Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

MASTER THREAD: Tesla Insurance Services in California

- Thread starter BobAbooey

- Start date

Kleenerth3

Member

According to the rep I spoke with, yes. I think this is part of the decision process they go through, whether or not you get a loaner Tesla or not.Does Tesla cover a rental car for as long as your vehicle is down for repairs no matter how long it takes? That would be a nice benefit if it did.

OCR1

Active Member

According to the rep I spoke with, yes. I think this is part of the decision process they go through, whether or not you get a loaner Tesla or not.

That is a good benefit. I just looked at my Amica policy and I was limited to $20/day and $600 max for rental car coverage. That’s not nearly enough to cover the potential downtime on a Tesla. I just increased the policy to no daily limit, $5,000 max per accident. It increased my premium by $89.00 per year, which seemed reasonable to me.

mnsweeps

Member

Kleenerth3

Member

Have you tried calling

844-348-3752 ?

That's the number I have to use from the policy form. Give it a shot...

844-348-3752 ?

That's the number I have to use from the policy form. Give it a shot...

Kleenerth3

Member

Look at the last post...I got the quote on day 1 and 2 and played around with diff options.. starting day 3 , I have been getting this error message...no one seems to help..

Forgot to hit reply the first time.

Resist

Active Member

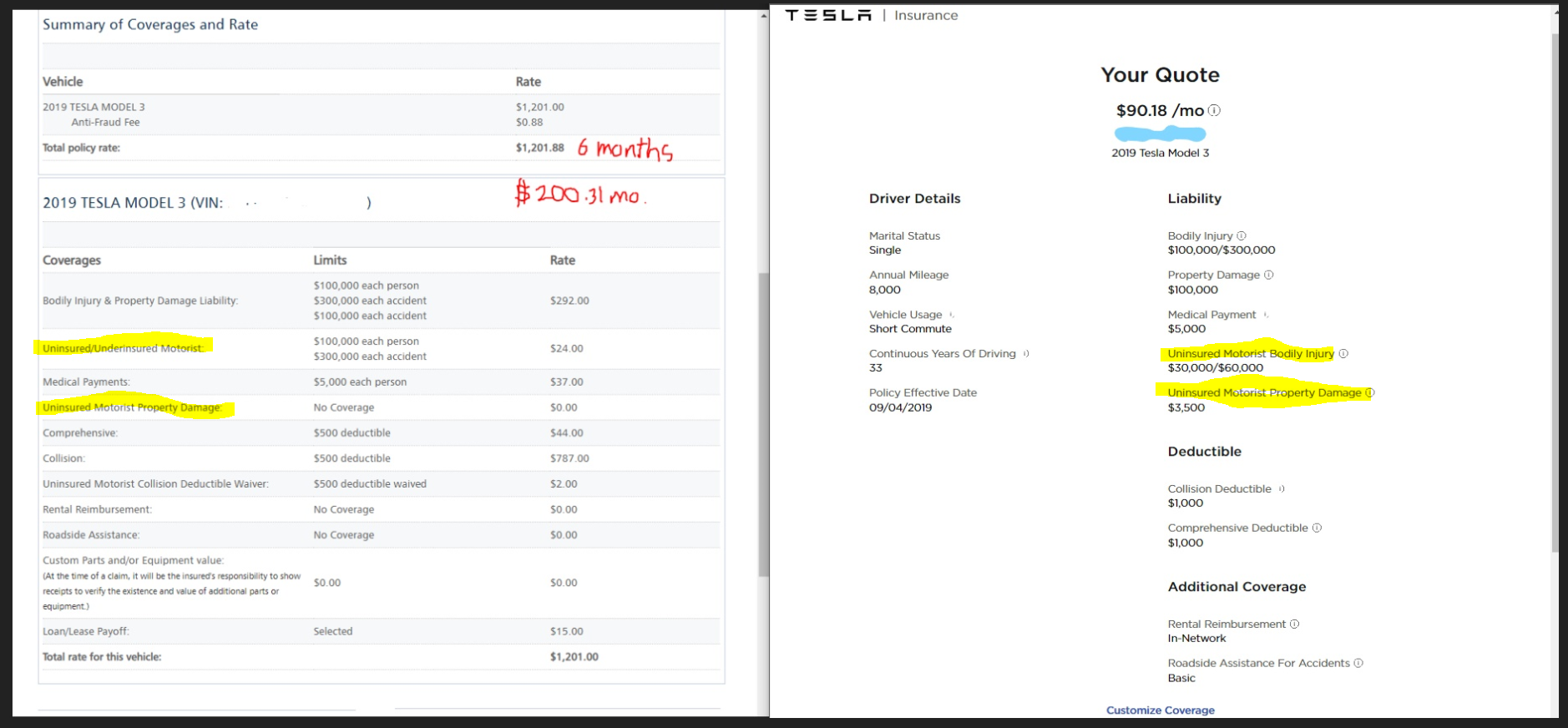

I've noticed something that is of great concern with Tesla's insurance. The Uninsured Motorist Property Damage is fixed at $3,500. This covers expenses for damage to your car caused by an at-fault driver who doesn't have insurance or by a hit-and-run or miss-and-run. How is our Tesla supposed to be repaired with only $3,500?

