Nice job. You broke the site.Where'd everyone go? Is TMC having a group nap from yesterday's festivities?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

TSLA, GM, Ford all equally down 4% today.

So what, do they just decide to attack the auto sector to pull down TSLA (representing most of it), then correct the others tomorrow?

Maybe someone has a bigger view of the macro data. Wouldn't all sectors be affected by inflation and supply issues, so why was "Automotive" in the headline on my TD website? Was that code for "Tesla?"

Auto is a sector that people assume will be seriously damaged in a recession. They just don't realize that Tesla will be the exception (for the most part).

Oh, its alright, this is a good time to sell some new PUTs to the silly bears, I just closed the previous set yesterday on the runup, so its good to reload.Nothing like losing previous day’s entire gains…still painful to watch. HODL.

Plus, it would be so boring if the SP moved in a straight line.. A rollercoaster is more fun!

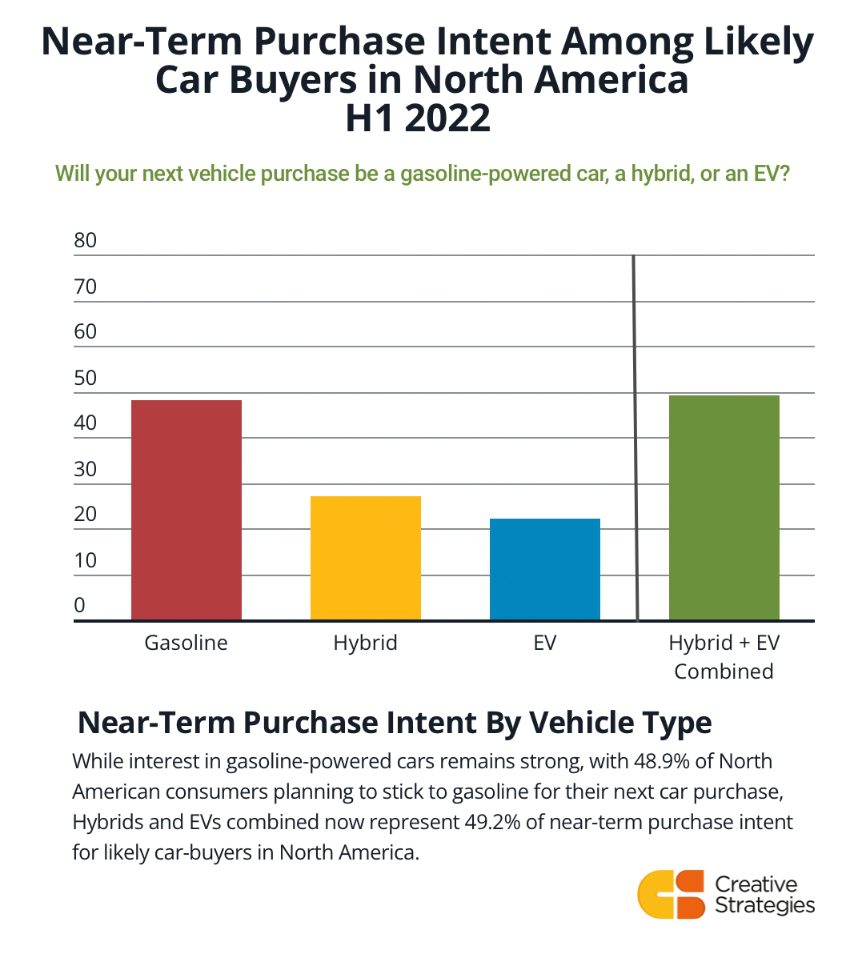

Creative Strategies did a survey and found that roughly half of North Americans intend to buy either a hybrid or EV as their next vehicle. About 23% are eyeballing an EV specifically.

The gap between EV supply and EV demand continues to grow.

creativestrategies.com

creativestrategies.com

Not entirely surprising, but good to see it quantified somewhat. Easy to see why we have 2 EV buyers lined up for every EV produced.

