That is a cool story. Elon perhaps assumed the the guy was a donor to his brother's charity.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla Gigafactory Investor Thread

- Thread starter teddyg

- Start date

-

- Tags

- Gigafactory TSLA

tftf

Member

I would like to see estimates from others how high the initial total investments for the "giga factory" (including tooling for the Gen III car) will be.

Let me give my rough guesstimate: 5-10 billion USD based on a production of 250-500k Gen III cars per year.

This is based on market comparables: What Nissan spent on their three battery plants (and earlier JV investments with NEC since 2007), what Panasonic invested to expand supply for Model S and X, the raw material input costs of cylindrical cells and tooling costs for a Gen III production of 250-500k cars/year, hence the wide range of 5-10 billion.

Im also assuming that...

- the plant is running on clean energy and that it includes recycling options for batteries (this based on Musk's remarks in the latest TSLA CC).

- Supply for Model S and X batteries continues to be produced by external suppliers as is (Panasonic, maybe Samsung or LG added down the road).

Since I'm bearish on TSLA my numbers might be far too high (?).

I would like to hear everyone's estimates on costs for the giga factory and Gen III ramp-up since this will influence the debt structure or share count of TSLA considerably.

PS: This Argonne PDF from December 2012 was also used for my guesstimate:

http://www.cse.anl.gov/batpac/files/BatPaC ANL-12_55.pdf

Let me give my rough guesstimate: 5-10 billion USD based on a production of 250-500k Gen III cars per year.

This is based on market comparables: What Nissan spent on their three battery plants (and earlier JV investments with NEC since 2007), what Panasonic invested to expand supply for Model S and X, the raw material input costs of cylindrical cells and tooling costs for a Gen III production of 250-500k cars/year, hence the wide range of 5-10 billion.

Im also assuming that...

- the plant is running on clean energy and that it includes recycling options for batteries (this based on Musk's remarks in the latest TSLA CC).

- Supply for Model S and X batteries continues to be produced by external suppliers as is (Panasonic, maybe Samsung or LG added down the road).

Since I'm bearish on TSLA my numbers might be far too high (?).

I would like to hear everyone's estimates on costs for the giga factory and Gen III ramp-up since this will influence the debt structure or share count of TSLA considerably.

PS: This Argonne PDF from December 2012 was also used for my guesstimate:

http://www.cse.anl.gov/batpac/files/BatPaC ANL-12_55.pdf

Last edited:

Zzzz...

Member

$127M for cap. equipment to produce 870MWh yearly is very cheap. Sure capital equipment is just a part of total investment, but ~$4 billion upfront cost to be able to produce 500,000 packs for Gen3 a year seems very affordable.PS: This Argonne PDF from December 2012 was also used for my guesstimate:

http://www.cse.anl.gov/batpac/files/BatPaC ANL-12_55.pdf

Different study, link was posted by CapitalistOppressor had much higher estimates for li-ion plants built in US or in China.

tftf

Member

Different study, link was posted by CapitalistOppressor had much higher estimates for li-ion plants built in US or in China.

I didn't find the study links or earlier calculations, but I found this recent post from CO:

I don't think a massive secondary would be as well received today as it would have been a month ago. They need like ~$5-$6b just for a baby giga-factory if I recall our calculations correctly. And $10b+ for any remotely optimistic assessment of the needs for GenIII.

Model S Battery Pack - Cost Per kWh Estimate - Page 44

So I might be not that far off compared to other estimates.

I find it hard to believe that none of the analysts present on the latest TSLA conference call asked specific questions how much this "giga factory" will cost and how TSLA will raise the funds (given that it has "only" about 0.8 billion in cash and equivalents at the moment) - either alone or in joint-venture(s) with its battery supply partners.

This issue will the most important one for Tesla over the next few years imho. This Forbes article also gives a good overview on the challenges ahead:

Tesla's 1% Problem Isn't What You Think - Forbes

PS: I raised the question about a follow-on stock offering back in late summer 2013 when the stock was trading near $200 (and warning about the valuation). I think this was an opportunity lost to raise cash easily when the stock was at such lofty levels.

