MLK Day is actually Mon 1/17 this year (it was on 1/18 last year) and as you said, stock and bond markets are both closed.(MLK Day, 1/18 is atradingnational holiday)

Last edited:

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

MLK Day is actually Mon 1/17 this year (it was on 1/18 last year) and as you said, stock and bond markets are both closed.(MLK Day, 1/18 is atradingnational holiday)

I had to disagree. Pavements don't concern me. Tesla is already producing in Giga Austin. IMO.looking at the drone flyover video, giga Austin is still working on parking lot pavement and roof insulation. The rumor of immediate production this week tuned out to be just rumor. neither Austin nor Berlin would be up running before er in late January.

Tsla was down a lot this week. Other growth stock like roku/sq were down more than 50% from ath. Tsla has better fundamentals and growth. But it’s not immune to macro. Short therm there will be multiple compression going on. Really don’t like those Twitter heads chanting immediate catalysts without solid evidence. Just lure ppl to trade on short term hopium.

Cathie? Is that you?One good thing about selling off a significant chunk of TSLA in late 2020, and diversifying, is now I have a lot of crappy stocks I don't mind selling to buy these dips.

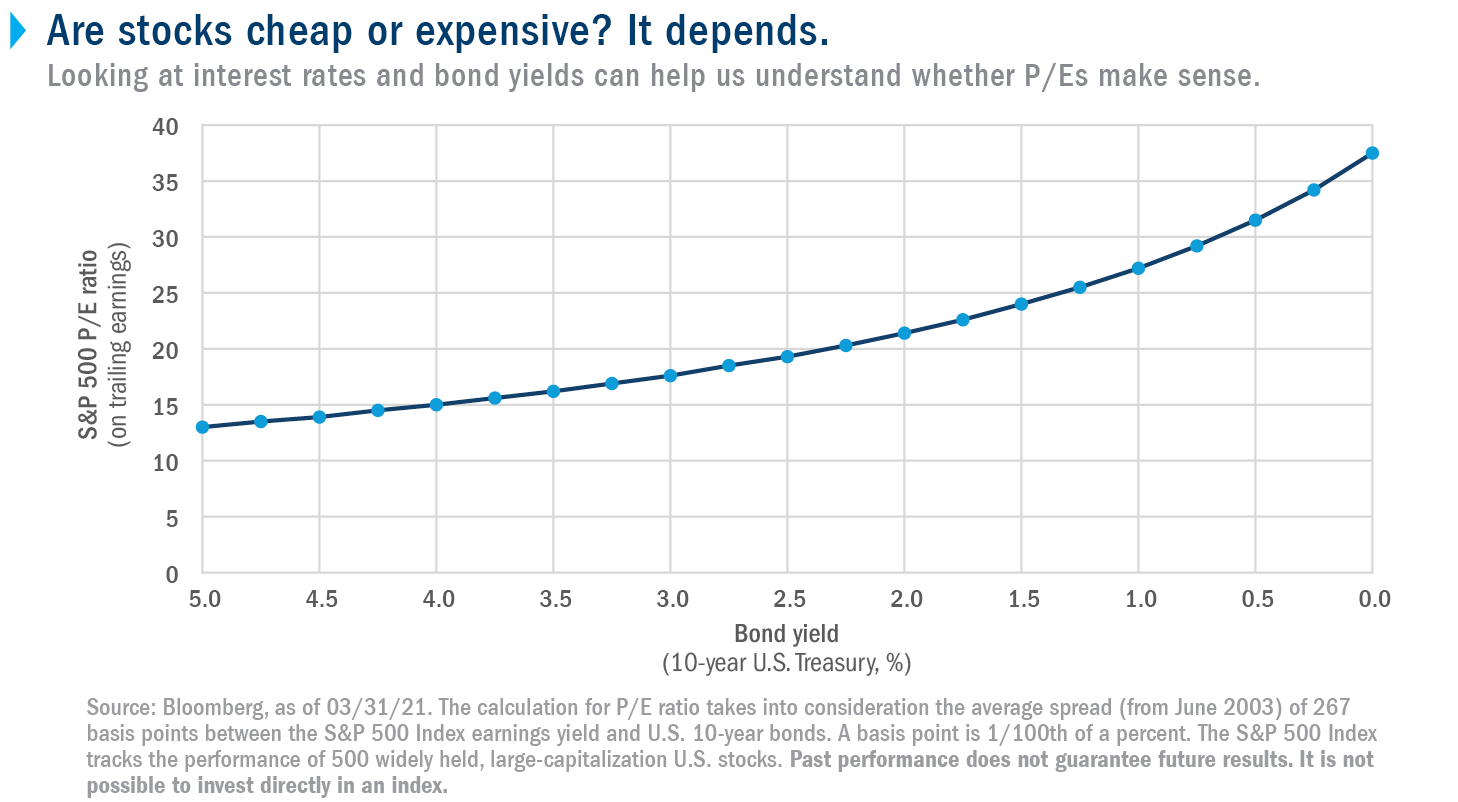

I think the formula here is:S&P P/E sits at 29 today. Here's a chart of what historically the PE is vs the 10 year.

Historically P/E usually don't sit at 25+ for very long but usually sits around 20ish. Then again historically we don't have 10y bond trading at less than 2% very long either

In ten years FSD will be standard like cruise control is now.Depends on what you want. The current product isn't worth $10K (or $12K). The "smarter" move is to take your $10K and buy 10 shares of TSLA until FSD is out of beta (quite awhile IMO). I suspect the SP will outpace Tesla's FSD price raises.

On the other hand, I have beta FSD because it's fun to keep tabs on the actual bleeding-edge product and to monitor the progress and I don't mind funding the mission a little

I feel this strategy requires lots of knowledge and decent sense of timing. Which years ago I didn't have. This is how I got called out of AMZN, FB, NFLX few years back, while they were rampaging.but I would strategically sell covered calls in those accounts.. pick what you are okay with parting with as a percentage of the overall managed portfolio assets, since its tax advantaged, if they get called you can just re=buy if you like with the available funds. pick and chose what event horizon you are targeting, earnings, fed announcements, etc.. with a decent CC strategy you should be able to easily boost overall portfolio performance by 4-6% a year nominal just by selling against ~20% of the portfolio and targeting 60-90 days periods.. so less work, LESS overall return but a nice way to measurably bump return

