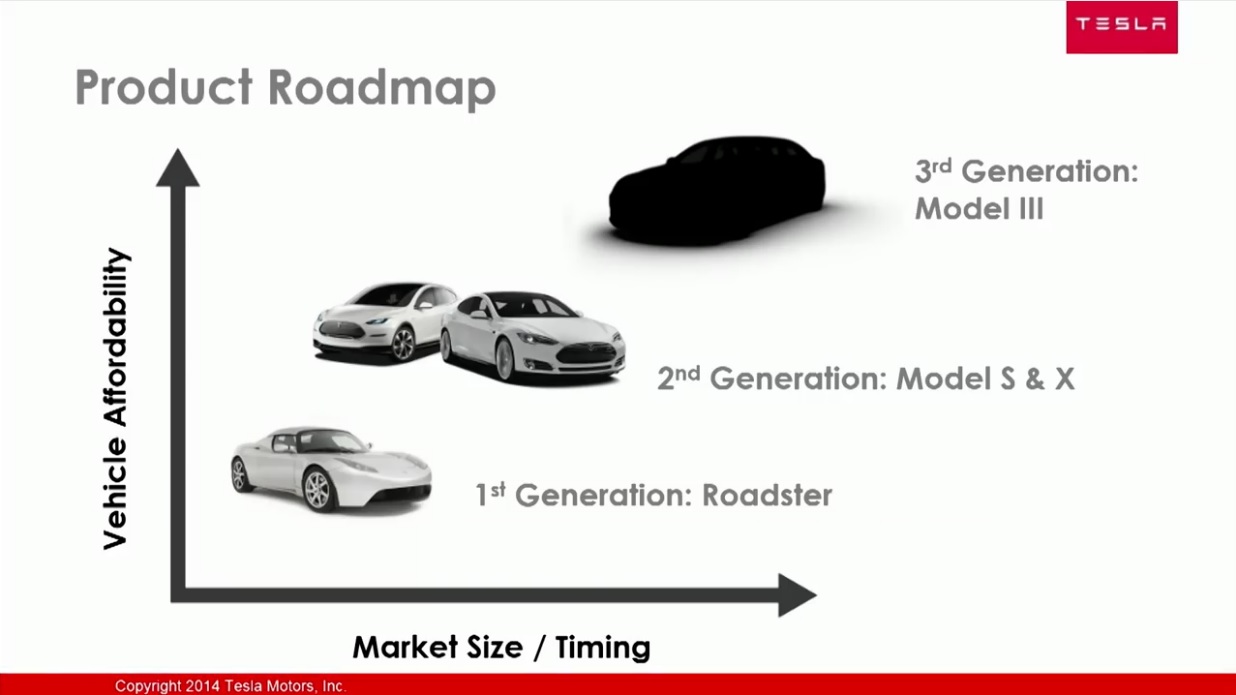

Seriously!?! WTF happened to the affordable car? Prices better go down once the 4680 lines are up next year and into 2023. The "affordable" version (third Gen.) of their plan is slowly drifting away....BREAKING: Tesla has increased the price of all US Model Y variants. All Model Y variants have increased in price by $1,000. Standard Range Model 3 is now $2,000 more. M3 Performance is $1,000 more.

• Model Y starting price: $54,990

• Model 3 starting price: $41,990 https://t.co/jfZpPhqgQe