moves up to the $1400 range and I started to sweat a bit, but the calls were stubbornly staying high-priced around $70.

Anyway, yesterday I decided to buy them back and transferred $40k into my account, stalled my price and bought them when the stock was in the $1380's for a $10k net loss. With the $26k I had left over in cash, I bought a 16/10 c1380 for $250. Then all hell broke lose and when the dust settled at the end of the day, the call is now trading in the $340's - so I already regained the loss

My advice, make a decision sooner rather than later and act. Better to loose $10k than loose 100 shares at a "low price" of $1500.

Now back to catching-up.

Oh, thanks mods for banning that troll, was a lot of scrolling making my fingers tired.

P.S. I'm very happy my $1400 prediction was totally wrong - Monday's going to be interesting...

Artful Dodger

"Neko no me"

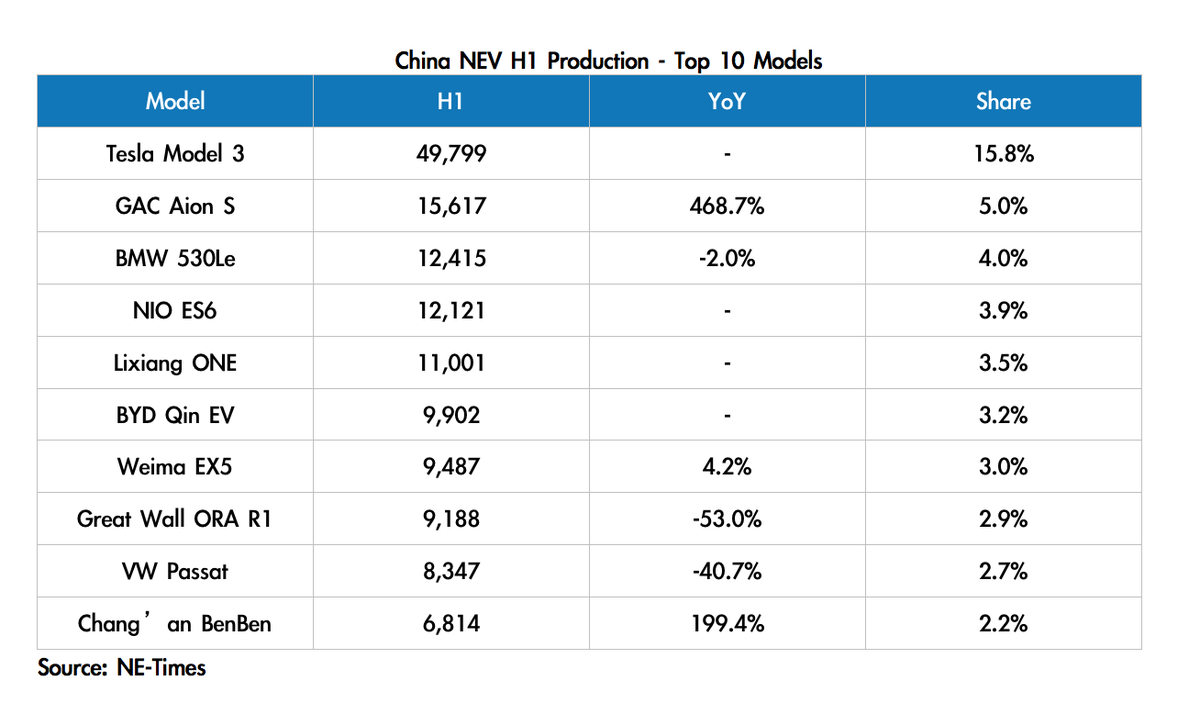

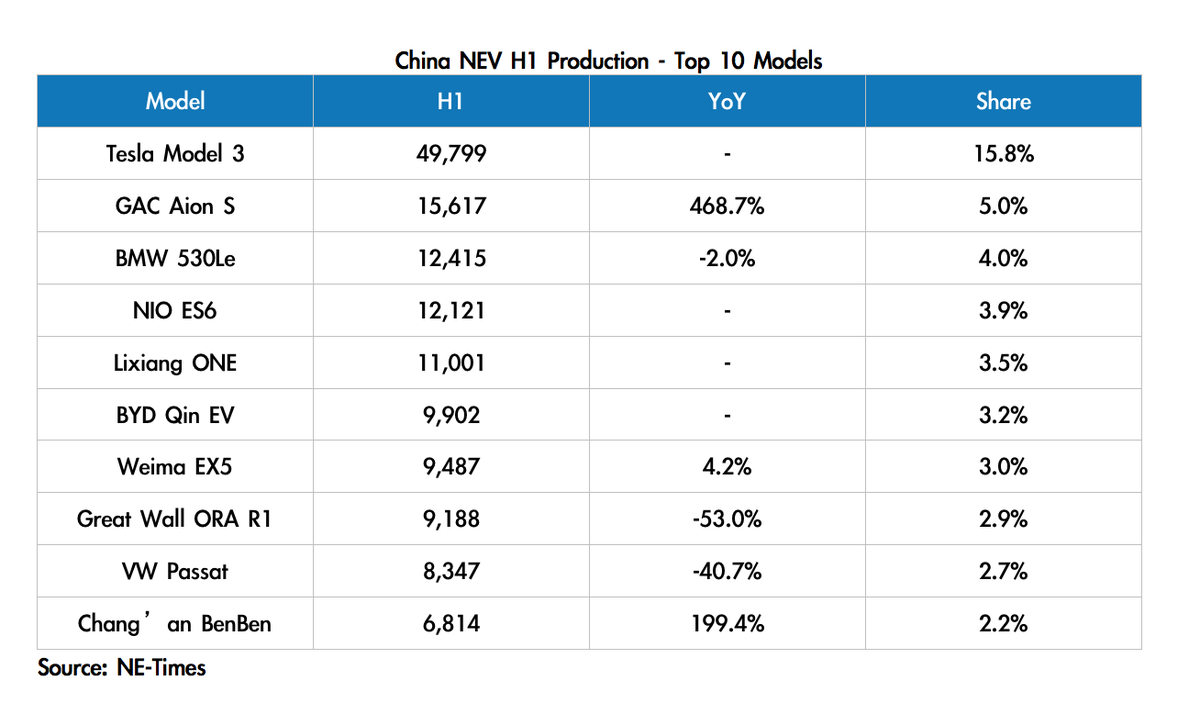

Tesla MiC 2020H1 Production Estimates: 49,799 (src: Moneyball - 8 hrs ago)

Given these results for the first half of 2020, and now with Model 3 production at 4K/wk at GF3/Shanghai, Tesla should be able to produce a total of ~150K Models 3 in China this year.

Cheers!

Given these results for the first half of 2020, and now with Model 3 production at 4K/wk at GF3/Shanghai, Tesla should be able to produce a total of ~150K Models 3 in China this year.

Cheers!

TrendTrader007

Active Member

IBKR interactive brokers has a tiered margin rate with a blended rate as low as 0.78% if you borrow in millionsWhere are you getting 2.5%/year?

At Fidelity, I'm seeing 4-8%, with 4% requiring a $1M balance.

I might need to have a conversation with them if there's an alternative broker with better rates.

TBH I do not expect much in the way of an SP change when S&P500 inclusion happens. This is likely the MOST widely discussed, debated and anticipated inclusion in history, so yoiu would have to be seriously living under a rock not to know its coming. People have bought the shares in anticipation.

I've made this mistake myself, but I think you're overestimating how well informed the general investing public is. Even institutional investors that are super bullish on TSLA own and keep up with a ton of other individual stocks. A lot of the TMC crowd that's largely or entirely invested in just TSLA is a rare breed. At best, some of the institutions realised during the 4th of July weekend that TSLA is likely to be included after Q2 ER.

Now naturally some institutions *cannot* buy them until they are officially in, but I suspect there are a lot of speculators who have bought recently for the express purpose of flipping them to index-holders after the inclusion.