we glanced at the pricing earlier today before we saw this (for business planning purposes). They are still constrained and nothing much is available before 2023 and they won't make a commitment even at that. Good/bad problem to have. I have not idea what production has already been sold but what's interesting is that on the CFO side of things they have almost full visibility into revenue a year out. This is pretty amazing for a industrial company. The numbers get tweaked as opportunities allow, cost inflate or contract, credits sold or bought, etc. But overall they are sold out of cars almost a year out. They are sold out of residential powerwalls, there is a bit of solar installation available, the solar roof thing is ?, FSD is some time out ...not this year. So that makes revenue forecasting pretty simple. Battery constraints after battery constraints this year. 2023 is going to be interesting.

I was openly asking myself earlier today when we would see the Energy side of Tesla show it's hand. The Lathrop Megapack facility broke ground in Sept. Recently, they added a ton of parking for new employees there. I would have to imagine that they're set to ramp production in late Q1 or Q2 and maybe the Energy side is materially adding to Tesla's revenue and profits by Q2 or Q3 with 2023 being the breakout year of Energy.

Same day as the FOMC meeting with a possible rate hike announcement. VolatilityLikely Wednesday January 26

Best scenario good macro + great earning. Tsla has a tendency to dip after earning. So selling way out of money call and puts is a safer playSame day as the FOMC meeting with a possible rate hike announcement. Volatility

It might be a good day to sell way OTM calls and puts.

Seems to me L5 will be almost impossible. Too many edge cases.We did. Again. But you have to ask yourself if you are okay with the basic features that it provides compared to the “coming soon” features like FSD city. Full FSD has been coming in a few months for 6 years. Who knows when it will arrive. I would like to see a solid level 2 or 3 system in the next year or two. I think full autonomous L4 or 5 is probably end of this decade.

Just my humble opinion and it’s definitely not popular here.

By that time Tesla will be selling heavy duty electric hover trucks and electric passenger aircraft!!!Now, this is getting ridiculous...

It is one thing to make vaporware announcements of vehicles 5 years down the line for which they do not even have an early blueprint, just some vague idea.

But "projecting" product releases 12+ years into the future ?!?

They totally deserve to go bankrupt and NOT get bailed out before the end of this decade.

Yes he did.Did Elon really tweet that the price of FSD is increasing to $12k on Jan 17 in the US, as reported in another thread without a copy of the tweet?