Musskiah

DisGruntled

That's the fun in it. Who knows?Which direction?

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

That's the fun in it. Who knows?Which direction?

Yeah, that too. I just didn’t feel like a soliloquy this morning. That’s not a jab at your thorough, thoughtful posts. Accurately, it’s me not you.

I wonder if someone more knowledgeable would care to comment on what seems to be the complete stall of the V4 supercharger rollout. Or at least the higher power version. I know there have been some faux 400 volt locations installed (pseudo V3’s). With the apparent dismal cybertruck charging speeds on V3’s I would have thought the V4 rollout would be further along. Is this related to the poor performance of the 4680 batteries and maybe their tolerance for more aggressive charging?

Feel free to take me to school on this.

Thanks in advance.

In. Your. Dreams.I know there are a bunch of different uses of capital possible but a modest share buyback would be a nice signal from Tesla that the shares are cheap.

It's the fossil agenda speaking. They don't care about having reduced inflation of EV car prices, pulling battery manufacturing into the US or reducing reliance on Middle East actors. Follow the money. They'd rather see the USA crash and burn than let go of their trillions of profits and subsidiesThis nonsense needs to stop… they don’t bother to mention anything about reducing reliance on Middle East oil, reducing greenhouse gases or any of the other benefits. They take a very (unnecessary) political angle… reminds me of ten years ago and all of the nonsense back then:

There's so much truth to this, yet TSLA being TSLA, another illogical runup far above $300 wouldn't surprise me in the least.I share the sentiment of @gtrplyr1. I've been holding since 2013 and all in since 2020 and while the long term prospects with Tesla are better than any other company, from what I can see happening with the world, the near term is bleak for Tesla share holders. The only thing that can move the stock price right now is FSD and the company (Elon) has clearly shifted focus to Bot. This means the next share price run isn't going to start for at least a year, probably more like 2+ years. Sitting on TSLA shares while MSFT, GOOG and NVDA are likely to continue running, seems foolish.

The market now demands results that hit the bottom line. This means Tesla needs to launch Robotaxi or, FSD has to become so appealing that most owners purchase it. I'm sure a lot of you are thinking Tesla Energy, CT ramping, Model Y refresh, etc. I'm sorry but no. Those things are simply not going to be enough to drive to new highs. Sorry, I just made it too easy for myself; those things aren't enough to drive the SP past 300.

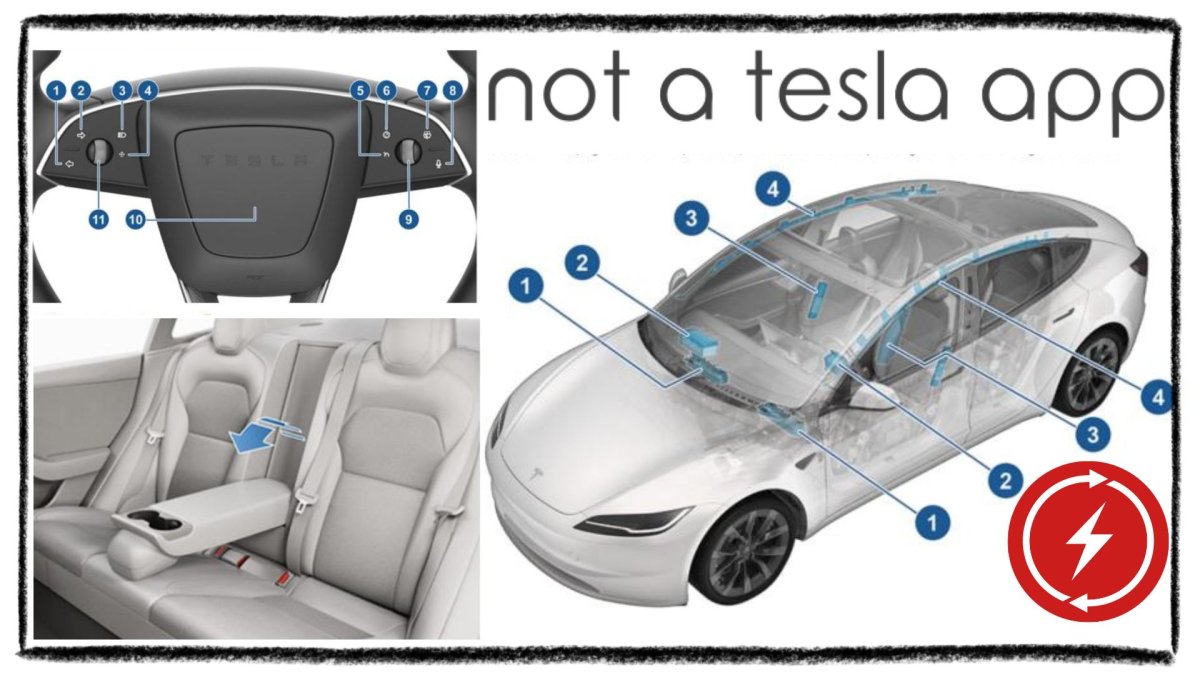

Knee airbags sound like a great safety win. I'd like wheel mounted turn signal buttons to flash when active.