In my opinion, TSLA will need tons of capital for unexpected events as a safety cushion (more fire incidents or other possible safety issues with Model S and X, supply chain disruptions in Japan or California...), the Gen III ramp-up and of course the billions for this "giga battery factory".

Last edited:

Zzzz...

Member

I didn't find the study links or earlier calculations, but I found this recent post from CO:

I meant this post.

Quote: "Although specific costs vary, the initial investment required to build a U.S. manufacturing facility for cylindrical 18650 lithium-ion cell production is roughly $4 per cell produced each year."

If we assume Gen3 will have ~5,000 cells(18650), and 500,000 yearly production rate, $4 per cell initial investment places upfront sum closer to $10 billion.

Link to pdf: http://americanmanufacturing.org/files/1-s2.0-S0378775312018940-main%20%284%29.pdf

tftf

Member

Thank you.

It's funny because I arrived at similar total numbers using different sources.

If anyone has completely different estimates for the "giga factory" investments needed, please post them.

PS: The Argonne PDF I linked is also looking at future 2020 numbers/estimates, so it may be optimistic.

It's funny because I arrived at similar total numbers using different sources.

If anyone has completely different estimates for the "giga factory" investments needed, please post them.

PS: The Argonne PDF I linked is also looking at future 2020 numbers/estimates, so it may be optimistic.

Last edited:

tftf

Member

Addition: The cost discussion was continued in the long-term fundamentals thread but I find it useful to copy a list of the largest producers of EV and hybrid car batteries here.

Some are competitors, some are potential suppliers for Tesla's "giga factory".

Edit: THIS LIST IS IN NO PARTICULAR ORDER

1. LG Chem

2. Johnson Controls

3. GS Yuasa (new JV with Bosch and Mitsubishi, also JV with Honda)

4. AESC (Nissan-NEC)

5. A123 Systems (now in Chinese control, Wangxiang) *

6. Panasonic Group (includes former Sanyo)

7. Samsung, former SB LiMotive (Bosch left, now just Samsung SDI)

8. Hitachi Vehicle Energy

9. BYD

10. Electrovaya

11. Blue Solutions (recent IPO in France, tied to Bollore)

12. Li-Tec and Accumotive (Evonik and Daimler) **

_______

* Given that A123 is out of bankruptcy, they may one day return as a big player, but they seem to focus on hybrids from now on:

Battery Maker A123 Now Focusing on Hybrid Cars - WSJ.com

What's Next For Chinese-Owned Battery Maker A123?

** Because of Daimler ties to TSLA and because Li-Tec is looking for additional partners, this may look interesting at first but the German government would prefer to retain domestic control (due to public funding).

Some are competitors, some are potential suppliers for Tesla's "giga factory".

Edit: THIS LIST IS IN NO PARTICULAR ORDER

1. LG Chem

2. Johnson Controls

3. GS Yuasa (new JV with Bosch and Mitsubishi, also JV with Honda)

4. AESC (Nissan-NEC)

5. A123 Systems (now in Chinese control, Wangxiang) *

6. Panasonic Group (includes former Sanyo)

7. Samsung, former SB LiMotive (Bosch left, now just Samsung SDI)

8. Hitachi Vehicle Energy

9. BYD

10. Electrovaya

11. Blue Solutions (recent IPO in France, tied to Bollore)

12. Li-Tec and Accumotive (Evonik and Daimler) **

_______

* Given that A123 is out of bankruptcy, they may one day return as a big player, but they seem to focus on hybrids from now on:

Advanced battery maker A123 Systems LLC is shifting its focus to small, hybrid-cars and away from fully-electric vehicles in a reflection of the slowly developing market for electric vehicles, the company's new chief executive said on Tuesday.

The company expects electric vehicles won't now become a major part of global auto demand for many years. However, new batteries for start-stop systems and hybrids is forecast to grow quickly as auto makers seek inexpensive ways to improve fuel economy in gasoline-powered cars, said Chief Executive Jason Forcier.

Battery Maker A123 Now Focusing on Hybrid Cars - WSJ.com

What's Next For Chinese-Owned Battery Maker A123?