woodisgood

Optimustic Pessimist

I've always had a very poor understanding of UMPD, and in what cases it's important. My understanding is that collision coverage covers the damage to your vehicle in the event of being hit by an uninsured motorist or in a hit-and-run, but they make it sound like if you don't get UMPD you're completely screwed if you have a run-in with an uninsured motorist. So they cover the same thing, but there must be a reason for its existence. Progressive also has a very puny UMPD. Maybe it's a compliance product? I know it's required in some states.

jamnmon66

Member

I think uninsured motorist is paired (optionally) with liability only coverage. If you get collision, then uninsured motorist coverage is included. But, it's been a long time since I looked at it so I might be wrong. Hopefully we'll get more input from the rest of the group.

Resist

Active Member

If you read the "i" next to the Uninsured Motorist Property Damage section, it specifically says...

"Covers expenses for damage to your car caused by an at-fault driver who doesn't have insurance (uninsured) or by a hit-and-run or miss-and-run."

This tells me that their insurance only covers $3,500 worth of repairs. None of the other headings covers repairs to your vehicle.

Either way, Tesla insurance would only save me around $18 a year, when comparing it with the same amounts of my current insurance.

"Covers expenses for damage to your car caused by an at-fault driver who doesn't have insurance (uninsured) or by a hit-and-run or miss-and-run."

This tells me that their insurance only covers $3,500 worth of repairs. None of the other headings covers repairs to your vehicle.

Either way, Tesla insurance would only save me around $18 a year, when comparing it with the same amounts of my current insurance.