The gap between EV supply and EV demand continues to grow.

New Research: Purchase Intent For Hybrids and EVs Has Reached An Inflection Point in North America

We have just completed new research into consumer perceptions of the changes taking place in the automotive sector. The study, which focuses primarily on likely car buyers in North America, gathered insights from over 1200 adults 18 and up in the United States and Canada. Among the key themes...

Not entirely surprising, but good to see it quantified somewhat. Easy to see why we have 2 EV buyers lined up for every EV produced.

TheTalkingMule

Distributed Energy Enthusiast

Nonstop OT posting drives people away. Clamping down on OT posting drives the OT/Reddit/chatroom posters away. Glorious silence remains!Where'd everyone go? Is TMC having a group nap from yesterday's festivities?

Took the dip opportunity today to sell a Jan2023 $550c I forgot about. Bought a fresh Jan2024 $1600c. Raised a chunk of cash. Bought a couple YOLOs for Friday and 4/22.

Good times!

Thank you. I wish, people stopped with this kind of nonsense posts.Except you haven't lost anything unless you were planning on selling your shares at the ridiculously low price of $1150.

Look in your brokerage account. It should show the exact same number of shares of the exact same company you owned yesterday.

Wondering if you would share your price estimates for EoY, and End of Q2 2023?Except you haven't lost anything unless you were planning on selling your shares at the ridiculously low price of $1150.

dhanson865

Well-Known Member

NO ONE needs to guess why a ridiculous number of posts are being deleted.

I don't see any posts here about the board member status, posted to Elon & Twitter

but I think it's worth mentioning since it's the first time Elon has been named a member of a board of a major company he didn't already have ties to/created.

How will this affect TSLA? That remains to be seen, this may be a play against the SEC or it might be a stand alone move. Either way until we are sure what Elon's plans are with TWTR it needs to at least be on the radar of possible factors for TSLA.

When I first heard of the stock purchase I would have said it does not affect TSLA, when I heard of the board seat that changed my opinion of the significance of this move.

Last edited:

Phobi

Member

Just another nothing burger day it seems before some movement on Thursday probably with the Austin celebration. It’s all about the countdown to earnings. On a side note, I got both of my brothers on team TSLA

Funding generations ahead, gotta love it.

HODL.

Funding generations ahead, gotta love it.

HODL.

UkNorthampton

TSLA - 12+ startups in 1

Big Tesla sales reported (badly) in Australia. "Shocking". Part of this might be that Tesla sales Year To date are all included in March.

Articles by media were awful, even the source (FCAI releases March 2022 new car sales figures) doesn't help. I'm presuming there's a proper write up somewhere but I don't know Aussie media at all other than the dirty digger.

Articles by media were awful, even the source (FCAI releases March 2022 new car sales figures) doesn't help. I'm presuming there's a proper write up somewhere but I don't know Aussie media at all other than the dirty digger.

Artful Dodger

"Neko no me"

Looks like multiple MMD's this morning... profit taking I assume...

It's more likely MMs moving to kill the $1,150 Calls. Those Calls were also the reason for the spike above $1,150 shortly after today's Open: a Whale needed to move their Call Options into the money to execute them. Then, the walk-down by MMs as they sell their share inventory hedged for $1,150.

TL;dr the tail wags the dawg on Wall St.

Cheers!

thesmokingman

Active Member

I literally just woke up from a power nap. What'd I miss?Where'd everyone go? Is TMC having a group nap from yesterday's festivities?

Artful Dodger

"Neko no me"

Nothing like losing previous day’s entire gains…still painful to watch. HODL.

Watch the Options Open Interest instead. There was no way MMs were going to allow all those Calls at the $1,150 Strike Price to remain in the money.

N.B. @Papafox publishes this Open Interest chart daily, albeit about 18 hrs after it is released (7:00 am ET)

No model Y's sold down under yet? All I see is model 3 sales...Big Tesla sales reported (badly) in Australia. "Shocking". Part of this might be that Tesla sales Year To date are all included in March.