** Because of Daimler ties to TSLA and because Li-Tec is looking for additional partners, this may look interesting at first but the German government would prefer to retain domestic control (due to public funding).

Last edited:

Zzzz...

Member

1. LG Chem

2. Johnson Controls

3. GS Yuasa (new JV with Bosch and Mitsubishi, also JV with Honda)

4. AESC (Nissan-NEC)

5. A123 Systems (now in Chinese control, Wangxiang) *

6. Panasonic Group (includes former Sanyo)

7. Samsung, former SB LiMotive (Bosch left, now just Samsung SDI)

8. Hitachi Vehicle Energy

9. BYD

10. Electrovaya

11. Blue Solutions (recent IPO in France, tied to Bollore)

12. Li-Tec and Accumotive (Evonik and Daimler) **

I might be wrong and I might have missed something... But how this list was compiled?

I mean last time I heard Japs & Koreans had ~ 40% of the worldwide market each, with China having more then 20% and Jap press crying out loud that Japan have lost #1 in li-ion industry to Korea and that China rapidly raising. That was like a year ago.

Biggest players were Panasonic/Samsung/LG/Sony(Nissan/NEC)/BYD. So five players total. All serving mostly phones and notebooks/tablets industries, but also communication etc.

But ok, in case of Li-Tec last time I noticed them was when Evonic were making news trying to sell their part of JV, but apparently Daimler is not interested and JV is going to die quietly. Or not?

And who the heck is A123? I mean they seems to be on par with Valence Technology. But Valence have not made it to the list. On the other hand, BYD, the biggest producer of li-ion cells in China made it only into #9 position. Could you really compare A123/Valence to BYD? You remember China li-ion industry is #3 worldwide and BYD is #1 in China?

No no, I'm fully aware that A123 were a Chinese company well before they gone bankrupt and were bought by Wangxiang. I mean most R&D money spent and the high tech part of production(cathode material plant) were happening in China, only stock listing and "headquarter" were in US. Yes, I know they had final assembly in South Korea and US. But that what was it - a final assembly. Ok, and headquarter. And stock listing. But IMO A123 still not worth mentioning among major players. Or Daimler backed Li-Tec. Or even more so with Johnson Controls/Blue Solutions/etc.

But sure if you want to count all compliance EV battery suppliers on a barely existing EV battery market then ok, that list might be relevant. But seeing BYD below A123 is offending mine senses

Last edited:

stopcrazypp

Well-Known Member

Assuming the order means anything, I'm guessing the list is trying to list the biggest EV battery makers. That's different from a list of the general li-ion suppliers (for all markets).

tftf

Member

Assuming the order means anything, I'm guessing the list is trying to list the biggest EV battery makers. That's different from a list of the general li-ion suppliers (for all markets).

My list is in no particular order. Sorry if this was confusing, this part wasn't copied over from the other thread.

Yes, it's supposed to list the major current battery suppliers for EVs and hybrid cars. Please add if I missed some companies (it's sometimes hard to catch them all, because many are JVs and private).

I might have missed many domestic suppliers in China for popular e-scooters etc., only BYD is listed.

I'm not listing other battery manufacturers. For example, Sony has a large Li-Ion battery production as well, but didn't supply the car sector afaik and was trying to off-load its unit recently:

Sony Energy Devices Corporation

http://www.reuters.com/article/2012/11/28/us-sony-batteries-idUSBRE8AQ19H20121128

Apple and other gadget makers with huge demand are therefore also not on the list as Zzzz pointed out.

These companies also compete with TSLA indirectly and might influence pricing for battery raw materials and supply, so it's important not to forget the demand from consumer electronics etc.

Edit: Talks with Samsung and LG ongoing:

Tesla Motors (Nasdaq: TSLA) and Panasonic (OTCBB: PCRFY) recent inked an expanded battery supply contract, which should run several years and be beneficial for both parties. But, that doesn't mean Tesla isn't looking to diversify its supply chain even further.

