Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla Gigafactory Investor Thread

- Thread starter teddyg

- Start date

-

- Tags

- Gigafactory TSLA

With the first gigafactory supposedly to break ground this month, what's best guess on its location (state)? I still think NV is the logical choice. However, who knows how the various state incentives will change the equation.

These posts: If you knew the exact location of Tesla's new 1100 acre Gigafactory? - Page 2 suggest that one location will be in Reno.

Zzzz...

Member

Maybe this has already been here. Very interesting article about gigafactory.

http://www.businessinsider.com/elon-musk-bet-on-the-gigafactory-2014-5

Claim that most cost of battery is coming from raw material is a plain wrong. Lithium itself contribute less than 5%. More like 2-3%. Anode usually made of carbon. There are plenty of new chemistries where cathode made of carbon or simply of metallic lithium. Electrolyte is an organic solvents with lithium salt. Current collectors are made of aluminum and copper.

But Argonne Lab have a valid point: most cost of li-ion cells comes from materials. Only difference - it is very high tech materials like cathode material and anode material... That is how battery production usually works, battery producers buy electrolyte chemicals, cathode-anode materials, separator from suppliers. And those cost a lot, as Argonne Lab rightfully pointed.

chickensevil

Active Member

Claim that most cost of battery is coming from raw material is a plain wrong. Lithium itself contribute less than 5%. More like 2-3%. Anode usually made of carbon. There are plenty of new chemistries where cathode made of carbon or simply of metallic lithium. Electrolyte is an organic solvents with lithium salt. Current collectors are made of aluminum and copper.

But Argonne Lab have a valid point: most cost of li-ion cells comes from materials. Only difference - it is very high tech materials like cathode material and anode material... That is how battery production usually works, battery producers buy electrolyte chemicals, cathode-anode materials, separator from suppliers. And those cost a lot, as Argonne Lab rightfully pointed.

Even JB said that the raw materials are rather expensive. They are getting them for cheaper though because they are putting in such a large order and cutting out the middle man. Instead of having to go through, say, a nickel exchange or a cobalt exchange to get those materials, they are going directly to the mines and ordering the entire mine's supply.

Note on the Gigafactory chart where they show the level of li-ion batteries currently being made in the world... now consider what ELSE people are ordering nickel for... so if you are even, say, Panasonic, who would be making about 20% of the batteries, that is only a smaller fraction of the total nickel usage in the world... in 2011 nickel production was around 1,590,000 tonnes. Considering 58% (as of 2008) of nickel is used in Stainless steel (which is in... like... everything), "Chemicals" (which is what batteries fall under) is only 8% of the usage of nickel (against of a 2008). So if I am Panasonic, running about 20% of the world battery supply, and I am only using 20% of 8% of the world nickel usage presently, what kind of power or control do I have to influence the cost of nickel on the market? Not a bit...

Now, Tesla/Panasonic are looking to take the entire li-ion battery market's supply and double it... effectively making their request for nickel up from around 25,440 (20% of 8%) tonnes up to 152,640 (127200 - 8% of the market - plus 25,440 Panasonic's current load) which bumps them from 1.6% global consumption to 9.6% global consumption. If you don't think that would give you significant buying power on the market, I don't know what would.

And this is just stats for nickel, which on the exchange runs at $19,310 per tonne. If they can break those prices to be lower than the going exchange rate, then that is going to be a cheaper battery. Controlling almost 10% of the supply would likely give you that power to not go through the exchange.

Bottom line, Argonne Lab was talking about base materials, but they weren't thinking big enough... which is why they don't see how Tesla can break the cost barrier on Nickel.

Sources:

http://www.nickelinstitute.org/~/media/Files/MediaCenter/NiInSociety/NiInSoc-EN.ashx#Page=1 -> Nickel Usages from 2008

All about nickel supply and demand from FastMarkets -> Nickel production levels in 2011

I could easily do this for other elements, but JB has said before that Nickel is their highest element in both volume and cost, so it is likely to be the metal to watch out for as far as getting that 30% reduction.

- - - Updated - - -

Let's put this another way... They have already said they are going through Canada to get some of their metals... since we don't really have Nickel in the US, and Canada is the number 3 producer, it only makes sense that they would go there for Nickel.

In 2008 Canada was producing 177,000 tonnes of nickel... if my back of the napkin math is even close to correct, they are about to eat all of Canada's Nickel supply in one giant purchase order. That is the kind of volume they are going for on this. That is going to mean new mines, and a huge required increase in the supply chains on the mining front.

