Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Happy Holidays Everyone!!

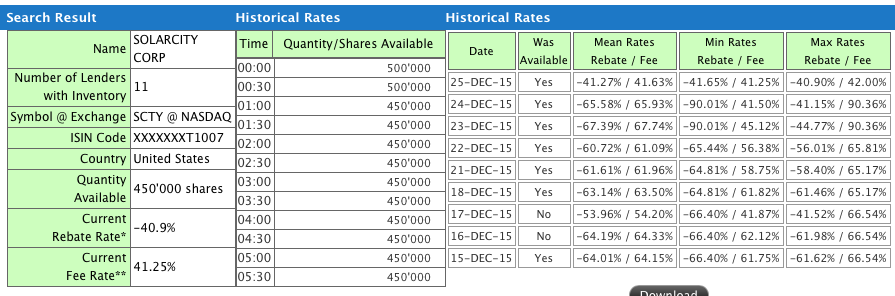

I have to admit that the rebate rates on christmas eve have been rather volatile, moving between 90% to 41%. So I am not entirely sure if it is due to short overcrowding or just some holiday season anomaly.

- - - Updated - - -

I also noticed strong correlation between recently exchange reported short interest data and MarkIt's daily data. As per MarkIt, short interest went down pretty much every day this week. Again adding evidence to theory that shorts are covering into weakness (NV ruling). That aligns well with the rebate rates in the last column of the above screenshot.

I have to admit that the rebate rates on christmas eve have been rather volatile, moving between 90% to 41%. So I am not entirely sure if it is due to short overcrowding or just some holiday season anomaly.

- - - Updated - - -

I also noticed strong correlation between recently exchange reported short interest data and MarkIt's daily data. As per MarkIt, short interest went down pretty much every day this week. Again adding evidence to theory that shorts are covering into weakness (NV ruling). That aligns well with the rebate rates in the last column of the above screenshot.

blakegallagher

Member

Layoffs already started in Nevada, merry Christmas solar installers, from the puc.

- - - Updated - - -

Layoffs have already started in Nevada, merry Christmas solar workers, compliments of your local PUC

SolarCity employees laid off after PUC decision - Story

- - - Updated - - -

Layoffs have already started in Nevada, merry Christmas solar workers, compliments of your local PUC

SolarCity employees laid off after PUC decision - Story

doggusfluffy

Closed

Merry Christmas all.

http://napavalleyregister.com/news/local/napa-sanitation-plant-to-store-power-in-tesla-batteries/article_acd83a48-cfa2-5946-921c-8974ce3bff16.html

http://napavalleyregister.com/news/local/napa-sanitation-plant-to-store-power-in-tesla-batteries/article_acd83a48-cfa2-5946-921c-8974ce3bff16.html

But it will cost the district nothing. Tesla installed the $3.2 million facility using a $1.9 million Pacific, Gas and Electric grant to cover part of the expense and will pay for operations and maintenance. The district and Tesla will split energy savings estimated of $110,000 annually.

Happy Holidays Everyone!!

I have to admit that the rebate rates on christmas eve have been rather volatile, moving between 90% to 41%. So I am not entirely sure if it is due to short overcrowding or just some holiday season anomaly.

View attachment 105463

- - - Updated - - -

I also noticed strong correlation between recently exchange reported short interest data and MarkIt's daily data. As per MarkIt, short interest went down pretty much every day this week. Again adding evidence to theory that shorts are covering into weakness (NV ruling). That aligns well with the rebate rates in the last column of the above screenshot.

SunEdison, SolarCity Robbed of Urgency by ITC Relief, Says Axiom; SUNE Surges - Tech Trader Daily - Barrons.com

Youre absolutely right SBenson. Here is another example of short covering trying hard to use media to create a short exit window. I have to say this is one of the most pathetic one at that. Solarcity will not suffer any demand from the passage of the ITC because this is not a selling point to 95% of their customers. Actually, the demand go up due to California net metering changes before the end of 2016(including New York and others). Yes, grandfathering better net metering rates is much more of an accelerant then ITC which is something rolled into the Solarcity cost/watt of leases/ppas/solar loans... Again, this gordon johnson guy is going to fry if he doesn't get out of his short, and I think he knows that and is doing some standard media spin tactics to do it.

doggusfluffy

Closed

I found the handy analyst roundup link, the Axiom Capital note might have contributed to the 12/24 rebate pricing weirdness.