Bloomberg -- citing Yonhap News -- reported Monday that Tesla has been in discussions with South Korea-based LG Chem and Samsung SDI as potential lithium-ion battery suppliers. Discussions were affirmed by Jeff Evanson, Tesla's VP of Investor Relations.

Evanson noted that it would take several years before other companies were qualified to supply batteries to Tesla.

The Tesla and Panasonic contract is estimated to be enough for production of around 330,000 cars.

http://www.streetinsider.com/Inside...+Panasonic+for+Battery+Suppliers/8897392.html

The number with Panasonic is of course over several (about four) years.

Last edited:

tftf

Member

The website InsideEVs just happened to discuss the Argonne paper I had linked in this thread earlier:

Argonne Computer Model And The Implications For The 3rd Generation Tesla

It's a good read/summary since the original paper is 140 pages long and difficult to digest in a hurry.

Some extracts:

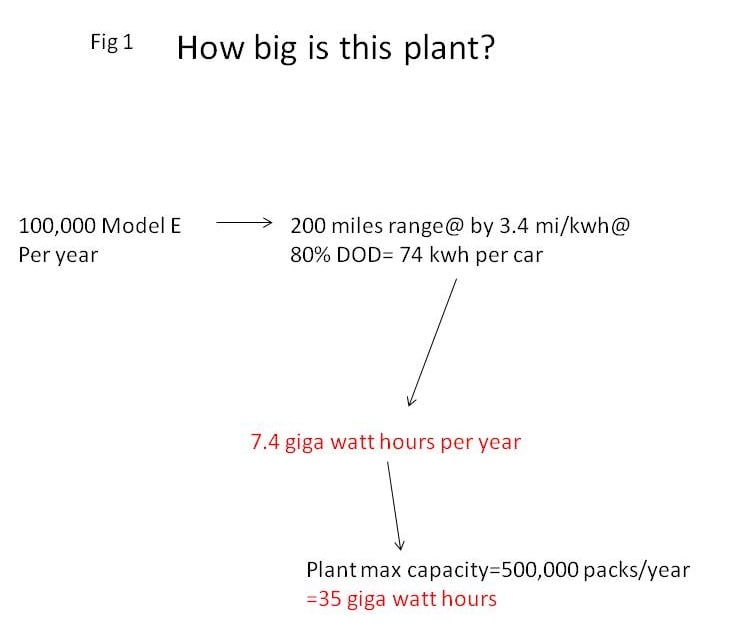

An important note on what may look like an obvious error in the summary (74 kWh assumption) at first sight:

Argonne Computer Model And The Implications For The 3rd Generation Tesla

I think even 59 kWh is high (?), please add your estimates.

In my simple assumptions I used 45-50 kWh for the Gen III low-end and about 60-65 kWh for the high-end Gen III car battery. This assumes again TSLA will offer two configurations as for the Model S. In the more price-sensitive Gen III buyers' segment more people could go for the lower-end configuration compared to the Model S and X.

(Very simply put, the low-end Gen III would have about double the current LEAF battery kWh number. This could fall short of real-world "200 miles of range" under certain conditions but enough to achieve it during testing.)

More per-battery pricing details also discussed in this paper could help estimate:

- Will TSLA switch to slightly larger cells or stay with 18650?

- Will they be able to use 4ah (or even higher) or stay at 3.xy ah - if so, will raw material input costs change?

- How can TSLA scale the battery plant per pack? I.e. does it make sense to add dark space for 500k battery packs/year and start at "only" 100k/year or build out for 250-500k right from the start?

...

I was more interested in the initial battery plant investment itself since I don't know enough about battery cell chemistry and cost details. But I guess it's safe to assume TSLA will also try to achieve cost-leadership on their Gen III batteries per kWh in addition to in-sourced supply safety.

I hope someone with more battery chemistry (plant) knowledge than me can discuss the Argonne PDF paper / .xls and hopefully produce more detailed estimates for the "giga factory" in the future.

Argonne Computer Model And The Implications For The 3rd Generation Tesla

It's a good read/summary since the original paper is 140 pages long and difficult to digest in a hurry.

