Why do you say that?Rivian doesn't seem to be planning on making a profit on retail vehicles.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

All discussion of Rivian Automotive

- Thread starter RobStark

- Start date

Based on features Rivian must be very expensive to build and are still priced wrong IMO. I assume Rivian pricing is the primary source behind Musk's recent comment about good EVs being easier to build than to build profitably. IMO Rivian should be priced like Model X and Range Rover. Rivian easily competes at that level.Why do you say that?

Rivian production cost per unit is likely 2x+ the Model Y at medium volumes. ASP of preorder cars maybe $85-90K? Three years or more to work through the preorders.

I assume the Rivians price rise caused so many cancellations because many preorders were based undervaluation. I'm one of many who preordered/cancelled/reinstated for that reason. If Rivian wants to sell me a vehicle at below cost II will take it.

Rivian obviously took many lessons from Tesla. The lesson they seemed to have missed is that people will pay a lot for unique high performance. features.

Doesn't sound sustainable. So they'll make enough off of commercial and do service and charging networks?

They don't plan on making a profit for vehicles reserved before March 3,2022.

Up to 71k cars. Word on the street is half the customers that cancelled after the price hikes did not return after original prices were restored.

So they have to sell ~55k trucks at a loss over the next ~2.5 years?

I don't know if Tesla made any money on the first 55k vehicles delivered either.

They did.I don't know if Tesla made any money on the first 55k vehicles delivered either.

If you are talking gross margins: other than 2008 (first year of the Roadster: 500 delivered Feb 2008-June 2009), Tesla cars always made money on a yearly basis. Nearly always on a quarterly basis also with the Q3 2012 S ramp up/ Roadster ramp down showing a loss.

Development services were a loss in 2014.

Roadster period: 2,450 cars or so, 2012 saw 2,650 S delivered, most in Q4

Model S

22k cars in 2013

35k in 2014

Interesting if half of Rivian's customers did not return after the price hike reversal. Cleaned up their reservation list.

As good as the first vehicles seem I'm not sure I see a path to the high valuation the company received. Tesla has been ruthless with cost control on their vehicles. Rivian seems to be selling a whole lot of features at below cost. In five years 100K vehicles/year at $100K price per unit at small margins is a very modest car company.

I'm not critical of Rivian of not making money for years. Bezos certainly wouldn't have a problem with that plan. I just wonder what the path is to high revenue and reasonable margins.

As good as the first vehicles seem I'm not sure I see a path to the high valuation the company received. Tesla has been ruthless with cost control on their vehicles. Rivian seems to be selling a whole lot of features at below cost. In five years 100K vehicles/year at $100K price per unit at small margins is a very modest car company.

I'm not critical of Rivian of not making money for years. Bezos certainly wouldn't have a problem with that plan. I just wonder what the path is to high revenue and reasonable margins.

They did.

If you are talking gross margins: other than 2008 (first year of the Roadster: 500 delivered Feb 2008-June 2009), Tesla cars always made money on a yearly basis. Nearly always on a quarterly basis also with the Q3 2012 S ramp up/ Roadster ramp down showing a loss.

Development services were a loss in 2014.

Roadster period: 2,450 cars or so, 2012 saw 2,650 S delivered, most in Q4

View attachment 787791

Model S

22k cars in 2013

35k in 2014

View attachment 787790

The company lost money during those years.

You can shuffle around the numbers for COGS.

The company lost money during those years.

You can shuffle around the numbers for COGS.

Tesla lost money in the early years but nowhere near the rate at which Rivian is currently losing money at. Rivian needs to improve their financials tremendously and very fast or they will blow through their cash reserves in two years, leaving them in a very dangerous position.

Personally I though Rivian made a big mistake when they reversed the price hikes. Did they really think they weren’t going to be left with enough sales to keep their factory going? Or that their precious brand was going to get trashed? The price of everything is going up, Rivian vehicle price hikes would be soon forgotten.