Articles by media were awful, even the source (FCAI releases March 2022 new car sales figures) doesn't help. I'm presuming there's a proper write up somewhere but I don't know Aussie media at all other than the dirty digger.

Maybe with Germany cranking up, the Chinese Y's that went to Europe can be shipped to Australia and New Zealand.

can you please explain what the hypothesis behind this is. I would say I know a little bit about options but why do MM's move calls ITM to "kill" them?It's more likely MMs moving to kill the $1,150 Calls. Those Calls were also the reason for the spike above $1,150 shortly after today's Open: a Whale needed to move their Call Options into the money to execute them. Then, the walk-down by MMs as they sell their share inventory hedged for $1,150.

I know that squawksquare on Twitter has the same hypothesis, but I never understood it and wrote it off. I'm not trying to be difficult/provocative, I honestly don't understand the mechanic behind it.

Thanks

Max

Artful Dodger

"Neko no me"

can you please explain what the hypothesis behind this is. I would say I know a little bit about options but why do MM's move calls ITM to "kill" them?

This is simple self-interest (greed) for MMs. They don't have to pay out on the options that aren't in the money. That's why they will buy or sell however many shares they need to move the SP to the point that minimized their net payout (Calls and Puts that they've sold).

So the PROBLEM with the current rules is that the Bookies are also allowed to game the table... Do you know about the Madoff Exemption? (if not, read about it).

#SEC

Wow active traders in the market are making bank.

So all this is because a dovish Fed member assured everyone that interest rates will rise and fast. Also that the balance sheet will be unraveled faster rather than slower.

I guess this could be construed as 'new' information. What I see for certain is that all the financial "authorities" (Bloomberg, CNBC etc) and their guests are all foaming relentlessly that this market MUST be sold.

Glad no one ever talks their books on these channels/s.

Still, one must give them credit. What exactly changed since yesterday? I dunno but they all seem pretty happy with the outcome.

So all this is because a dovish Fed member assured everyone that interest rates will rise and fast. Also that the balance sheet will be unraveled faster rather than slower.

I guess this could be construed as 'new' information. What I see for certain is that all the financial "authorities" (Bloomberg, CNBC etc) and their guests are all foaming relentlessly that this market MUST be sold.

Glad no one ever talks their books on these channels/s.

Still, one must give them credit. What exactly changed since yesterday? I dunno but they all seem pretty happy with the outcome.

Knightshade

Well-Known Member

It's more likely MMs moving to kill the $1,150 Calls. Those Calls were also the reason for the spike above $1,150 shortly after today's Open: a Whale needed to move their Call Options into the money to execute them.

This makes no sense.

First- you can execute options any time you want, ITM or OTM. (though there's almost always a better choice than executing them OTM- see point 2)

Second- if you want to acquire shares, and you hold 1150 calls, and the share price is below 1150, you'd typically be better off just BUYING the shares cheaper, and also selling your calls for whatever they're worth at the time. In fact- even when the price gets ABOVE 1150, on a Tuesday, you're often still better off just buying shares and selling the option because the option still has time value left in it. This will always be true in a non-taxable account for example... there may be certain tax reasons not to do this, if working in a taxable account, but YMMV.

Third, you explain no mechanism by which the whale moved those calls ITM in the first place- the Madoff exemption allows naked shorting- which would do the opposite of that

Fed successfully pulls the punch bowl from the party again. I am beginning to sense when they are going to do this. It's when I hear lots of "to the moon" and "time for a new ATH" type statements. I took some profits yesterday with my trading shares.Wow active traders in the market are making bank.

So all this is because a dovish Fed member assured everyone that interest rates will rise and fast. Also that the balance sheet will be unraveled faster rather than slower.

I guess this could be construed as 'new' information. What I see for certain is that all the financial "authorities" (Bloomberg, CNBC etc) and their guests are all foaming relentlessly that this market MUST be sold.

Glad no one ever talks their books on these channels/s.

Still, one must give them credit. What exactly changed since yesterday? I dunno but they all seem pretty happy with the outcome.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K