RSI went straight up on the 1 and 2 hr charts. Don't know if that means we keep going or pull back. I would have made a lot more money on my CCs had I waited a little....

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

jeewee3000

Active Member

This price action seems to hold true to what @dl003 posted a few days ago:

- low 160's by end of May;

- but before that, bounce around $168 to $180-ish "on news"

- then leg down to low $160's.

Even though last Friday AH that theory was questioned (since we went to $167,x, below $168), the price action today seems in line with the above.

Around $175 I flipped some sold puts into covered calls. Will do more of that if we get to $180.

EDIT: whilst writing dl all but confirmed my post lol

- low 160's by end of May;

- but before that, bounce around $168 to $180-ish "on news"

- then leg down to low $160's.

Even though last Friday AH that theory was questioned (since we went to $167,x, below $168), the price action today seems in line with the above.

Around $175 I flipped some sold puts into covered calls. Will do more of that if we get to $180.

EDIT: whilst writing dl all but confirmed my post lol

All because Deep Kitty Litter posted a cryptic picture...?Should have bought GME calls...holy *sugar*.

Stock has been halted - gotta help the poor short sellers out you know

Let's just say the stock has more room to run today. It touched 173.86 and bounced just now, so I expect it will touch 173.86 again after spiking from here, if it spikes. So if you're wondering what you should do if you're sweating CCs, I'd wait for that retest, if there is going to be a retest. Probably tomorrow/Wednesday, and go from there.

EDIT: as I was typing this, it went lower. So take note of the coming bottom when it finally spikes up again, that'll be your "safe" magnet. Not saying it will spike up again, just that if it spikes, take note of the spot where it bounces.

EDIT: as I was typing this, it went lower. So take note of the coming bottom when it finally spikes up again, that'll be your "safe" magnet. Not saying it will spike up again, just that if it spikes, take note of the spot where it bounces.

dc_h

Active Member

The color issue is especially true in the USA where you have two plants. Why not make different colors in the two plants.Tesla has a pile of cash that has been earning interest, so I assume that will offset some of the cost and they could underwrite a lot of it themselves?

Regarding stimulating demand, I really don't understand why Tesla doesn't introduce new paint colours. What they currently offer is very boring. I would personally bring a ne limited run colour every year, something a bit more adventurous, like lime green, pink, orange, etc.

Well, sure would be nice if it popped to $180 so I could step away from my puts and finally shift to wide strangles going forwards...Let's just say the stock has more room to run today. It touched 173.86 and bounced just now, so I expect it will touch 173.86 again after spiking from here, if it spikes. So if you're wondering what you should do if you're sweating CCs, I'd wait for that retest, if there is going to be a retest. Probably tomorrow/Wednesday, and go from there.

EDIT: as I was typing this, it went lower. So take note of the coming bottom when it finally spikes up again, that'll be your "safe" magnet. Not saying it will spike up again, just that if it spikes, take note of the spot where it bounces.

Let's just say the 1st move has completed. 172.5 is the spot to fix or close your CCs. It can go lower than 172.5 if the move has completed, no question about it. But the window starts there. If this is just a DCB, which I very much suspect it is, it can go crazy real quick. Shorts have fear, too.The idea is a full move rarely exceeds 4.618x of the first leg. If it goes the full 4.618x or even 5.618x and then pulls back, close my CCs after the pullback has gone retraced at least 40% of the move.

thenewguy1979

"The" Dog

That mean we go down now? Or bigger bounce up?Let's just say the 1st move has completed. 172.5 is the spot to fix or close your CCs.

Even though this is a DCB, I suspect it will spike up again. If the 1st leg terminated at 175.xx, then 172.5 is where it will begin to look for bottom of the pullback. Now, it'd be crazy if both the spike and the pullback terminated on the same day, but this is TSLA.That mean we go down now? Or bigger bounce up?

aerocristobal

Member

Etrade decided the market didn't need to be open today.