The U.S. Version of the New Model 3 Gets a Steering Wheel Light and Additional Airbags

The latest updates to Tesla's 2024 Model 3, including new safety features, a mysterious steering wheel button, and production insights.www.notateslaapp.com

Agreed 100%. TBH if five years ago people had said 'No buybacks until 25 billion in cash' nobody would have argued, but here we are at 26 bn and still not even a single billion buyback. Seems like a VERY good investment to me.I know there are a bunch of different uses of capital possible but a modest share buyback would be a nice signal from Tesla that the shares are cheap.

Perhaps, but as long as it’s a possible high ROI option I’d like to know management considered it.In. Your. Dreams.

Buybacks are a total loss for Tesla.Perhaps, but as long as it’s a possible high ROI option I’d like to know management considered it.

But buying Bitcoin made sense?Buybacks are a total loss for Tesla.

They are good for TSLA and its shareholders. But there is zero value or ROI for the company itself.

Edit: if you think “ya that’s what I meant, they should still do it” you probably don’t know much about Tesla or its management thinking. And if that’s that case why are you investing in TSLA

Those buyers who protest are shown the door or threatened with a Soviet-style waiting list.

In one example, a Toronto dealer’s bill of sale lists a protection package priced at $3,399, a “top-up” warranty at $899 and an administration fee of $599, adding $5,533 (including tax) in unnecessary costs to the price of a $28,000-economy-car. That’s on top of the usual freight, predelivery inspection, fees and taxes.

Opinions are awesome, they’re just simply full of hot air and worth less. Not worthless, but worth less. For our literary experts. Just wanted you to know the space wasn’t a mistake.

YMMV, true that. I'm also retired (kinda) but just getting ripe. Like these fine young men below.I'm old & retired. YMMV.

Has the question not been asked already? I think Tesla has already answered dividend and buyback questions.Perhaps, but as long as it’s a possible high ROI option I’d like to know management considered it.

They explained why they did that. You don’t have to agree or like it, but they didn’t do it just because they couldn’t think of anything else to do.But buying Bitcoin made sense?

You might mention auto dealers specifically for they are major political forces everywhere in the world, even more so at local level. They hate EV in general because of decreased service, and Tesla specifically because they, by their existence threaten auto dealers.To me, "Disruption" is the key word for unlocking the answer.

Sure, it could happen to any stock, but it is easier to hit Tesla as the volatility is being driven by media campaigns championed by those being disrupted by Elon's creations.

There is a long list of the dearly disrupted which, among others, includes:

- Fossil Fuel Energy players, and their supporting industries

- ICE automotive players and their supporting industries

- Advertising companies and their well-developed network of outlets

- Social Media outlets with any specific bias

- News companies with any specific bias

These are the tip of the ICEberg and the greater disruption and transformation toward a world of abundance will impact other players who have depended upon tools like control of the price of energy to dictate technical progress, wealth distribution, and classes of lifestyle.

The potential of the long-term effects of Tesla, and other Musk companies, threatens age-old regimes that have concentrated wealth and progress to be controlled by a plethora of power brokers.

Take a gander at some of the Tony Seba videos on YouTube to get more detail on where the world is headed, why it is headed that way, and then think about who will be affected negatively by such a paradigm shift.

This isn't a conspiracy. It is an affront to a wide variety of players who each are finding they have an axe to grind and will make their subtle attempts to put off their own demise and maintain their station in life.

This leads to Tesla being THE stock most affected, creating an environment where the folks on Wall Street can most easily capitalize on the action that results.

Add to this the rules governing naked shorting and Wally's work becomes easy to accomplish when given a suitable target.

Funny how most people have no problem with opinions that they agree with.

I have been bullish on Tesla since 2013 but I still appreciate a well thought out bearish opinion and there are plenty of bullish opinions that are complete b**l c**p.

Pretty much everything on this forum is opinion. Every one has access to the same facts. It’s what they mean that is the bone of contention