Some extracts:

An important note on what may look like an obvious error in the summary (74 kWh assumption) at first sight:

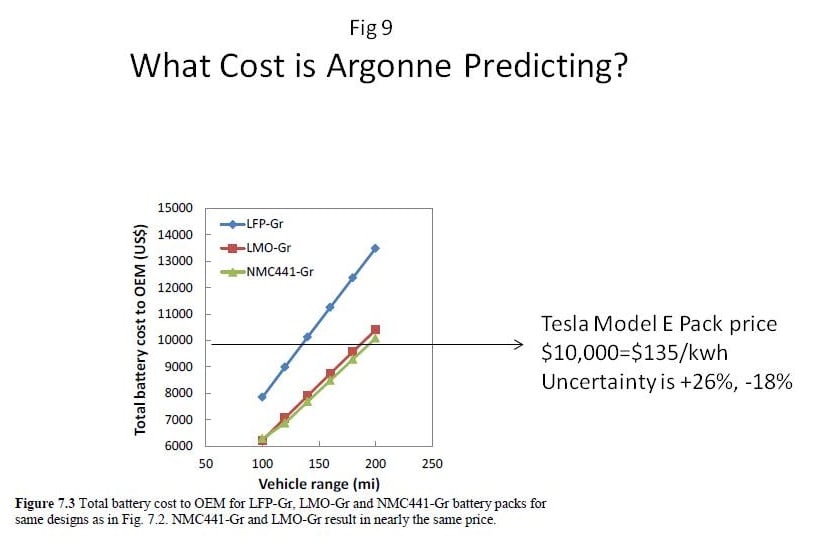

If you look at figure 9 Argonne projected the 200 mile range pack for $10,000.

I went back to the report and, although not totally clear, it looks like in another section of the report they are using 250wh/mi for the cars MPGe and a DOD of .85 which works out to 58.8 kwh pack not 74 as I had calcualted. So that makes their pack more like 170$/kwh.

Argonne Computer Model And The Implications For The 3rd Generation Tesla

I think even 59 kWh is high (?), please add your estimates.

In my simple assumptions I used 45-50 kWh for the Gen III low-end and about 60-65 kWh for the high-end Gen III car battery. This assumes again TSLA will offer two configurations as for the Model S. In the more price-sensitive Gen III buyers' segment more people could go for the lower-end configuration compared to the Model S and X.

(Very simply put, the low-end Gen III would have about double the current LEAF battery kWh number. This could fall short of real-world "200 miles of range" under certain conditions but enough to achieve it during testing.)

More per-battery pricing details also discussed in this paper could help estimate:

- Will TSLA switch to slightly larger cells or stay with 18650?

- Will they be able to use 4ah (or even higher) or stay at 3.xy ah - if so, will raw material input costs change?

- How can TSLA scale the battery plant per pack? I.e. does it make sense to add dark space for 500k battery packs/year and start at "only" 100k/year or build out for 250-500k right from the start?

...

I was more interested in the initial battery plant investment itself since I don't know enough about battery cell chemistry and cost details. But I guess it's safe to assume TSLA will also try to achieve cost-leadership on their Gen III batteries per kWh in addition to in-sourced supply safety.

I hope someone with more battery chemistry (plant) knowledge than me can discuss the Argonne PDF paper / .xls and hopefully produce more detailed estimates for the "giga factory" in the future.

Last edited:

Zzzz...

Member

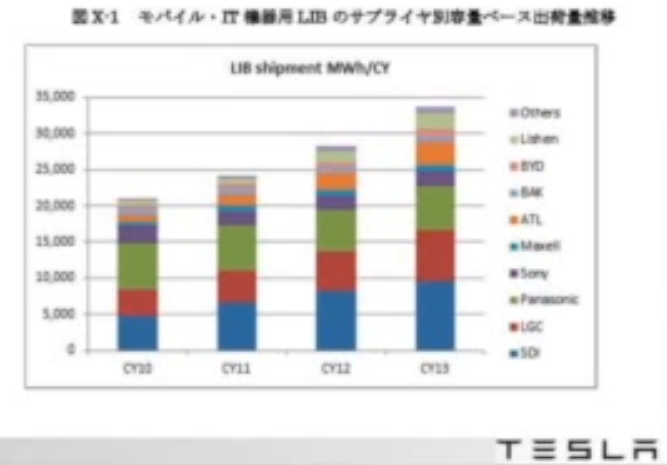

There was this talk given by JB. Lots of interesting info from investor prospective too, like current Tesla Gen3 target production numbers for year 2017-2019.