Reversing the price hikes is costing about $1B over two years, and will trash the p/l for the next 8 quarters. You have to have a really big ego to believe it was worth $1B to do that.

To show a counter example, Tesla has a great brand but while also doing customer unfriendly things on a routine basis. Their new vehicle introductions are always chronically late. Their signature vehicles are both very expensive and often have defects. Their SC network is chronically overloaded in southern CA. FSD is a running joke for how many years now? My point being that a car company can get away with a lot and still be admired and respected.

Rivian should have stuck to their guns and done the right thing for the company.

Reversing the price hikes is costing about $1B over two years, and will trash the p/l for the next 8 quarters. You have to have a really big ego to believe it was worth $1B to do that.

To show a counter example, Tesla has a great brand but while also doing customer unfriendly things on a routine basis. Their new vehicle introductions are always chronically late. Their signature vehicles are both very expensive and often have defects. Their SC network is chronically overloaded in southern CA. FSD is a running joke for how many years now? My point being that a car company can get away with a lot and still be admired and respected.

Rivian should have stuck to their guns and done the right thing for the company.

The company lost money during those years.

You can shuffle around the numbers for COGS.

Are you claiming the R&D and/ or SG&A contained a material amount of misplaced CoGS?

They combined for $518 million in 2013.

Net loss was only $71 million pretax.

How do you explain the numbers if the vehicle sales were a net loss? That there was less than $71 million of actual R&D and SG&A?

With perfect hindsight perhaps Rivian should have done an early non-retroactive price hike with a warning. But the timing of that move would be early covid, and in reality having the confidence to implement that price increase would have been very unlikely.

Rivian is on their way to establish a good brand. But I have a hard time seeing where they can establish more than a niche product. Perhaps with Ford they were looking at the relationship Porsche has with VW. But Rivian found out that can't really work. Ford would take a huge risk not being expert in-house for all things EV.

I have no sense if Rivian is on track to become a highly efficient manufacturer. I'm too traumatized from the early claims about Fremont and the machine that builds the machine to investigate.

Rivian is on their way to establish a good brand. But I have a hard time seeing where they can establish more than a niche product. Perhaps with Ford they were looking at the relationship Porsche has with VW. But Rivian found out that can't really work. Ford would take a huge risk not being expert in-house for all things EV.

I have no sense if Rivian is on track to become a highly efficient manufacturer. I'm too traumatized from the early claims about Fremont and the machine that builds the machine to investigate.

Trucks aren't a niche/boutique product.

Rivian can easily expand to compact pickup/SUV and into full size pickup/SUV plus their rally car Subaru WRX type vehicle. They can go down market as volume increases and cut prices. This market position has the potential to outsell what Ford is doing at the moment,~6.3M vehicles world wide.

Plus there is Rivian's commercial vehicles.

Rivian can easily expand to compact pickup/SUV and into full size pickup/SUV plus their rally car Subaru WRX type vehicle. They can go down market as volume increases and cut prices. This market position has the potential to outsell what Ford is doing at the moment,~6.3M vehicles world wide.

Plus there is Rivian's commercial vehicles.

Doggydogworld

Active Member

Ford sold less than 4m vehicles worldwide last year. Less than 2m in the US.This market position has the potential to outsell what Ford is doing at the moment,~6.3M vehicles world wide.

Ford sold less than 4m vehicles worldwide last year. Less than 2m in the US.

I approximated a normal Ford year. Not pandemic year.

Rivian currently has a 150k unit capacity in Normal Illinois and permits to expand to 200k have been granted.

Rivians Georgia facility will have a 400k unit capacity with enough land to double that capacity.

Rivian is looking at a European factory in the UK, Serbia, and a few other European countries.