- - - Updated - - -

PS: I would look for some Canadian Nickel Mining companies if you want to try to bet on this giant increase in production and demand. Or even just trade in Nickel Futures since everyone still riding on the exchange is likely to see a supply drop, and therefore an increase in Nickel price.

Zzzz...

Member

Even JB said that the raw materials are rather expensive. They are getting them for cheaper though because they are putting in such a large order and cutting out the middle man. Instead of having to go through, say, a nickel exchange or a cobalt exchange to get those materials, they are going directly to the mines and ordering the entire mine's supply.

Yes, nickel and cobalt responsible for substantial cost percentage of the cell. I would say for more than 5% of total cost of the cell. Lots of room for potential savings.

But that is not what I tried to point out. Journalist-reporter claimed that cost of RAW MATERIALS exceeds 75% of the total costs of the li-ion cell. Chart in the article shows 76%!!! Do you, chickensevil, understand difference between raw material and high tech one?

For example, speaking of anode, almost all commercially produced li-ion cells anode materials are basically carbon. You really think we got severe carbon dioxide shortage in this world? If not, then with you and that "journalist" logic anodes for li-ion cells should be essentially free, right? And forget about nickel and cobalt, there are chemistries that are based on carbon only for cathode, and they outperform nickel cobalt based ones. Should I point to the price of carbon once again? Well, those chemistries are more expensive, way more expensive, but not because price of raw material, the carbon dioxide is too high.

chickensevil

Active Member

First off, sorry if it came across that I was fighting against what you were saying... I wasn't. I was just making sure that you were giving enough credit to the overall cost of the raw materials themselves, since that seems pretty core even to the Argonne report. It has also been pretty core to what Tesla has been saying all along. Carbon is more expensive than I think you give it credit for, specifically for Graphite... Given that it is synthetic graphite that Panasonic is using the prices I am seeing listed is 20,000$/MT which makes it just as expensive as Nickel is. If they switch to spherical graphite made from natural flake it could be had for 6,000 to 10,000.

Just for kicks, I went and found the actual Argonne National Laboratory report. It is pretty thorough about all of it's data. Here is the PDF:

http://www.ipd.anl.gov/anlpubs/2011/10/71302.pdf

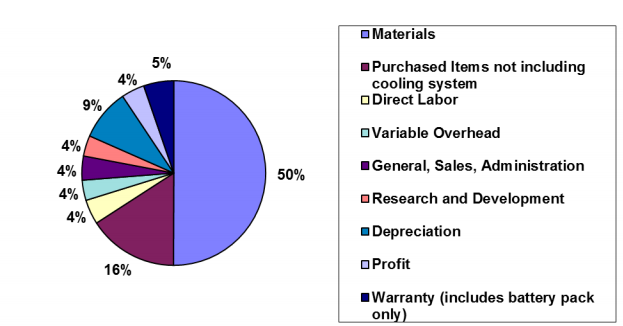

I direct your attention to this chart... not sure where Business Insider got their chart from, since the percentages are way off. this is on Page 70

Now, if you go to page 45, they actually break down the pricings associated with at least the Positive Electrode, and it does appear that in this instance they are pulling this as if you are buying the whole unit as opposed to making your own. But, they do some calculations to figure out how much you are actually spending in core material costs and come out to $6/kg for Li2CO3, $5.5/kg for NiSO4, $32/kg for CoSO4, and $1/kg for MnSO4. They have a chart there with a breakout of their costs for each of the cathode types, but I believe even those are estimations based on their formula they have posted on page 47.

I think there is substantial cost savings to be had on both fronts. In the raw materials and in the actual component assembly.

- - - Updated - - -

Oh, and the quality isn't the greatest on the video that was uploaded, but here is a capture from the symposium that JB was at, which shows all their core battery materials.

The reason they care about this is to ensure they get the best price possible, since avoiding the open exchange and buying in large enough bulk can save them a lot of money.