It's over an hour into the trading day and still completely hosed. At least I could log in finally

It's over an hour into the trading day and still completely hosed. At least I could log in finally

ChiefRollo

Member

I still can't (log in).Etrade decided the market didn't need to be open today.

View attachment 1046718

It's over an hour into the trading day and still completely hosed. At least I could log in finally

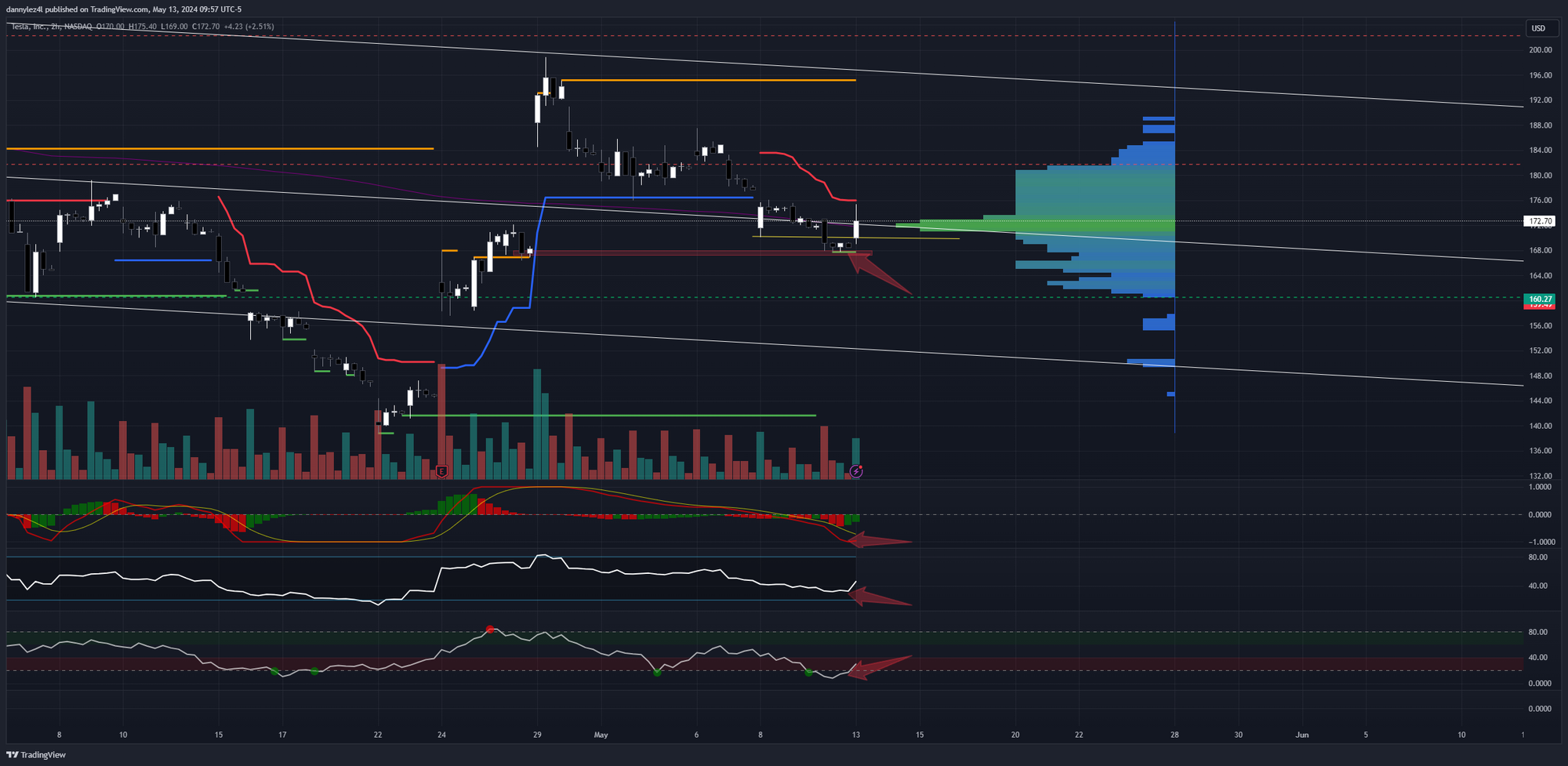

This is what it looked like on the 2H

Retested the breakout level at 168

Norm. MACD (2nd panel) showed peak bearish momentum

RSI (3rd) and MFI (4th) both showed oversold condition.