Speaking of gigafactory: in whole world in 2012 there were 27GWh worth of batteries produced. In 2019 Tesla would need 40GWh...

And speaking about li-ion producers list, there is an interesting slide:

So list looks like this:

1)Samsung

2)LG

3)Panasonic

4)Sony (was #4 in 2010 but at least two companies overtook it by 2013)

5)Marvell (tiny in 2013)

6)ATL, http://www.atlbattery.com - huge in 2013, number 4 in 2013

7)BAK, http://www.bak.com.cn - small

8)BYD, small in 2013

9)could not make name, but HUGE, one of two companies who overtook Sony, any idea who are they?

Notice how Panasonic+Sony were producing more or around as much batteries as rest of the world in 2010! In 2013 in terms of volume their volume is half of Korea producers...

Link to the video: JB Straubel | Energy@Stanford SLAC 2013 - YouTube

Speaking of gigafactory: in whole world in 2012 there were 27GWh worth of batteries produced. In 2019 Tesla would need 40GWh...

And speaking about li-ion producers list, there is an interesting slide:

So list looks like this:

1)Samsung

2)LG

3)Panasonic

4)Sony (was #4 in 2010 but at least two companies overtook it by 2013)

5)Marvell (tiny in 2013)

6)ATL, http://www.atlbattery.com - huge in 2013, number 4 in 2013

7)BAK, http://www.bak.com.cn - small

8)BYD, small in 2013

9)could not make name, but HUGE, one of two companies who overtook Sony, any idea who are they?

Notice how Panasonic+Sony were producing more or around as much batteries as rest of the world in 2010! In 2013 in terms of volume their volume is half of Korea producers...

Link to the video: JB Straubel | Energy@Stanford SLAC 2013 - YouTube

Last edited:

stopcrazypp

Well-Known Member

Looks to be Lishen: http://en.lishen.com.cn/9)could not make name, but HUGE, one of two companies who overtook Sony, any idea who are they?

tftf

Member

There was this talk given by JB. Lots of interesting info from investor prospective too, like current Tesla Gen3 target production numbers for year 2017-2019.

Speaking of gigafactory: in whole world in 2012 there were 27GWh worth of batteries produced. In 2019 Tesla would need 40GWh...

(...)

Link to the video: JB Straubel | Energy@Stanford SLAC 2013 - YouTube

That video indeed contains very important information. I looked at it repeatedly in the past. The interesting part concerning future supply needs is around minute 22:00+.

I still can't come up with less than roughly 5 billion of investments needed to cover TSLA's future battery needs (assuming the Gen III project goes as planned and is not postponed).

I don't think TSLA will able to simply source batteries from suppliers and just "increase orders" as some pointed out.

The numbers cited by CTO Straubel and risks in cap ex are too big for outside suppliers to handle in my opinion.

I think the battery plant has to be ready (at least a partial buildout for 100k or so packs/year) shortly before the Gen III goes on sale.

I also think building this plant could take about 2-3 years including permits (assuming it will be built on the land TSLA purchased next to its factory).

It took Nissan that long in Tennessee (and this is a smaller plant for smaller (kWh wise) LEAF batteries still running below capacity):

http://wheels.blogs.nytimes.com/2012/12/13/nissan-battery-plant-begins-operations-in-tennessee/?_r=0

Construction of Nissans Smyrna battery plant on schedule

NISSAN | SUSTAINABLE MOBILITY COMES TO UNITED STATES WITH DEDICATION OF NISSAN LEAF PRODUCTION SITE

Nissan schedule: May 2010 - October 2012 (first battery packs were ready in early 2013 after "aging")

So assuming the Gen III is supposed to be on sale later in 2017 TSLA would have to start building the plant in early 2015 after securing the funding.