I've seen Fact Checking on Twitter float around numbers as high as 70-80M for total number of shares that will be bought as part of the S&P 500 inclusion, including some short covering, delta hedging, etc. The actual amount will likely be less than that, but volume this week was only 93M shares. This may seem like a lot, but the vast majority of this is not shares going from one long to another. The vast majority is made up of algorithms, market makers delta hedging, day trading, and the likes.

When Goldman Sachs initiated positive coverage of TSLA in early April, 110M shares were traded in a single week. In mid-January, there were a number of weeks with 100M+ shares traded. During the infamous first week of February, 214M shares were traded in a single week. Somebody other than me might be able to chip in better on what percentage of trades are real trades from one long to another, but I'd be surprised if it was much more than 10M this week, probably less.

Although a handful of people probably started to position themselves for S&P 500 inclusion much earlier (perhaps December-February), I highly doubt we're even halfway towards the adjustments that will have to be made.

Lets be honest, there are not many other feasible explanations for such a rise in the SP. Q2 looks surprisingly good, sure, but the company is still (and remember I'm a super-bull here, with 1,100 shares) NOT making THAT many cars. To justify the valuation, they need to have China and Berlin and Freemonet all churning out cars at maximum capacity.

I agree to an extent, but different people value different companies vastly differently.

- Ford is trading at 0.16x revenues and 15x 2021 projected EPS

- General Electric is trading at 0.6x revenues and 16x 2021 projected EPS

- Apple is trading at 6.5x revenues and 30x EPS

- Amazon is trading at 5.5x revenues and 150x EPS

- Tesla is trading at 11x revenues and ~130x 2021 projected EPS (likely based on far too low projections by analysts)

- Netflix is trading at 12x revenues and 110x EPS

- Zoom is trading at 95x revenues and 1,625x EPS

- Nikola is trading on unicorns and coke

Almost everyone got a lot richer yesterday... on paper. But paper doesn’t buy you a house, a car, food or an island. It only can if you sell shares. So almost everyone is still as rich or poor as they were the day before. Which brings me to my question: when are most of us planning to really get rich? Because if you want to be rich there will have to be a day when the HODL’ing ends.