Meanwhile, the 4H is still very far from showing these signs, which is why I think this is a DCB. To sustain a move higher than 200, we need at least the 4H to be cheap.

Retested the breakout level at 168

Norm. MACD (2nd panel) showed peak bearish momentum

RSI (3rd) and MFI (4th) both showed oversold condition.

Meanwhile, the 4H is still very far from showing these signs, which is why I think this is a DCB. To sustain a move higher than 200, we need at least the 4H to be cheap.

dc_h

Active Member

Annoyed at myself. I sold 20 187.5 calls too soon this morning. Busy and didn't wait for a top. Closed 165 puts as we hit 175 and will be glad not to sweat them this week. Would still like to see green on the Model Y too.Where is everyone? All in a state of shock at the green colour the chart??

187.50 seems a pretty safe strike to me, maybe you left some premium on the table, but I'd swap -p165's for -c187.50's if I could...Annoyed at myself. I sold 20 187.5 calls too soon this morning. Busy and didn't wait for a top. Closed 165 puts as we hit 175 and will be glad not to sweat them this week. Would still like to see green on the Model Y too.

dc_h

Active Member

I'll roll them down as the week progresses, assuming we don't run into the 180's and try to roll in some July 220 calls.187.50 seems a pretty safe strike to me, maybe you left some premium on the table, but I'd swap -p165's for -c187.50's if I could...

Is it me or is this DCB beginning to look a bit tired now...?

