Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

I will never understand why people think that gold would hold any value at all in a doomsday scenario. At that point it's just yellow rocks.

It depends what you envision as doomsday scenario, the way i meant it was: doomsday = market and currencies collapsing. To be clear I do NOT envision or count with such a scenario. The holding of gold in a diversified portfolio makes sense IMO in a environment of historically low interest rates as a hedge. When markets are soaring usually gold is down and vice versa.

Kenriko

Former Vendor

I will never understand why people think that gold would hold any value at all in a doomsday scenario. At that point it's just yellow rocks.

Real Doomsday items of value: Food, Clothing, Shelter, Energy.

Another

This is the downside to EM being involved with the Trump panels and his subsequent tweets that appear to be 'tepid'.

TM will never reveal how this changes cancellation numbers.

Cult of Tesla.

View attachment 212729

This is the downside to EM being involved with the Trump panels and his subsequent tweets that appear to be 'tepid'.

TM will never reveal how this changes cancellation numbers.

Jonathan Hewitt

Active Member

I wonder what kind of car he will buy now that he canceled his Model 3 reservation? Maybe a Chevy Bolt so GM can sell more gas guzzlers.

I wonder what kind of car he will buy now that he canceled his Model 3 reservation? Maybe a Chevy Bolt so GM can sell more gas guzzlers.

Isn't Mary Barra meeting with Trump too?

Maybe a Schwinn

racer26

Active Member

Because Gold is useful for a great many things. I mostly agree with you, that the things its useful for are not really that important in a doomsday scenario, but its one of the most diverse commodities in terms of utility. It does indeed make some sense.I will never understand why people think that gold would hold any value at all in a doomsday scenario. At that point it's just yellow rocks.

I'm also quickly moving to the camp of de-leveraging my TSLA position in a big way. Yesterday I bought shares in 3 different North American Cobalt mining companies. I'm thinking about bailing out of my very green March calls now, and rolling them out to J19 LEAPS.

Colin Niloc and anyone like him are idiots. First off - what other car would you buy? The other automakers are actively lobbying the Trump administration to repeal CAFE and other regulations that are critical to the longevity of our species. Elon isn't supporting anything Trump says or does and is actively trying to mitigate the damage being done in DC, while not appearing openly hostile to Trump, which would be detrimental to his companies.

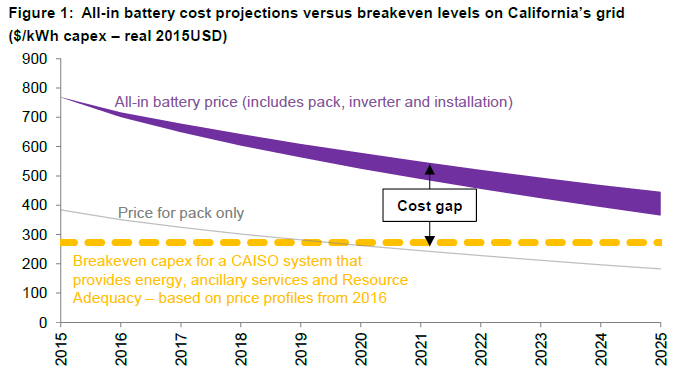

This is a chart from the BNEF report titled: "Batteries two times too costly for California’s grid" published Jan 10, 2017.

As you can see from the chart, the all-in cost is dramatically different from the battery-pack cost. We have been largely focused on just the pack cost as we can find it on Tesla website. But utilities focus on all-in costs. Unless Tesla/Musk figures out some way to dramatically lower the gap, all bets are off.

From what I understand, the first tier battery markets are Australia, Hawaii, Germany. Immediate next is California. If CA is this far away from gaining meaningful traction, we can pretty much ignore everything behind it. I don't know how big the potential market size is in first tier markets. Even if Tesla manages to make some sales, and some meaningful gross margins, I think it is highly unlikely they will make any meaningful (> $100mln) operating profits for years to come. Overall, I'm finding Jonas to be credible with his assumption of TE being 0 value for foreseeable future.

As you can see from the chart, the all-in cost is dramatically different from the battery-pack cost. We have been largely focused on just the pack cost as we can find it on Tesla website. But utilities focus on all-in costs. Unless Tesla/Musk figures out some way to dramatically lower the gap, all bets are off.

From what I understand, the first tier battery markets are Australia, Hawaii, Germany. Immediate next is California. If CA is this far away from gaining meaningful traction, we can pretty much ignore everything behind it. I don't know how big the potential market size is in first tier markets. Even if Tesla manages to make some sales, and some meaningful gross margins, I think it is highly unlikely they will make any meaningful (> $100mln) operating profits for years to come. Overall, I'm finding Jonas to be credible with his assumption of TE being 0 value for foreseeable future.

Last edited:

racer26

Active Member

Funny, by my estimation, Tesla's all-in cost is more like the thin grey line labeled pack only.This is a chart from the BNEF report titled: "Batteries two times too costly for California’s grid" published Jan 10, 2017.