Just for kicks, I went and found the actual Argonne National Laboratory report. It is pretty thorough about all of it's data. Here is the PDF:

http://www.ipd.anl.gov/anlpubs/2011/10/71302.pdf

I direct your attention to this chart... not sure where Business Insider got their chart from, since the percentages are way off. this is on Page 70

Now, if you go to page 45, they actually break down the pricings associated with at least the Positive Electrode, and it does appear that in this instance they are pulling this as if you are buying the whole unit as opposed to making your own. But, they do some calculations to figure out how much you are actually spending in core material costs and come out to $6/kg for Li2CO3, $5.5/kg for NiSO4, $32/kg for CoSO4, and $1/kg for MnSO4. They have a chart there with a breakout of their costs for each of the cathode types, but I believe even those are estimations based on their formula they have posted on page 47.

I think there is substantial cost savings to be had on both fronts. In the raw materials and in the actual component assembly.

- - - Updated - - -

Oh, and the quality isn't the greatest on the video that was uploaded, but here is a capture from the symposium that JB was at, which shows all their core battery materials.

The reason they care about this is to ensure they get the best price possible, since avoiding the open exchange and buying in large enough bulk can save them a lot of money.

Johan

Ex got M3 in the divorce, waiting for EU Model Y!

Great post chicken! Good sources. To get that 30% reduction in cost it has to be 1% here and 2% there etc. Raw marerials will be important too, as you point out. Being a big buyer has its perks.

But I'm strongly opposed to Tesla doing mining themselves, except in co-op with SpaceX on an asteroid. Elon is good friends with the CEO of Planetary Resources (Planetary Resources ) Eric Anderson. Asteroid mining will be a reality sooner than many think.

But I'm strongly opposed to Tesla doing mining themselves, except in co-op with SpaceX on an asteroid. Elon is good friends with the CEO of Planetary Resources (Planetary Resources ) Eric Anderson. Asteroid mining will be a reality sooner than many think.

chickensevil

Active Member

Great post chicken! Good sources. To get that 30% reduction in cost it has to be 1% here and 2% there etc. Raw marerials will be important too, as you point out. Being a big buyer has its perks.

But I'm strongly opposed to Tesla doing mining themselves, except in co-op with SpaceX on an asteroid. Elon is good friends with the CEO of Planetary Resources (Planetary Resources ) Eric Anderson. Asteroid mining will be a reality sooner than many think.

It's not that I would expect them to mine anything themselves... That would be a lot of capital costs to buy up land and the go exploring for materials... All they are doing is buying direct from the supplier and making their own contract deal rather than going through and exchange. Look at it this way, I as a miner can choose to sell my stuff on the, say, Nickel exchange. I will get 19,000 per tonne and go on my way. The exchange will turn around and sell it for, say 19500, so they flip a profit to stay in business for being the host. Problem is, it is an open market, and someone has to be willing to buy my Nickel before it will be considered sold. This could be quick, and it could be slow. I am going to try to figure out how much to extract each month, based on how fast the open market can sell it since I don't want to waste production on product nobody wants. I have no guarantee that anyone will buy it, and it could take a while to get it for a price I am happy with.

If however a large company comes along and says, hey, your whole mining output, how much could you give me at full production? Oh, 20,000 tonnes per year? And what is your current production level? Oh only 15,000 per year? I will buy all 20k of that from you per contract for 18500 per tonne.

This overly simple example means that tesla not only is picking up that cost lower than the current sell rate but that the miner is benefitting because they have a guaranteed sell source to take all of their supply from.

Maybe three gigafactory sites! (from shareholder's meeting)

'likely' 3 starts I think he finally settled on. And would name the '1st' one to be completed by end of year. I'm paraphrasing from memory, but that was the jest of it.

JRP3

Hyperactive Member

I think what he means is that the first factory site that will eventually be completed will be chosen by the end of the year.

He said he hoped that the concrete foundation/slab would be poured by end of year and they would have approved building plans in place. Sounded to me that they would just back burner the sites/ states that were going to go slow in terms of permitting, and these sites would end up eventually being gigafactory #2 and #3. This would allow Tesla to reap tax breaks from three states, and have a jump on dominating battery supply for the entire EV market, not just their own use.

If he is talking to mines directly, that can only mean contracting to purchase a set amount of material up front, since that is effectively what the metal exchanges do for the mines (they need to have a guaranteed price to raise money to open mines). Actually, there is another thing Tesla can do for mines, and that is help financing new mine construction. Either way, or both, Tesla will end up buying raw materials significantly cheaper, but from a business perspective, it means they MUST build a lot of battery cells, or else they will sitting on thousands of tons of nickel.