That would be the day my oldest commits to a college, I suppose. Fortunately, it's a few years yet. Go Tesla!

I got quoted 2.5% by my broker. My initial thought: how can they do this, there must be a catch. The catch is: your shares used for collateral are locked up. You cannot trade those shares. My guess is that they will make another pretty penny by loaning out these shares to others. I need to investigate more what the exact terms and conditions are, especially what power the broker has to increase interest at will, or change the requirements for collateral, e.g. how far TSLA can dip until they will require additional shares added to the account.

With Flatex in Europe I pay 3.5%. I think it is more interesting to them than it seems, because banks are required to put money they have in their coffers at the European Central Bank and pay interest over that!

Where are you getting 2.5%/year?

At Fidelity, I'm seeing 4-8%, with 4% requiring a $1M balance.

I might need to have a conversation with them if there's an alternative broker with better rates.

ibkr lowest rates by far

I got quoted 2.5% by my broker. My initial thought: how can they do this, there must be a catch. The catch is: your shares used for collateral are locked up. You cannot trade those shares. My guess is that they will make another pretty penny by loaning out these shares to others. I need to investigate more what the exact terms and conditions are, especially what power the broker has to increase interest at will, or change the requirements for collateral, e.g. how far TSLA can dip until they will require additional shares added to the account.

disagreed to clarify

margin shares are not locked up in the sense that you cannot trade them...what gave you that idea?

but they can, and likely will be, loaned out

Last edited:

Words of HABIT

Active Member

The longer S&P waits to include Tesla, with a rising share price the more disruption will be caused. IMO S+P will likely speed up TSLA inclusion as quickly as possible once all criteria have been met.So if Tesla qualifies for S&P, what is the timeline for when it happens?

I think there will be powerful groups interested to delay it as much as possible ..(say 3-6mths atleast)

Words of HABIT

Active Member

In response to TSLA SP reaching $1,500 USD, thought an Avatar change was necessary.

Next Avatar change at $3,000.

Contratulations to all the believers.

Next Avatar change at $3,000.

Contratulations to all the believers.

@FrankSG

The benefit in kind in the Netherlands is for non-BEV 22% (The amount to be added to your taxable income if you have a car paid for by the company). For BEV cars it was

2019: 4% for the first €50k (I don’t know the percentage above that).

2020: 8% for the first €45k, 22% above that.

future:

2021 12% for the first 40k.

2022-2025 : 16% for the first 40k.

2026 onward: 22%.

The benefit in kind in the Netherlands is for non-BEV 22% (The amount to be added to your taxable income if you have a car paid for by the company). For BEV cars it was

2019: 4% for the first €50k (I don’t know the percentage above that).

2020: 8% for the first €45k, 22% above that.

future:

2021 12% for the first 40k.

2022-2025 : 16% for the first 40k.

2026 onward: 22%.

Johann Koeber

Happy Owner

0.5 is the lowest rate in Euro, but you know the exchange rate may work against you. Or it may not.IBKR interactive brokers has a tiered margin rate with a blended rate as low as 0.78% if you borrow in millions

Anyway, as I am spending in Euro, I will borrow in Euro (but investing is in $).

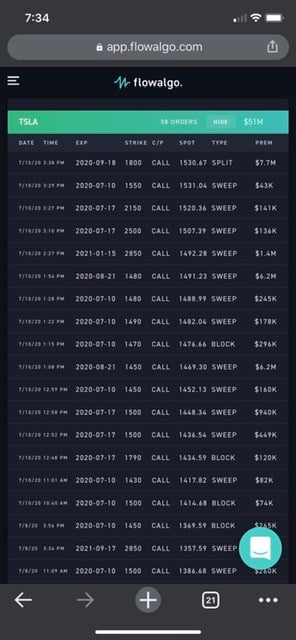

Just saw this posted on my Twitter feed-51M in premiums .

ZeApelido

Active Member

There is one more thing you need to do to take fear out of the equation:

You have already explained how you don't need to money to avoid having to work in the rope factory. Now you just need to let go of your attachment to that number at the top of your brokerage account. It's not money, it's just a figure that you are trying to grow.

Once you've recognized you don't need it, it becomes a fun game. The problem is thinking of stocks as money. Tesla stock is not money, it is fractional ownership in an exciting company that is changing the world. The number is simply the amount of money someone is willing to pay you for that ownership right at present. When you no longer want to own the company, you can sell your share of the company.

Don't get too hung up about how much someone is willing to presently pay you for that ownership unless you happen to need to the money now, just watch what your company is doing and whether they are on track to fulfill their goals.

Zen and the Art of Investment Maintenance, by StealthP3D

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K