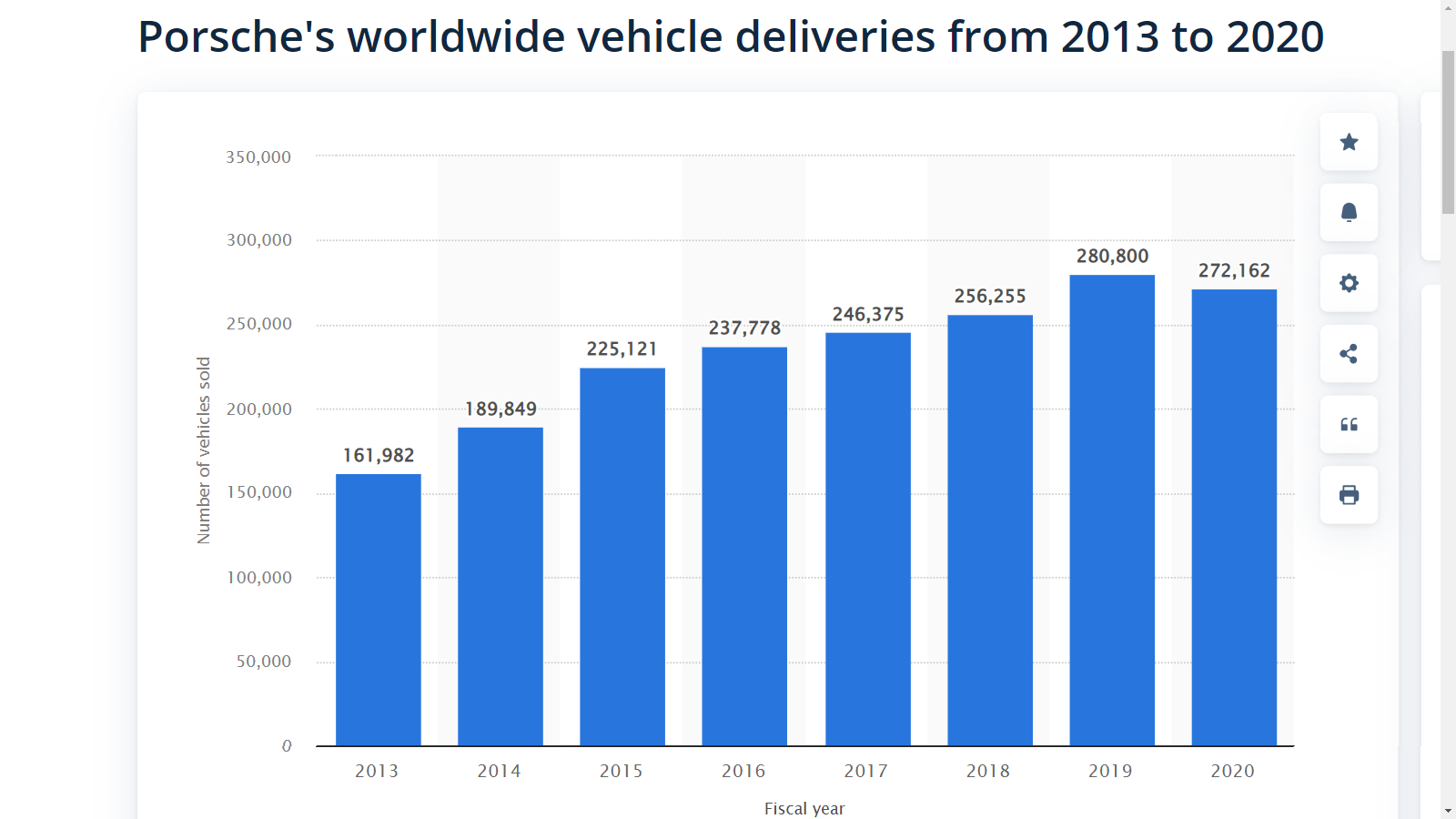

Rivian will likely go bankrupt if it can only generate Porsche levels of demand in 10 years. But I doubt that will be the case.

Rivian will not be to Ford what Porsche is to VW Group.

Rivians Georgia facility will have a 400k unit capacity with enough land to double that capacity.