I think that is why Elon is talking about giga 2 and 3. He needs to build them to use the raw materials he is going to contract to buy. I think Toyota has something to do with this too - he implied they were willing to buy lots and lots of battery packs from Tesla, but Tesla just doesn't have the batteries to sell them. Tesla is setting itself up to be the sole supplier of battery packs to lots of car companies.

Bottom line, Elon is thinking big(ger) again...

If he is talking to mines directly, that can only mean contracting to purchase a set amount of material up front, since that is effectively what the metal exchanges do for the mines (they need to have a guaranteed price to raise money to open mines). Actually, there is another thing Tesla can do for mines, and that is help financing new mine construction. Either way, or both, Tesla will end up buying raw materials significantly cheaper, but from a business perspective, it means they MUST build a lot of battery cells, or else they will sitting on thousands of tons of nickel.

I think that is why Elon is talking about giga 2 and 3. He needs to build them to use the raw materials he is going to contract to buy. I think Toyota has something to do with this too - he implied they were willing to buy lots and lots of battery packs from Tesla, but Tesla just doesn't have the batteries to sell them. Tesla is setting itself up to be the sole supplier of battery packs to lots of car companies.

Bottom line, Elon is thinking big(ger) again...

Last edited:

He said he hoped that the concrete foundation/slab would be poured by end of year and they would have approved building plans in place. Sounded to me that they would just back burner the sites/ states that were going to go slow in terms of permitting, and these sites would end up eventually being gigafactory #2 and #3. This would allow Tesla to reap tax breaks from three states, and have a jump on dominating battery supply for the entire EV market, not just their own use.

If he is talking to mines directly, that can only mean contracting to purchase a set amount of material up front, since that is effectively what the metal exchanges do for the mines (they need to have a guaranteed price to raise money to open mines). Actually, there is another thing Tesla can do for mines, and that is help financing new mine construction. Either way, or both, Tesla will end up buying raw materials significantly cheaper, but from a business perspective, it means they MUST build a lot of battery cells, or else they will sitting on thousands of tons of nickel.

I think that is why Elon is talking about giga 2 and 3. He needs to build them to use the raw materials he is going to contract to buy. I think Toyota has something to do with this too - he implied they were willing to buy lots and lots of battery packs from Tesla, but Tesla just doesn't have the batteries to sell them. Tesla is setting itself up to be the sole supplier of battery packs to lots of car companies.

Bottom line, Elon is thinking big(ger) again...

that's the way I read his statements as well. Add to that his lead guy JB probably wants one of them soley for stationery storage and the conversations get even bigger

jstoneman

Member

Yeah, I agree. I've been reading between the lines for some time on this gigafactory. Mr Musk was quoted recently as saying that the world will need "hundreds" of factories to meet demand. Tesla isn't about to build and permit three separate building sites just to abandon them. They'll be factories 1, 2, 3. If one of them takes a little bit longer, that's fine, see you in 2018 when we start work on our trucks. If the third one takes a couple extra years, that's fine, see you when we start doing mass market batteries for solar city installs in 2019. Musk is playing chess and he's 5 moves in front of everybody. Amazing.

CalDreamin

Member

A battery factory is a chemical plant, and California is hostile to chemical plants. I'm skeptical that California could make all the changes necessary to make this work. What would the state do to prevent the typical push back and lawsuits from private citizens and organizations that drag out environmental impact and permitting reviews for years, exacting high and sometimes insurmountable costs for compliance? Though I'd love to see these jobs in California, I don't want Tesla to go bankrupt trying to overcome these hurdles.

Jack6591

Active Member

A battery factory is a chemical plant, and California is hostile to chemical plants. I'm skeptical that California could make all the changes necessary to make this work. What would the state do to prevent the typical push back and lawsuits from private citizens and organizations that drag out environmental impact and permitting reviews for years, exacting high and sometimes insurmountable costs for compliance? Though I'd love to see these jobs in California, I don't want Tesla to go bankrupt trying to overcome these hurdles.

Computer chip plants are essentially chemical plants. California is chock full of 'em.

Computer chip plants are essentially chemical plants. California is chock full of 'em.

Huh? Since when? 1980? Almost all actual chip making plants have long, long left California. CA environmental regulations are no joke, and chip making plants use lots of very toxic chemicals that run afoul of the CA EPA.

Similar threads

- Replies

- 1

- Views

- 779

- Replies

- 0

- Views

- 272

- Replies

- 3

- Views

- 562

- Replies

- 1

- Views

- 561