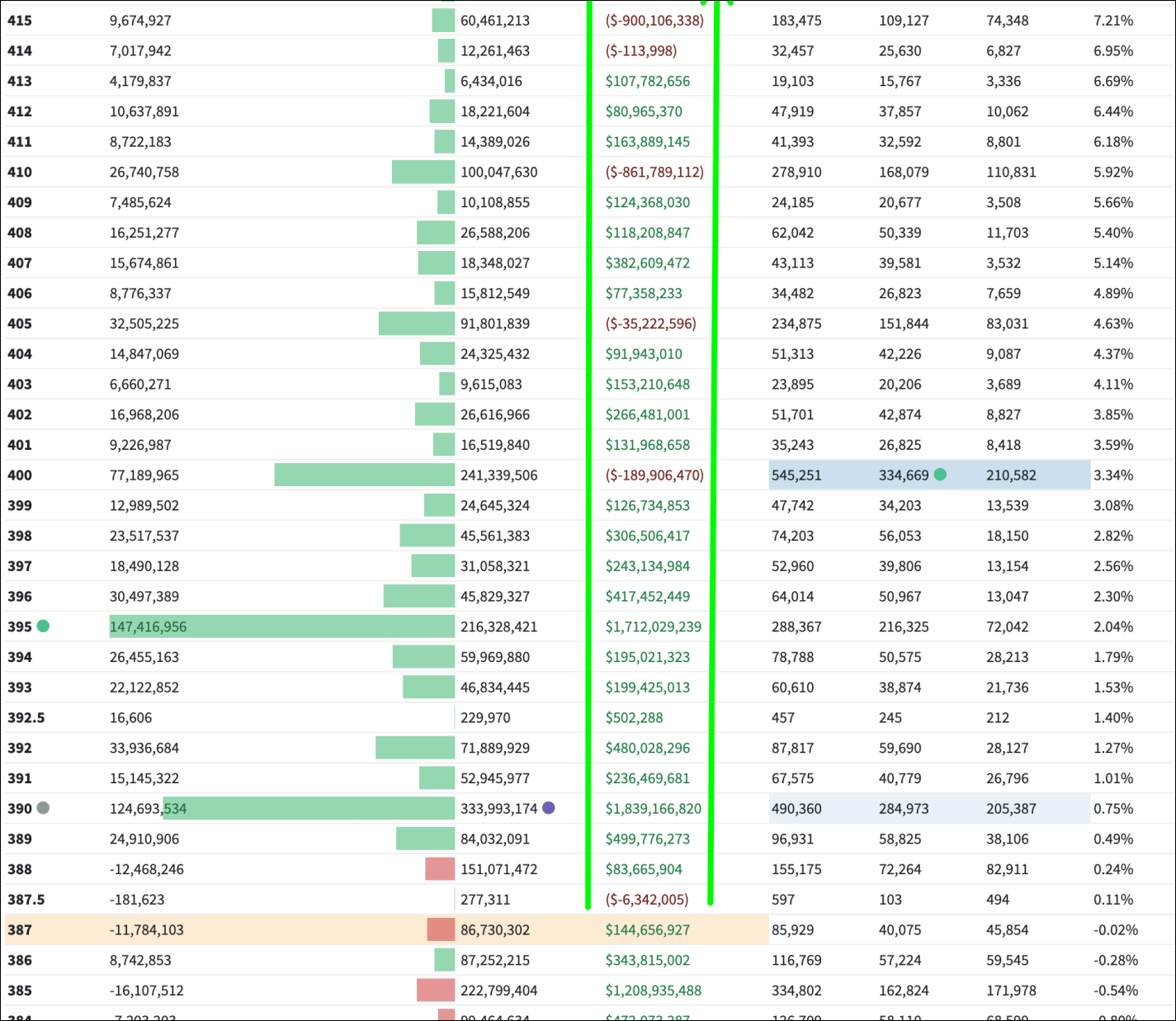

Using Notional Delta Data:

When Notional Delta column is mostly green = good indication of price heading higher with less resistance; mostly red=resistance/downward pressure.

(It doesn't mean price has to go in the direction, but rather that it will be met with less or more resistance and can expect supply zones to be dried up quicker.)

For example, this is an old snapshot of the SPY's GEX. Notice there's very little Green GEX and the notional delta column was all red. Indeed SPY was red.

Compared to this GEX profile, which has green all around (bullish):