Rivian is looking at a European factory in the UK, Serbia, and a few other European countries.

Rivian will likely go bankrupt if it can only generate Porsche levels of demand in 10 years. But I doubt that will be the case.

Rivian will not be to Ford what Porsche is to VW Group.

Rivian will likely go bankrupt if it can only generate Porsche levels of demand in 10 years. But I doubt that will be the case.

With a truck as good as the R1T demand likely won't be an issue for Rivian. However, they need to do two things very quickly:

1) Ramp production

2) Reduce spending & increase profitability

At the rate Rivian is burning through their cash their largest threat is running out of money before they can accomplish the above two goals.

That is my concern as well. Last I heard they were only producing about 20 vehicles per day.With a truck as good as the R1T demand likely won't be an issue for Rivian. However, they need to do two things very quickly:

1) Ramp production

2) Reduce spending & increase profitability

At the rate Rivian is burning through their cash their largest threat is running out of money before they can accomplish the above two goals.

Hopefully they did better in March but the low production numbers along with the recent pricing increase / roll back puts them in a bad place right now.

Doggydogworld

Active Member

Ford's sales didn't start a rapid decline in 2018 due to Covid. And they declined further in 2021 while overall vehicle sales rebounded. They've exited segments where they could no longer compete, e.g. US sedans. The bad news is they focused on segments which suffer when gas prices rise. The good news is they tend to get better gas mileage than the competition (thanks to Alan Mulally).

Ford's sales didn't start a rapid decline in 2018 due to Covid. And they declined further in 2021 while overall vehicle sales rebounded. They've exited segments where they could no longer compete, e.g. US sedans. The bad news is they focused on segments which suffer when gas prices rise. The good news is they tend to get better gas mileage than the competition (thanks to Alan Mulally).

Ford exited sedans. Knowing their $20k hybrid 4 door 5 passenger compact pickup that gets 42 mpg city was right around the corner.

Covid has very much impacted Maverick ramp up.

As well as Mach-e ramp up. Bronco ramp-up. Bronco-Sport ramp up. Lightning ramp-up.

Ford has some homeruns in place of Focus, Fusion, 500, Continental, Taurus.

Irvine, California, April 5, 2022: Rivian

Automotive, Inc. (NASDAQ: RIVN) today

announced production totals for the quarter

ending March 31, 2022. The company produced

2,553 vehicles at its manufacturing facility in

Normal, Illinois and delivered 1,227 vehicles

during the same period. These figures are in line

with the company's expectations, and it believes

it is well positioned to deliver on the 25,000

annual production guidance provided during its

fourth quarter earnings call on March 10, 2022

Automotive, Inc. (NASDAQ: RIVN) today

announced production totals for the quarter

ending March 31, 2022. The company produced

2,553 vehicles at its manufacturing facility in

Normal, Illinois and delivered 1,227 vehicles

during the same period. These figures are in line

with the company's expectations, and it believes

it is well positioned to deliver on the 25,000

annual production guidance provided during its

fourth quarter earnings call on March 10, 2022

Doggydogworld

Active Member

That's a crazy gap between produced and delivered. Are some 'produced' trucks missing components? They really shouldn't count those.Irvine, California, April 5, 2022: Rivian

Automotive, Inc. (NASDAQ: RIVN) today

announced production totals for the quarter

ending March 31, 2022. The company produced

2,553 vehicles at its manufacturing facility in

Normal, Illinois and delivered 1,227 vehicles

during the same period. These figures are in line

with the company's expectations, and it believes

it is well positioned to deliver on the 25,000

annual production guidance provided during its

fourth quarter earnings call on March 10, 2022

1410 on March 8, so 1143 in 23 calendar days. 17 production days assuming 5 day week (no reason for OT if they can't get parts). So maybe 65 per workday. That's 18k annualized vs. their 25k target. So they maybe plan to double from here. Feels like they're letting an opportunity slip by.