ibGeek

Member

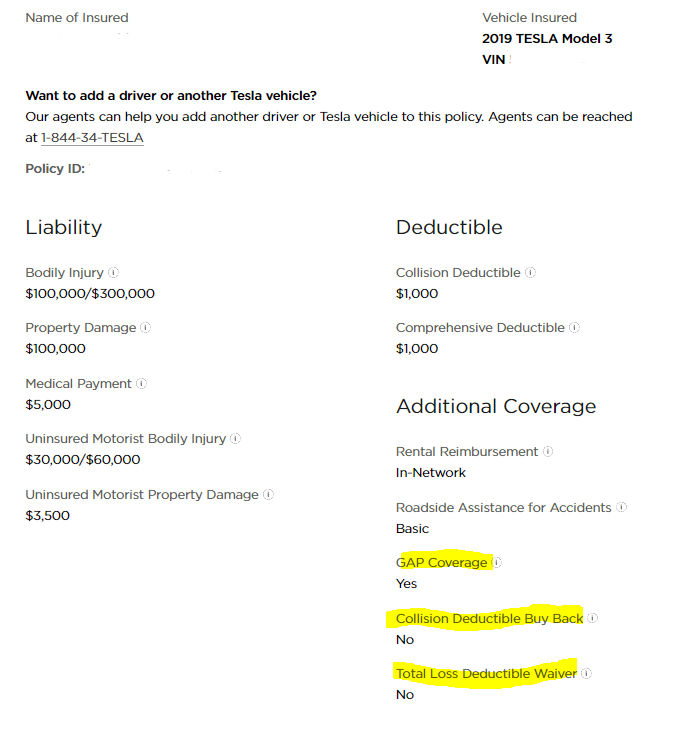

As a Tesla insurance customer I can tell you that all numbers can be adjusted. You just need to call them and ask them to make the changes you want. I called after I started my policy and added Loan payoff to my policy for $3.00 more a month.

I want to also point out that my progressive policy (which cost 2 times as much) had zero coverage for property damage.

I did make some changes to my coverage but if I had kept UM bodily injury at the same as Progressive, my rate would still be less than half of Progressive. I live around 20 mins north of the Fremont Factory. Hope that helps.

I want to also point out that my progressive policy (which cost 2 times as much) had zero coverage for property damage.

I did make some changes to my coverage but if I had kept UM bodily injury at the same as Progressive, my rate would still be less than half of Progressive. I live around 20 mins north of the Fremont Factory. Hope that helps.

r1200gs4ok

Active Member

Resist

Active Member

I know the numbers can be adjusted, but not Uninsured Motorist Property Damage, it had only one amount of $3,500. Not sure how Progressive allowed you to have zero coverage for property damage, when in California the legal minimum is $5k.As a Tesla insurance customer I can tell you that all numbers can be adjusted. You just need to call them and ask them to make the changes you want. I called after I started my policy and added Loan payoff to my policy for $3.00 more a month.

I want to also point out that my progressive policy (which cost 2 times as much) had zero coverage for property damage.

I did make some changes to my coverage but if I had kept UM bodily injury at the same as Progressive, my rate would still be less than half of Progressive. I live around 20 mins north of the Fremont Factory. Hope that helps.

View attachment 450646

I have roughly the same coverage as you with Farmers and I only pay $447 every 6 months.

Last edited:

ibGeek

Member

I know the numbers can be adjusted, but not Uninsured Motorist Property Damage, it had only one amount of $3,500. Not sure how Progressive allowed you to have zero coverage for property damage, when in California the legal minimum is $5k.

No I mean they can be adjusted over the phone. They do not have loan pay off on their website at all. But when I called they added it no problem. The website is over simplified. I think/hope it will be improved soon, but any number can be adjusted, even if it's not on the website form.

ibGeek

Member

Here are 3 items that are available that are not on the form. You just call during business hours and they hook you up.

I played a lot with coverage. The item that make the biggest impact was annual miles driven. Everything else was fairly small in comparison.

I played a lot with coverage. The item that make the biggest impact was annual miles driven. Everything else was fairly small in comparison.

I've noticed something that is of great concern with Tesla's insurance. The Uninsured Motorist Property Damage is fixed at $3,500. This covers expenses for damage to your car caused by an at-fault driver who doesn't have insurance or by a hit-and-run or miss-and-run. How is our Tesla supposed to be repaired with only $3,500?

According to the California Department of Insurance, $3500 is the most allowed by law:

Automobile Insurance Information GuideUninsured motorist property damage (UMPD): This pays for the damage to your car from an accident with an uninsured driver who is at fault. The limit is $3,500. This only pays if the uninsured driver is identified. You may not need it if you have collision coverage.

Daniel in SD

(supervised)

In California collision insurance is required to cover property damage caused by an uninsured (or underinsured) motorists or hit and run. I'm not sure what the purpose of UMPD insurance is if you already have collision insurance (I don't have it). Maybe it covers the deductible?

Similar threads

- Replies

- 5

- Views

- 805

- Replies

- 16

- Views

- 934

- Replies

- 45

- Views

- 4K

- Replies

- 8

- Views

- 1K