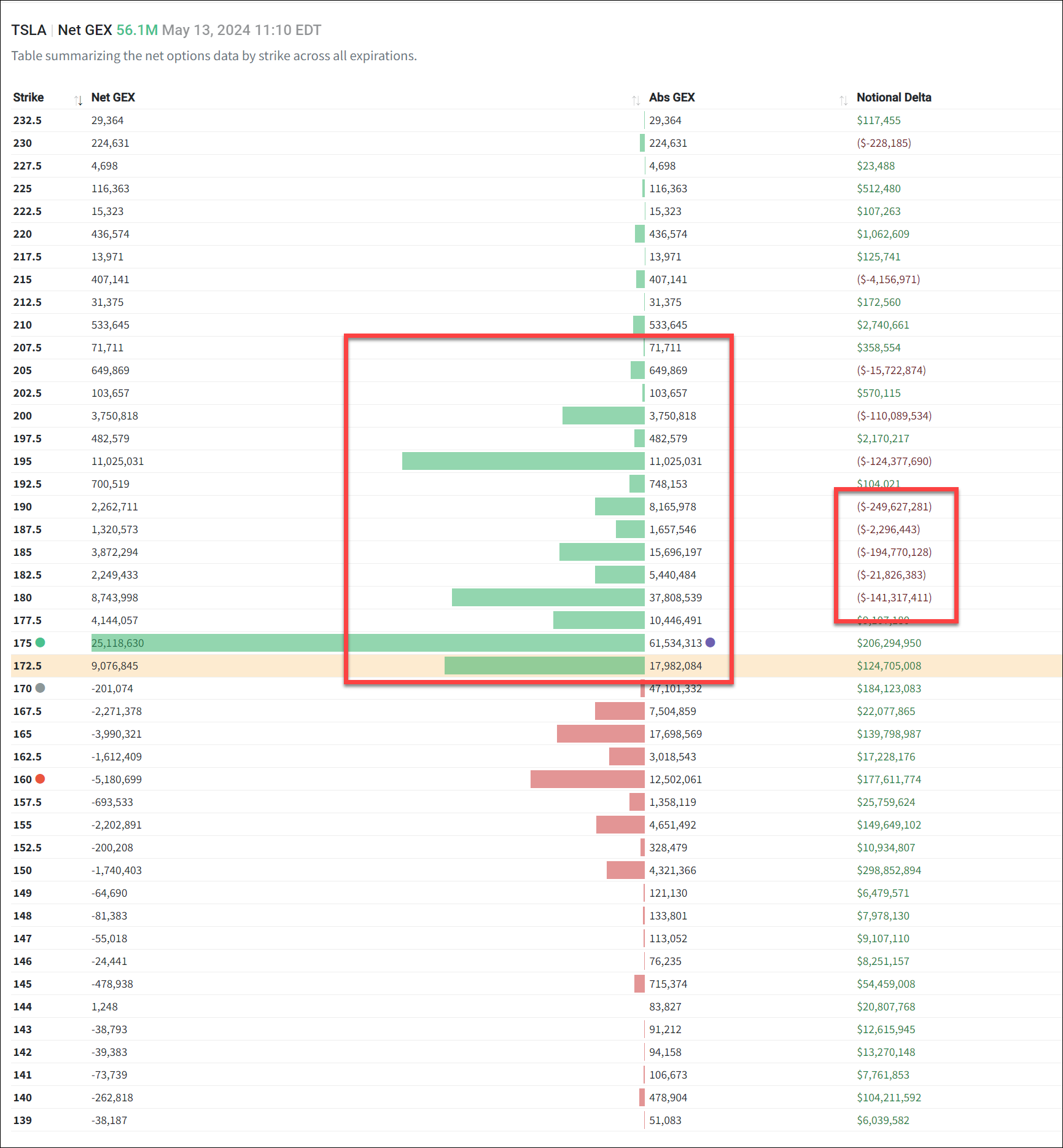

Bringing this to TSLA, this is this week's GEX/Delta 5/17 data:

Green on GEX side = Good for upward support

Decent Green on Notional Delta = Good for upward support as well, but the few reds can act as bumps/resistance, depending how large they are. When Notional Delta is fully red, then caution is advised if expecting a run.

Here: Majority of $180-195 is negative Notional Delta. $175 is the important strike though, it needs to hold above 175 in order for it to have a shot at 180. Note: Notional Delta is not highly important on individual stocks (better on inidexes), it's just another tell.

When Notional Delta column is mostly green = good indication of price heading higher with less resistance; mostly red=resistance/downward pressure.

(It doesn't mean price has to go in the direction, but rather that it will be met with less or more resistance and can expect supply zones to be dried up quicker.)

For example, this is an old snapshot of the SPY's GEX. Notice there's very little Green GEX and the notional delta column was all red. Indeed SPY was red.

Compared to this GEX profile, which has green all around (bullish):

Bringing this to TSLA, this is this week's GEX/Delta 5/17 data:

Green on GEX side = Good for upward support

Decent Green on Notional Delta = Good for upward support as well, but the few reds can act as bumps/resistance, depending how large they are. When Notional Delta is fully red, then caution is advised if expecting a run.

Here: Majority of $180-195 is negative Notional Delta. $175 is the important strike though, it needs to hold above 175 in order for it to have a shot at 180. Note: Notional Delta is not highly important on individual stocks (better on inidexes), it's just another tell.

Last edited:

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K