SolarCity Corporation (SCTY) - Stock Predictions Price Targets

SolarCity Corporation (SCTY) - Stock Predictions Price Targets

Last edited:

anticitizen13.7

Not posting at TMC after 9/17/2018

Hello all! I'm considering adding SCTY to my long-term portfolio, and looking at the SEC 10-Q (30 Oct 2015) in order to understand the company's financials: http://investors.solarcity.com/sec.cfm?view=all

If I am reading this correctly, Solar City expended roughly 1.7 Billion USD in the first 9 months of 2015. These expenditures funded operations, about 500M USD, and construction of new solar arrays 1.2B USD.

The company raised approximately 750M USD from a line item described as: "Proceeds from investment by noncontrolling interests and redeemable noncontrolling interests in subsidiaries" Question: Is this cash raised through some kind of debt obligation? Like bonds sold to some private entity?

The other big line item for cash raised is about 780M USD from "long term debt". How is this different from the 750M mentioned above?

About 400M USD in raised $ comes from Solar Bonds and asset backed notes, which I understand. The SolarCity website has a section where I could actually buy bonds directly from them.

As I understand it, the basic business model for SolarCity is to spend a lot of $ up front deploying Leased Solar Arrays to homes and businesses, and realize cash flows over the 20 year lease period[paying for the cost of the hardware and/or the electricity the panels generate]. This seems to be similar to Internet services companies (like a health insurance brokerage), which spend a lot of money upfront in the hopes of realizing subscription revenue that will eventually greatly exceed the upfront cost.

I guess one could attempt to model the expected cash flows and attempt to see when SolarCity begins to take in more $ than they expend in expansion. In the first 3Q of this year they took in about 285M USD in revenue. I am trying to figure out what this year's massive capital investment will yield next year.

If I am reading this correctly, Solar City expended roughly 1.7 Billion USD in the first 9 months of 2015. These expenditures funded operations, about 500M USD, and construction of new solar arrays 1.2B USD.

The company raised approximately 750M USD from a line item described as: "Proceeds from investment by noncontrolling interests and redeemable noncontrolling interests in subsidiaries" Question: Is this cash raised through some kind of debt obligation? Like bonds sold to some private entity?

The other big line item for cash raised is about 780M USD from "long term debt". How is this different from the 750M mentioned above?

About 400M USD in raised $ comes from Solar Bonds and asset backed notes, which I understand. The SolarCity website has a section where I could actually buy bonds directly from them.

As I understand it, the basic business model for SolarCity is to spend a lot of $ up front deploying Leased Solar Arrays to homes and businesses, and realize cash flows over the 20 year lease period[paying for the cost of the hardware and/or the electricity the panels generate]. This seems to be similar to Internet services companies (like a health insurance brokerage), which spend a lot of money upfront in the hopes of realizing subscription revenue that will eventually greatly exceed the upfront cost.

I guess one could attempt to model the expected cash flows and attempt to see when SolarCity begins to take in more $ than they expend in expansion. In the first 3Q of this year they took in about 285M USD in revenue. I am trying to figure out what this year's massive capital investment will yield next year.

Last edited:

jhm

Well-Known Member

Hello all! I'm considering adding SCTY to my long-term portfolio, and looking at the SEC 10-Q (30 Oct 2015) in order to understand the company's financials: http://investors.solarcity.com/sec.cfm?view=all

If I am reading this correctly, Solar City expended roughly 1.7 Billion USD in the first 9 months of 2015. These expenditures funded operations, about 500M USD, and construction of new solar arrays 1.2B USD.

The company raised approximately 750M USD from a line item described as: "Proceeds from investment by noncontrolling interests and redeemable noncontrolling interests in subsidiaries" Question: Is this cash raised through some kind of debt obligation? Like bonds sold to some private entity?

The other big line item for cash raised is about 780M USD from "long term debt". How is this different from the 750M mentioned above?

About 400M USD in raised $ comes from Solar Bonds and asset backed notes, which I understand. The SolarCity website has a section where I could actually buy bonds directly from them.