This is not a far-off event in my opinion, especially not given the investment numbers involved and planning which battery size and chemistry to use.

Just 400 hits on that YT video (compare that to the attention other threads and discussions about the TSLA fires got) highlights in my opinion that many investors are either not concerned or simply not fully aware of these battery supply challenges. Too bad.

In my opinion, there is no Gen III car (at least not in the numbers most analysts currently model in) without this plant. So basically the most important critical path in Tesla's future until 2020.

Maybe the analysts covering TSLA will finally start talking about it in 2014. So far crickets.

PS: Even Nissan producing a relatively small number of LEAF batteries in NA (one of three plants)still has issues ramping up at the moment:

http://insideevs.com/nissan-wont-be-able-to-increase-us-leaf-production-until-december-or-january/Nissan Won’t Be Able to Increase US LEAF Production Until December or January

Last edited:

JRP3

Hyperactive Member

74kWh for a 200 mile range Model E is insane. The Model S 60kWh pack does 200 miles in a larger, heavier car. Total nonsense. 45-50kWh is more likely.

tftf

Member

74kWh for a 200 mile range Model E is insane. The Model S 60kWh pack does 200 miles in a larger, heavier car. Total nonsense. 45-50kWh is more likely.

Yes, I discussed this below the graphic in the post above, net of dod (depth of discharge) it's more like 59 kWh, the person compiling the summary made an error he later caught himself (see my quote above). I still posted his graphic (Fig 1) to get a feeling for the overall numbers.

59kWh is too high for me as I noted above. I also assume around 45-50 kWh for the low-end version of the Gen III car and maybe 60-65 kWh for the higher-end version (assuming there will be two versions).

In total, 35GWh (from Fig 1) may be much too high for the initial plant buildout. On the other hand, Straubel even talks about 40 GWh for 2019 in the Stanford video linked.

Assuming the size of the cells stays the same and the Ah rating isn't much higher, I would estimate 3500-4000 (low-end) to 5000-5500 cells (high-end) per Gen III car.

Then there's the question how cost-effectively TSLA could scale the battery plant from (for example) 100k in the beginning to 500k packs per year or if it's cheaper to build out for 250k and then 500k from the beginning and run at low capacity first. This is very difficult for outsiders to estimate. There is another chart from the summary showing the effect of price elasticity:

Costs effects of different cell sizes are also estimated:

Given the complexity and the timeframe (assuming TSLA can't build the plant much faster than Nissan), maybe the first batch of Gen III vehicles (signature edition or similar) could still use supplier-sourced batteries to keep the 2017 timeframe?

Last edited:

JRP3

Hyperactive Member

Once you have the building, or buildings, you can fill them with equipment as needed. You'll have a number of redundant machines running on redundant production lines, much like the existing Tesla factory. Right now they have a single production line built for 400 cars per week, they can do 800 cars per week with two shifts. They can scale this up to around 500K cars per year by adding more production lines.

tftf

Member

Once you have the building, or buildings, you can fill them with equipment as needed. You'll have a number of redundant machines running on redundant production lines, much like the existing Tesla factory. Right now they have a single production line built for 400 cars per week, they can do 800 cars per week with two shifts. They can scale this up to around 500K cars per year by adding more production lines.

My question was more about scaling the battery plant part (equipment etc.). Scaling (for example) from 100k to 500k packs per year and the costs involved for a small initial setup vs building out for 250k or even 500k in advance and running at low capacities in the first year(s).

The car part should be easier thanks to people with Toyota experience (Gilbert Passin and his team) and many parallels to "traditional" ICE car manufacturing.

Last edited:

JRP3

Hyperactive Member

I was talking about the battery plant and using the vehicle plant as an example. I see no point in filling a plant with machinery that you won't need for a few years.

Similar threads

- Replies

- 1

- Views

- 741

- Replies

- 3

- Views

- 462

- Replies

- 1

- Views

- 468

- Article

- Replies

- 36

- Views

- 19K

- Replies

- 0

- Views

- 309