2virgule5

Member

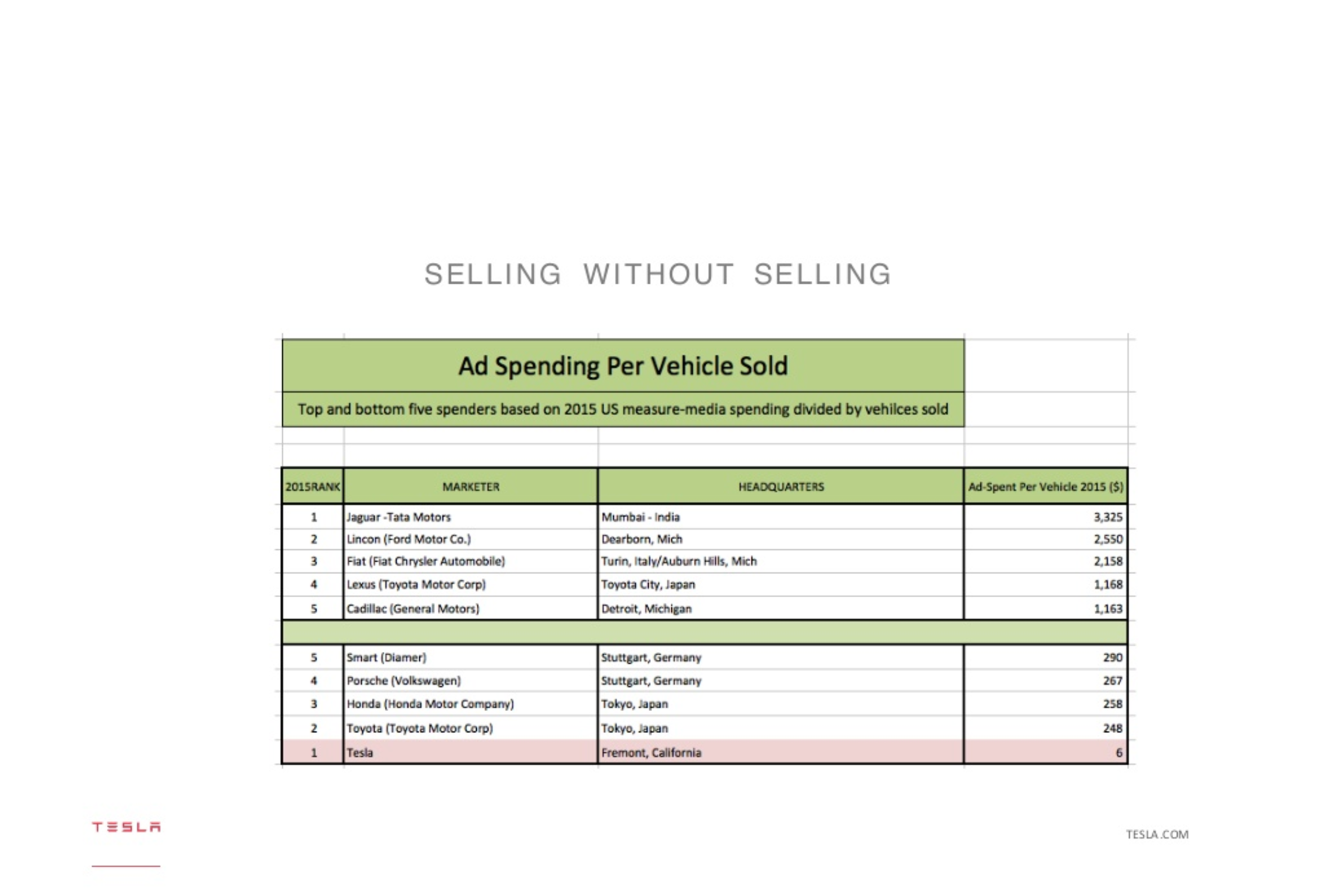

View attachment 209191

(rough numbers in for Tesla... precision here isn't the point)

This is why I will most likely not change my general short position on TSLA in the near future. When will Tesla Auto ever substantially contribute to the $100B to $1T market cap claims by longs or even the $36B it currently holds? TSLA is currently priced at levels that the company doesn't even have medium term goals for... 1m/yr M3 by 2020 is the last stated goal which doesn't even justify the current position in the list above.

I understand CAGR... but when I look at this... and consider risk of execution combined with how many years out this stock is priced... and in those years the competition will only increase... I just don't get it... Unless everyone expects Tesla to just drop auto and just become Tesla Energy... go ahead and rail me... what am I missing here?

If electrification of automobile is inevitable, you should maybe make another table that only lists the 'electric car' business of those companies. And do another one for battery storage and solar. I'm sure 100 years ago some similar table was built and Henri Ford business looked very small and irrelevant in the middle of the horse/carriage companies.