As I understand it, the basic business model for SolarCity is to spend a lot of $ up front deploying Leased Solar Arrays to homes and businesses, and realize cash flows over the 20 year lease period[paying for the cost of the hardware and/or the electricity the panels generate]. This seems to be similar to Internet services companies (like a health insurance brokerage), which spend a lot of money upfront in the hopes of realizing subscription revenue that will eventually greatly exceed the upfront cost.

I guess one could attempt to model the expected cash flows and attempt to see when SolarCity begins to take in more $ than they expend in expansion. In the first 3Q of this year they took in about 285M USD in revenue. I am trying to figure out what this year's massive capital investment will yield next year.

I believe the noncontroling interest line refers to the contribution of tax equity partners. They provide project equity in exchange for the Investment Tax Credits, accelerated depreciation and a portion of customer payments.

Regarding your second question, tax equity and debt are two separate sources of funding.

You will want to read the recent Analyst Day presentation deck to understand management's strategy and the sort of metrics they use to track progress along that strategic path. It is a complex business model, so it will take a fair amount of time to digest it all. In this forum we have debated just about every conceivable angle on this business. So we'll be happy to engage any questions you may have.

jhm

Well-Known Member

Events & Presentations - SolarCity

Find the Analyst Day on this page under archived events, December 15, 2015.

Find the Analyst Day on this page under archived events, December 15, 2015.

anticitizen13.7

Not posting at TMC after 9/17/2018

Events & Presentations - SolarCity

Find the Analyst Day on this page under archived events, December 15, 2015.

Thanks. Page 19, which discusses the Tax Equity partnerships, pointed me in the right direction. I did not understand that the "partnership" referred to entities owned jointly by SolarCity and financial companies providing the capital for the purpose of optimizing the distribution of tax benefits and $ flow.

The example of the economics of a hypothetical deal are helpful, but I wonder about the specifics of the actual partnership or LLC agreements with the other companies like Goldman and Google.

Broadly speaking, what are the risks of such arrangements for SolarCity? The continuance of the ITC was one such risk, but I saw on the news it was extended. Depreciation and cash flow are the other 2 factors. Depreciation would seem to be a fairly constant item, absent book cooking. Cash flow is likely only a problem if a lot of hardware goes bad or customers don't pay their monthly bills (as in the sub-prime crisis), though SolarCity claims to have generally creditworthy customers.

TSLA is fairly straightforward to understand in comparison to SCTY

I'm reading through this entire thread... I'm only on page 16 or so

Couldn't keep up with this thread the last several days with the Holidays going on, but I've had a chance to catch up and wanted to say thanks for all the links. Seems the battles are starting to heat up with this transition.

jhm - I really like your idea about keeping up with the oil/utility industry and digging into some of those articles on oilprice.com. Not sure if I have the time, but I'll start checking some of them out as well.

jhm - I really like your idea about keeping up with the oil/utility industry and digging into some of those articles on oilprice.com. Not sure if I have the time, but I'll start checking some of them out as well.

jhm

Well-Known Member

Couldn't keep up with this thread the last several days with the Holidays going on, but I've had a chance to catch up and wanted to say thanks for all the links. Seems the battles are starting to heat up with this transition.

jhm - I really like your idea about keeping up with the oil/utility industry and digging into some of those articles on oilprice.com. Not sure if I have the time, but I'll start checking some of them out as well.

Thanks, with investments in Tesla, SolarCity and other solar compqnies, I find it important to understand the overall energy transition that is in play. I can't help be think that much of the extreme polarization in these stocks has mostly to do with the blindness of incumbent energy sector. The denial and vehement hatred of renewables betrays an insecure and increasingly threatened world view. The whole energy sector is having its Kodak moment, and psychological defense mechanisms are on high alert. As long as energy investors are in denial, the market will systematically over value investments in fossil fuels and its infrastrures while under valuing renewables and Tesla. I think this massive denial is what gives renewable investors a persistent advantage.

durkie

Member

Not news to any regulars on this thread, but another article laying out the stranded asset case: Why Big Oil Should Kill Itself by Anatole Kaletsky - Project Syndicate

Renewable energy is a big part of these predictions, but the article also points out how shale producers force OPECs hand: OPEC can limit supply to drive prices upwards (and send more business to shale producers) or they can keep production steady, which depresses prices and drains reserves.

