A nice new feature that may help boost Tesla sales.

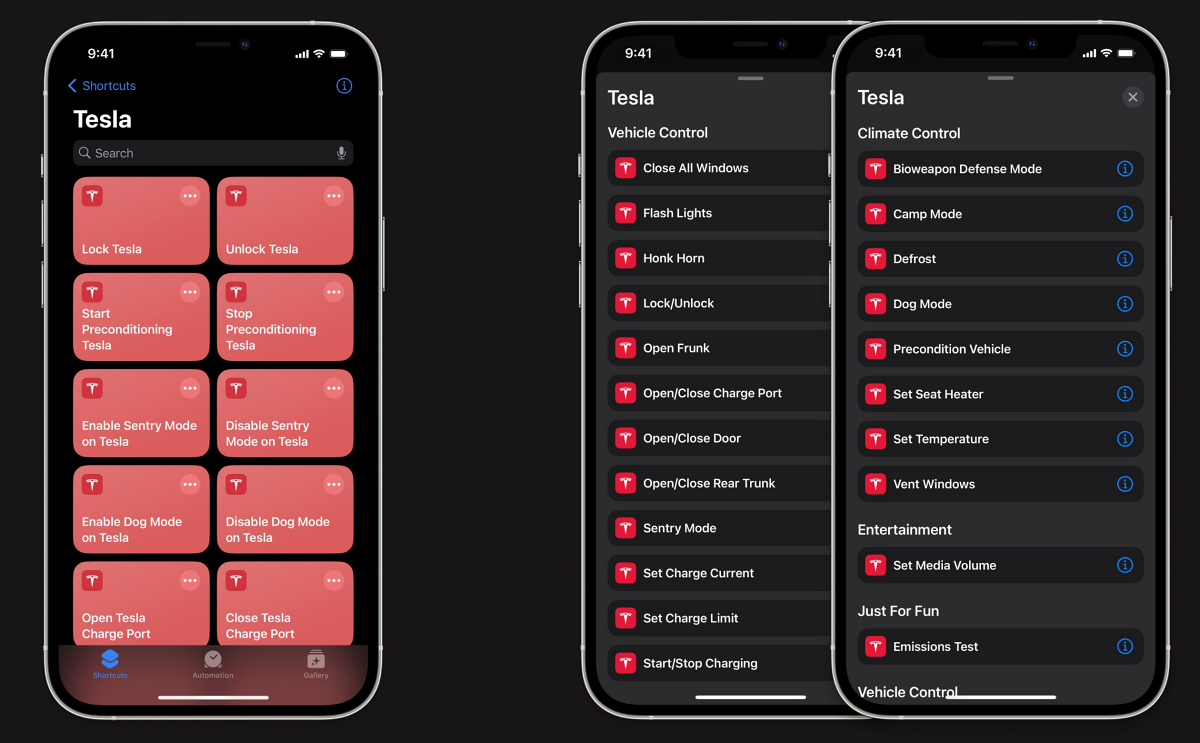

As of yesterday the new version 4.24.0 of the Tesla app supports Apple shortcuts.

With an iPhone or iWatch you can easily address a lot of functions of your Tesla through Siri.

www.iphoneincanada.ca

www.iphoneincanada.ca

As of yesterday the new version 4.24.0 of the Tesla app supports Apple shortcuts.

With an iPhone or iWatch you can easily address a lot of functions of your Tesla through Siri.

Tesla’s iOS App Now Supports Apple’s Siri Shortcuts • iPhone in Canada Blog

In a move to further streamline the user experience, Tesla has unveiled its latest iOS app update, version 4.24.0, which now integrates seamlessly with Apple's Shortcuts app. This integration means that Tesla owners can now control various vehicle functions simply by giving voice commands to...

www.iphoneincanada.ca

www.iphoneincanada.ca

Attachments

Last edited: