FTFY.I’m gonna laugh whenit ends up beingOPENS green today

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Right before bed, I decided to drop it to 1141 from 1151... oh well, maybe later.The tokenized TSLA is trading at $1,111 right now. You will probably get you chairs.

Tesla tokenized stock FTX price today, TSLA to USD live price, marketcap and chart | CoinMarketCap

The live Tesla tokenized stock FTX price today is $0 USD with a 24-hour trading volume of $0 USD. We update our TSLA to USD price in real-time.coinmarketcap.com

Knightshade

Well-Known Member

This is factually wrong and has already been corrected multiple times. This one seems to combine lots different bits of misinformation in to a single claim remarkably.

The options in question right now are his 2012 options, not 2018. The 2018 ones are good for 10 years.

Those 2012 options have NO required holding period.

Even the 2018s 5 year period excludes anything he sells to pay for taxes or exercise of them

Selling LT shares significantly increases total tax paid, because he owes the 53% on ALL exercised shares regardless of selling or not. Selling EXERCISED shares to pay the tax is 0% extra tax at that point. Selling pre-owed shares to pay the bill is an extra 20 percent tax on top of the 53%

Waiting till next year to do any of this likely increases his taxes even further given the surcharges in the build back bill.

The % of exercised shares he needs to sell does not materially change with the stock price (someone already showed the math on this, it was like 0.2% of exercised shares with a $1000 difference in SP- a difference in hundreds of dollars obviously far smaller)

Again all of this has been covered by multiple posters. Please stop repeating misinformation.

(little scary Teslas 3rd largest shareholder gets so much of this wrong too but that's another topic- the great Dave Lee corrects him on a few of these things in the replies on the twitter thread)

5 make that 4...maybe 3....no 2 years from now 1200 will be a dream price for TSLA.

The annualized run rate for just the cars by then will be 2 to 3 times what it is now.

The energy part will finally be ramping up.

So if you're wanting to "buy the dip" this is it. Once in a lifetime company for sure.

The annualized run rate for just the cars by then will be 2 to 3 times what it is now.

The energy part will finally be ramping up.

So if you're wanting to "buy the dip" this is it. Once in a lifetime company for sure.

Skryll

Active Member

I got one order through at 1155 thanks to your suggestionRight before bed, I decided to drop it to 1141 from 1151... oh well, maybe later.

The Accountant

Active Member

Reserve Your Tickets Early for the Q4 Fireworks

Yellow Highlighted Numbers:

First month of Q1 - 21,484

First month of Q2 - 25,845

First month of Q3 - 33,345

First month of Q4 - 54,391

What a start to the quarter !! Although Oct deliveries of 54k are below Sep numbers of 56k, note that in Sep, Tesla drew down inventory as it produced 50k units while shipping the 56k units (see orange boxes below). Inventory in Shanghai is now thin so I estimate that Oct Production was somewhere between 52k-56k units - showing production growth to Sep despite the Oct holiday.

Yellow Highlighted Numbers:

First month of Q1 - 21,484

First month of Q2 - 25,845

First month of Q3 - 33,345

First month of Q4 - 54,391

What a start to the quarter !! Although Oct deliveries of 54k are below Sep numbers of 56k, note that in Sep, Tesla drew down inventory as it produced 50k units while shipping the 56k units (see orange boxes below). Inventory in Shanghai is now thin so I estimate that Oct Production was somewhere between 52k-56k units - showing production growth to Sep despite the Oct holiday.

Nice way to look at it: we are living the dip!5 make that 4...maybe 3....no 2 years from now 1200 will be a dream price for TSLA.

The annualized run rate for just the cars by then will be 2 to 3 times what it is now.

The energy part will finally be ramping up.

So if you're wanting to "buy the dip" this is it. Once in a lifetime company for sure.

Hopefully that's the bottom, I'm no connoisseur, mostly hunches based on input I find here.I got one order through at 1155 thanks to your suggestion

@ArtfulDodger gave me that key info needed with the uptick rule and I just cut it in half for 2 tranches. Then I changed it. Thanks buddy!

Alert Tesla that a Supercharger is needed near there.And I failed to get a charge at the train station on the way to COP26 protests on saturday as the Chargepoint Scotland charger had been bought by BRITISH PETROLEUM and left unsupported. This also happened to me several times over last few months including right n the middle of Oxford a BP branded charger that had been out of service for several months. A good systematic way to delay adoption of EVs ?

I dipped in for some more too. 1151 and a smaller one at 1160 after selling off something else that took a few extra seconds.I got one order through at 1155 thanks to your suggestion

It's the Friendly Giant! My favorite show when I was about 10 in Canada. Lol, I still say it, but nobody in Arizona gets it.

Grabbed a fresh 25 chairs for now at 1166. Not letting this sale go untouched! Need 75 more to round out the numbers again.

This TMC stuff is killing my posture, time for a new ride!

Just ordered this Herman Miller last week, was on sale nationwide, and I LOVE A GOOD SALE!

Just ordered this Herman Miller last week, was on sale nationwide, and I LOVE A GOOD SALE!

2

22522

Guest

Thanks for the link. It said GM uses a wholesale model rather than a retail model and that all GM's numbers look better, sometimes by a lot.Personally, my fear of that is one reason I continue to examine downside risks for every security I buy. Luckily I have not yet repeated my egregious errors of the 1960's. Just paying attention has helped avoid most of the crises and helped me to benefit from some of the 1973 and 2008 events. It is astonishing to me that it is so hard to be rational about things that evoke such positive images personally.

By far the hardest one for me has been TSLA, for six reasons: 1. high volatility; 2. key person dependency; 3. technology evolution; 4. raw materials sourcing risks; 5. Regulatory impediments; 6. Logistics/supplier issues.

Most of my analysis time is devoted to those six issues.

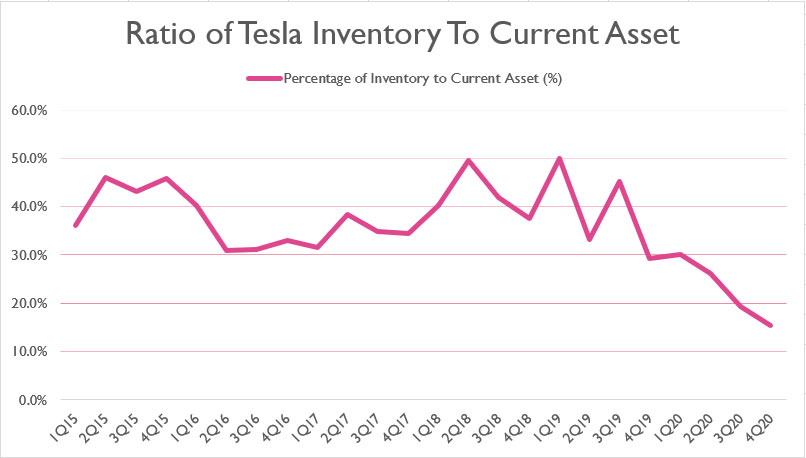

One key item that is NOT an issue is financial instability. The reasons for that exclusion are ones regularly pointed out by several people here. Simply, TSLA generates free cash flow in increasing levels every year. The chief reason is that Tesla has the shortest supplier delivery to cash received cycle I have ever heard of for an industrial company. The business model effectively eliminates finished goods inventory in typical industrial practice. No dealers and no speculative products builds allows finished goods to cash cycle to be typically less than two weeks, so global Days-on-hand keeps diminishing. This chart shows just how important that is to financial health, while giving the major clue to how Tesla manages to grow at ~50% pa and still have positive Free Cash Flow.

How Efficient Has Tesla Been Managing Its Inventory? | Fundamental Data And Statistics For Stocks

Discover Tesla's inventory levels and management thru the inventory turnover ratio, days of inventory, inventory to current assets and to sales/revenue ratio.stockdividendscreener.com

Although not one of my six items my singular principle metric of merit is Free Cash Flow, and the fastest way to observe that is a trifle indirect, inventory % of current assets. So, why use an indirect measure when direct lines are available? Simple, the inventory % of current assets is essentially predictive fo continuing cash flow generation cycle. Long before one can see financial reports showing weaker cash flow the reporting of inventory and current assets tends to be available. The direct measures all must employ sources and uses of funds with careful assessment of financing activities.

2022 is, in my opinion, the year that will test Tesla more than any other. The scale increases will be beyond anything we have seen before, with massive growth in every element form Shanghai, Grüneheide, Austin, Sparks and Fremont to all the myriad suppliers for each and the factories from Buffalo and Markham teeter also.

Thus among the six categories 2022 will test logistics in ways that have never been faced by Tesla. That, and the world logistics challenges, combine to make item six fundamental to risk assessment next year.

Thus our fondest hopes are facing unprecedented challenges now. Careful risk evaluation is essential to be a prudent bull.

Which brings up several very important points:

- If you think of the path between Ore and Customer as a pipe. Breaking the pipe in the middle helps you hide inventory and doctor your numbers. BUT, true demand cannot be created in the middle this pipe!

- The distributor (dealer) introduces a negotiation point in the transactive flow of product. Quality, delivery and price all become points of contention.

- The distributor owns the product for a very short time. Total cost of ownership threats are rust during shipping. The primary customer does not care how long the car lasts. They care about first cost. They also do not live with the product. That means they don't care if the product is any good as long as it clears their lots.

Shorter summary: Over time, the use of distributors causes companies to deliver undesirable products that you have to "pay people to take."

Last edited by a moderator:

Pretty sure GJ is considering being a long to spite the liberals.If EM haters want to ensure he pays more taxes, they need to buy them frikkin shares and make sure there is no dip.

C'om $TSLAQ, here is your golden opportunity

TheTalkingMule

Distributed Energy Enthusiast

Did it ruin your weekend to find out you and GJ are so closely aligned? I kid!Pretty sure GJ is considering being a long to spite the liberals.

Artful Dodger

"Neko no me"

Pre-Market Volume 2,442,862If EM haters want to ensure he pays more taxes, they need to buy them frikkin shares and make sure there is no dip.

C'om $TSLAQ, here is your golden opportunity

Bitcoin is up. I saw a mention that Elon would be selling TSLA and buying BTC.

So the rumor is valid, let's see if it comes true so I can sell a few.

We should make (recommend) a new rule - If anyone here buys a new Tesla, they get to show it here On Topic, complete with pics, options, region, how long waited, story, and amount paid for some realtime data points.

So the rumor is valid, let's see if it comes true so I can sell a few.

Wow, congrats!Sorry for the OT - I know some others have received theirs earlier - but I just got my PLAID!!!!

Picked up Friday afternoon - ordered October 1st..

I haven't even had a chance to see what it can do because of crummy weather!

Cheers to the longs!

We should make (recommend) a new rule - If anyone here buys a new Tesla, they get to show it here On Topic, complete with pics, options, region, how long waited, story, and amount paid for some realtime data points.

StealthP3D

Well-Known Member

I used to look to TL.0 as a "view into the future", but then stopped when I saw how New York would grab the reins and drive the stock in whichever direction it pleased when it was N.Y.'s turn. The average volume for Berlin is 77,666. The average volume in U.S. is about 21.5 million. That's a 300 X greater volume of what we wield here in the U.S.

Course I could be wrong. Just want to ease the minds of those nervously waiting.

Even the pre-market in the U.S. has a tiny fraction of the volume of regular hours. This means anyone with a few dollars to throw around and a desire for more shares at lower prices, can spend a little money to help reinforce an existing narrative (like the world is ending because Elon wants to sell) in order to acquire shares on the cheap. The market is often more about psychology than detailed financial modelling of value. Big volume of the regular session is the market's great equalizer so it's best to not pay much attention to after-hours markets.

My sense is that there is a lot of organic demand for TSLA shares out there and buyers are just looking for entry prices that won't leave them feeling burnt. As soon as people figure out there really aren't that many sellers with significant numbers of shares to supply, this little dip will be over almost before it began. Time will tell but those hoping for three digits again are going to end up empty-handed unless the overall market takes a dump.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K