So now that oil is subject to actual competitive forces, we should just use the cheapest oil we can get. Oil companies in turn should take this time to gracefully exit from their incredibly expensive quests for new and harder-to-develop reserves, since there's little reason it will make economic sense to produce from those sources in the absence of a cartel to protect prices.

Renewable energy is a big part of these predictions, but the article also points out how shale producers force OPECs hand: OPEC can limit supply to drive prices upwards (and send more business to shale producers) or they can keep production steady, which depresses prices and drains reserves.

So now that oil is subject to actual competitive forces, we should just use the cheapest oil we can get. Oil companies in turn should take this time to gracefully exit from their incredibly expensive quests for new and harder-to-develop reserves, since there's little reason it will make economic sense to produce from those sources in the absence of a cartel to protect prices.

jhm

Well-Known Member

Not news to any regulars on this thread, but another article laying out the stranded asset case: Why Big Oil Should Kill Itself by Anatole Kaletsky - Project Syndicate

Renewable energy is a big part of these predictions, but the article also points out how shale producers force OPECs hand: OPEC can limit supply to drive prices upwards (and send more business to shale producers) or they can keep production steady, which depresses prices and drains reserves.

So now that oil is subject to actual competitive forces, we should just use the cheapest oil we can get. Oil companies in turn should take this time to gracefully exit from their incredibly expensive quests for new and harder-to-develop reserves, since there's little reason it will make economic sense to produce from those sources in the absence of a cartel to protect prices.

This is a pretty good piece. However, the author is still of the mind that renewables are not yet at price parity with fossil fuels. He sees this as a future development when at the margins it has already happened. It is certainly not necessary for renewables to be cheaper than fossils in every application. If renewables are able to address just 5% of the market for fossil fuels, this is sufficient to create a glut until 5% market share is taken from fossils.

But even at a gross level, solar already is cheaper than oil. Consider a solar PPA at $40/MWh. There are 5.8 MMBTU per barrel crude oil, and an oil-fired generator uses 10.33 MMBTU to make 1 MWh. Thus, ignoring the cost of refining and shipping oil to make it useful, a $40/MWh PPA is at parity with crude at $22.41/bbl. Or if one wants to back out 30% ITC (as if any energy prices are free of political influences anywhete), then we have solar at $57/MWh is at parity with $32.08/bbl. Either way crude is trading at a premium to solar per unit of electricity.

I believe that OPEC understands that oil cannot trade at too high of a premium to solar or any other energy source. It has often been said that solar does not really compete with oil because not much oil is used for electricity production. But in 2012, 5% of electricity was petroleum-based, about 1.13 TWh. This amounts to about 5.5 mb/d of demand for crude, or about 6% of total crude consumption. Because solar power can be obtained local just about anywhere, solar competes with the 5.5 mb/d oil demand in a way that is inaccessible to coal or natural gas, though LNG can make in roads too. Obviously, if oil is priced at too much of a premium to solar, it will lose market share. Moreover, with batteries solar could take 5 mb/d or more. Now it takes about 145 GW of solar to offset 1 mb/d of oil. So while OPEC thinks about putting a cap on production to cut output 1 mb/d, they also have to consider the impact of higher oil prices pushing 145 GW of solar into oil-fired generation markets. So with $32/bbl at parity with $57/MWh, oil above $64 allows utility scale solar in this market to breakeven in about 7 years. Now this is not even considering the cost of refining or shipping, so all-in savings can accumulate even faster. These other costs continue to make solar energy cheaper than oil generation when oil is under $32/bbl, just look at Hawaii. Even so, the uptake of solar would be much faster with oil over $60. So the folly of OPEC pushing the price back up to $60 is that in just two years at this price solar could wipe out over 1 mb/d in demand. As it stands, the world will install about 70 GW solar in 2016, growing at just 30%, but if oil were still floating around $90, solar would go into hyper growth, say 50% per year, 115 GW in 2016 and 170 GW in 2017. OPEC knows they can't afford to prime that powder keg.

Gerardf

Active Member

This is a pretty good piece. However, the author is still of the mind that renewables are not yet at price parity with fossil fuels. He sees this as a future development when at the margins it has already happened. It is certainly not necessary for renewables to be cheaper than fossils in every application. If renewables are able to address just 5% of the market for fossil fuels, this is sufficient to create a glut until 5% market share is taken from fossils.

But even at a gross level, solar already is cheaper than oil. Consider a solar PPA at $40/MWh. There are 5.8 MMBTU per barrel crude oil, and an oil-fired generator uses 10.33 MMBTU to make 1 MWh. Thus, ignoring the cost of refining and shipping oil to make it useful, a $40/MWh PPA is at parity with crude at $22.41/bbl. Or if one wants to back out 30% ITC (as if any energy prices are free of political influences anywhete), then we have solar at $57/MWh is at parity with $32.08/bbl. Either way crude is trading at a premium to solar per unit of electricity.

I believe that OPEC understands that oil cannot trade at too high of a premium to solar or any other energy source. It has often been said that solar does not really compete with oil because not much oil is used for electricity production. But in 2012, 5% of electricity was petroleum-based, about 1.13 TWh. This amounts to about 5.5 mb/d of demand for crude, or about 6% of total crude consumption. Because solar power can be obtained local just about anywhere, solar competes with the 5.5 mb/d oil demand in a way that is inaccessible to coal or natural gas, though LNG can make in roads too. Obviously, if oil is priced at too much of a premium to solar, it will lose market share. Moreover, with batteries solar could take 5 mb/d or more. Now it takes about 145 GW of solar to offset 1 mb/d of oil. So while OPEC thinks about putting a cap on production to cut output 1 mb/d, they also have to consider the impact of higher oil prices pushing 145 GW of solar into oil-fired generation markets. So with $32/bbl at parity with $57/MWh, oil above $64 allows utility scale solar in this market to breakeven in about 7 years. Now this is not even considering the cost of refining or shipping, so all-in savings can accumulate even faster. These other costs continue to make solar energy cheaper than oil generation when oil is under $32/bbl, just look at Hawaii. Even so, the uptake of solar would be much faster with oil over $60. So the folly of OPEC pushing the price back up to $60 is that in just two years at this price solar could wipe out over 1 mb/d in demand. As it stands, the world will install about 70 GW solar in 2016, growing at just 30%, but if oil were still floating around $90, solar would go into hyper growth, say 50% per year, 115 GW in 2016 and 170 GW in 2017. OPEC knows they can't afford to prime that powder keg.

Very insightful post about he tricky position oil producers & oil producing countries are in. Thanks.

If companies like Shell, BP, Exxon etc do not act now and turn into energy companies instead of oil companies, they might get in big trouble soon. Best option for them could actually be to become energy storage & energy producers by investing in solar cell & battery cell production.

Once investors start moving away from them in bigger number than they already do now, they will no longer have the funds & credit to invest in large solar and energy storage, and their current customers (the utilities, car companies and consumers) will no longer need them and do that themselves in growing numbers.

jhm

Well-Known Member

Very insightful post about he tricky position oil producers & oil producing countries are in. Thanks.

If companies like Shell, BP, Exxon etc do not act now and turn into energy companies instead of oil companies, they might get in big trouble soon. Best option for them could actually be to become energy storage & energy producers by investing in solar cell & battery cell production.

Once investors start moving away from them in bigger number than they already do now, they will no longer have the funds & credit to invest in large solar and energy storage, and their current customers (the utilities, car companies and consumers) will no longer need them and do that themselves in growing numbers.

I think that is a really tough transition for oil companies. They may have capital for now, but lack competitive competency in alternative energy. So their investors are not likely to go along with this. If you're an oil-focused investor in Exxon and they start delving deeply into solar and batteries, you think management is waiting money on terrible investment, so you're not happy. If you are a shareholder in Exxon who happens to see the potential in batteries and solar, then you're already invested in competent pure plays. NRG ran into this problem with splitting it's investors. So it is spinning off the renewable business into a separate company. The other sort of option is for an oil company to focus on returning capital to investors as the oil market shrinks. The big problem for investors is wasting capital on new exploration and development leading to an oversupply of the market. So consider the $650B that oil companies are investing in expanding reserves. If these companies simply return that to shareholder as stick repurchase and dividends, the glut could be minimized, the price of oil stabilized, and oil investors satisfied with their return on investment. Note also that vertically integrated oil majors can do quite well on other parts of the supply chain, refining, distribution and retail.

TheTalkingMule

Distributed Energy Enthusiast

Importing industry.

How does a state like Nevada with no inherent energy industry push renewables out? Protecting entrenched utility companies is an obvious enough incentive, but how do you put off importing millions of dollars in tax revenue?

It's obvious enough why Pennsylvania's legislators protect the natural gas industry, we're awash in methane and lots of folks are employed by frackers so we're somewhat willing to be influenced against our own interest. But the economic impact for a state like Nevada must be astronomically negative.

Are there any good articles out there calculating the financial impact to a "non-energy" state's bottom line? What kind of return can NY expect if they turn western NY into the solar hub of the east coast?

How does a state like Nevada with no inherent energy industry push renewables out? Protecting entrenched utility companies is an obvious enough incentive, but how do you put off importing millions of dollars in tax revenue?

It's obvious enough why Pennsylvania's legislators protect the natural gas industry, we're awash in methane and lots of folks are employed by frackers so we're somewhat willing to be influenced against our own interest. But the economic impact for a state like Nevada must be astronomically negative.

Are there any good articles out there calculating the financial impact to a "non-energy" state's bottom line? What kind of return can NY expect if they turn western NY into the solar hub of the east coast?

Jack6591

Active Member

Excerpted from Governor's Sandoval's Statement

I am particularly hopeful that we will hear more from the Nevada Bureau of Consumer Protection and the Nevada Consumer Advocate. The Nevada Consumer Advocate is an independent office created by law with the statutory charge to protect the interests of all Nevada consumers. I, like other Nevada ratepayers, look forward to hearing more from the Consumer Advocate and his position on the PUC's final order.

I await the PUC's final decision and remain committed to working with the renewable energy industry and Consumer Advocate moving forward,” said Governor Brian Sandoval.

For myself, I do not understand this decision being "retroactive". I cannot imagine a legal standing for it being imposed retroactively.

Importing industry.

How does a state like Nevada with no inherent energy industry push renewables out? Protecting entrenched utility companies is an obvious enough incentive, but how do you put off importing millions of dollars in tax revenue?

It's obvious enough why Pennsylvania's legislators protect the natural gas industry, we're awash in methane and lots of folks are employed by frackers so we're somewhat willing to be influenced against our own interest. But the economic impact for a state like Nevada must be astronomically negative.

Are there any good articles out there calculating the financial impact to a "non-energy" state's bottom line? What kind of return can NY expect if they turn western NY into the solar hub of the east coast?

I am particularly hopeful that we will hear more from the Nevada Bureau of Consumer Protection and the Nevada Consumer Advocate. The Nevada Consumer Advocate is an independent office created by law with the statutory charge to protect the interests of all Nevada consumers. I, like other Nevada ratepayers, look forward to hearing more from the Consumer Advocate and his position on the PUC's final order.

I await the PUC's final decision and remain committed to working with the renewable energy industry and Consumer Advocate moving forward,” said Governor Brian Sandoval.

For myself, I do not understand this decision being "retroactive". I cannot imagine a legal standing for it being imposed retroactively.

Jack6591

Active Member

Governor Sandoval's response to the Solar Industry (Lyndon Rive)

Sandoval Issues Statement Regarding Solar Industry Critique of Solar Industry Ruling

Sandoval Issues Statement Regarding Solar Industry Critique of Solar Industry Ruling

dha

Member

Short Situation Update:

As of this morning, ETrade does seem to have some shares available for me to borrow whereas there were absolutely no shares to borrow last week. I am still getting a "hard to borrow" warning with an "Estimated Borrow Rate" of 35%. It does appear that the shorties are covering!

OptionsHouse still gives me the following error message when I attempt to short: "This stock is not available to borrow. Short sales cannot be accepted."

As of this morning, ETrade does seem to have some shares available for me to borrow whereas there were absolutely no shares to borrow last week. I am still getting a "hard to borrow" warning with an "Estimated Borrow Rate" of 35%. It does appear that the shorties are covering!

OptionsHouse still gives me the following error message when I attempt to short: "This stock is not available to borrow. Short sales cannot be accepted."

- Status

- Not open for further replies.

Similar threads

- Replies

- 4

- Views

- 2K

- Replies

- 6

- Views

- 11K

- Replies

- 741

- Views

- 312K

- Replies

- 23

- Views

- 5K

B