View attachment 212730

Why is the *sugar* happening here if Elon is "helping" Trump and Mike Pence is the VP and his old state? Mike should be shutting stuff like this down. Another sign all this is upside down and inside out........

Indiana introduces a new bill to kill Tesla’s business model in the most unsubtle way

Indiana introduces a new bill to kill Tesla’s business model in the most unsubtle way

Last edited by a moderator:

With the malignant narcissist in the WH, anyone going full cash/gold? The way it's going, civil war may not be too far off. What are the safe havens for the ensuing turmoil? One colleague just sold all shares today. TIA.

I'm 20% cash and considering not increasing any investments at all. If more EOs start appearing and more protests, I might consider liquidating more. I don't like what is going on.

JRP3

Hyperactive Member

As you can see from the chart, the all-in cost is dramatically different from the battery-pack cost. We have been largely focused on just the pack cost as we can find it on Tesla website. But utilities focus on all-in costs. Unless Tesla/Musk figures out some way to dramatically lower the gap, all bets are off.

We know that Tesla was at half their "Pack cost" line last April, why would you think this chart applies to them?

N5329K

Active Member

Not upside down. It's just a well-executed con that demands symbols to keep the con going. Think Bernie Madoff redecorating his office tower to "prove" his solvency to new marks...er, investors.Why is the *sugar* happening here if Elon is "helping" Trump and Mike Pence is the VP and his old state? Mike should be shutting stuff like this down. Another sign all this is upside down and inside out........

Indiana introduces a new bill to kill Tesla’s business model in the most unsubtle way

Robin

JRP3

Hyperactive Member

Stock up on canned goods. Also install solar panels and Powerwalls, and drive an EV. Actually TSLA should go up in that scenario.I will never understand why people think that gold would hold any value at all in a doomsday scenario. At that point it's just yellow rocks.

The same Bloomberg Technology article indicated that Tesla's goal is to deliver 15GWh of battery storage a year by 2020.

Didn't Tesla recently triple the estimate of Gigafactory1 production from 50 to 150 gwh by 2020? Wouldn't this mean a tripling of energy storage production from 15 to 45 gwh by the same date?

-

Who does not consider all-in-cost? Too costly as opposed to what?

If peaker plant has a break even of 10-15 years there's little reason to invest in one now if battery storage will be as cheap or cheaper in 10 years. Sprinkle it with (weak -the only possibility) carbon tax and there's even more reason to consider battery storage in place of any new peaker plant project.

This is a chart from the BNEF report titled: "Batteries two times too costly for California’s grid" published Jan 10, 2017.

View attachment 212730

As you can see from the chart, the all-in cost is dramatically different from the battery-pack cost. We have been largely focused on just the pack cost as we can find it on Tesla website. But utilities focus on all-in costs. Unless Tesla/Musk figures out some way to dramatically lower the gap, all bets are off.

From what I understand, the first tier battery markets are Australia, Hawaii, Germany. Immediate next is California. If CA is this far away from gaining meaningful traction, we can pretty much ignore everything behind it. I don't know how big the potential market size is in first tier markets. Even if Tesla manages to make some sales, and some meaningful gross margins, I think it is highly unlikely they will make any meaningful (> $100mln) operating profits for years to come. Overall, I'm finding Jonas to be credible with his assumption of TE being 0 value for foreseeable future.

Who does not consider all-in-cost? Too costly as opposed to what?

If peaker plant has a break even of 10-15 years there's little reason to invest in one now if battery storage will be as cheap or cheaper in 10 years. Sprinkle it with (weak -the only possibility) carbon tax and there's even more reason to consider battery storage in place of any new peaker plant project.

Didn't Tesla recently triple the estimate of Gigafactory1 production from 50 to 150 gwh by 2020? Wouldn't this mean a tripling of energy storage production from 15 to 45 gwh by the same date?

I do not think that 150GWh was tied to 2020, but Bloomberg might be wrong about 15GWh of battery storage by 2020. Hopefully Jeff Evanson will respond to my e-mail, but I do not count on it as we are very close to the ER and Tesla will probably prefer to stay quiet until then.

We know that Tesla was at half their "Pack cost" line last April, why would you think this chart applies to them?

That chart is in utilities (buyers) perspective. Tesla is certainly not selling at half the pack-cost line.

Moreover Tesla's claims of battery costs have been very wild and unproven through any financial statements. Except bulls on TMC, nobody believes them. The enlightening information from Straubel that TE will not be separated out in financials for "several years" is all the more proof that there is nothing to see there (yet). In a nutshell, we are years away from stock price appreciation due to TE.

- Status

- Not open for further replies.

Similar threads

- Replies

- 8

- Views

- 1K

- Replies

- 6

- Views

- 11K

- Sticky

- Replies

- 462K

- Views

- 51M

- Locked

- Replies

- 27K

- Views

- 3M